Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In terms of the figure attached: 1. What will happen to WACC if interest rates went up? 2. What will happen to IRR if interest

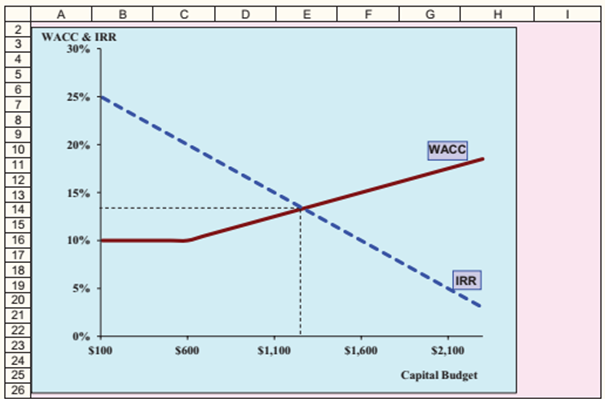

In terms of the figure attached:

1. What will happen to WACC if interest rates went up?

2. What will happen to IRR if interest rates went up?

3. Where will the new equilibrium be? More investment or less investment?

4. How would an event sure as the credit crisis of 2008, where interest rates for many corporate borrowers climbed quite high, affect the size of a firms capital budget?

Thank you!

6 WACC & IRR 30% WACC $100 $600 $1,100 $1,600 $2,100 Capital Budget 6 WACC & IRR 30% WACC $100 $600 $1,100 $1,600 $2,100 Capital BudgetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started