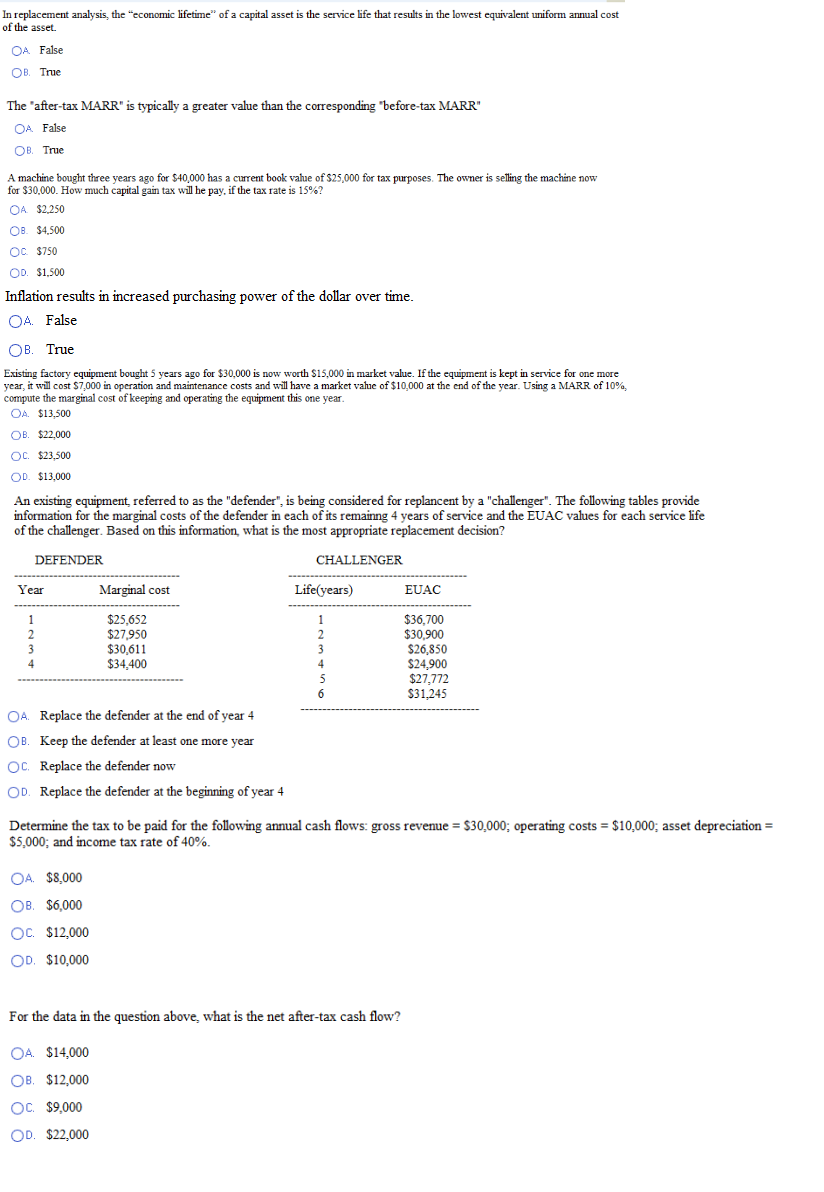

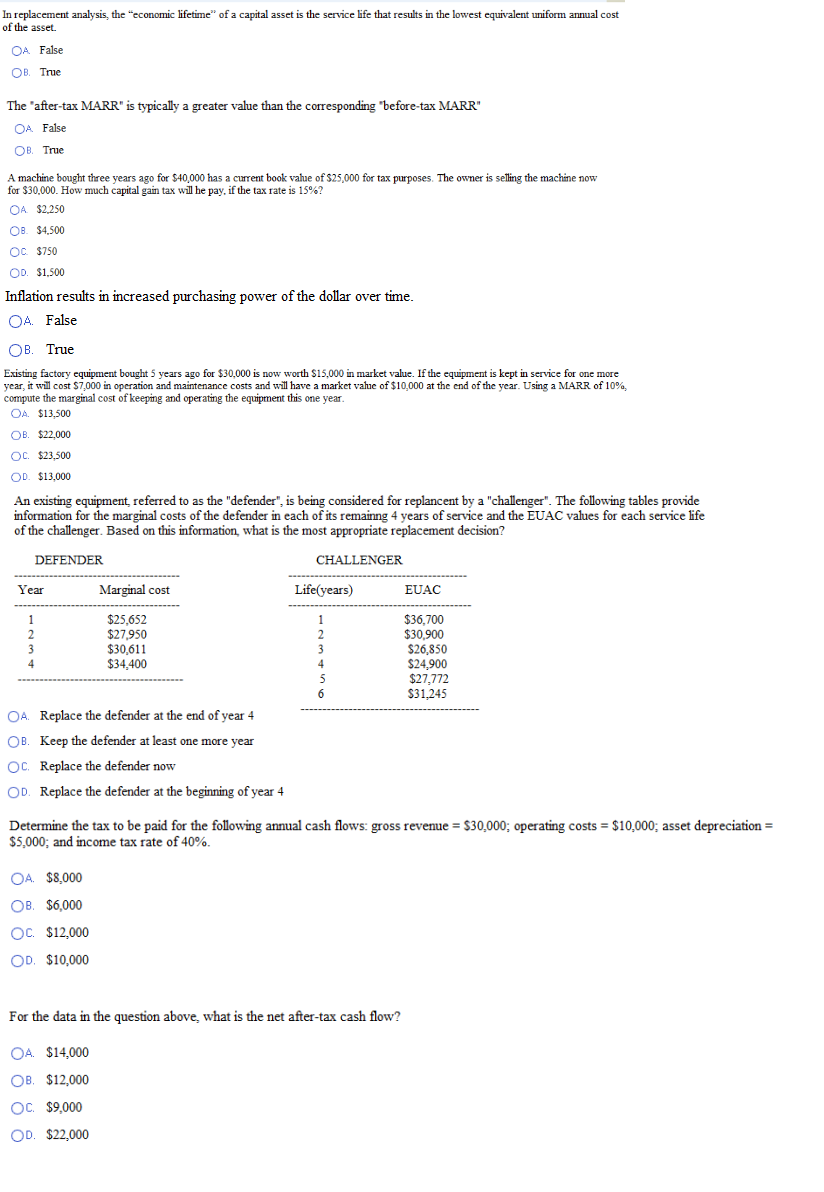

In replacement analysis, the "economic lifetime" of a capital asset is the service life that results in the lowest equivalent uniform annual cost of the asset. False True The "after-tax MARR" is typically a greater value than the corresponding "before-tax MARR" False True A machine bought three years ago for $40,000 has a current book value of $25,000 for tax purposes. The owner is selling the machine now for $30,000. How much capital gain tax will he pay, if the tax rate is 15%? $2,250 $4,500 $750 $1,500 Inflation results in increased purchasing power of the dollar over time. False True Existing factory equipment bought 5 years ago for $30,000 is now worth $15,000 in market value. If the equipment is kept in service for one more year, it will cost $7,000 in operation and maintenance costs and will have a market value of $10,000 at the end of the year. Using a MARR of 10%, compute the marginal cost of keeping and operating the equipment this one year. $13,500 $22,000 $23,500 $13,000 An existing equipment, referred to as the "defender", is being considered for replacement by a "challenger". The following tables provide information for the marginal costs of the defender in each of its remaining 4 years of service and the EUAC values for each service life of the challenger. Based on this information, what is the most appropriate replacement decision? Replace the defender at the end of year 4 Keep the defender at least one more year Replace the defender now Replace the defender at the beginning of year 4 Determine the tax to be paid for the following annual cash flows: gross revenue = $30,000; operating costs = $10,000; asset depreciation = $5,000; and income tax rate of 40%. $8,000 $6,000 $12,000 $10,000 For the data in the question above, what is the net after-tax cash flow? $14,000 $12,000 $9,000 $22,000 In replacement analysis, the "economic lifetime" of a capital asset is the service life that results in the lowest equivalent uniform annual cost of the asset. False True The "after-tax MARR" is typically a greater value than the corresponding "before-tax MARR" False True A machine bought three years ago for $40,000 has a current book value of $25,000 for tax purposes. The owner is selling the machine now for $30,000. How much capital gain tax will he pay, if the tax rate is 15%? $2,250 $4,500 $750 $1,500 Inflation results in increased purchasing power of the dollar over time. False True Existing factory equipment bought 5 years ago for $30,000 is now worth $15,000 in market value. If the equipment is kept in service for one more year, it will cost $7,000 in operation and maintenance costs and will have a market value of $10,000 at the end of the year. Using a MARR of 10%, compute the marginal cost of keeping and operating the equipment this one year. $13,500 $22,000 $23,500 $13,000 An existing equipment, referred to as the "defender", is being considered for replacement by a "challenger". The following tables provide information for the marginal costs of the defender in each of its remaining 4 years of service and the EUAC values for each service life of the challenger. Based on this information, what is the most appropriate replacement decision? Replace the defender at the end of year 4 Keep the defender at least one more year Replace the defender now Replace the defender at the beginning of year 4 Determine the tax to be paid for the following annual cash flows: gross revenue = $30,000; operating costs = $10,000; asset depreciation = $5,000; and income tax rate of 40%. $8,000 $6,000 $12,000 $10,000 For the data in the question above, what is the net after-tax cash flow? $14,000 $12,000 $9,000 $22,000