Question

In Problem 4, what is the internal rate of return (IRR) of the Starlite laptop computer project? Give the answer as a percentage with FOUR

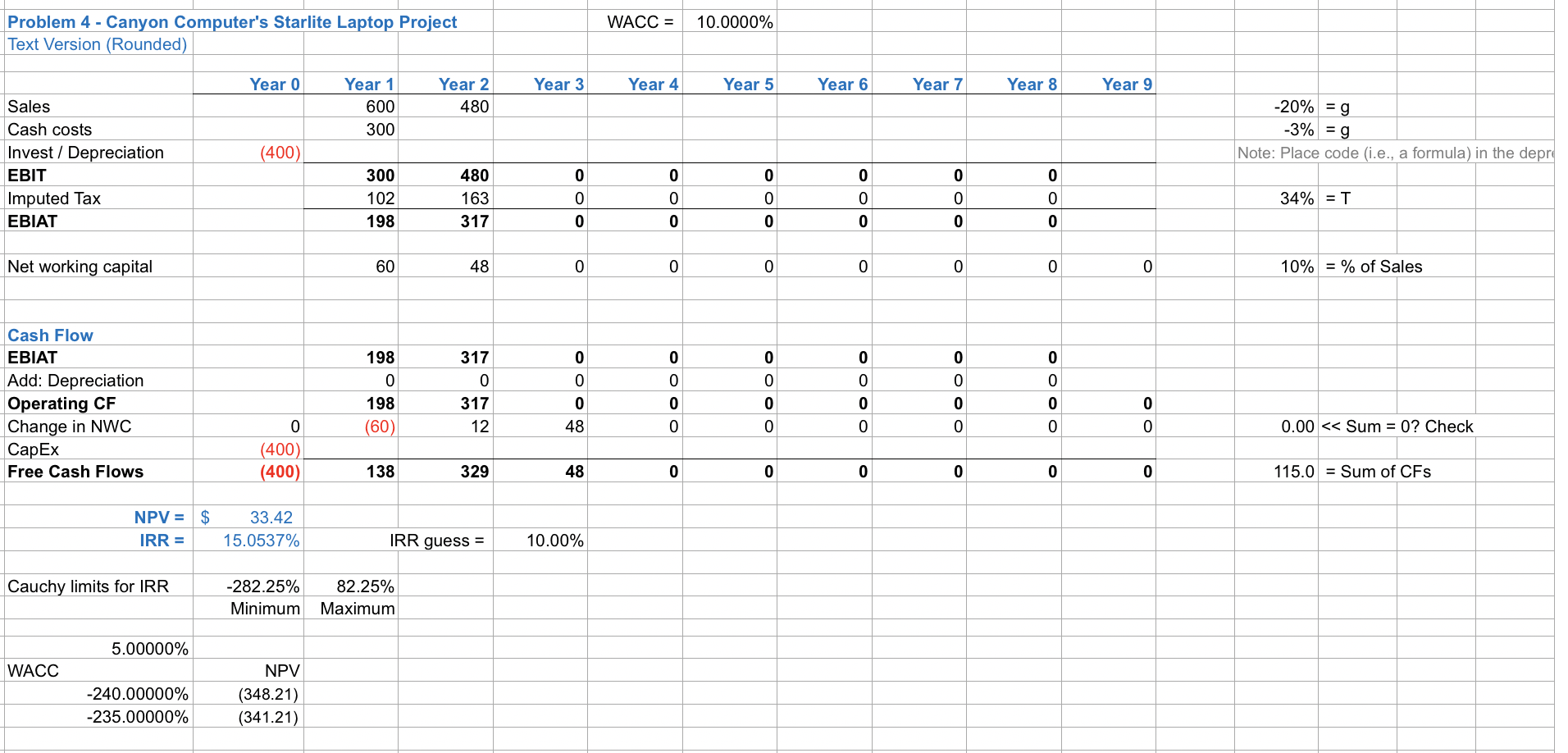

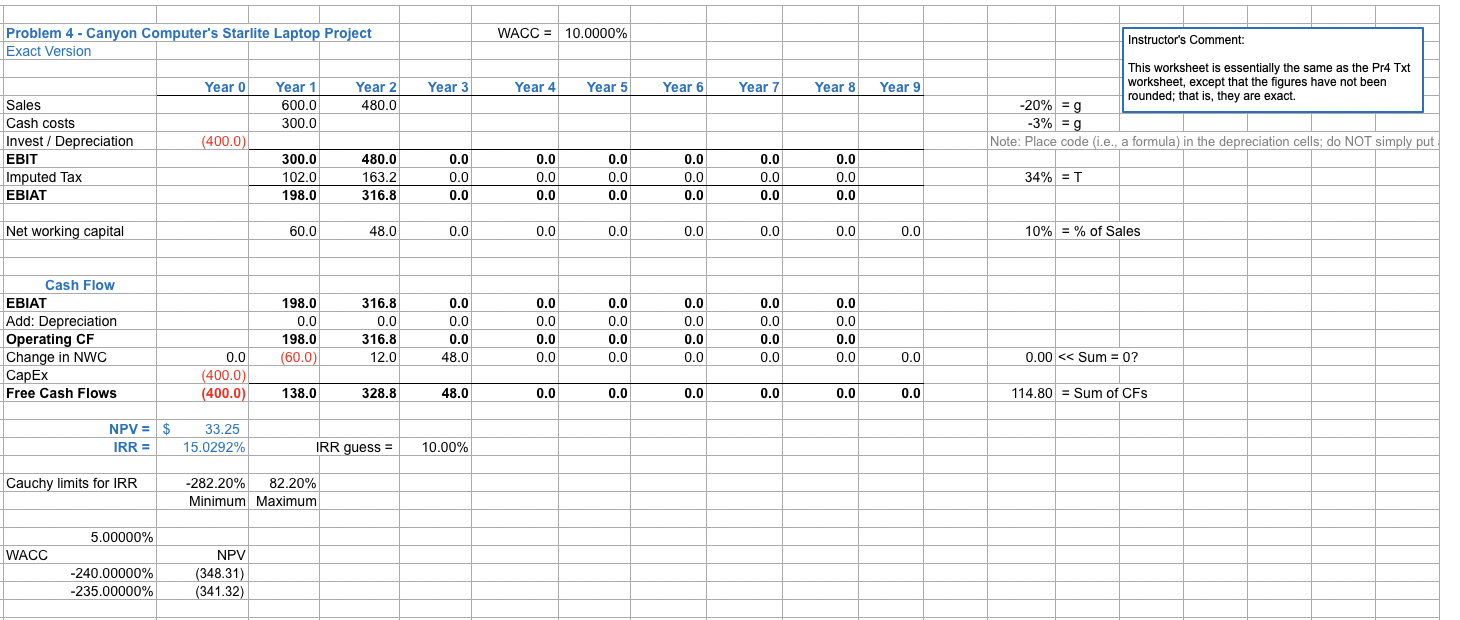

In Problem 4, what is the internal rate of return (IRR) of the Starlite laptop computer project? Give the answer as a percentage with FOUR (4) decimals but do not write the % symbol; e.g., if the answer is 7.1276% you should write 7.1276 in the answer box. IMPORTANT: As is done in the two tables provided for this problem, you should disregard the millions in all your inputs and calculations. Thus, you will input the investment of $400 million in year 0 as -400 for calculation purposes.

IMPORTANT: Do all the calculations using the Pr4 Exct worksheet. In other words, use EXACT figures for every item (Sales, Cash costs, etc.), not the rounded figures given in the text.

- A similar reminder about NWC as in Problem 3 applies here.

- As in Problem 3, assume that taxes are symmetric; that is, if the firm has positive EBIT it pays taxes, but if it has negative EBIT it receives a tax refund. By the way, this is a realistic assumption given that we are analyzing an investment project within the firm, and not the entire firm.

- IMPORTANT: The integer numbers given in the text have been rounded for presentation. In other words, the actual Sales figure in Year 4 is 600*(1-0.2)^3 = 307.20 but it is shown in the text as 307. For the IRR calculations, use the integer figures given in the text, as if they were the exact figures.

- It will probably be challenging to find the IRR to a 4-decimal accuracy, but it is there! One way to find it is to create an NPV profile (but you do not need the actual graph) by putting in one column of Excel the values of r from, say 99% to + 30% (in 1% increments) computing NPV(r) for each of them, and then visually noting where the NPV changes sign. That will give you a "ballpark estimate, but remember that you need a 4-decimal accuracy so theres more work you must do to refine the IRR estimate.

- There is another way to calculate the IRR without using Excel at all. It requires that you use a humble, often maligned, tool that you should already have (hows that for a teaser?)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started