In Separate Excel Sheets :

1.Prepare conversion Journal Entries necessary to prepare Government-wide Financial Statements

2.Prepare a Conversion worksheet

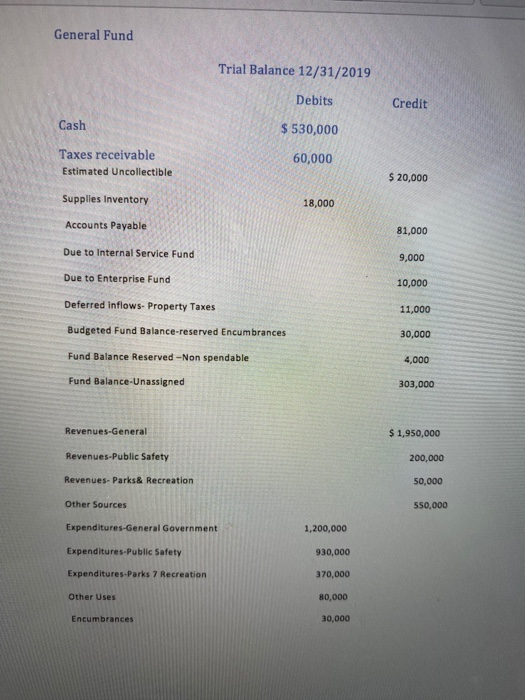

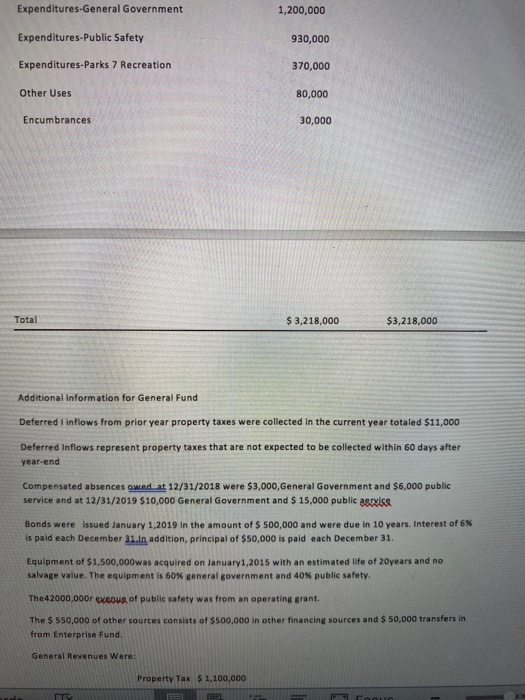

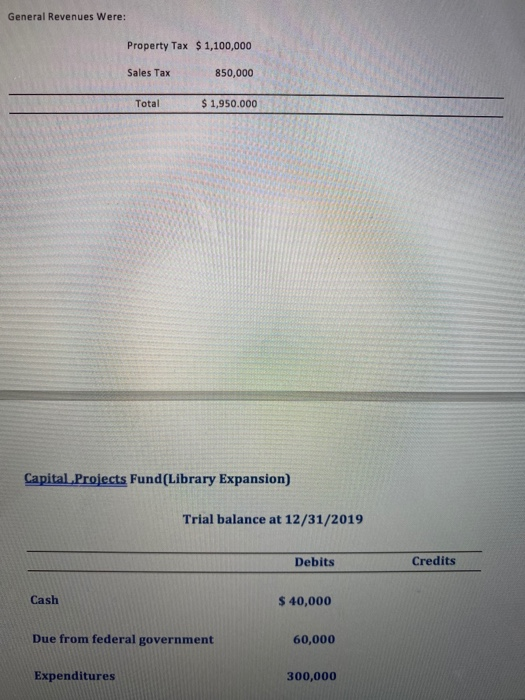

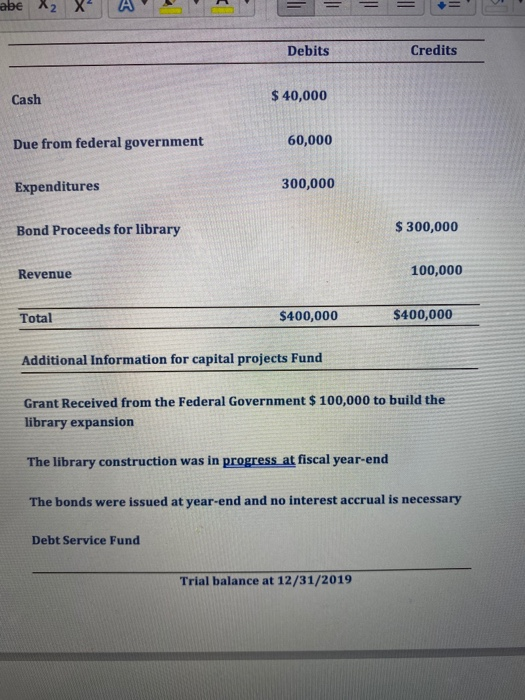

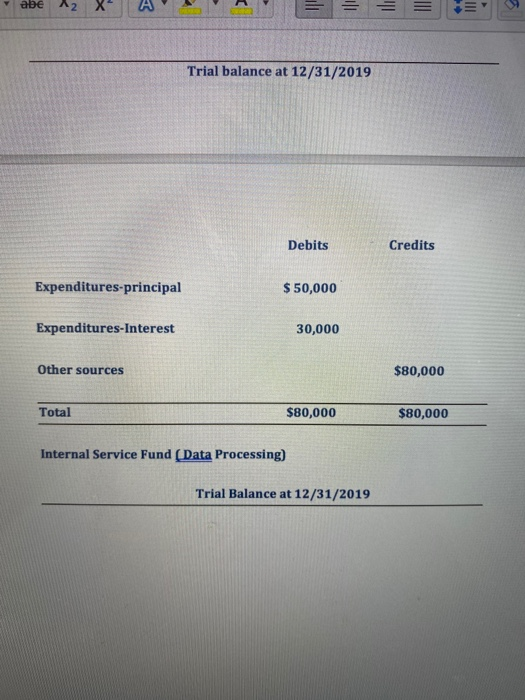

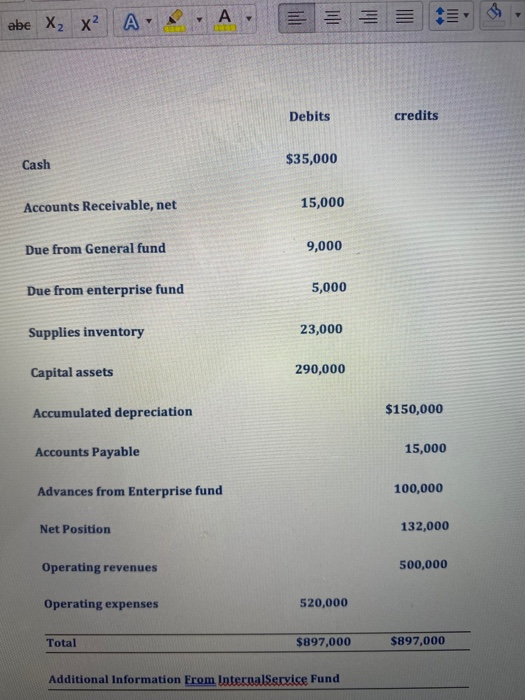

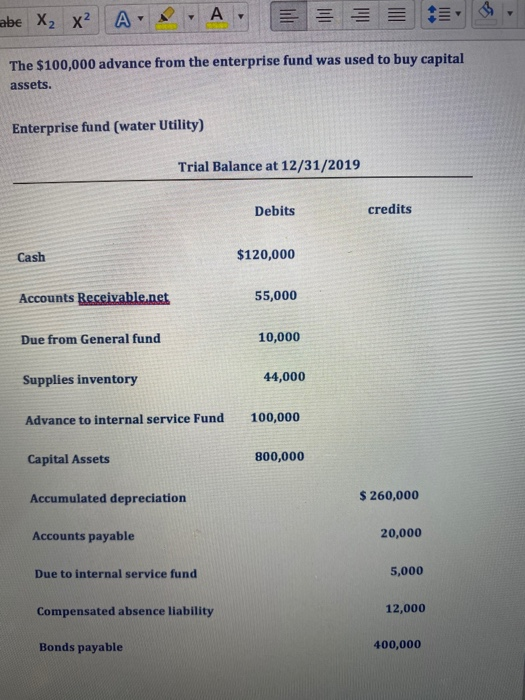

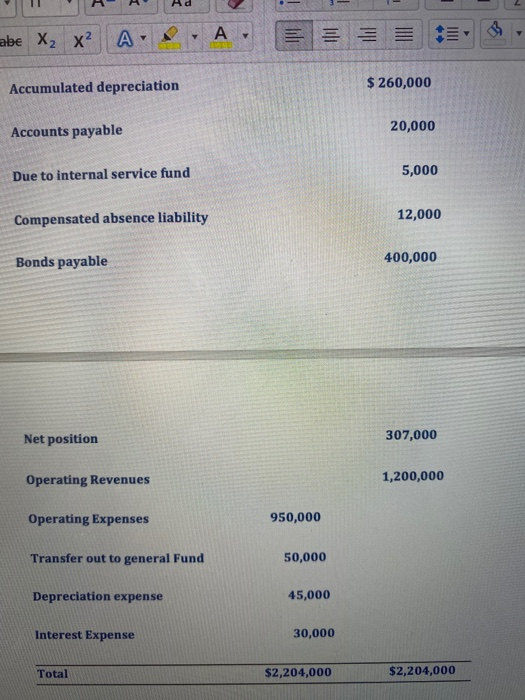

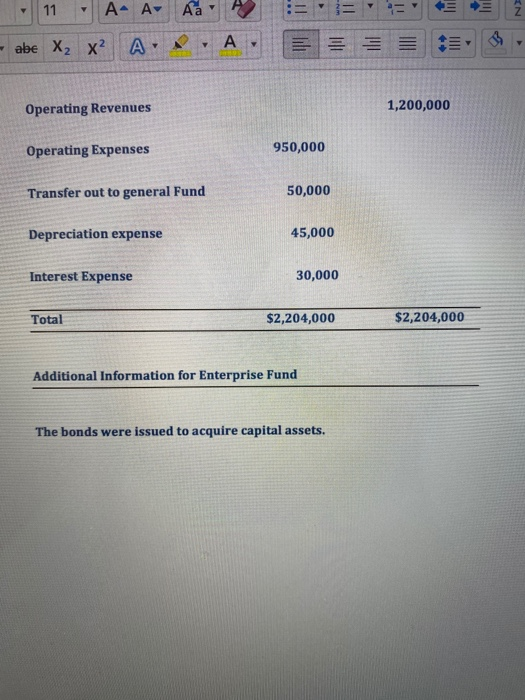

General Fund Trial Balance 12/31/2019 Debits Credit Cash $530,000 Taxes receivable Estimated Uncollectible 60,000 $ 20,000 Supplies Inventory 18,000 Accounts Payable 81,000 Due to Internal Service Fund 9,000 Due to Enterprise Fund 10,000 Deferred inflows- Property Taxes 11,000 Budgeted Fund Balance-reserved Encumbrances 30,000 Fund Balance Reserved -Non spendable 4,000 Fund Balance-Unassigned 303,000 Revenues-General $ 1,950,000 Revenues-Public Safety 200,000 50,000 Revenues- Parks & Recreation Other Sources 550,000 Expenditures-General Government 1,200,000 Expenditures-Public Safety 930,000 Expenditures-Parks 7 Recreation 370,000 Other Uses 80,000 Encumbrances 30,000 Expenditures-General Government 1,200,000 Expenditures-Public Safety 930,000 Expenditures-Parks 7 Recreation 370,000 Other Uses 80,000 Encumbrances 30,000 $ 3,218,000 $3,218,000 Additional Information for General Fund Deferred inflows from prior year property taxes were collected in the current year totaled $11,000 Deferred Inflows represent property taxes that are not expected to be collected within 60 days after year-end Compensated absences owed at 12/31/2018 were $3,000, General Government and $6,000 public service and at 12/31/2019 $10,000 General Government and $ 15,000 public axis Bonds were issued January 1,2019 in the amount of $ 500,000 and were due in 10 years. Interest of 6 is paid each December 21. In addition, principal of $50,000 is paid each December 31. Equipment of $1,500,000was acquired on January 1, 2015 with an estimated life of 20years and no salvage value. The equipment is 60% general government and 40% public safety. The42000,000r exeous of public safety was from an operating grant. 350.000 of other sources consists of $500,000 in other financing sources and s 50.000 transfers from Enterprise Fund. General Revenues Were: Property Tax $ 1.100,000 General Revenues Were: Property Tax $ 1,100,000 Sales Tax 850,000 Total $1,950.000 Capital Projects Fund(Library Expansion) Trial balance at 12/31/2019 Debits Credits Cash $ 40,000 Due from federal government 60,000 Expenditures 300,000 b A2 X Debits Credits Cash $ 40,000 Due from federal government 60,000 Expenditures 300,000 Bond Proceeds for library $ 300,000 Revenue 100,000 Total $400,000 $400,000 Additional Information for capital projects Fund Grant Received from the Federal Government $ 100,000 to build the library expansion The library construction was in progress at fiscal year-end The bonds were issued at year-end and no interest accrual is necessary Debt Service Fund Trial balance at 12/31/2019 ae 12 X AJ = = = = = Trial balance at 12/31/2019 Debits Credits Expenditures-principal $ 50,000 Expenditures-Interest 30,000 Other sources $80,000 Total $80,000 $80,000 Internal Service Fund (Data Processing) Trial Balance at 12/31/2019 abe X2 x A. Debits credits Cash $35,000 Accounts Receivable, net 15,000 Due from General fund 9,000 Due from enterprise fund 5,000 Supplies inventory 23,000 Capital assets 290,000 Accumulated depreciation $150,000 Accounts Payable 15,000 Advances from Enterprise fund 100,000 Net Position 132,000 Operating revenues 500,000 Operating expenses 520,000 Total $897,000 $897,000 Additional Information From Internal Service Fund abe X2 X A The $100,000 advance from the enterprise fund was used to buy capital assets. Enterprise fund (water Utility) Trial Balance at 12/31/2019 Debits credits Cash $120,000 Accounts Receivable.net 55,000 Due from General fund 10,000 Supplies inventory 44,000 Advance to internal service Fund 100,000 Capital Assets 800,000 Accumulated depreciation $ 260,000 Accounts payable 20,000 Due to internal service fund 5,000 Compensated absence liability 12,000 Bonds payable 400,000 AR abe X X A . A. = = = Accumulated depreciation $ 260,000 Accounts payable 20,000 Due to internal service fund 5,000 Compensated absence liability 12,000 Bonds payable 400,000 Net position 307,000 Operating Revenues 1,200,000 Operating Expenses 950,000 Transfer out to general Fund 50,000 Depreciation expense 45,000 Interest Expense 30,000 Total $2,204,000 $2,204,000 11 A- A Aa E E = abe X2 X? A. = Operating Revenues 1,200,000 Operating Expenses 950,000 Transfer out to general Fund 50,000 Depreciation expense 45,000 Interest Expense 30,000 Total $2,204,000 $2,204,000 Additional Information for Enterprise Fund The bonds were issued to acquire capital assets. General Fund Trial Balance 12/31/2019 Debits Credit Cash $530,000 Taxes receivable Estimated Uncollectible 60,000 $ 20,000 Supplies Inventory 18,000 Accounts Payable 81,000 Due to Internal Service Fund 9,000 Due to Enterprise Fund 10,000 Deferred inflows- Property Taxes 11,000 Budgeted Fund Balance-reserved Encumbrances 30,000 Fund Balance Reserved -Non spendable 4,000 Fund Balance-Unassigned 303,000 Revenues-General $ 1,950,000 Revenues-Public Safety 200,000 50,000 Revenues- Parks & Recreation Other Sources 550,000 Expenditures-General Government 1,200,000 Expenditures-Public Safety 930,000 Expenditures-Parks 7 Recreation 370,000 Other Uses 80,000 Encumbrances 30,000 Expenditures-General Government 1,200,000 Expenditures-Public Safety 930,000 Expenditures-Parks 7 Recreation 370,000 Other Uses 80,000 Encumbrances 30,000 $ 3,218,000 $3,218,000 Additional Information for General Fund Deferred inflows from prior year property taxes were collected in the current year totaled $11,000 Deferred Inflows represent property taxes that are not expected to be collected within 60 days after year-end Compensated absences owed at 12/31/2018 were $3,000, General Government and $6,000 public service and at 12/31/2019 $10,000 General Government and $ 15,000 public axis Bonds were issued January 1,2019 in the amount of $ 500,000 and were due in 10 years. Interest of 6 is paid each December 21. In addition, principal of $50,000 is paid each December 31. Equipment of $1,500,000was acquired on January 1, 2015 with an estimated life of 20years and no salvage value. The equipment is 60% general government and 40% public safety. The42000,000r exeous of public safety was from an operating grant. 350.000 of other sources consists of $500,000 in other financing sources and s 50.000 transfers from Enterprise Fund. General Revenues Were: Property Tax $ 1.100,000 General Revenues Were: Property Tax $ 1,100,000 Sales Tax 850,000 Total $1,950.000 Capital Projects Fund(Library Expansion) Trial balance at 12/31/2019 Debits Credits Cash $ 40,000 Due from federal government 60,000 Expenditures 300,000 b A2 X Debits Credits Cash $ 40,000 Due from federal government 60,000 Expenditures 300,000 Bond Proceeds for library $ 300,000 Revenue 100,000 Total $400,000 $400,000 Additional Information for capital projects Fund Grant Received from the Federal Government $ 100,000 to build the library expansion The library construction was in progress at fiscal year-end The bonds were issued at year-end and no interest accrual is necessary Debt Service Fund Trial balance at 12/31/2019 ae 12 X AJ = = = = = Trial balance at 12/31/2019 Debits Credits Expenditures-principal $ 50,000 Expenditures-Interest 30,000 Other sources $80,000 Total $80,000 $80,000 Internal Service Fund (Data Processing) Trial Balance at 12/31/2019 abe X2 x A. Debits credits Cash $35,000 Accounts Receivable, net 15,000 Due from General fund 9,000 Due from enterprise fund 5,000 Supplies inventory 23,000 Capital assets 290,000 Accumulated depreciation $150,000 Accounts Payable 15,000 Advances from Enterprise fund 100,000 Net Position 132,000 Operating revenues 500,000 Operating expenses 520,000 Total $897,000 $897,000 Additional Information From Internal Service Fund abe X2 X A The $100,000 advance from the enterprise fund was used to buy capital assets. Enterprise fund (water Utility) Trial Balance at 12/31/2019 Debits credits Cash $120,000 Accounts Receivable.net 55,000 Due from General fund 10,000 Supplies inventory 44,000 Advance to internal service Fund 100,000 Capital Assets 800,000 Accumulated depreciation $ 260,000 Accounts payable 20,000 Due to internal service fund 5,000 Compensated absence liability 12,000 Bonds payable 400,000 AR abe X X A . A. = = = Accumulated depreciation $ 260,000 Accounts payable 20,000 Due to internal service fund 5,000 Compensated absence liability 12,000 Bonds payable 400,000 Net position 307,000 Operating Revenues 1,200,000 Operating Expenses 950,000 Transfer out to general Fund 50,000 Depreciation expense 45,000 Interest Expense 30,000 Total $2,204,000 $2,204,000 11 A- A Aa E E = abe X2 X? A. = Operating Revenues 1,200,000 Operating Expenses 950,000 Transfer out to general Fund 50,000 Depreciation expense 45,000 Interest Expense 30,000 Total $2,204,000 $2,204,000 Additional Information for Enterprise Fund The bonds were issued to acquire capital assets