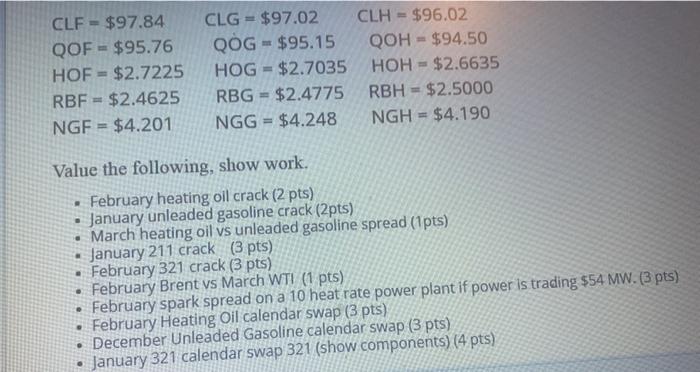

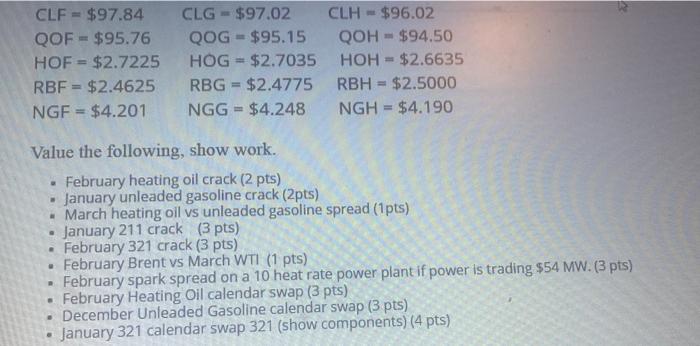

In respect to any of the markets discussed in W2, give an example of a market maker creating a "plain vanilla swap. (2) a differential wap and (3)a margin/crack swap. In each example show how this price risk could be hedged. TT T Anal 3(12pt) CLF = $97.84 QOF = $95.76 HOF - $2.7225 RBF = $2.4625 NGF = $4.201 CLG = $97.02 QOG = $95.15 HOG = $2.7035 RBG = $2.4775 NGG = $4.248 CLH = $96.02 QOH =$94.50 HOH - $2.6635 RBH = $2.5000 NGH = $4.190 . Value the following, show work. February heating oil crack (2 pts) January unleaded gasoline crack (2pts) March heating oil vs unleaded gasoline spread (1pts) January 211 crack (3 pts) February 321 crack (3 pts) February Brent vs March WTI (1 pts) February spark spread on a 10 heat rate power plant if power is trading $54 MW. (3 pts) February Heating Oil calendar swap (3 pts) December Unleaded Gasoline calendar swap (3 pts) January 321 calendar swap 321 (show components) (4 pts) . . CLF = $97.84 CLG -$97.02 CLH - $96.02 QOF - $95.76 QOG - $95.15 QOH - $94.50 HOF - $2.7225 HOG -$2.7035 HOH = $2.6635 RBF = $2.4625 RBG = $2.4775 RBH - $2.5000 NGF = $4.201 NGG = $4.248 NGH = $4.190 Value the following, show work. February heating oil crack (2 pts) January unleaded gasoline crack (2pts) March heating oil vs unleaded gasoline spread (1pts) January 211 crack (3 pts) February 321 crack (3 pts) February Brent vs March WTI (1 pts) February spark spread on a 10 heat rate power plant if power is trading $54 MW. (3 pts) February Heating Oil calendar swap (3 pts) December Unleaded Gasoline calendar swap (3 pts) January 321 calendar swap 321 (show components) (4 pts) . In respect to any of the markets discussed in W2, give an example of a market maker creating a "plain vanilla swap. (2) a differential wap and (3)a margin/crack swap. In each example show how this price risk could be hedged. TT T Anal 3(12pt) CLF = $97.84 QOF = $95.76 HOF - $2.7225 RBF = $2.4625 NGF = $4.201 CLG = $97.02 QOG = $95.15 HOG = $2.7035 RBG = $2.4775 NGG = $4.248 CLH = $96.02 QOH =$94.50 HOH - $2.6635 RBH = $2.5000 NGH = $4.190 . Value the following, show work. February heating oil crack (2 pts) January unleaded gasoline crack (2pts) March heating oil vs unleaded gasoline spread (1pts) January 211 crack (3 pts) February 321 crack (3 pts) February Brent vs March WTI (1 pts) February spark spread on a 10 heat rate power plant if power is trading $54 MW. (3 pts) February Heating Oil calendar swap (3 pts) December Unleaded Gasoline calendar swap (3 pts) January 321 calendar swap 321 (show components) (4 pts) . . CLF = $97.84 CLG -$97.02 CLH - $96.02 QOF - $95.76 QOG - $95.15 QOH - $94.50 HOF - $2.7225 HOG -$2.7035 HOH = $2.6635 RBF = $2.4625 RBG = $2.4775 RBH - $2.5000 NGF = $4.201 NGG = $4.248 NGH = $4.190 Value the following, show work. February heating oil crack (2 pts) January unleaded gasoline crack (2pts) March heating oil vs unleaded gasoline spread (1pts) January 211 crack (3 pts) February 321 crack (3 pts) February Brent vs March WTI (1 pts) February spark spread on a 10 heat rate power plant if power is trading $54 MW. (3 pts) February Heating Oil calendar swap (3 pts) December Unleaded Gasoline calendar swap (3 pts) January 321 calendar swap 321 (show components) (4 pts)