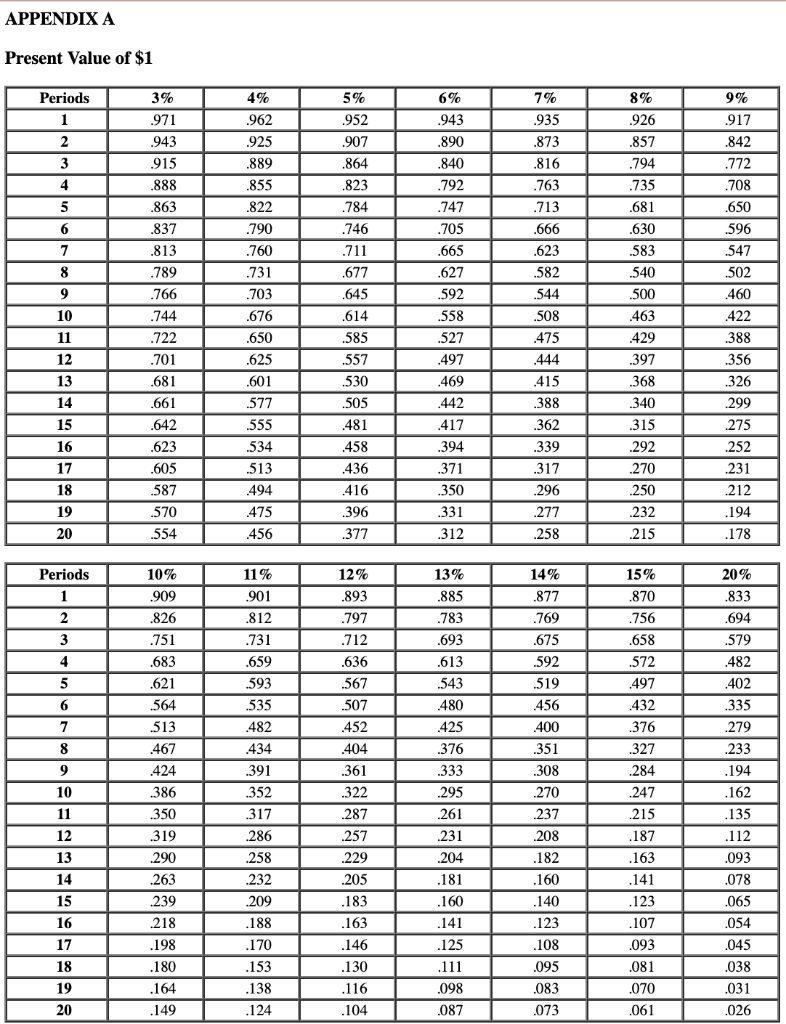

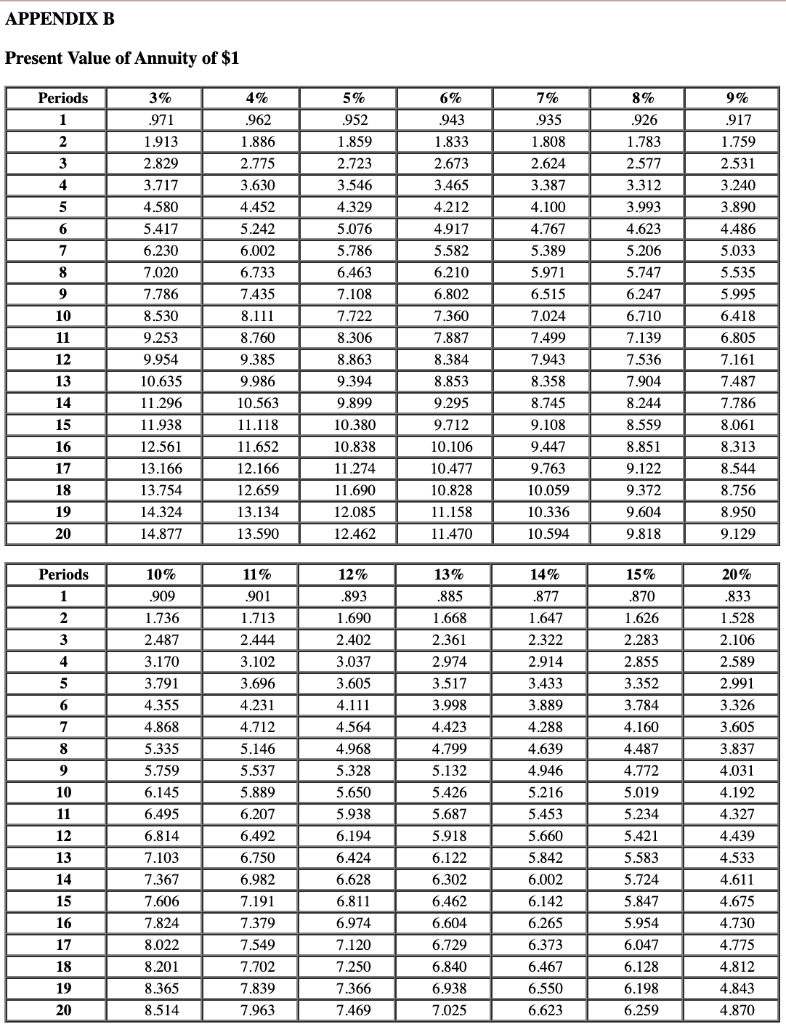

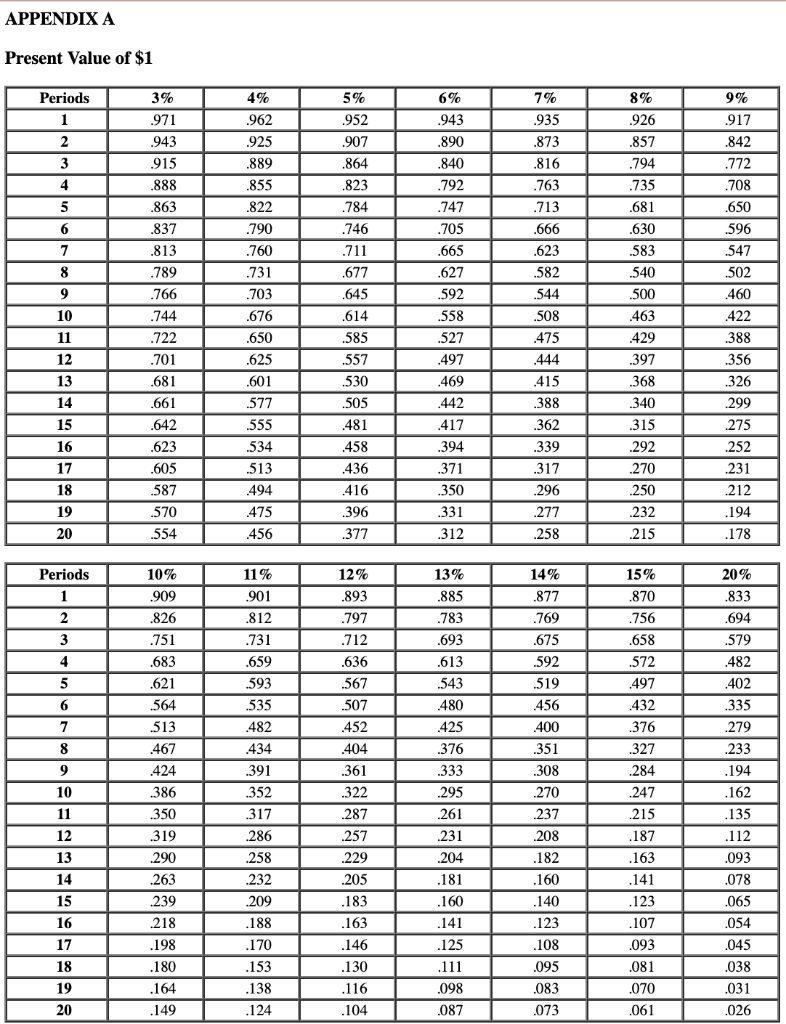

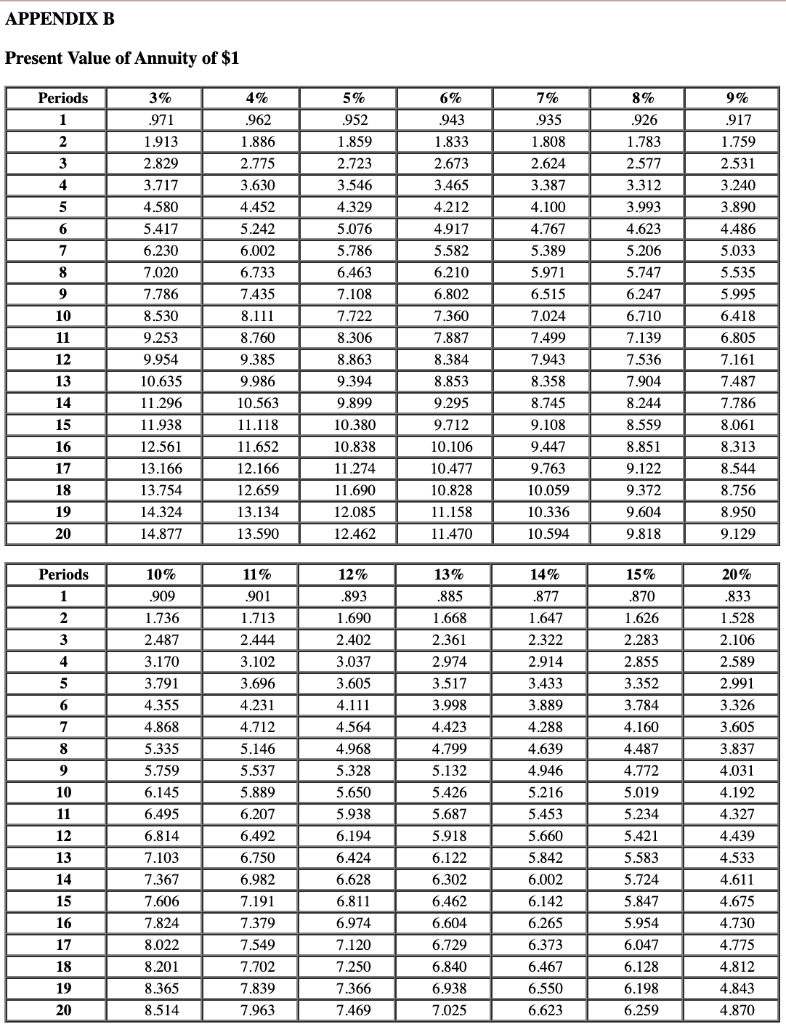

In tax year 2022, Fig Corporation made a $100,000 contribution to charity. In each of the following situations, compute the after- tax cost of this contribution assuming that Fig uses a 6 percent discount rate to compute NPV. Use Appendix A and Appendix B. Required: a. Fig had $8 million taxable income before consideration of the contribution. b. Fig had $490,000 taxable income before consideration of the contribution. Next year, Fig's taxable income will be $6 million, and it will make no charitable contributions. c. Fig had $190,000 taxable income before consideration of the contribution. For the next five years, Fig's annual taxable income will be $130,000, and it will make no charitable contributions. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the after-tax cost of this contribution assuming that Fig uses a 6 percent discount rate to compute NPV. Fig had $8 million taxable income before consideration of the contribution. (Round intermediate calculations to the nearest whole dollar amount. Enter your answer in dollars not in millions of dollars.) After-tax cost Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the after-tax cost of this contribution assuming that Fig uses a 6 percent discount rate to compute NPV. Fig had $490,000 taxable income before consideration of the contribution. Next year, Fig's taxable income will be $6 million, and it will make no charitable contributions. (Round intermediate calculations to the nearest whole dollar amount. Enter your answer in dollars not in millions of dollars.) Show less After-tax cost Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the after-tax cost of this contribution assuming that Fig uses a 6 percent discount rate to compute NPV. Fig had $190,000 taxable income before consideration of the contribution. For the next five years, Fig's annual taxable income will be $130,000, and it will make no charitable contributions. (Round intermediate calculations to the nearest whole dollar amount.) After-tax cost