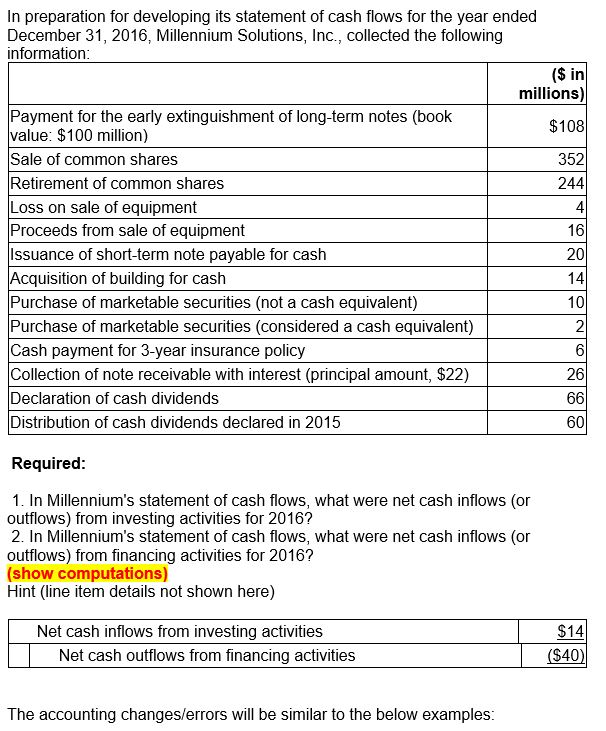

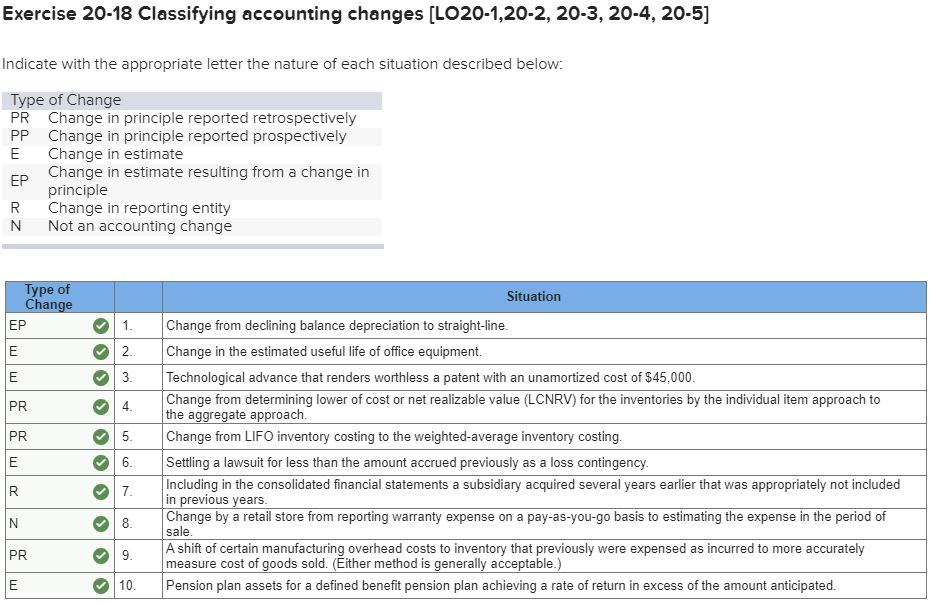

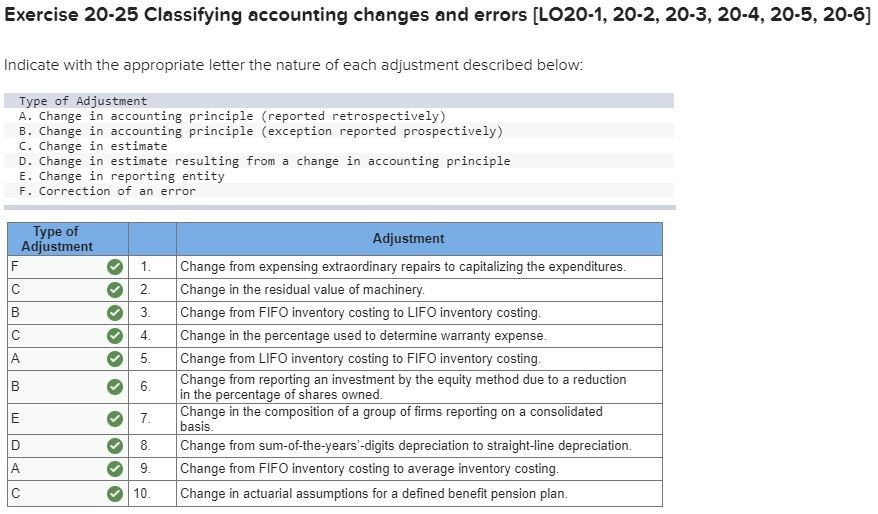

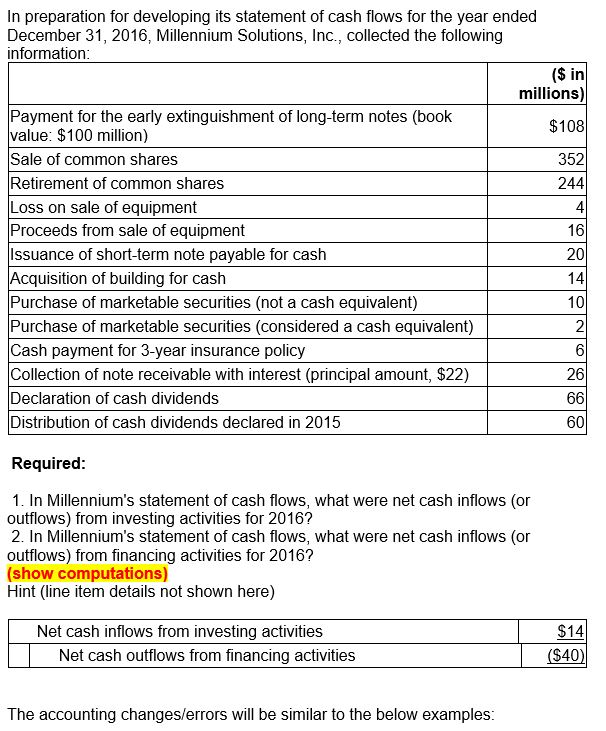

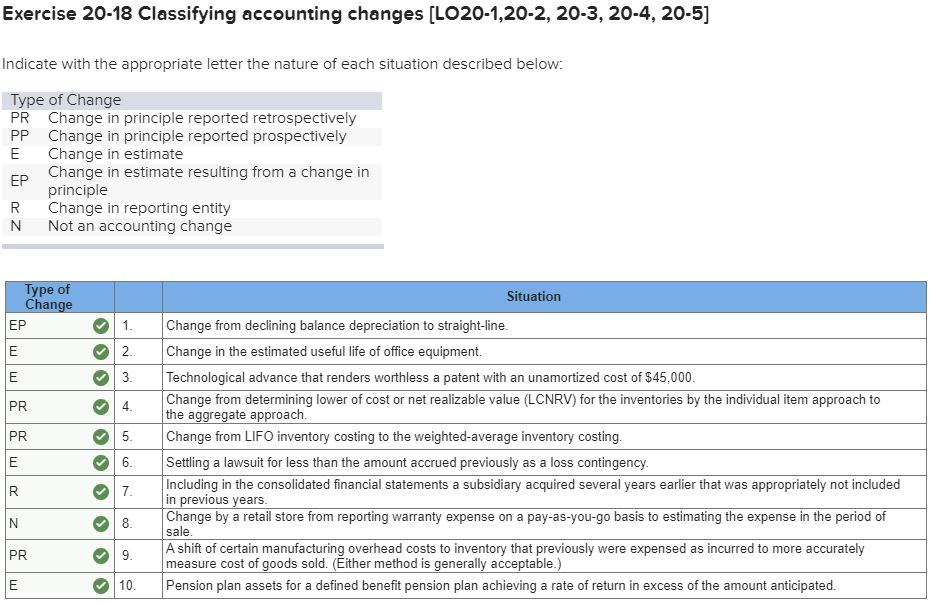

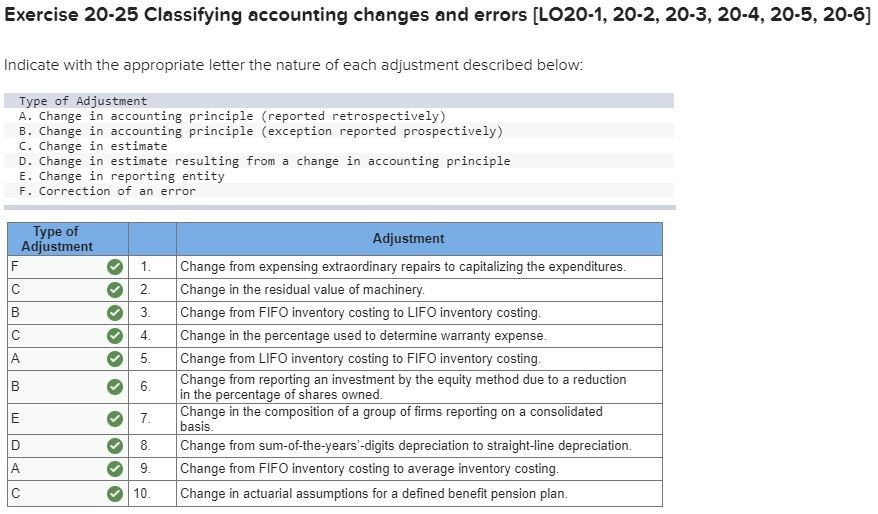

In preparation for developing its statement of cash flows for the year ended December 31, 2016, Millennium Solutions, Inc., collected the following information: ($ in millions) $108 352 244 Payment for the early extinguishment of long-term notes (book value: $100 million) Sale of common shares Retirement of common shares Loss on sale of equipment Proceeds from sale of equipment Issuance of short-term note payable for cash Acquisition of building for cash Purchase of marketable securities (not a cash equivalent) Purchase of marketable securities (considered a cash equivalent) Cash payment for 3-year insurance policy Collection of note receivable with interest (principal amount, $22) Declaration of cash dividends Distribution of cash dividends declared in 2015 Required: 1. In Millennium's statement of cash flows, what were net cash inflows (or outflows) from investing activities for 2016? 2. In Millennium's statement of cash flows, what were net cash inflows (or outflows) from financing activities for 2016? (show computations) Hint (line item details not shown here) $14 Net cash inflows from investing activities Net cash outflows from financing activities (540) The accounting changes/errors will be similar to the below examples: Exercise 20-18 Classifying accounting changes [LO 20-1,20-2, 20-3, 20-4, 20-5] Indicate with the appropriate letter the nature of each situation described below: Type of Change PR Change in principle reported retrospectively PP Change in principle reported prospectively E Change in estimate FP Change in estimate resulting from a change in principle R Change in reporting entity N Not an accounting change Type of Change Situation 1. olov1 Change from declining balance depreciation to straight-line. Change in the estimated useful life of office equipment. Technological advance that renders worthless a patent with an unamortized cost of $45,000. Change from determining lower of cost or net realizable value (LCNRV) for the inventories by the individual item approach to the aggregate approach. Change from LIFO inventory costing to the weighted-average inventory costing. Settling a lawsuit for less than the amount accrued previously as a loss contingency. Including in the consolidated financial statements a subsidiary acquired several years earlier that was appropriately not included in previous years. Change by a retail store from reporting warranty expense on a pay-as-you-go basis to estimating the expense in the period of sale. A shift of certain manufacturing overhead costs to inventory that previously were expensed as incurred to more accurately measure cost of goods sold. Either method is generally acceptable.) Pension plan assets for a defined benefit pension plan achieving a rate of return in excess of the amount anticipated. N 7. 8 9. 10. PR Exercise 20-25 Classifying accounting changes and errors [LO20-1, 20-2, 20-3, 20-4, 20-5, 20-6] Indicate with the appropriate letter the nature of each adjustment described below: Type of Adjustment A. Change in accounting principle (reported retrospectively) B. Change in accounting principle (exception reported prospectively) C. Change in estimate D. Change in estimate resulting from a change in accounting principle E. Change in reporting entity F. Correction of an error Type of Adjustment LOO 2. 3.