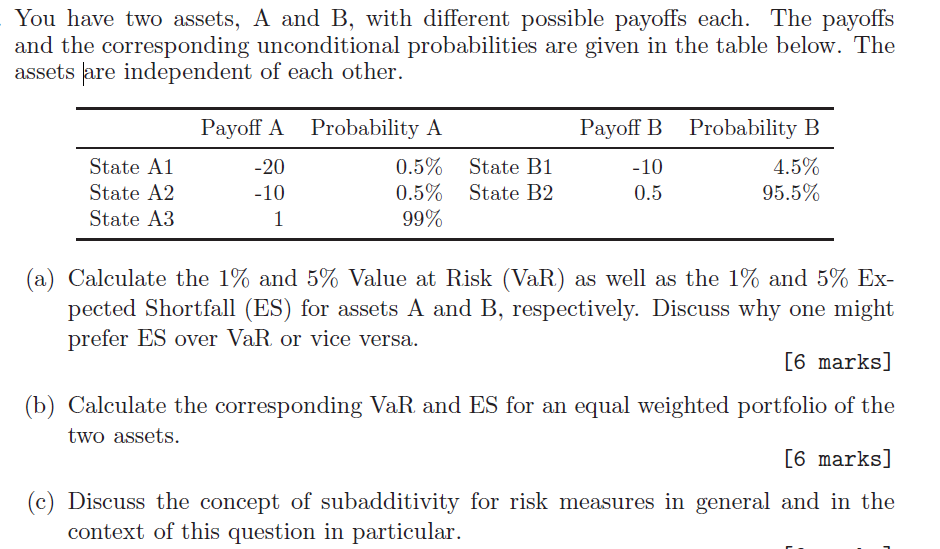

You have two assets, A and B, with different possible payoffs each. The payoffs and the corresponding unconditional probabilities are given in the table

You have two assets, A and B, with different possible payoffs each. The payoffs and the corresponding unconditional probabilities are given in the table below. The assets are independent of each other. State Al State A2 State A3 Payoff A Probability A -20 -10 1 0.5% State B1 0.5% State B2 99% Payoff B Probability B -10 4.5% 0.5 95.5% (a) Calculate the 1% and 5% Value at Risk (VaR) as well as the 1% and 5% Ex- pected Shortfall (ES) for assets A and B, respectively. Discuss why one might prefer ES over VaR or vice versa. [6 marks] (b) Calculate the corresponding VaR and ES for an equal weighted portfolio of the two assets. [6 marks] (c) Discuss the concept of subadditivity for risk measures in general and in the context of this question in particular.

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the Value at Risk VaR and Expected Shortfall ES for assets A and B we need to determine the cumulative probabilities for each assets payoff distribution a Calculation of VaR and ES ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started