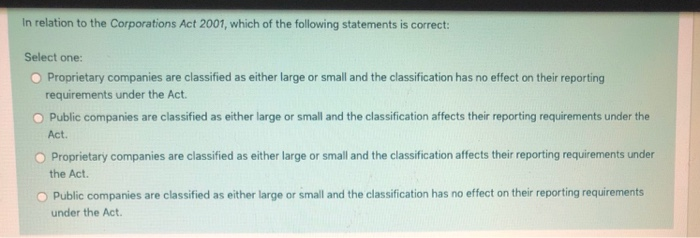

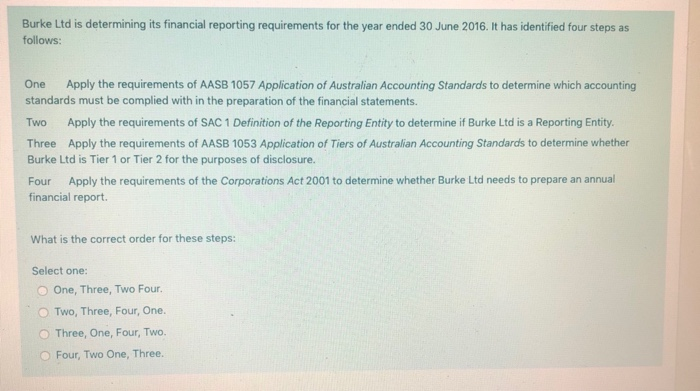

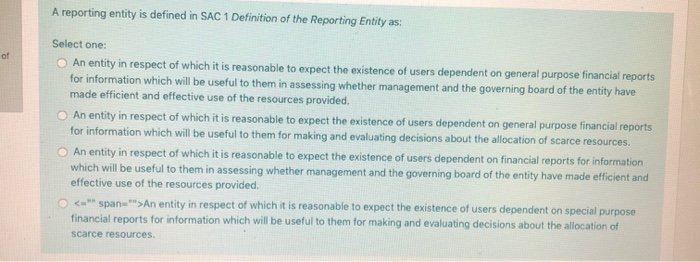

In relation to the Corporations Act 2001, which of the following statements is correct: Select one: Proprietary companies are classified as either large or small and the classification has no effect on their reporting requirements under the Act. Public companies are classified as either large or small and the classification affects their reporting requirements under the Act. Proprietary companies are classified as either large or small and the classification affects their reporting requirements under the Act. Public companies are classified as either large or small and the classification has no effect on their reporting requirements under the Act. Burke Ltd is determining its financial reporting requirements for the year ended 30 June 2016. It has identified four steps as follows: One Apply the requirements of AASB 1057 Application of Australian Accounting Standards to determine which accounting standards must be complied with in the preparation of the financial statements. Two Apply the requirements of SAC 1 Definition of the Reporting Entity to determine if Burke Ltd is a Reporting Entity. Three Apply the requirements of AASB 1053 Application of Tiers of Australian Accounting Standards to determine whethe Burke Ltd is Tier 1 or Tier 2 for the purposes of disclosure. Four Apply the requirements of the Corporations Act 2001 to determine whether Burke Ltd needs to prepare an annual financial report. What is the correct order for these steps: Select one: One, Three, Two Four. Two, Three, Four, One. Three, One, Four, Two. Four, Two One, Three. A reporting entity is defined in SAC 1 Definition of the Reporting Entity as: Select one: An entity in respect of which it is reasonable to expect the existence of users dependent on general purpose financial reports for information which will be useful to them in assessing whether management and the governing board of the entity have made efficient and effective use of the resources provided. An entity in respect of which it is reasonable to expect the existence of users dependent on general purpose financial reports for information which will be useful to them for making and evaluating decisions about the allocation of scarce resources An entity in respect of which it is reasonable to expect the existence of users dependent on financial reports for information which will be useful to them in assessing whether management and the governing board of the entity have made efficient and effective use of the resources provided. An entity in respect of which it is reasonable to expect the existence of users dependent on special purpose financial reports for information which will be useful to them for making and evaluating decisions about the allocation of scarce resources