in that format please

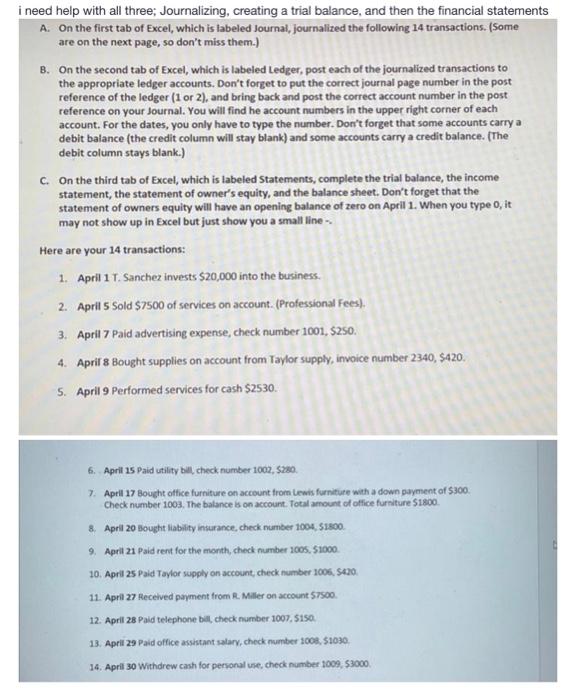

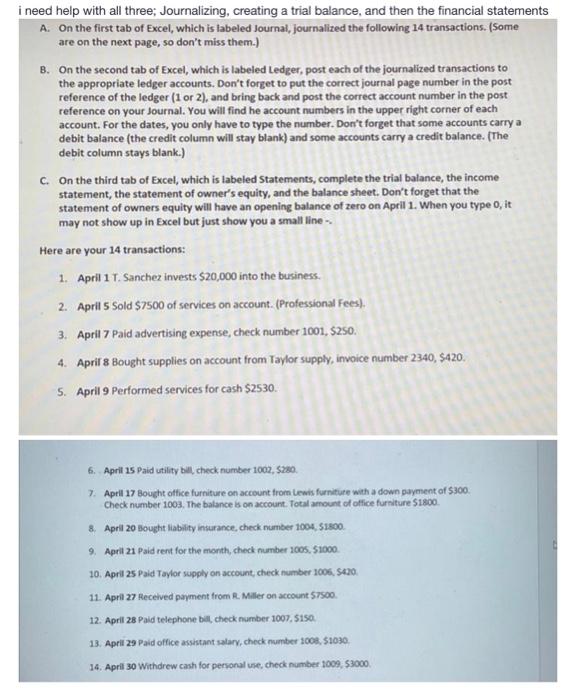

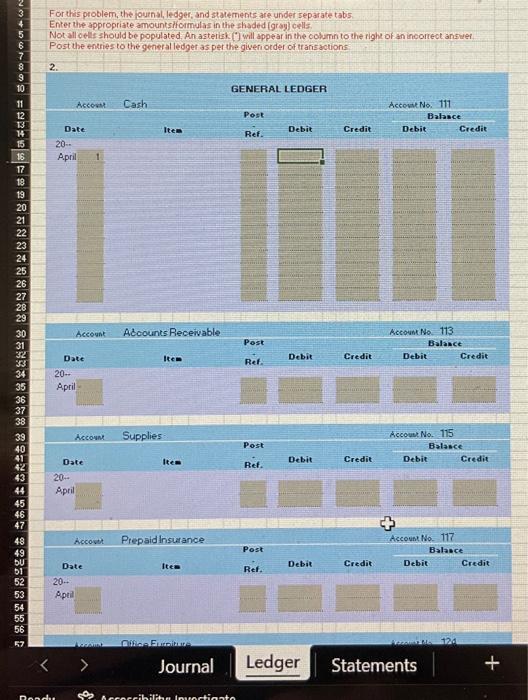

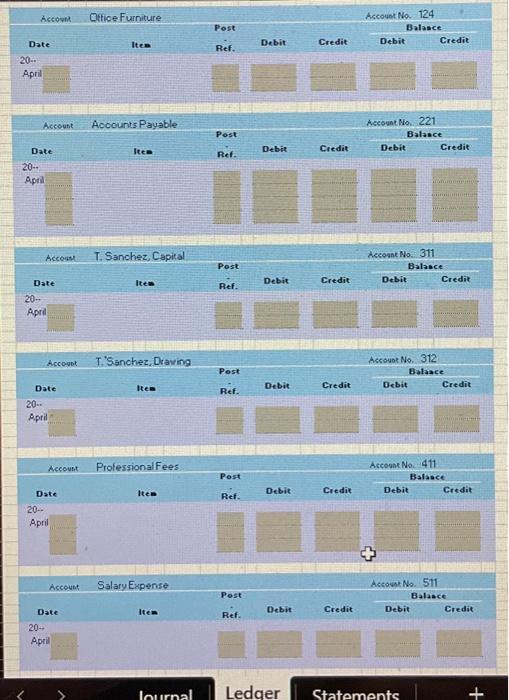

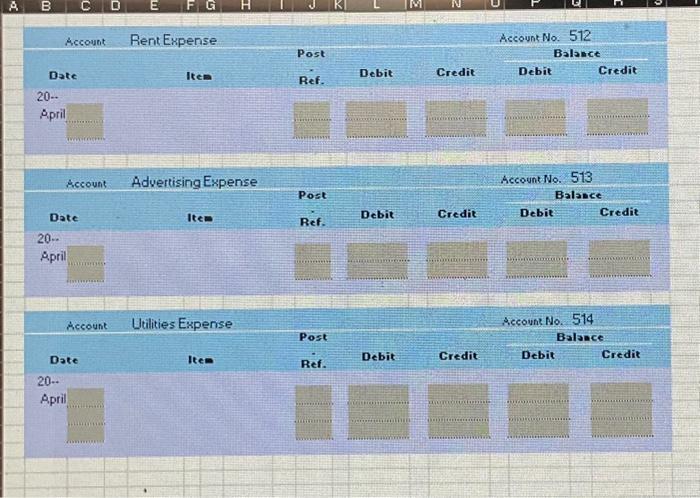

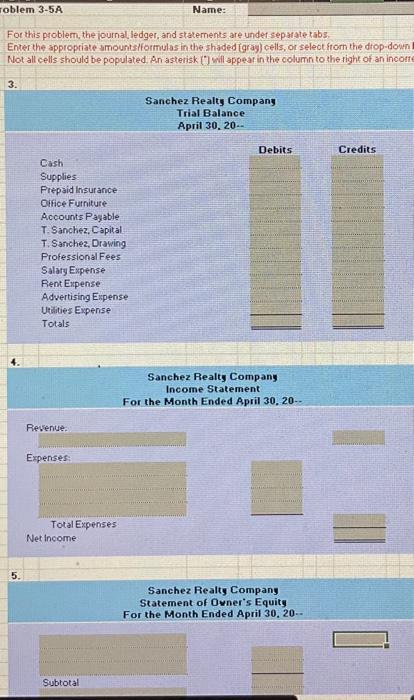

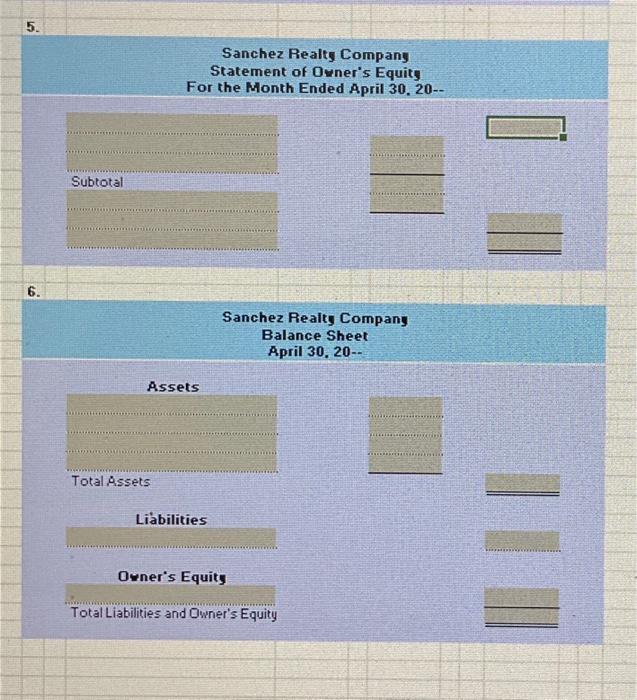

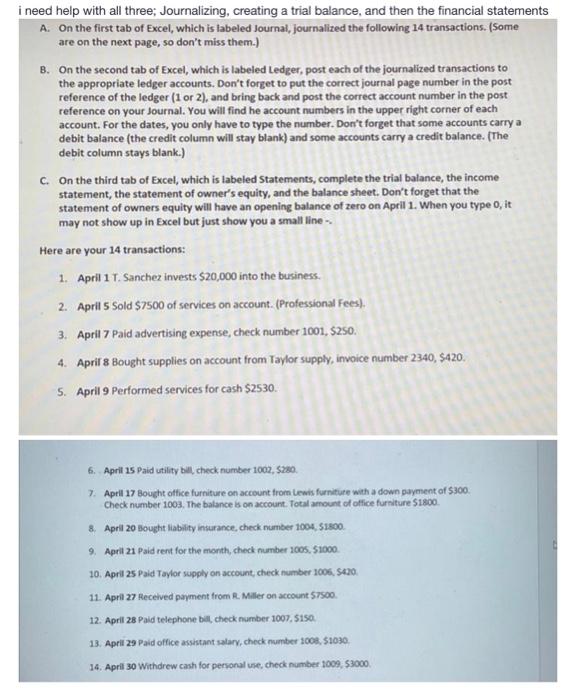

A. On the first tab of Excel, which is labeled Journal, journalized the following 14 transactions. (Some are on the next page, so don't miss them.) B. On the second tab of Excel, which is labeled Ledger, post each of the journalized transactions to the appropriate ledger accounts. Don't forget to put the correct journal page number in the post reference of the ledger ( 1 or 2), and bring back and post the correct account number in the post reference on your Journal. You will find he account numbers in the upper right corner of each account. For the dates, you only have to type the number. Don't forget that some accounts carry a debit balance (the credit column will stay blank) and some accounts carry a credit balance. (The debit column stays blank.) C. On the third tab of Excel, which is labeled Statements, complete the trial balance, the income statement, the statement of owner's equity, and the balance sheet. Don't forget that the statement of owners equity will have an opening balance of zero on April 1. When you type 0 , it may not show up in Excel but just show you a small line -. Here are your 14 transactions: 1. April 1T. Sanchez invests $20,000 into the business. 2. April 5 Sold $7500 of services on account. (Professional Fees). 3. April 7 Paid advertising expense, check number 1001,$250. 4. Aprif 8 Bought supplies on account from Taylor supply, invoice number 2340,$420. 5. April 9 Performed services for cash $2530. 6. April 15 Paid utility bill check number 1002, s280. 7. Aprill 17 Bought office furniture on account from Lewis furniture with a down payment of 5300 . Check number 1003. The balunce is on account. Total amount of office furniture $1800 8. Aprli 20 Bought liability insurance, check number 1004,51800. 9. April 21 Paid rent for the month, check number 1005,51000. 10. April 25 Paid Taylor supply on account, check number 1006, $420 11. April 27 Received payment from R. Miller on account 57500 . 12. Aprill 28 Paid telephone bill check number 1007,5150 . 13. Aprii 29 Paid office assistant salarv, check number 1008,51030. 14. Aprill 30 Withdrew cash for pervonal use, check number 1009,53000 . For this problem, the ournal, ledger; and stamements are under separate tabis Enter the appropriate amountshormulas in the shaded [grag] cells Not all celis should be populated. An astertsk (') Will appetar in the column to the right of an incortect ansuef Post the entriesto the general ledger as per the giveri otder of tr ans actions: Accown Oitice Furniture Ascouet No. 124 Date Ites Pest Ref. Debit 20= April Account Acocunts Payable Ascount No. 221 Date Des Def. Debit Credit Debit Clace Credit 20 Aptil Accoin T. Sanchez, Capital Accoane No: 311 Date ltem Bef. Debit Credit Balace Debit 20 . April Accoubt T'Sanchez, Draving Asrouot No. 312 Account ProfessionalFees Accouht No. 411 Date Ite Best Debit Credit Dalace 20 April Account Salary Expense Asecoust No. 511 Account Rent Expense Account No. 512 Post Balasce Date Item Credit Ref. Debit Credit Debit 20 .. April Account Advertising Expense For this problem, the pournal ledger, and statements are under separate tabs. Enter the appropriate amountstformulas in the shaded (gray) cells, or select from the drop-down Not all cells should be populated. An asterisk (?) will appear in the column to the right of an incoft 5. Sanchez Realty Company Statement of Owner's Equity For the Month Ended April 30.20 -- Subtotal 6. Sanchez Reaity Company Balance Sheet April 30, 20-. Assets Total Assets Liabilities Owner's Equity Total Liabilities and Owner's Equity