In the attached files are the questions to be answered and the information needed to answer them. Answer all parts of the question completely.

Questions: 3-25, 3-32

3-25:

a) Compute the 2010 return on net operating assets (RNOA) for each company.

b) Disaggregate RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for each company.

c) Discuss any differences in these ratios for each company.

3-32:

a) Compute the liabilities-to-equity ratio for each year and discuss any noticeable change.

b) What is your overall assessment of the companys financing risks from the analyses part in part a? Explain.

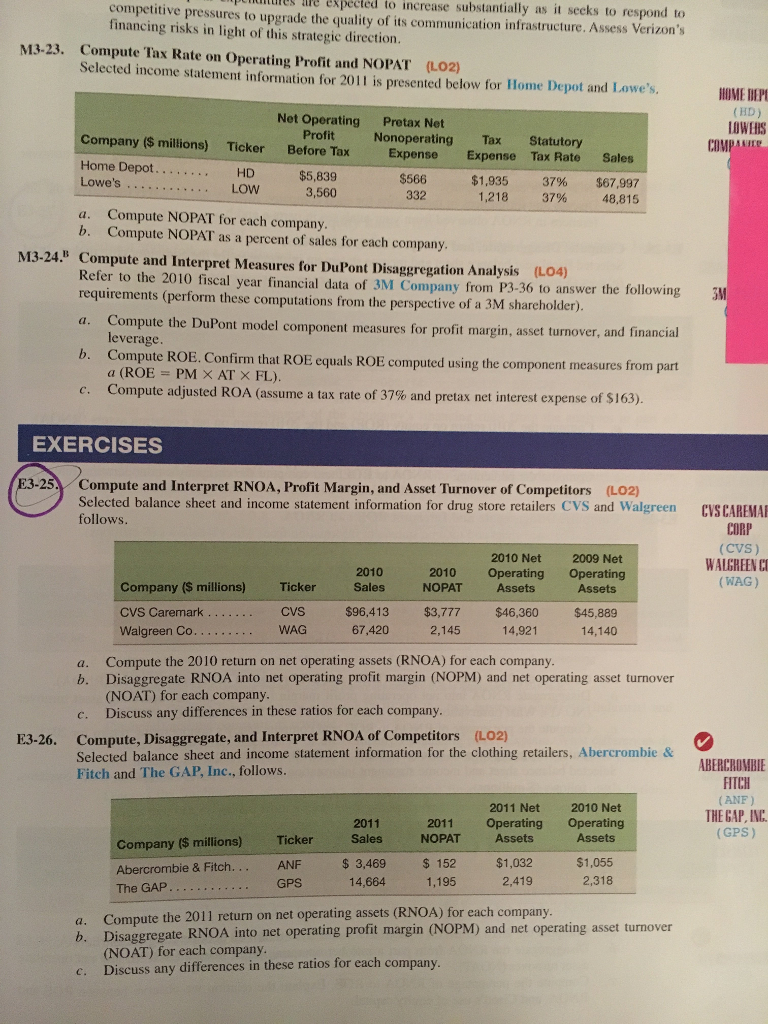

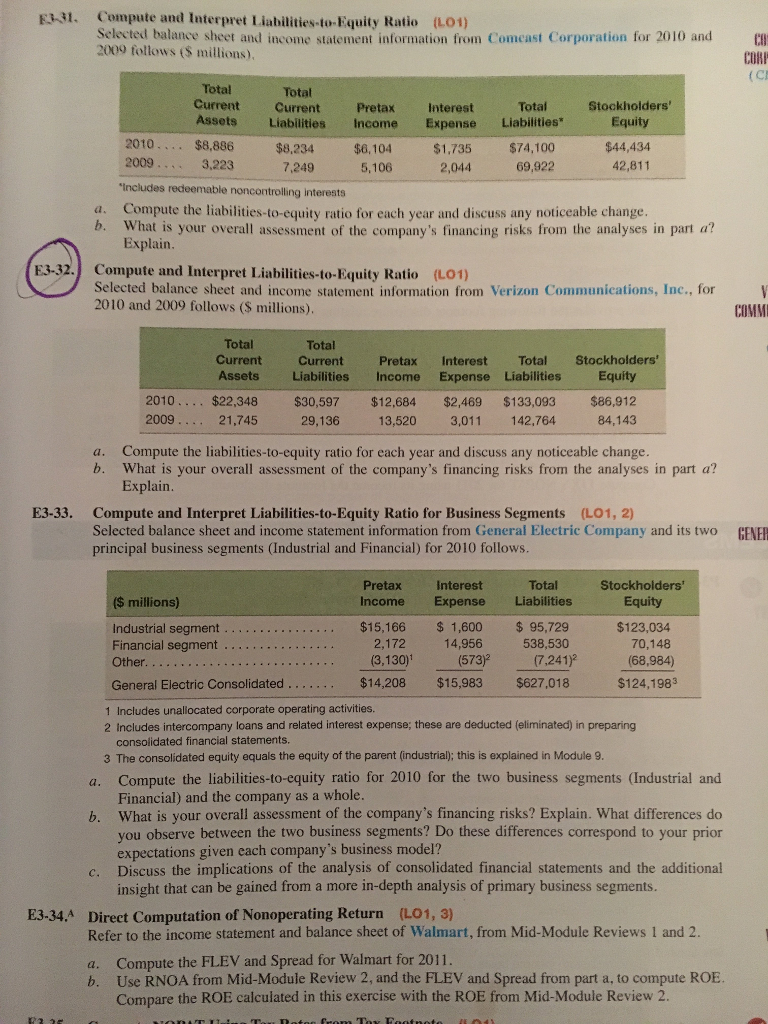

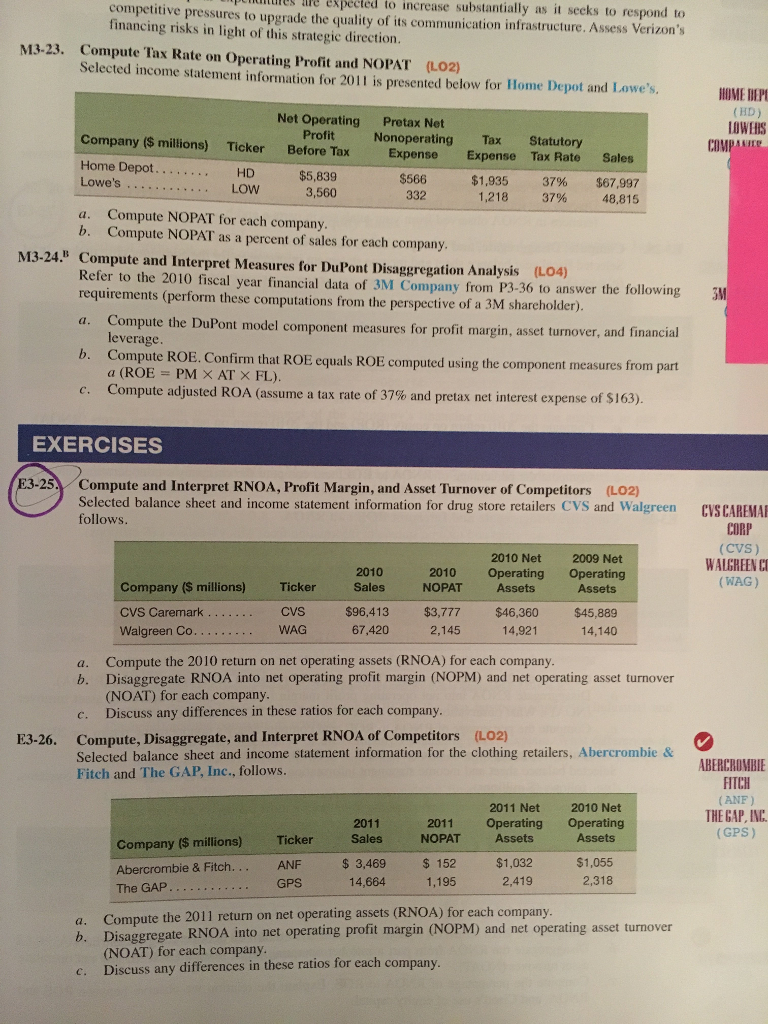

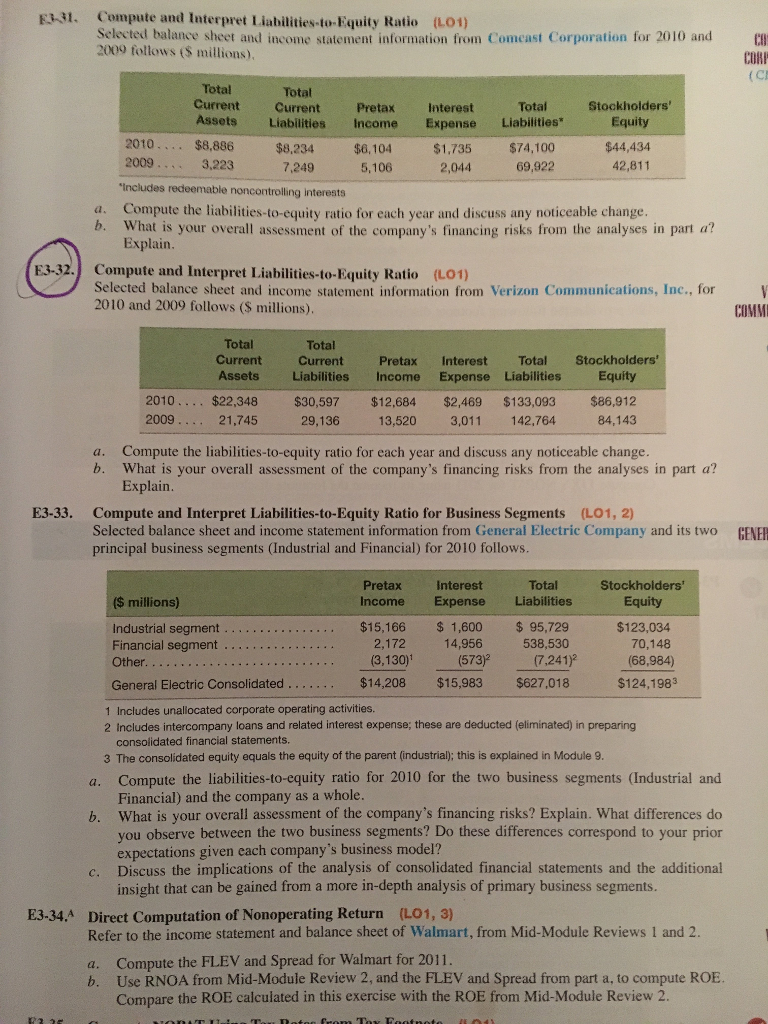

re expected to increase substantially as it seeks to respond to competitive pressures to upgrade the quality of its communication infrastructure. Assess Verizon's financing risks in light of this strategic direction M3-23. Compute Tax Rate on Operating Profit and NOPAT (LO2) Selected income statement information for 2011 is presented below for Home Depot and Lowe's. HUME IEP Net Operating Pretax Net Company (S millions) Ticker Before Tax Expense Expense Tax Rate Sales LOWERS Profit Nonoperating Tax Statutory Home Depot $5,839 3,560 $566 $1,935 37% $67,997 1,218 37% 48,815 LOW a. Compute NOPAT for each company. b. Compute NOPAT as a percent of sales for each company M13-24" Compute and Interpret Measures for DuPont Disaggregation Analysis (L04) Refer to the 2010 fiscal year financial data of 3M Company from P3-36 to answer the following requirements (perform these computations from the perspective of a 3M sh 3 Compute the DuPont model component measures for profit margin, leverage Compute ROE. Confirm that ROE equals ROE computed using the component measures t a (ROE-PM AT FL) Compute adjusted ROA (assume a tax rate of 37% and pretax net interest expense of S163). a. asset turnover, and financial b. c. EXERCISES Compute and Interpret RNOA, Profit Margin, and Asset Turnover of Competitors (LO2) Selected balance sheet and income statement information for drug store retailers CVS and Walgreen follows CVS CAREMA CORP 2010 Net 2009 Net Assets $96,413 $3,777 $46,360 $45,889 2010 Operating Operating NOPAT Assets WALCREEN CO (WAG) Company (S millions) Ticker CVS WAG CVS Caremark Walgreen Co. 67,420 14,921 Compute the 2010 return on net operating assets (RNOA) for each company Disaggregate RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT) for each company Discuss any differences in these ratios for each company a. b. e. Compute, Disaggregate, and Interpret RNOA of Competitors Selected balance sheet and income statement information for the clothing retailers, Abercrombie & Fitch and The GAP, Inc., follows E3-26. (L02) ABERCROMBIE FITCH 2011 Net 2010 Net 2011 Operating Operating THE GAP,INC 2011 Sales NOPAT Ticker ANF Assets Assets Company ($ millions) Abercrombie & Fitch. The GAP $ 3,469 14,664 a. Compute the 2011 return on net operating assets (RNOA) for each company. b. Disaggregate RNOA into net operating profit margin (NOPM) and net operating asset turnover NOAT) for each company Discuss any differences in these ratios for each company c