Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In response to the above debate, with regard to project appraisal methodology, assistant finance manager of Edlar Services Itd. attends a two-day course on

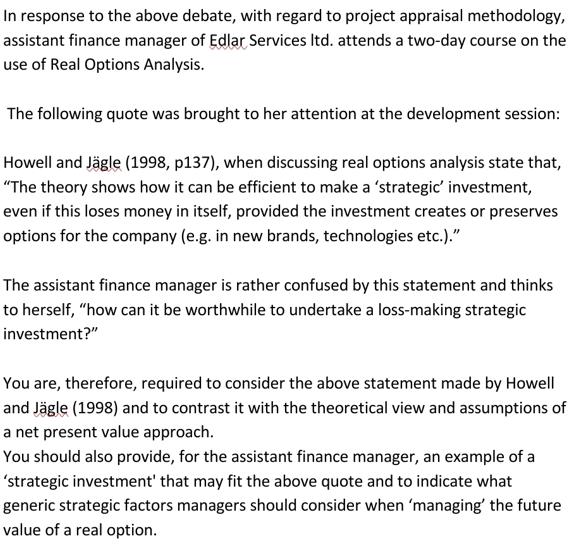

In response to the above debate, with regard to project appraisal methodology, assistant finance manager of Edlar Services Itd. attends a two-day course on the use of Real Options Analysis. The following quote was brought to her attention at the development session: Howell and Jgle (1998, p137), when discussing real options analysis state that, "The theory shows how it can be efficient to make a 'strategic' investment, even if this loses money in itself, provided the investment creates or preserves options for the company (e.g. in new brands, technologies etc.)." The assistant finance manager is rather confused by this statement and thinks to herself, "how can it be worthwhile to undertake a loss-making strategic investment?" You are, therefore, required to consider the above statement made by Howell and Jgle (1998) and to contrast it with the theoretical view and assumptions of a net present value approach. You should also provide, for the assistant finance manager, an example of a 'strategic investment' that may fit the above quote and to indicate what generic strategic factors managers should consider when 'managing' the future value of a real option.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Real options analysis ROA is a relatively new project appraisal methodology which looks beyond the t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started