Answered step by step

Verified Expert Solution

Question

1 Approved Answer

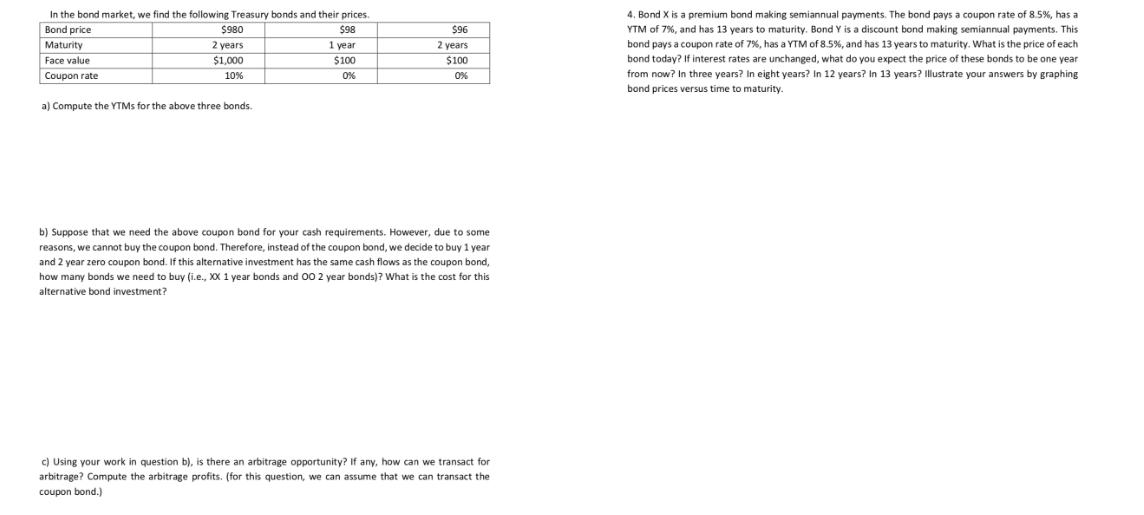

In the bond market, we find the following Treasury bonds and their prices. Bond price Maturity Face value Coupon rate $980 2 years $1,000

In the bond market, we find the following Treasury bonds and their prices. Bond price Maturity Face value Coupon rate $980 2 years $1,000 10% a) Compute the YTMs for the above three bonds. $98 1 year. $100 0% $96 2 years $100 0% b) Suppose that we need the above coupon bond for your cash requirements. However, due to some reasons, we cannot buy the coupon bond. Therefore, instead of the coupon bond, we decide to buy 1 year and 2 year zero coupon bond. If this alternative investment has the same cash flows as the coupon bond, how many bonds we need to buy (i.e., XX 1 year bonds and OO 2 year bonds)? What is the cost for this alternative bond investment? c) Using your work in question b), is there an arbitrage opportunity? If any, how can we transact for arbitrage? Compute the arbitrage profits. (for this question, we can assume that we can transact the coupon bond.) 4. Bond X is a premium bond making semiannual payments. The bond pays a coupon rate of 8.5%, has a YTM of 7%, and has 13 years to maturity. Bond Y is a discount bond making semiannual payments. This bond pays a coupon rate of 7%, has a YTM of 8.5%, and has 13 years to maturity. What is the price of each bond today? If interest rates are unchanged, what do you expect the price of these bonds to be one year from now? In three years? In eight years? In 12 years? In 13 years? Illustrate your answers by graphing bond prices versus time to maturity.

Step by Step Solution

★★★★★

3.23 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Compute the YTMs for the above three bonds Bond 1 Face value 1000 Coupon rate 10 Maturity 2 years ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started