Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In reference to the tables above, if you were presenting to senior management and had to give one number for each final valuation, what would

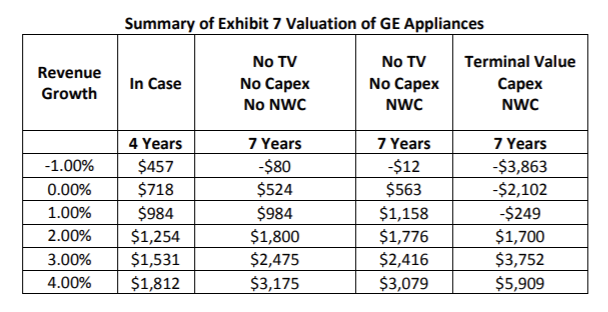

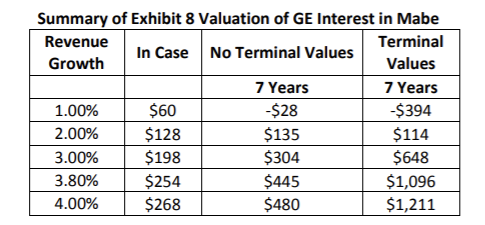

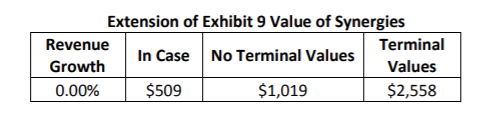

In reference to the tables above, if you were presenting to senior management and had to give one number for each final valuation, what would those numbers be, and how would you arrive at the numbers?

Hint: Think of final valuation as the conservative number. For GE, you should look at 7-year TV, Capex, and NWC. For Mabe, use No TV and slightly higher revenue growth, and for synergies, use the case numbers.

***Please explain why you chose the numbers you chose.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started