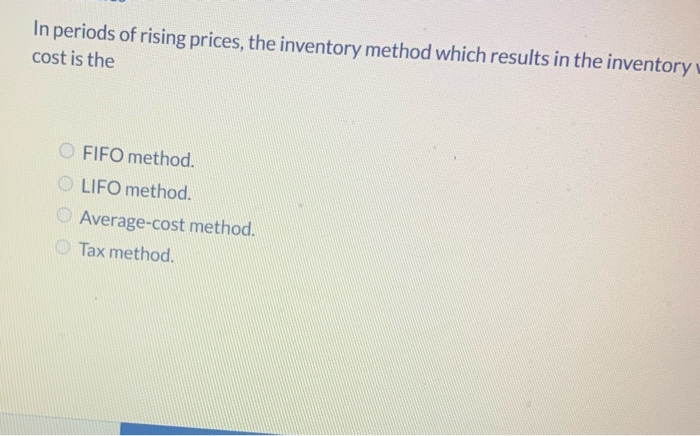

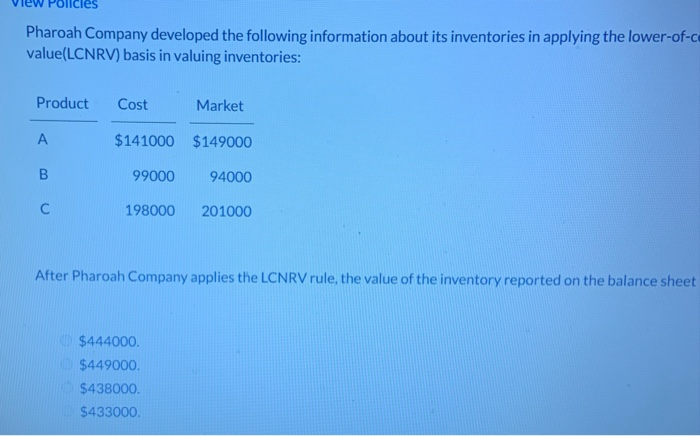

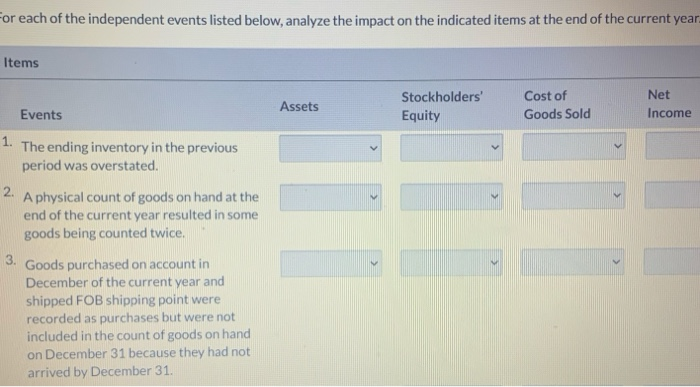

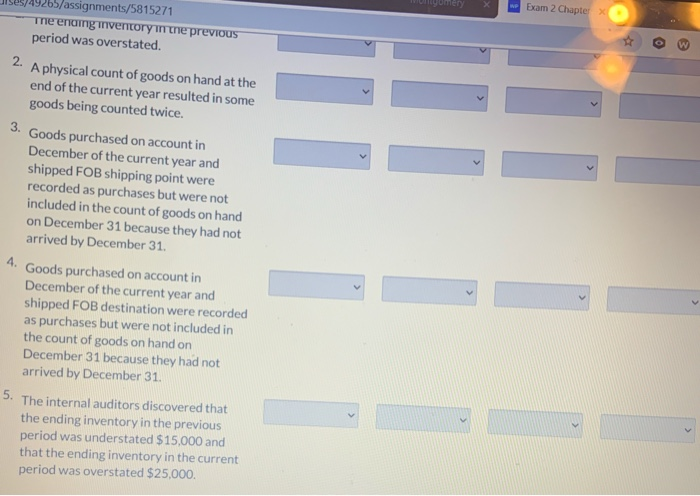

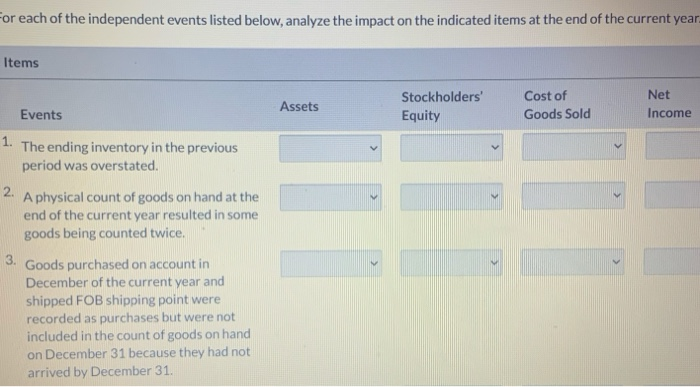

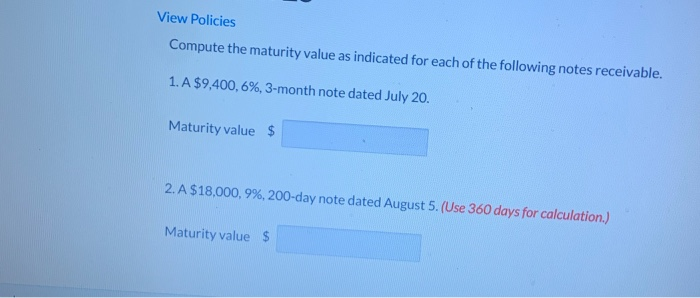

In periods of rising prices, the inventory method which results in the inventory cost is the FIFO method. OLIFO method. Average-cost method. Tax method. les Pharoah Company developed the following information about its inventories in applying the lower-of-ce value(LCNRV) basis in valuing inventories: Product Cost Market $141000 $149000 B 99000 94000 198000 201000 After Pharoah Company applies the LCNRV rule, the value of the inventory reported on the balance sheet $444000 $449000. $438000 $433000 or each of the independent events listed below, analyze the impact on the indicated items at the end of the current year. Items Assets Stockholders Equity Cost of Goods Sold Net Income Events 1. The ending inventory in the previous period was overstated. 2. A physical count of goods on hand at the end of the current year resulted in some goods being counted twice. 3. Goods purchased on account in December of the current year and shipped FOB shipping point were recorded as purchases but were not included in the count of goods on hand on December 31 because they had not arrived by December 31. Exam 2 Chapter w III 49265/assignments/5815271 The enging mvertory in the previous period was overstated. 2. A physical count of goods on hand at the end of the current year resulted in some goods being counted twice. 3. Goods purchased on account in December of the current year and shipped FOB shipping point were recorded as purchases but were not included in the count of goods on hand on December 31 because they had not arrived by December 31. 4. Goods purchased on account in December of the current year and shipped FOB destination were recorded as purchases but were not included in the count of goods on hand on December 31 because they had not arrived by December 31. 5. The internal auditors discovered that the ending inventory in the previous period was understated $15,000 and that the ending inventory in the current period was overstated $25,000 or each of the independent events listed below, analyze the impact on the indicated items at the end of the current year. Items Assets Stockholders' Equity Cost of Goods Sold Net Income Events 1. The ending inventory in the previous period was overstated. 2. A physical count of goods on hand at the end of the current year resulted in some goods being counted twice. 3. Goods purchased on account in December of the current year and shipped FOB shipping point were recorded as purchases but were not included in the count of goods on hand on December 31 because they had not arrived by December 31. View Policies Compute the maturity value as indicated for each of the following notes receivable. 1. A $9,400, 6%, 3-month note dated July 20. Maturity value $ 2. A $18,000,9%, 200-day note dated August 5. (Use 360 days for calculation.) Maturity value $