Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the article by Zombie Offices' Spell Trouble for Some Banks by Jeanna Smialek, Why are small and medium banks considered to be at higher

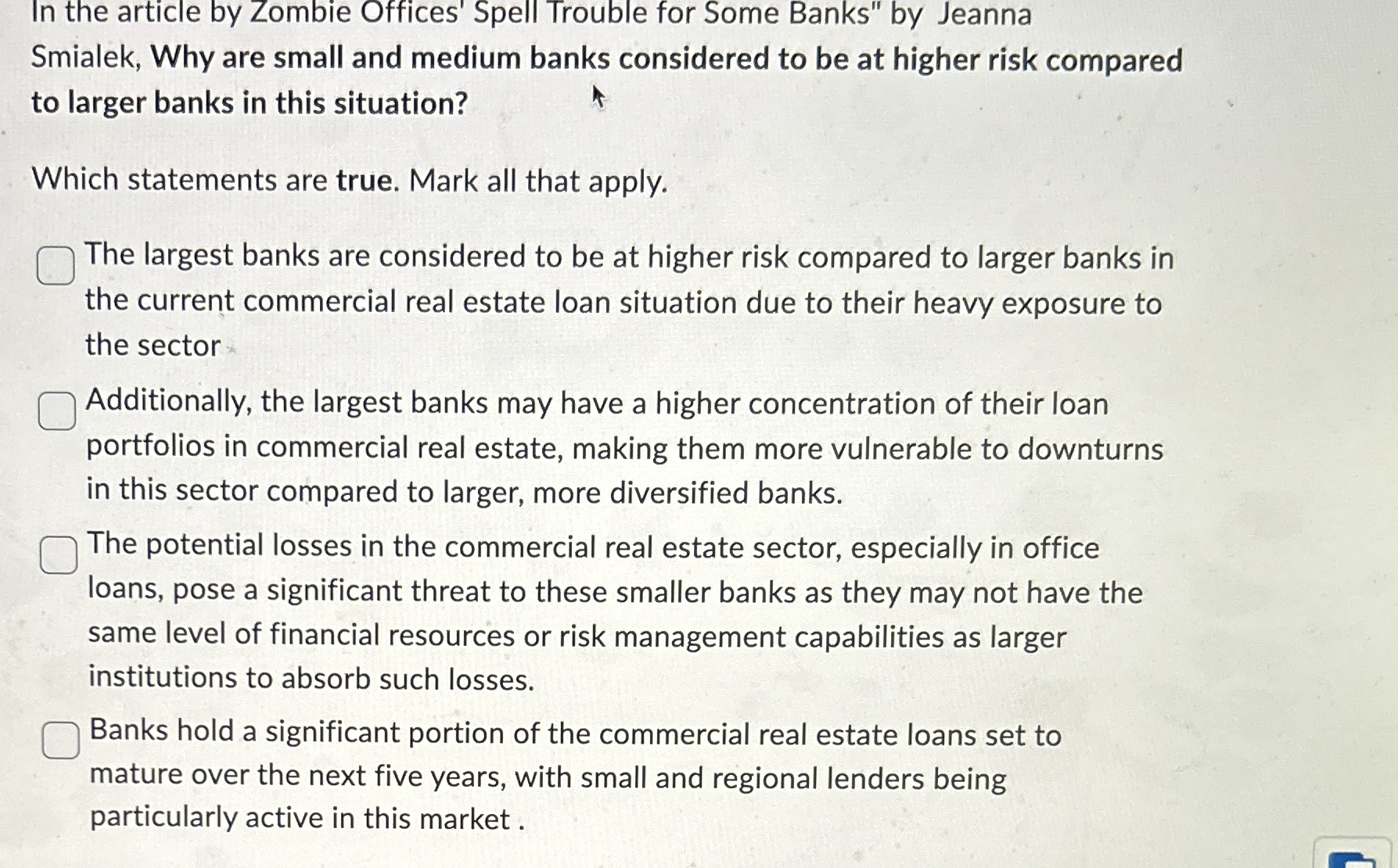

In the article by Zombie Offices' Spell Trouble for Some Banks" by Jeanna

Smialek, Why are small and medium banks considered to be at higher risk compared

to larger banks in this situation?

Which statements are true. Mark all that apply.

The largest banks are considered to be at higher risk compared to larger banks in

the current commercial real estate loan situation due to their heavy exposure to

the sector

Additionally, the largest banks may have a higher concentration of their loan

portfolios in commercial real estate, making them more vulnerable to downturns

in this sector compared to larger, more diversified banks.

The potential losses in the commercial real estate sector, especially in office

loans, pose a significant threat to these smaller banks as they may not have the

same level of financial resources or risk management capabilities as larger

institutions to absorb such losses.

Banks hold a significant portion of the commercial real estate loans set to

mature over the next five years, with small and regional lenders being

particularly active in this market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started