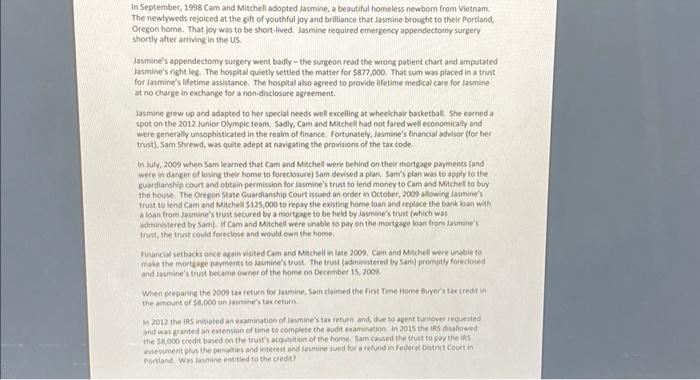

In September, 1998Cam and Mitchell adopted lasmine, a beastiful homeless newborn from Vietnam. The newlyweds rejolced at the gift of youthful joy and brilliance that lasmine brought to their Portiand, Oregon home. That joy was to be short+ived. Jasmine required emergency appendectomy surgery shortly alter arming in the US. tasmine's appendectomy surgetry went badly - the surgeon read the wrong patient chart and amputated Jasmine's right les. The hospitul quletly settled the matter for $877,000. That sum was placed in a trust for jasmine's lifetime assistance. The hospital also agreed to provide lifetime medical care for lasmine at no charge in exchange for a non-disclosure agreetment. Jasmine zrew up and adapted to her speclal needs well excelling at wheelchair basketball, She earned a spot on the 2012 Junior Olympic team. Sadly, Cam and Mactell had not fared well economicaly and were generally unsophisticated in the realm of finance. fortunately, lasmine's financial adwisor for ber trust), Sam Shrewd, was quite adept at navigating the provisions of the tax code. In July, 2009 when Sam learned that Cam and Michell were behind on their mortcage parments land were In dancer of losine their home to foreclosure) Sam devised a plan. San's plan was to apply to the puardiansh court and obtain permision for lasmine's trunt to lend money to Cam and Mitcheli to biry the house. The Ornon State Guardianhip Court issued an order in October, 2009 allowing lasmine's trust to lend Cam and Mitchell $125,000 to repay the existing home loan and replace the bank loyn will a loan from Jaumine's trust secured by a morteace to be held by Jasnine's trute (which was adminblered by Sam). If Cam and Mitchell were unable to par on the mortgage loan from iasmine's tout, the trust couks ferecloce and would own the home. rinancial setbacs once aqain visted Cam ard Mucheil in Ge 2009. Cam and Motchell were unyble to and inmine i thent became owner of the home on December 15,2002 When perpancy the 2000 tar return for Jamine, Samclained the fint Time Home fuyer fur credit in the amount of $8,000 on lasnine's tax return. in 2012 the ifs initiated an examination of Immine s tax netum and, due to apent turnover requested the shoco credit based on the trusts atovilion of the home sam chused the thust to par the ind Fortiand. Wos lasmine emitled to the credit