Answered step by step

Verified Expert Solution

Question

1 Approved Answer

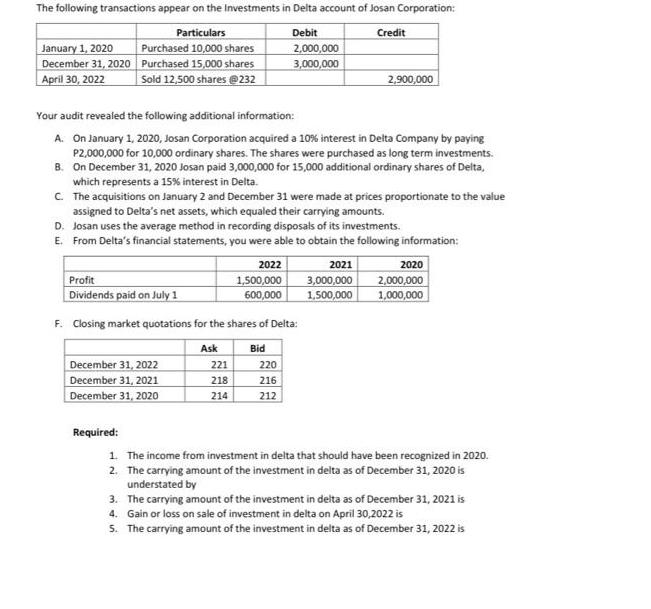

The following transactions appear on the Investments in Delta account of Josan Corporation: Particulars Purchased 10,000 shares December 31, 2020 Purchased 15,000 shares Sold

The following transactions appear on the Investments in Delta account of Josan Corporation: Particulars Purchased 10,000 shares December 31, 2020 Purchased 15,000 shares Sold 12,500 shares @232 Debit Credit January 1, 2020 2,000,000 3,000,000 April 30, 2022 2,900,000 Your audit revealed the following additional information: A. On January 1, 2020, Josan Corporation acquired a 10% interest in Delta Company by paying P2,000,000 for 10,000 ordinary shares. The shares were purchased as long term investments. B. On December 31, 2020 Josan paid 3,000,000 for 15,000 additional ordinary shares of Delta, which represents a 15% interest in Delta. C The acquisitions on January 2 and December 31 were made at prices proportionate to the value assigned to Delta's net assets, which equaled their carrying amounts. D. Josan uses the average method in recording disposals of its investments. E. From Delta's financial statements, you were able to obtain the following information: 2022 2021 2,000,000 1,000,000 2020 Profit Dividends paid on July 1 1,500,000 600,000 3,000,000 1.500,000 F. Closing market quotations for the shares of Delta: Ask Bid December 31, 2022 December 31, 2021 December 31, 2020 221 220 218 216 214 212 Required: 1. The income from investment in delta that should have been recognized in 2020. 2. The carrying amount of the investment in delta as of December 31, 2020 is understated by 3. The carrying amount of the investment in delta as of December 31, 2021 is 4. Gain or loss on sale of investment in delta on April 30,2022 is S. The carrying amount of the investment in delta as of December 31, 2022 is

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 The income from investment in delta that should have been recognized in 2020 is P1000000 which is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started