Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the 1980's the Australian government imposed quotas on the importation of cars without imposing restrictions on the construction of foreign-owned car factories in

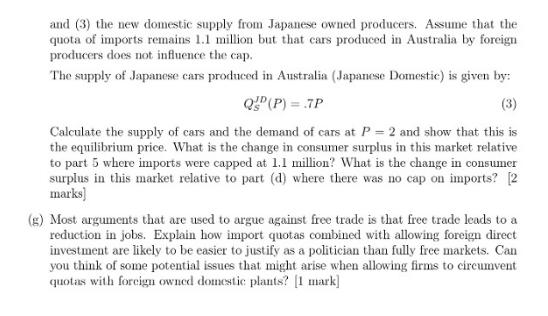

In the 1980's the Australian government imposed quotas on the importation of cars without imposing restrictions on the construction of foreign-owned car factories in Australia. This question is intended for you to analyze a potential rationale for these policies. The demand for cars in Australia has the following form: Qp(P)- (1) where Qp(P) is in millions of cars and P is in units of $10,000. The domestic supply of cars in Australia takes the following form: Qs(P) = P (2) (a) What is the price elasticity of demand of this function when P = 2? What is the price elasticity when P = 3? (Hint: = -) 1 mark] (b) As you can see by your answers in (a), the demand function is unique because it has the same clasticity along the entire demand curve. We call demand functions with this property "isoclastic." Use the formula for elasticity to show that the clasticity is always cqual to your answer in part I regardless of the P chosen. [1 mark} (c) Suppose the economy is closed to imports. What is the price of cars in a closed cconomy? What is the quantity of cars sold at this price? In a demand/supply graph indicate the cquilibrium price and quantity and show the arca representing consuncr surplus and the arca represcnting producer surplus.[1 mark) (ed) Now suppose that the intermational price of cars is Pe = 2 and that there is an infinite supply of cars at this price. If there were no restrictions, how many cars would be imported? Ilow many would be produced domestically? llow many would be consumed? On your graph, show what the change in consumer surplus would be relative to the case of the closed economy. Show the change in producer surplus for the domestic car company. (Both consumer and producer surphus can be shown graphrically - yon don't need to solve them.) 2 marks (e) Suppose Australia imposes a quota on imports of 1.1 million cars from abroad. What is the price paid by consumers to buy a car in Australia following the introduetion of the quota? Assume that the quota rights are assigned to Japanese car producers and that these producers always find it in their interest to produce for any price at or above 2. What is the change in domestic producer surplus with respect to the open trade outcome considered in part (d)? what is the change in consumer surplus in this market relative to the open trade outcome considered in part (d)? What is the dead- weight loss caused by the introduction of the quotas? (Again, do the producer surplus, consumer surplus, and deadweight loss graphically.) [2 marks] (1) Imagine that due to the high Australian price for cars, some Japanese car producers open plants in Australia. So now the supply of cars in Australia is the sum of (1) the domestic supply from Australian owned producers, (2) the imported cars from Japan, and (3) the new domestic supply from Japanese owned producers. Assume that the quota of imports remains 1.1 million but that cars produced in Australia by foreign producers does not influence the cap. The supply of Japanese cars produced in Australia (Japanese Domestic) is given by: QP (P) = .7P (3) Calculate the supply of cars and the demand of cars at P = 2 and show that this is the equilibrium price. What is the change in consumer surplus in this market relative to part 5 where imports were capped at 1.1 million? What is the change in consumer surplus in this market relative to part (d) where there was no cap on imports? [2 marks) (s) Most arguments that are used to argue against free trade is that free trade leads to a reduction in jobs. Explain how import quotas combined with allowing foreign direct investiment are likely to be easier to justify as a politician than fully free markets. Can you think of some potential issues that might arise when allowing firms to circumvent quotas with forcign owned domestic plants? [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started