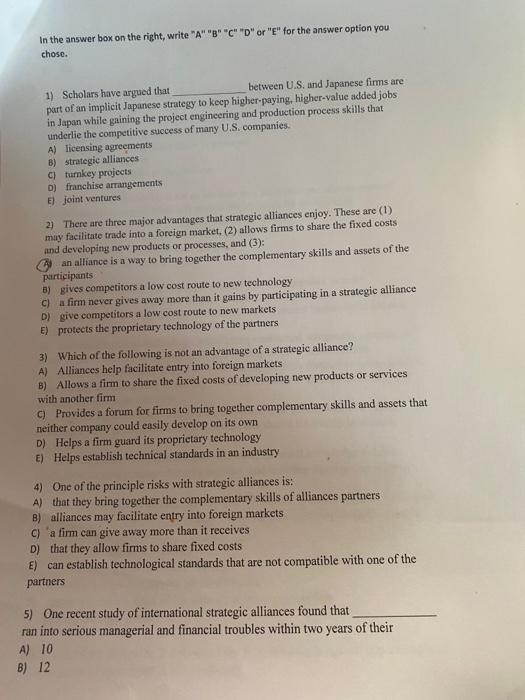

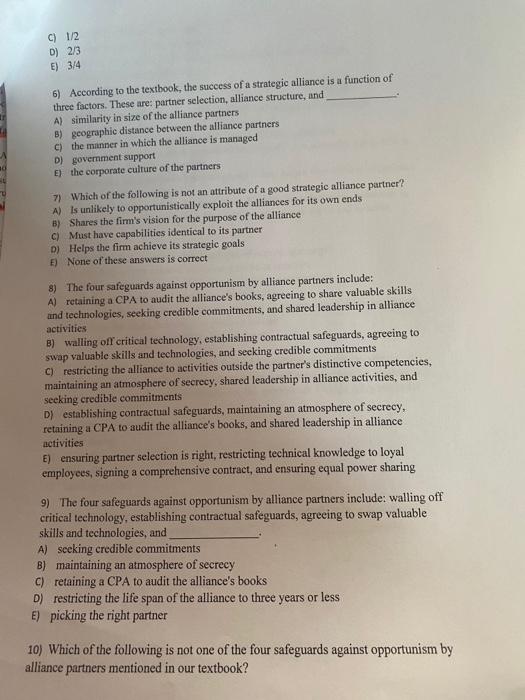

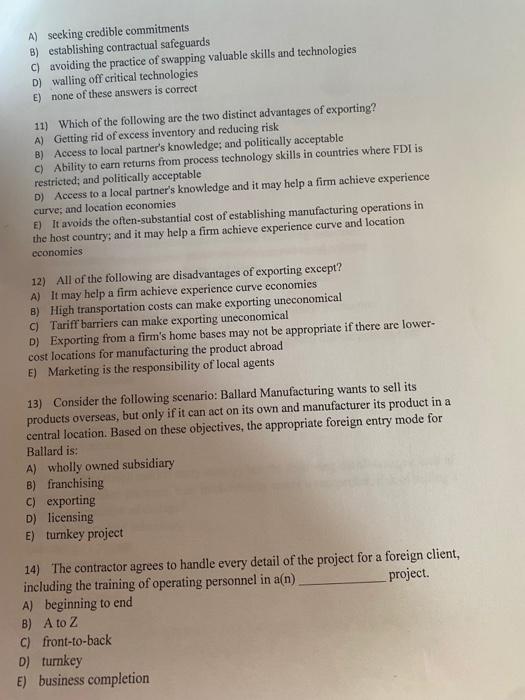

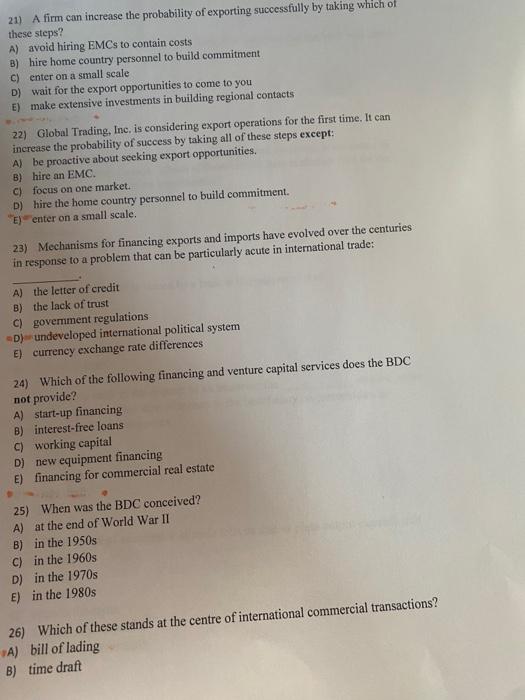

In the answer box on the right, write " A " "B" "C" "D" or "E" for the answer option you chose. 1) Scholars have argued that between U.S, and Japanese firms are part of an implicit Japanese strategy to kecp higher-paying, higher-value added jobs in Japan while gaining the project engincering and production process skills that underlie the competitive success of many U,S, companies. A) licensing agreements B) strategic alliances- c) turnkey projects D) franchise arrangements E) joint ventures 2) There are three major advantages that strategic alliances enjoy. These are (1) may facilitate trude into a foreign market, (2) allows firms to share the fixed costs and developing new products or processes, and (3): (8) an alliance is a way to bring together the complementary skills and assets of the purticipants B) gives competitors a low cost route to new technology C) a firm never gives away more than it gains by participating in a strategic alliance D) give competitors a low cost route to new markets E) protects the proprietary technology of the partners 3) Which of the following is not an advantage of a strategic alliance? A) Alliances help facilitate entry into foreign markets B) Allows a firm to share the fixed costs of developing new products or services with another firm c) Provides a forum for firms to bring together complementary skills and assets that neither company could easily develop on its own D) Helps a firm guard its proprictary technology E) Helps establish technical standards in an industry 4) One of the principle risks with strategic alliances is: A) that they bring together the complementary skills of alliances partners B) alliances may facilitate entry into foreign markets C) a firm can give away more than it receives D) that they allow firms to share fixed costs E) can establish technological standards that are not compatible with one of the partners 5) One recent study of international strategic alliances found that ran into serious managerial and financial troubles within two years of their A) 10 B) 12 C) 1/2 D) 2/3 E) 3/4 6) According to the textbook, the suceess of a strategic alliance is a function of three factors. These are: partner selection, alliance structure, and A) similarity in size of the alliance partners B) geographic distance between the alliance partners C) the minner in which the alliance is managed D) government support E) the corporate culture of the partners 7) Which of the following is not an attribute of a good strategic alliance partner? A) Is unlikely to opportunistically exploit the alliances for its own ends B) Shares the firm's vision for the purpose of the alliance C) Must have capabilities identical to its partner D) Helps the firm achieve its strategic goals E) None of these answers is correct 8) The four safeguards against opportunism by alliance partners include: A) retaining a CPA to audit the alliance's books, agreeing to share valuable skills and technologies, seeking credible commitments, and shared leadership in alliance activities B) walling off critical technology, establishing contractual safeguards, agreeing to swap valuable skills and technologies, and seeking credible commitments c) restricting the alliance to activities outside the partner's distinctive competencies, maintaining an atmosphere of secrecy, shared leadership in alliance activities, and seeking credible commitments D) establishing contractual safeguards, maintaining an atmosphere of secrecy, retaining a CPA to audit the alliance's books, and shared leadership in alliance activities E) ensuring partner selection is right, restricting technical knowledge to loyal employees, signing a comprehensive contract, and ensuring equal power sharing 9) The four safeguards against opportunism by alliance partners include: walling off critical technology, establishing contractual safeguards, agreeing to swap valuable skills and technologies, and A) seeking credible commitments 8) maintaining an atmosphere of secrecy C) retaining a CPA to audit the alliance's books D) restricting the life span of the alliance to three years or less E) picking the right partner 10) Which of the following is not one of the four safeguards against opportunism by alliance partners mentioned in our textbook? A) seeking credible commitments B) establishing contractual safeguards C) avoiding the practice of swapping valuable skills and technologies D) walling off critical technologies E) none of these answers is correct 11) Which of the following are the two distinct advantages of exporting? A) Getting rid of excess inventory and reducing risk B) Access to local partner's knowledge; and politically acceptable C) Ability to earn returns from process technology skills in countries where FDI is restricted; and politically acceptable D) Access to a local partner's knowledge and it may help a firm achieve experience curve; and location economies E) It avoids the often-substantial cost of establishing manufacturing operations in the host country; and it may help a firm achieve experience curve and location economies 12) All of the following are disadvantages of exporting except? A) It may help a firm achieve experience curve economies B) High transportation costs can make exporting uneconomical C) Tariff barriers can make exporting uneconomical D) Exporting from a firm's home bases may not be appropriate if there are lowercost locations for manufacturing the product abroad E) Marketing is the responsibility of local agents 13) Consider the following scenario: Ballard Manufacturing wants to sell its products overseas, but only if it can act on its own and manufacturer its product in a central location. Based on these objectives, the appropriate foreign entry mode for Ballard is: A) wholly owned subsidiary B) franchising C) exporting D) licensing E) turnkey project 14) The contractor agrees to handle every detail of the project for a foreign client, including the training of operating personnel in a(n) project. A) beginning to end B) A to Z C) front-to-back D) turnkey E) business completion 21) A firm can increase the probability of exporting successfully by taking which of these steps? A) avoid hiring EMCs to contain costs B) hire home country personnel to build commitment C) enter on a small scale D) Wait for the export opportunities to come to you E) make extensive investments in building regional contacts 22) Global Trading, Inc, is considering export operations for the first time. It can increase the probability of success by taking all of these steps except: A) be pronctive about seeking export opportunities. B) hire an EMC. C) focus on one market D) hire the home country personnel to build commitment. E) enter on a small scale. 23) Mechanisms for financing exports and imports have evolved over the centuries in response to a problem that can be particularly acute in intemational trade: A) the letter of credit B) the lack of trust C) government regulations: a) undeveloped international political system E) currency exchange rate differences 24) Which of the following financing and venture capital services does the BDC not provide? A) start-up financing B) interest-free loans C) working capital D) new equipment financing E) financing for commercial real estate 25) When was the BDC conceived? A) at the end of World War II B) in the 1950s C) in the 1960s D) in the 1970s E) in the 1980s 26) Which of these stands at the centre of international commercial transactions? A) bill of lading B) time draft c) way bill D) sight draft E) letter of credit 27) What is the document, issued by a bank, that indicates that the bank will make payments under specifie circumstances known as? A) bill of lading B) time draft C) way bill D) sight draft E) letter of credit 28) Access International, a British based greeting card company, is interested in importing paper from Canada. Which of these should Access arrange first for the Canadian company to ship the merchandise? A) letter of credit B) bill of Eading C) time draft D) sight draft E) way bill 29) The letter of credit is issued by a bank at the request of a(n) : A) exporter B) govemment C) importer D) shipping company E) exporter's bank 30) Issued by a bank at the request of an importer, the states that the bank will pay a specified sum of money to the beneficiary on presentation of particular, specified documents. A) bill of lading B) Ietter of credit C) time draft D) sight draft E) draft 31) The concept of economies of scale tells us that as plant output expands unit costs do what? A) increase B) decrease C) remain the same D) expand exponentially E) decrease exponentially 32) The deelines with output until a certain output level is reached; at which point further increases in output realize little reduction in unit costs. A) component expense curve B) unit expense line C) unit cost curve D) component cost slope E) marginal cost curve 33) The larger the minimum efficient scale of a plant, the greater the argument for centralizing production in a single location or a limited number of locations is the implication of the concept. A) consumer input B) cconomies of scale C) production D) materials management E) TQM 34) What are manufacturing technologies that are designed to reduce setup times; increase use of individual machines through better scheduling, and improve quality control at all stages of manufacturing called? A) multifaceted production B) lean production C) lateral production D) temporal production E) six sigma 35) According to the textbook, manufacturing technologies provide a company the ability to produce a wider variety of end products at a unit cost that at one time could be achieved only through the mass production of a standardized output. A) multifaceted B) lateral C) side by side D) flexibie E) mass customization 36) Which of the following is not one of the objectives of flexible manufacturing technology, or lean production? A) reduce setup times for complex equipment B) bring a factory into compliance with ISO 9000 C) improve quality control at all stages of the manufacturing process D) increase utilization of individual machines through scheduling E) none of these answers is correct