Question

In the attached files are the questions to be answered and the information needed to answer them. Answer all parts of the question completely. Questions:

In the attached files are the questions to be answered and the information needed to answer them. Answer all parts of the question completely.

Questions: 2-35, 2-37

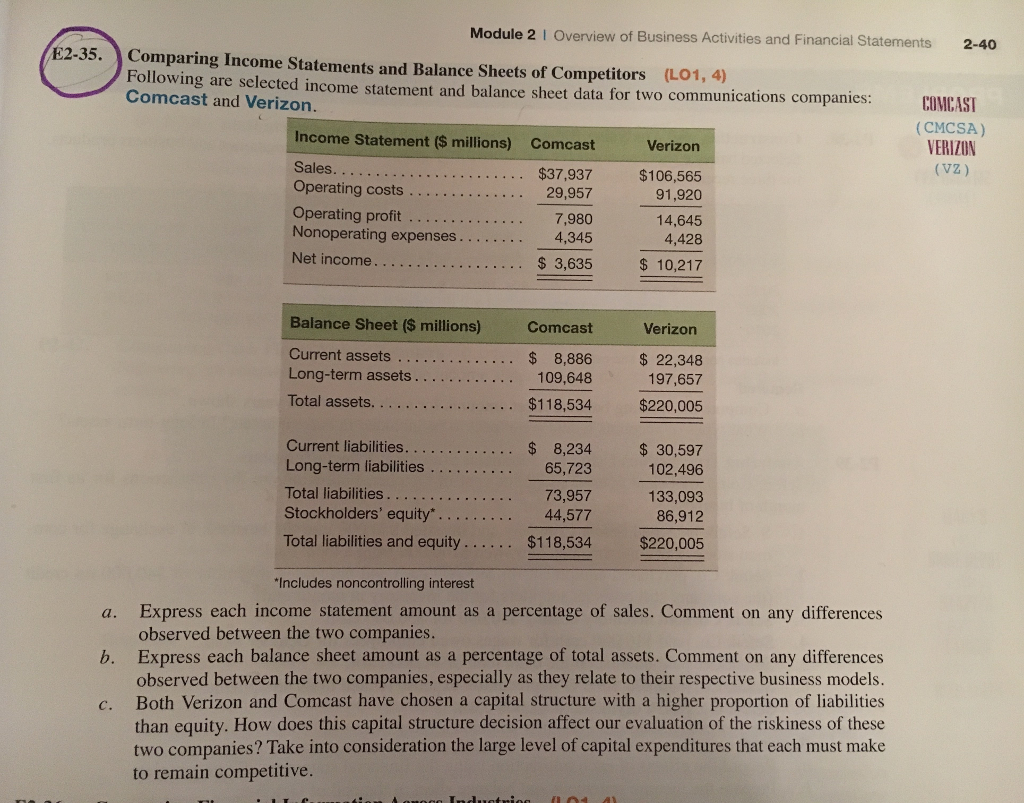

2-35:

a)Express each income statement amount as a percentage of sales. Comment on any differences observed between the two companies.

b) Express each balance sheet amount as a percentage of total assets. Comment on any differences observed between the two companies, especially as they relate to their respective business models.

c) Both Verizon and Comcast have chosen a capital structure decision affect our evaluation of the riskiness of these two companies? Take into consideration the large level of capital expenditures that each must take to remain competitive.

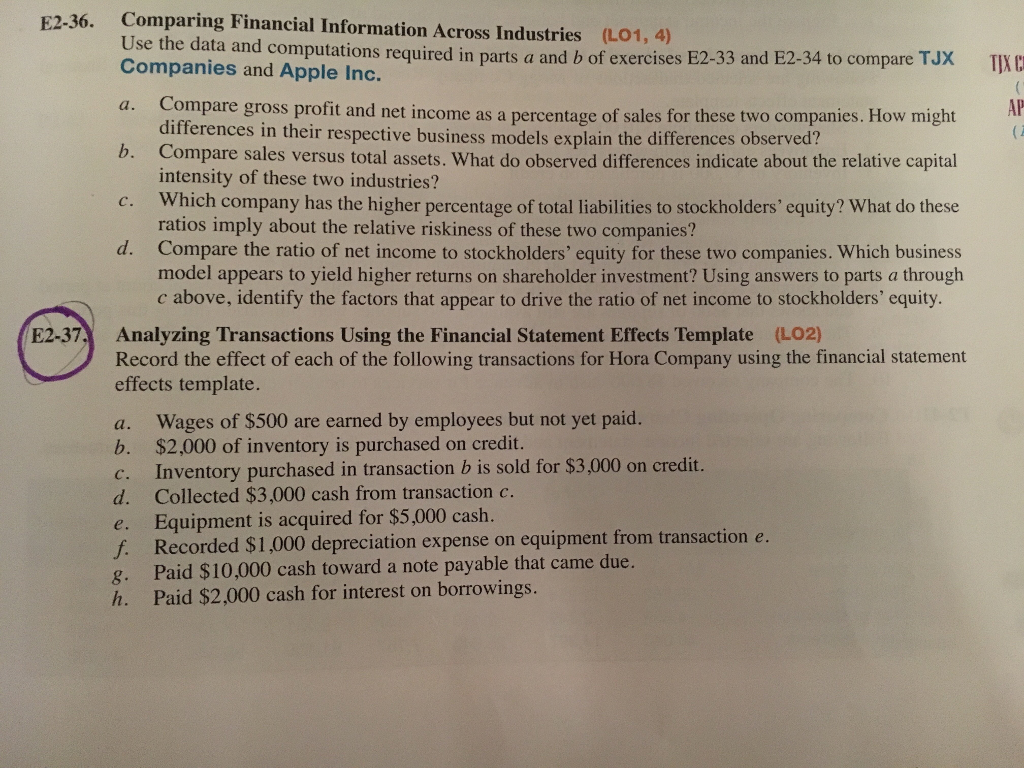

2-37:

Record the effect of each of the following transactions for Hora Company using the financial statement effects template.

a) Wages of $500 are earned by employees but not yet paid.

b) $2,000 of inventory is purchased on credit.

c) Inventory purchased in transaction b is sold for $3,000 on credit.

d) Collected $3,000 cash from transaction c.

e) Equipment is acquired for $5,000 cash.

f) Recorded $1,000 depreciation expense on equipment from transaction e.

g) Paid $10,000 cash toward a note payable that came due.

h) Paid $2,000 cash for interest on borrowings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started