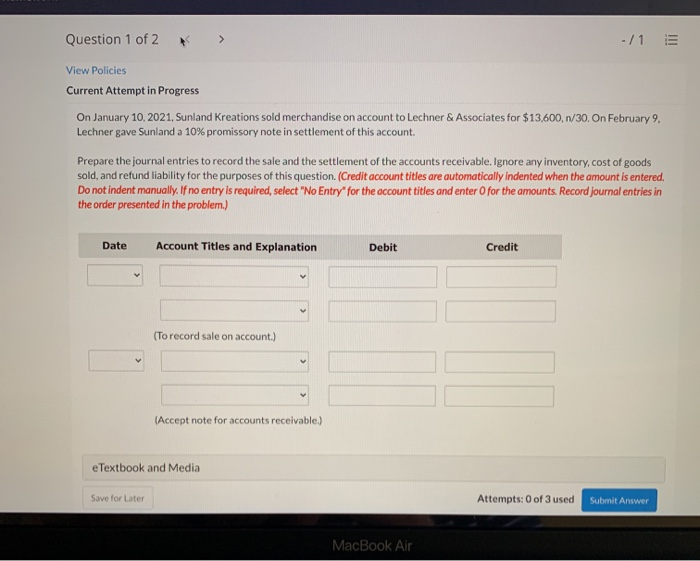

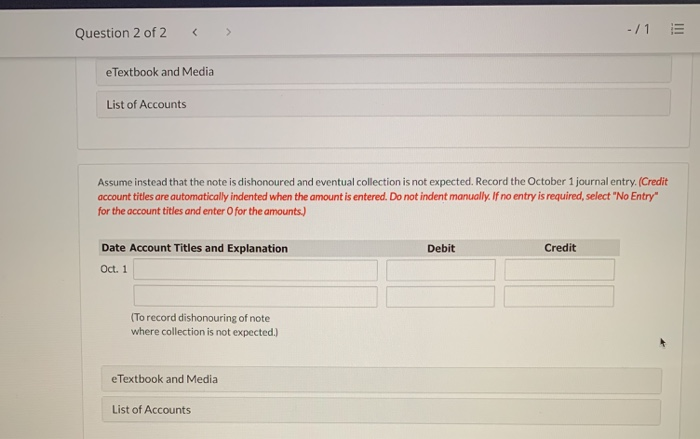

In question 1: prepare a journal entry to record the sales and settlement of the account receivable.

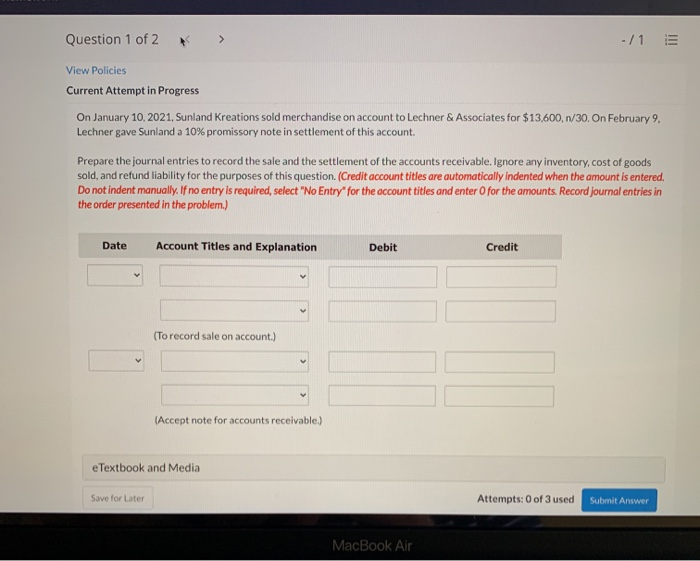

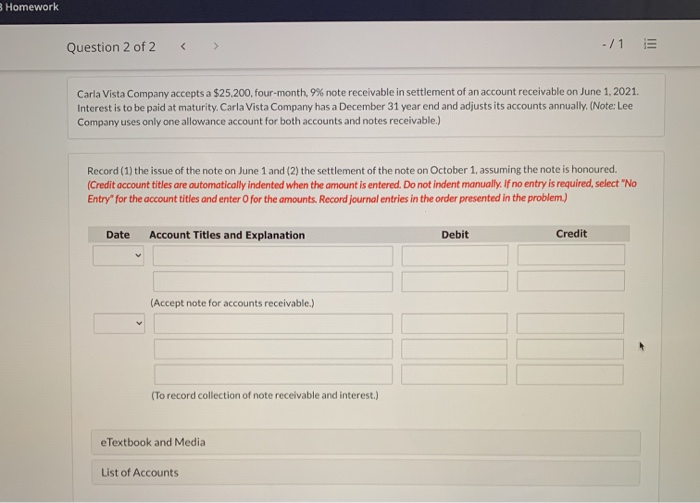

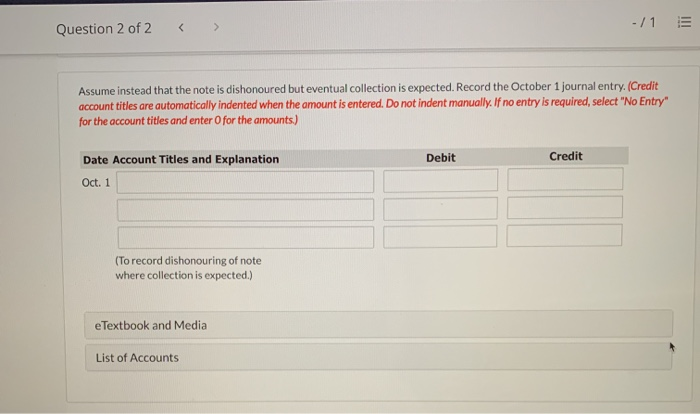

in question 2:

1. Record the issue of the note on June 1 and the settlement of note on October 1, assuming the note is honoured.

2. assume instead that the note is Dishoner but eventual collection is expected. record the October 1 Journ entry.

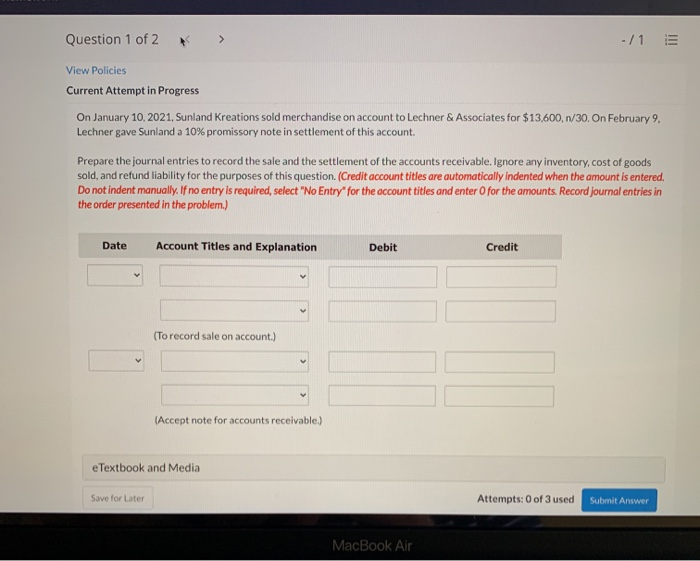

3. assume instead that the note is dishonored eventually collection is not expected. record the October 1 journal entry.

pictures of given below:

Question 1 of 2 - /1 E View Policies Current Attempt in Progress On January 10, 2021, Sunland Kreations sold merchandise on account to Lechner & Associates for $13,600,n/30. On February 9, Lechner gave Sunland a 10% promissory note in settlement of this account Prepare the journal entries to record the sale and the settlement of the accounts receivable. Ignore any inventory, cost of goods sold, and refund liability for the purposes of this question. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record sale on account.) (Accept note for accounts receivable.) e Textbook and Media Save for Later Attempts: 0 of 3 used Submit Answer MacBook Air 3 Homework Question 2 of 2 -/1 Carla Vista Company accepts a $25,200, four-month, 9% note receivable in settlement of an account receivable on June 1, 2021. Interest is to be paid at maturity. Carla Vista Company has a December 31 year end and adjusts its accounts annually. (Note: Lee Company uses only one allowance account for both accounts and notes receivable.) Record (1) the issue of the note on June 1 and (2) the settlement of the note on October 1, assuming the note is honoured. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (Accept note for accounts receivable.) (To record collection of note receivable and interest.) e Textbook and Media List of Accounts -/1 E Question 2 of 2 Assume instead that the note is dishonoured but eventual collection is expected. Record the October 1 journal entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Oct. 1 (To record dishonouring of note where collection is expected.) eTextbook and Media List of Accounts Question 2 of 2 -/15 eTextbook and Media List of Accounts Assume instead that the note is dishonoured and eventual collection is not expected. Record the October 1 journal entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Debit Credit Date Account Titles and Explanation Oct. 1 (To record dishonouring of note where collection is not expected.) eTextbook and Media List of Accounts