Answered step by step

Verified Expert Solution

Question

1 Approved Answer

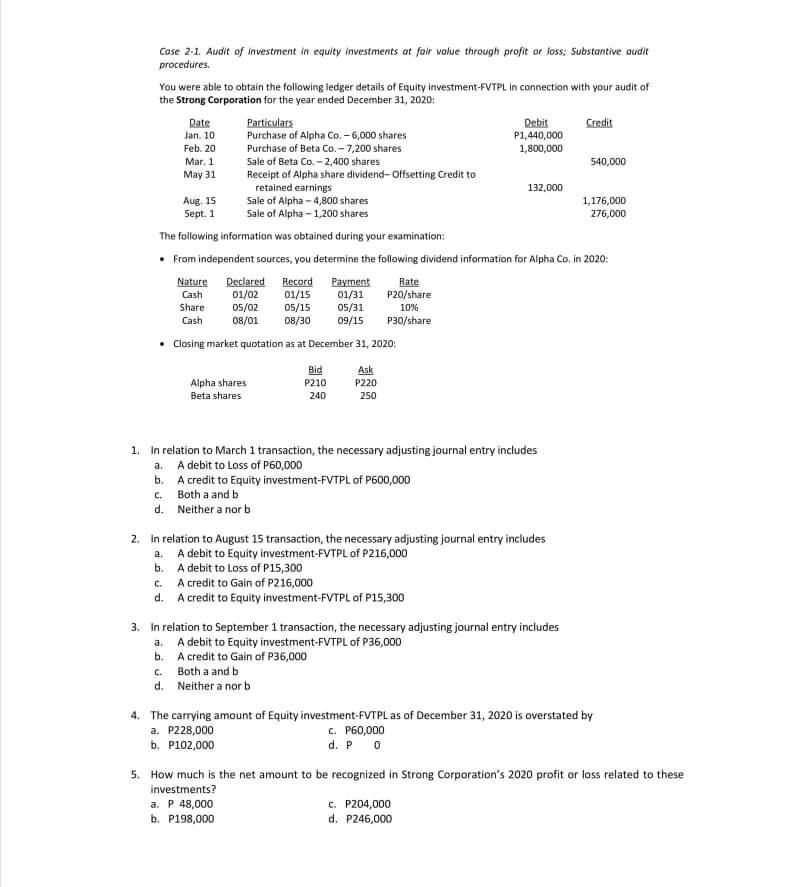

Case 2-1. Audit of investment in equity investments at fair value through profit or loss; Substantive audit procedures. You were able to obtain the

Case 2-1. Audit of investment in equity investments at fair value through profit or loss; Substantive audit procedures. You were able to obtain the following ledger details of Equity investment-FVTPL in connection with your audit of the Strong Corporation for the year ended December 31, 2020: Date Jan. 10 Feb. 20 Mar. 1 May 31 Aug. 15 Sept. 1 Particulars Purchase of Alpha Co. -6,000 shares Purchase of Beta Co.-7,200 shares Sale of Beta Co.-2,400 shares Receipt of Alpha share dividend-Offsetting Credit to retained earnings Sale of Alpha-4,800 shares Sale of Alpha-1,200 shares Alpha shares Beta shares Bid P210 240 The following information was obtained during your examination: From independent sources, you determine the following dividend information for Alpha Co. in 2020: Nature Declared Record Payment Cash 01/15 01/31 05/15 05/31 08/01 08/30 09/15 01/02 05/02 Share Cash Closing market quotation as at December 31, 2020: Ask P220 250 b. c. Both a and b d. Neither a nor b a. P 48,000 b. P198,000 Rate P20/share 10% P30/share 1. In relation to March 1 transaction, the necessary adjusting journal entry includes a. A debit to Loss of P60,000 b. A credit to Equity investment-FVTPL of P600,000 c. Both a and b d. Neither a nor b Debit P1,440,000 1,800,000 2. In relation to August 15 transaction, the necessary adjusting journal entry includes a. A debit to Equity investment-FVTPL of P216,000 b. A debit to Loss of P15,300 C. A credit to Gain of P216,000 d. A credit to Equity investment-FVTPL of P15,300 132,000 3. In relation to September 1 transaction, the necessary adjusting journal entry includes A debit to Equity investment-FVTPL of P36,000 A credit to Gain of P36,000 . 60,000 d. P0 Credit c. P204,000 d. P246,000 540,000 4. The carrying amount of Equity investment-FVTPL as of December 31, 2020 is overstated by a. P228,000 b. P102,000 1,176,000 276,000 5. How much is the net amount to be recognized in Strong Corporation's 2020 profit or loss related to these investments?

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To answer the questions related to the audit of investment in equity investments at fair value through profit or loss lets analyze the information provided 1 In relation to the March 1 transact...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started