Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In recent years, corporate financial accounting scandals no longer become unexpected news of the day. Cases such as Enron, WorldCom, Global Crossing and Tyco

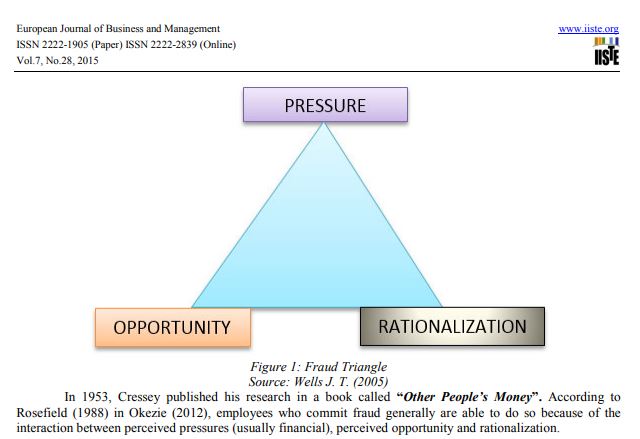

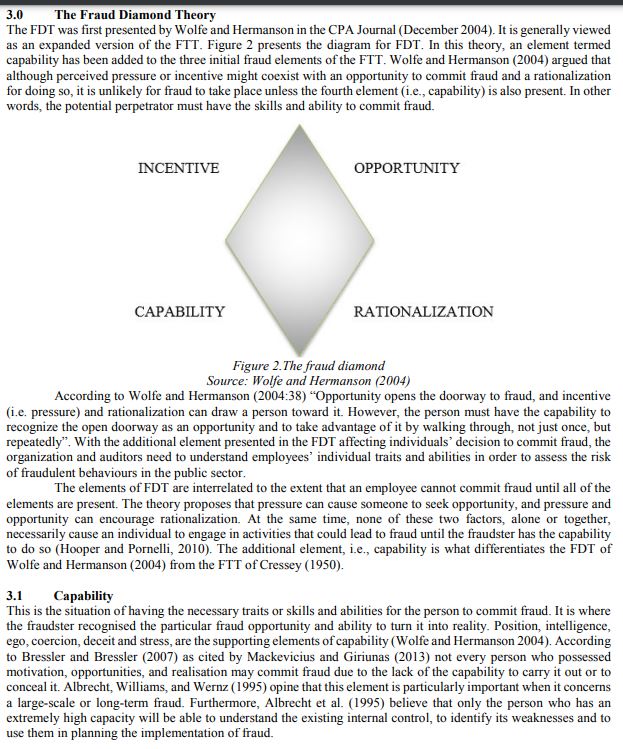

In recent years, corporate financial accounting scandals no longer become unexpected news of the day. Cases such as Enron, WorldCom, Global Crossing and Tyco are among the most prominent ones which had suffered from the devastating impact of fraud. These costly scandals have increased global concerns about fraud, wiping out billions of dollars of shareholder value, and led to the erosion of investors and public confidence in the financial markets (e.g., Peterson and Buckhoff, 2004; Rezaee, Crumbley and Elmore 2004 in Bierstaker, Brody and Pacini 2006). Many studies have discussed fraud-related issues and the general view is that fraud prevention should be the main focus. It is less expensive and more effective to prevent fraud from happening than to detect it after occurrence. Usually, by the time the fraud is discovered, the money is unrecoverable or the chance to recover the full amount of the lost is very slim. Furthermore, it is costly and time consuming to investigate frauds especially involving large-scale multinational operations. However, if the focus is on fraud prevention all the monetary losses, time and effort to reconstruct fraudulent transactions, track down the perpetrator, and reclaim missing funds can be saved. Thanasak (2013:1) states that before making any efforts to reduce fraud and manage the risks proactively, it is important for the business organizations to identify the factors leading to fraudulent behaviour by understanding who are the fraudsters, when and why frauds are committed. Various theories have attempted to explain the causes of fraud and the two most cited theories are the Fraud Triangle Theory (FTT) of Cressey (1950) and Fraud Diamond Theory (FDT) of Wolfe and Hermanson (2004). Both of them identify the elements that lead perpetrators to commit fraud. According to Dorminey, Fleming, Kranacher, and Riley (2010), the origin of the FTT dates to the works of Edwin Sutherland (1939) who coined the term white-collar crime, and Cressey was one of Sutherland's former students. Cressey (1950) focused his research on the factors that lead individuals to engage in fraudulent and unethical activity. His research later became known as the FTT. This theory consists of three elements that are necessary for fraud to occur: (i) perceived pressure, (ii) opportunity, and (iii) rationalization. David T. Wolfe and Dana R. Hermanson believed that the former FTT has to be enhancing to improve both fraud prevention and detection by considering an additional element above the three, mentioned elements of FTT. They considered four sided FDT there by adding capability as the fourth element. Wolfe and Hermanson (2004 pp.38) state that fraud cannot successfully concealed unless the fraudster has capability: personal traits and abilities that play a major role in whether fraud may occur even with the presence of other three elements. In their separate works, Wolfe and Hermanson (2004), Thanasak (2013), Norman and Faizal (2010), Florenz (2012), Gbegi and Adebisi (2013) examined and discussed the FDT. Their main conclusion was that the FDT is an extended or improved version of the FTT with an addition of "capability" added to the three basic elements of fraud in the FTT. Therefore, this paper aims to further explain the convergent and divergent between the FTT and FDT. The paper is presented as follows: Section 1 discusses the fundamental concept of fraud; while section 2 examines the classical fraud theories, their convergent as well as divergent in general. In section 3 the paper was concluded and highlighted the areas likely for future research and the contribution to the existing body of knowledge. 2.0 Fundamental Concept of Fraud Fraud has grown rapidly over the last few years and there is a growing trend for large organisations to consider hiring professionals such as forensic accountants to reduce the pressure and potential of occupational financial frauds. According to the Association of Certified Fraud Examiner (ACFE, 2010), occupational fraud is the use of one's occupation for personal enrichment through the deliberate misuse of or misapplication of the employing organization's resources or assets. Irrespective of the sector, a wide category of crimes, swindles and employee trust violations fall under the category of fraud (ACFE, 2010; Duffield and Grabosky, 2001 & Levi, 2008, Kiragu, Wanjau, Gekara, and Kanali 2013). According to Merriam Webster's Dictionary of Law (1996) as quoted in Manurung and Hadian (2013, pp. 4), fraud can be defined as: "Any act, expression, omission, or concealment calculated to deceive another to his or her disadvantage, specifically, a misrepresentation or concealment with reference to some fact material to a transaction that is made with knowledge of its falsity. And or in reckless disregard of its truth or falsity and worth the intent to deceive another and that is reasonably relied on by the other who is injured thereby" Ernst and Young (2009) defines fraud as an act of deliberate action or mistake made by person or group of persons who knows that the error can result in some benefits that are not either to individuals or entities or other parties. According to Adeneji (2004:354) and Institute of Chartered Accountants of Nigeria (ICAN) (2006:206), fraud is an intentional act made by one or more individuals among management, employees or third parties who produce errors in financial reporting. Fraud can also be seen as misrepresentation, storage or negligence of a truth for the purpose of manipulating the financial statement to harm the company or organization, that also includes embezzlement, theft or any attempt to steal or unlawfully obtained, abuse or harm assets of an organization (asset misappropriation). European Journal of Business and Management ISSN 2222-1905 (Paper) ISSN 2222-2839 (Online) Vol. 7, No.28, 2015 OPPORTUNITY PRESSURE RATIONALIZATION www.iiste.org IISTE Figure 1: Fraud Triangle Source: Wells J. T. (2005) In 1953, Cressey published his research in a book called "Other People's Money". According to Rosefield (1988) in Okezie (2012), employees who commit fraud generally are able to do so because of the interaction between perceived pressures (usually financial), perceived opportunity and rationalization. 2.1 The Fraud Triangle Theory In order to appreciate the similarities and differences between FTT and FDT it is important to begin with Cressey's FTT (1950). In 1950, Donald Cressey, a criminologist, started the study of fraud by arguing that there must be a reason behind everything people do. Questions such as why people commit fraud led him to focus his research on what drives people to violate trust? He interviewed 250 criminals in a period of 5 months whose behaviour met two criteria: (i) the person must have accepted a position of trust in good faith, and (ii) the person must have violated the trust. He found that three factors must be present for a person to violate trust and was able to conclude that: "Trust violators, when they conceive of themselves as having a financial problem which is non- shareable, and have knowledge or awareness that this problem can be secretly resolved by violation of the position of financial trust. Also they are able to apply to their own conduct in that situation verbalizations which enable them to adjust their conceptions of themselves as trusted persons with their conceptions of themselves as users of the entrusted funds or property" (Crassey 1953:742). The three factors illustrated are non-shareable financial problem, opportunity to commit the trust violation, and rationalization by the trust violator. When it comes to non-shareable financial problem, Cressey (1953) stated that, "persons become trust violators when they conceive of themselves as having incurred financial obligations which are considered as non-socially sanction-able and which, consequently, must be satisfied by a private or secret means" (Crassey 1953: 741). In addition, Crassey (1953) also mentioned that perceived opportunity arises when the fraudster sees a way to use their position of trust to solve the financial problem, knowing they are unlikely to be caught. As for rationalization, he concluded that most fraudsters are first-time offenders with no criminal record. They see themselves as ordinary, honest people who are caught in a bad situation. This enables them to reason their own criminal actions to themselves in a way that makes it acceptable or justifiable: "In the interviews, many trust violators expressed the idea that they knew the behaviour to be illegal and wrong at all times and that they merely kidded themselves into thinking that it was not illegal" (Crassey 1953:741). The three elements of fraud summarized by Cressey (1953) are commonly presented in a diagram shown in Figure 1. The top element of the diagram represents the pressure or motive to commit the fraudulent act while the two elements at the bottom are perceived opportunity and rationalization (Wells 2011 in Rasha and Andrew, 2012). Over the years, the fraud hypothesis intiated by Cressey (1950) has become known as the FTT. 2.2 Perceived Pressure/Incentive/Motive Perceived pressure or incentive relates to the motivation that leads to unethical behaviors. Every fraud perpetrator faces some type of pressure to commit unethical behavior. Albrecht et al. (2006) pointed out that, the word perceived is important because pressure does not have to be real; if the perpetrators believed that they are pressurized, this belief can lead to fraud. Perceived pressure can result from various circumstances, but it often involves a non-sharable financial need. Financial pressure has a major impact on an employee's motivation and is consider the most common type of pressure. Specifically, about 95% of all cases of fraud have been influenced by financial pressure (Albrecht et al, 2006). Lister (2007) states that, pressure is a significant factor in committing fraud. He determines three types of pressure which are personal, employment stress, and external pressure. Vona (2008) further examines personal and corporate pressures as motivations' proxies for fraud commitment. Examples of perceived pressure include greed, living beyond one's means, large expenses or personal debt, family financial problem or health, drug addiction and gambling. Lister (2007:63) defined the pressure/motive to commit fraud as "the source of heat for the fire" but he believed the presence of these pressures in someone's life does not mean he or she will commit fraud. Murdock (2008) also argued that the pressure could be related to financial, non-financial, political and social. Non-financial pressure can be derived from a lack of personal discipline or other weaknesses such as gambling habit and drug addiction. On the other hand, political and social pressure occurs when people feel they cannot appear to fail due to their status or reputation. According to Rae and Subramanian (2008) pressure relates to employees' motivation to commit fraud because of greed or personal financial pressure. Along the same line, Vona (2008) as quoted by Rasha and Andrew (2012:193) believed the motive to commit fraud is often associated with personal pressures or corporate pressures on the individual. The initial motive to commit fraud may be driven just by the pressure, rationalization, or by sheer opportunity. Chen and Elder (2007) as cited by Fazli, Mohd and muhammed (2014) identified six basic categories for pressure including transgression of obligations, problems originated from individual problems, corporate inversion, position achievement and relationship between employees. Albrecht et al. (2008) categorized pressure in four groups including economic, vice, job-related and other pressures. According to Hooper and Pornelli (2010), pressure can be either a positive or a negative force. When goals are achievable, pressure contributes to creativity, efficiency, and competitiveness. However, temptations for misconduct arise when goals do not appear to be attainable by normal means, yet pressure continues unabated, with career advancement, compensation, and even continued employment at risk. When pressure is transformed into an obsessive determination to achieve goals regardless of the cost, it becomes unbalanced and potentially destructive. This is a situation where individuals are most likely to resort to questionable activities that may eventually lead to fraud (Hooper and poenelli 2010). Singleton, Bologna, Lindquist, and Singleton (2006) stated that pressure, incentive or motivation refers to something that has happened in the fraudster's personal life that creates a stressful need for funds and thus, pushes the person to steal. However, this financial strain could also be a symptom of other types of pressures. According to Kenyon and Tilton (2006), management or other employees 32 22 European Journal of Business and Management ISSN 2222-1905 (Paper) ISSN 2222-2839 (Online) Vol. 7, No.28, 2015 www.iiste.org IISTE may find themselves offered incentives or placed under pressure to commit fraud. Singleton et al. (2006) stated that incentives or pressures might take a variety of forms within an organization. These financial 'rewards' include bonuses or pay-related incentives including employees or group's compensation and share price targets. Perceived Opportunity 2.3 The second necessary element for fraud to occur is perceived opportunity. Opportunity is created by ineffective control or governance system that allows an individual to commit organisational fraud. In the field of accounting, this is termed as internal control weaknesses. The concept of perceived opportunity suggests that people will take advantage of circumstances available to them (Kelly and Hartley, 2010). Perceived opportunity is similar to perceived pressure in that the opportunity does not have to be real. The perpetrator must simply believe or perceive that the opportunity exists. In most cases, the lower the risk of being caught, the more likely it is that fraud will take place (Cressey 1953). Other factors related to perceived opportunity can also contribute to fraud, such as the assumption that, the employer is unaware, the assumption that employees are not checked regularly for violating organizational policies, the belief that no one will care, and that no one will consider the behaviour to be a serious offense (Sauser, 2007). According to Rae and Subramanian (2008) in Rasha and Andrew (2012), opportunity refers to a weakness in the system where the employee has the power or ability to exploit the situation and, making fraud possible. Hooper et al. (2010) state that, even when the pressure is extreme, financial fraud cannot occur unless an opportunity is present. Opportunity has two aspects: (i) the inherent susceptibility of the organization to manipulation, and (ii) the conditions within the organization that may allow a fraud to occur. Furthermore, Srivastava, Mock and Turner (2005) argue that even if a person has a motive, he cannot commit fraud if no possibilities are created. For example, if there is a poor job division, a poor internal control, the audit is not performed on a regular basis, and the like, then the conditions will be favourable for the employee to commits fraud. Chen and Elder (2007) and Fazli, Mohd and Muhammad (2014) used three proxies based on TSAS 43 to measure opportunity including related party transactions, CEO duality and difference between control and cash flow rights. Moyes et al. (2005) report that the presence of related party transactions ranks the second amongst the most frequently encountered opportunity. In a study by Wilks and Zimbelman (2004) the related party transactions was placed the third amongst the most common of opportunity to the fraudster. Similarly, Ming and Wong (2003) also used related party transactions as a proxy to measure the opportunity. Vance (1983) state that another proxy for opportunity was ineffective monitoring which was attributed to weak directorship in the public sector. Vance (1983) suggested that CEO domination decreases the effectiveness of board in providing accurate control over management activities. Another proxy is organizational structure. According to Kenyon and Tilton (2006), as quoted by Ewa and Udoayang (2012) absent or ineffective controls, lack of supervision or inadequate segregation of duties may provide opportunities to commit fraud. Lindquist and Singleton (2006), stated that the 'Report To The Nation (RTTN) (2004) research carried out by Association of Certified Fraud Examiners showed that most employees and managers who commits fraud tend to have a long tenure with organization. That is what gives the chance to exploit the opportunity therein the organization. Ewa and Udoayang (2012) deduced, that employees and managers who have been around for years know quite well where the weaknesses are in the internal controls and have gained sufficient knowledge of how to commit the crime successfully without fear and stress. Rationalization 2.4 The third element of the FTT is rationalization. This concept suggests that the perpetrator must formulate some type of morally acceptable rationalization before engaging in unethical behaviour. Rationalization refers to the justification that the unethical behaviour is something other than criminal activity. If an individual cannot justify unethical actions, it is unlikely that he or she will engage in fraud. Some examples of rationalizations of fraudulent behaviour include "I was only borrowing the money", "I was entitled to the money", "I had to steal to provide for my family", "I was underpaid/my employer had cheated me" (Cressey, 1953). It is important to note that rationalization is difficult to observe, as it is impossible to read the perpetrator's mind (Cressey 1953 in Wells, 2005). Individuals who commit fraud possess a particular mind-set that allows them to justify or excuse their fraudulent actions (Hooper and Pornelli, 2010). Rationalization is a justification of fraudulent behaviour because of an employee's lack of personal integrity, or other moral reasoning (Rae and Subramanian, 2008). Some individuals are more prone than others to commit fraud. That the propensity to commit fraud depends on people ethical values as well as on their personal circumstances. The ethical behaviour is motivated both by a person's character and by external factors, which include job insecurity such as during a downsizing, redundancy, a work environment that inspires resentment such as being, passed over for promotion. Likewise, external environment includes the tone at the top i.e. the attitude of management toward fraud risk and management's response to actual instances of fraud. They posited that when fraud has occurred in the past and management has not responded appropriately, others might conclude that the 33 European Journal of Business and Management ISSN 2222-1905 (Paper) ISSN 2222-2839 (Online) Vol.7, No.28, 2015 issue is not taken seriously and they can get away with it (Kenyon and Tilton, 2006). www.iiste.org IISTE Wilson (2004) explains "opportunity" as the ability to override fraud controls. Similarly, Wilson ibid describes "pressure" as the motivation to commit the fraudulent act, and "rationalization" as referring to the moral and ethical argument used to justify the act. The elements of incentive/pressure, opportunity, rationalization and capability are all inter-related, and the strength of each element influences the others. Howe and Malgwi (2006) concluded that a bridge between incentive/pressure and opportunity is created when an individual is able to rationalize the fraudulent behaviour. 3.0 The Fraud Diamond Theory The FDT was first presented by Wolfe and Hermanson in the CPA Journal (December 2004). It is generally viewed as an expanded version of the FTT. Figure 2 presents the diagram for FDT. In this theory, an element termed capability has been added to the three initial fraud elements of the FTT. Wolfe and Hermanson (2004) argued that although perceived pressure or incentive might coexist with an opportunity to commit fraud and a rationalization for doing so, it is unlikely for fraud to take place unless the fourth element (i.e., capability) is also present. In other words, the potential perpetrator must have the skills and ability to commit fraud. INCENTIVE CAPABILITY OPPORTUNITY RATIONALIZATION Figure 2. The fraud diamond Source: Wolfe and Hermanson (2004) According to Wolfe and Hermanson (2004:38) "Opportunity opens the doorway to fraud, and incentive (i.e. pressure) and rationalization can draw a person toward it. However, the person must have the capability to recognize the open doorway as an opportunity and to take advantage of it by walking through, not just once, but repeatedly". With the additional element presented in the FDT affecting individuals' decision to commit fraud, the organization and auditors need to understand employees' individual traits and abilities in order to assess the risk of fraudulent behaviours in the public sector. The elements of FDT are interrelated to the extent that an employee cannot commit fraud until all of the elements are present. The theory proposes that pressure can cause someone to seek opportunity, and pressure and opportunity can encourage rationalization. At the same time, none of these two factors, alone or together, necessarily cause an individual to engage in activities that could lead to fraud until the fraudster has the capability to do so (Hooper and Pornelli, 2010). The additional element, i.e., capability is what differentiates the FDT of Wolfe and Hermanson (2004) from the FTT of Cressey (1950). 3.1 Capability This is the situation of having the necessary traits or skills and abilities for the person to commit fraud. It is where the fraudster recognised the particular fraud opportunity and ability to turn it into reality. Position, intelligence, ego, coercion, deceit and stress, are the supporting elements of capability (Wolfe and Hermanson 2004). According to Bressler and Bressler (2007) as cited by Mackevicius and Giriunas (2013) not every person who possessed motivation, opportunities, and realisation may commit fraud due to the lack of the capability to carry it out or to conceal it. Albrecht, Williams, and Wernz (1995) opine that this element is particularly important when it concerns a large-scale or long-term fraud. Furthermore, Albrecht et al. (1995) believe that only the person who has an extremely high capacity will be able to understand the existing internal control, to identify its weaknesses and to use them in planning the implementation of fraud. 3.2 Position/Function Wolfe and Hermanson (2004:39) state that the person's position or function within the organization may furnish 34 4 European Journal of Business and Management ISSN 2222-1905 (Paper) ISSN 2222-2839 (Online) Vol.7, No.28, 2015 www.iiste.org IISTE the ability to create or exploit an opportunity for fraud not available to others. In a research conducted as An Analysis of U.S. Public Companies, Beasley et al. (1999) as quoted by Wolfe and Hermanson (2004) found that corporate CEOs were implicated in over 70 percent of publicly-company's accounting frauds. They also report that many organizations do not implement sufficient checks and balances to mitigate their CEO's capabilities to influence and perpetuate frauds. Additionally, when people perform a certain function repeatedly, such as bank reconciliations or setting up new vendor accounts, their capability to commit fraud increases as their knowledge of the function's processes and controls expands over time. 3.3 Intelligence/Creativity and Ego The fraudster is someone who understands and capable of exploiting internal control weaknesses and using the position; function or authorized access to the greatest advantage. Intelligent, experienced, creative people with a solid grasp of controls and vulnerabilities, commit many of today's largest frauds. This knowledge is used to leverage the person's responsibility over or authorized access to systems or assets (Wolfe and Hermanson 2004:40). According to the Association of Certified Fraud Examiners (2003), 51% of the perpetrators of occupational fraud had at least a bachelor's degree, and 49% of the fraudsters were over 40 years old. In addition, managers or executives committed 46% of the frauds based on the Association's recent study. The fraudster has a strong ego and great confidence that he will not be detected, or believes that he could easily take himself out of trouble if caught. Such confidence or arrogance can affect one's cost benefit analysis of engaging in fraud. The more confident the person, the lower the estimated cost of fraud will be (Wolfe and Hermanson 2004:40). In an article entitled, "The Human Face of Fraud" it is noted that, one of the common personality types among fraudsters is the ego. An egoistic person refers to someone who is "driven to succeed at all costs, self-absorbed, self-confident and narcissistic" (Duffield and Grabosky, 2001). "The Psychology of Fraud" notes that, in addition to financial strain, an aspect of aspect of motivation that may apply to some or all types of fraud is ego/power. Wolfe and Hermanson (2004:40) quoting Sutherland (1977) "Theory of White Collar Criminals" state that, "As fraudsters found themselves successful at this crime, they began to gain some secondary delight in the knowledge that they are fooling world, that they are showing their superiority to others". The individuals committing fraud must have a strong ego and great confidence that they will not be detected. The common personality types include someone who is driven to succeed at all costs, self-absorbed, self-confident, and often-narcissistic (Rudewicz 2011). According to the Diagnostic and Statistical Manual of Mental Disorders (DSMMD), as cited by Rudewicz (2011) narcissistic personality disorder is a pervasive pattern of grandiosity, a need for admiration and a lack of empathy for others. Individuals with this disorder believe they are superior or unique, and they are likely to have inflated views of their own accomplishments and abilities. -What did you learn? In your own words what does it mean? -What do you agree or disagree with? -What is not clear? What questions do you have? -Why is this information relevant? -Are there other points of view? What are the pros and cons? -Do you have any relevant personal experiences?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started