Answered step by step

Verified Expert Solution

Question

1 Approved Answer

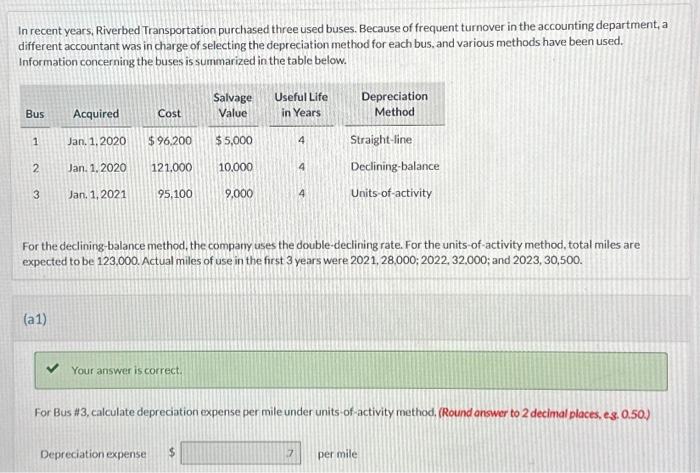

In recent years, Riverbed Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant was in charge of selecting

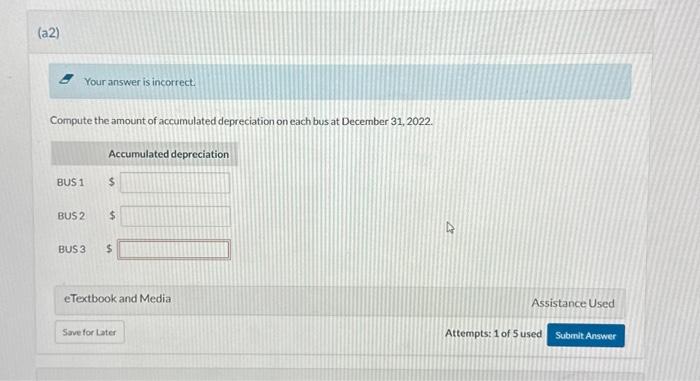

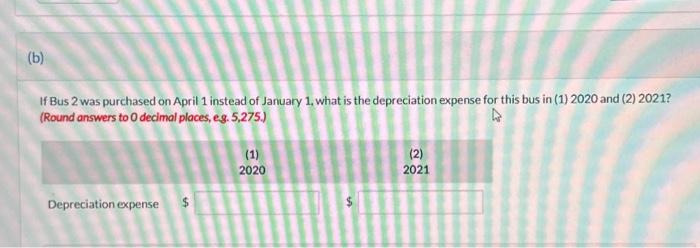

In recent years, Riverbed Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant was in charge of selecting the depreciation method for each bus, and various methods have been used. Information concerning the buses is summarized in the table below. Bus 1 2 3 Acquired (a1) Jan. 1, 2020 Jan. 1, 2020 Jan. 1, 2021 Cost $ 96,200 121,000 Depreciation expense 95,100 Your answer is correct. Salvage Value $5,000 10,000 9,000 Useful Life in Years 4 For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total miles are expected to be 123,000. Actual miles of use in the first 3 years were 2021, 28,000; 2022, 32,000; and 2023, 30,500. 4 .7 Depreciation Method Straight-line Declining-balance Units-of-activity For Bus #3, calculate depreciation expense per mile under units-of-activity method. (Round answer to 2 decimal places, e.g. 0.50.) per mile

please help with A2 & B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started