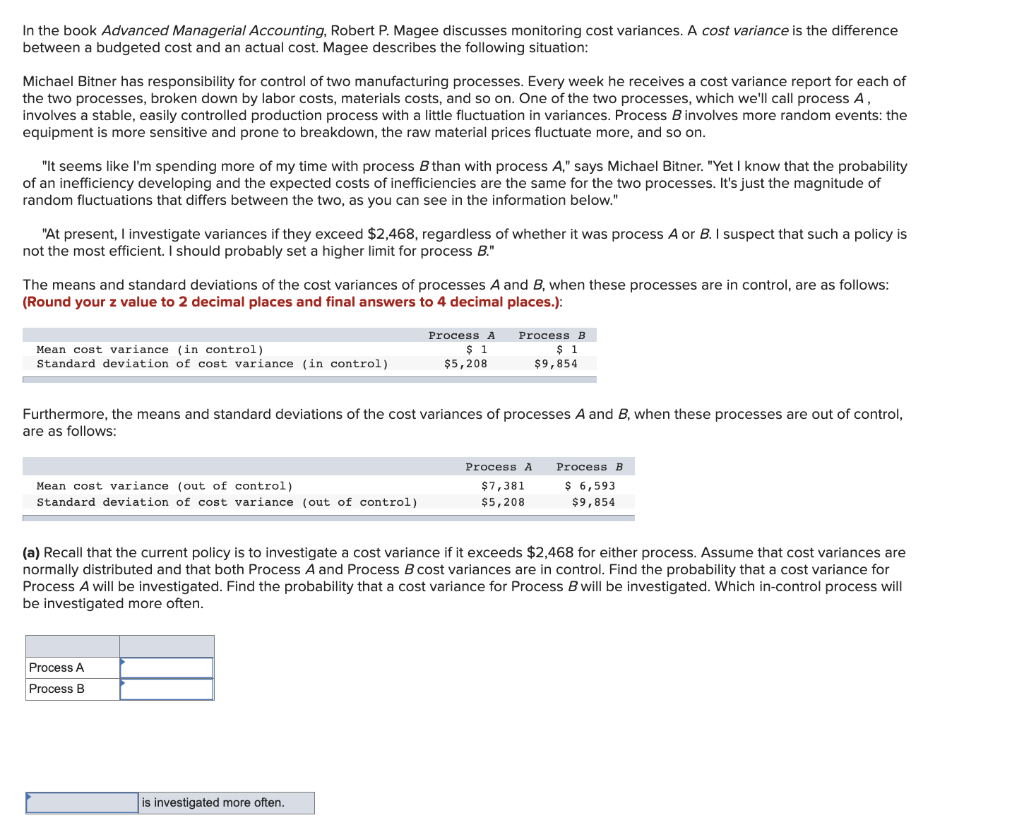

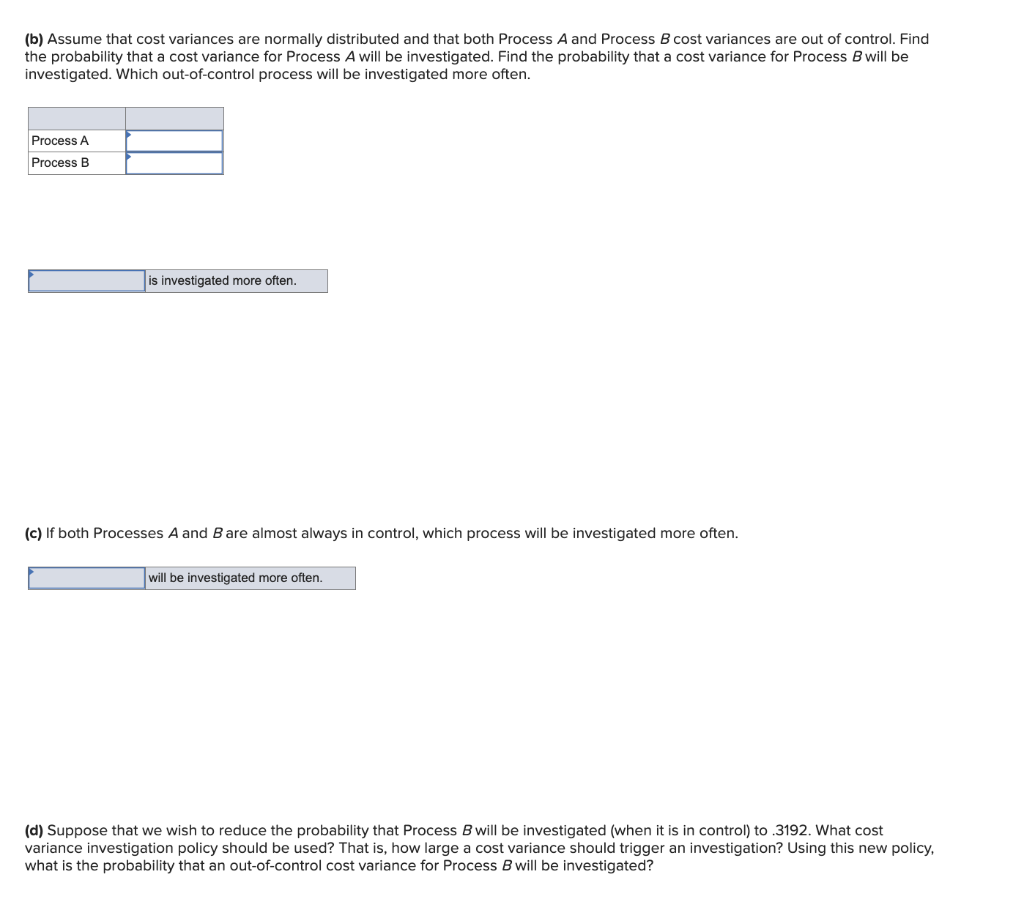

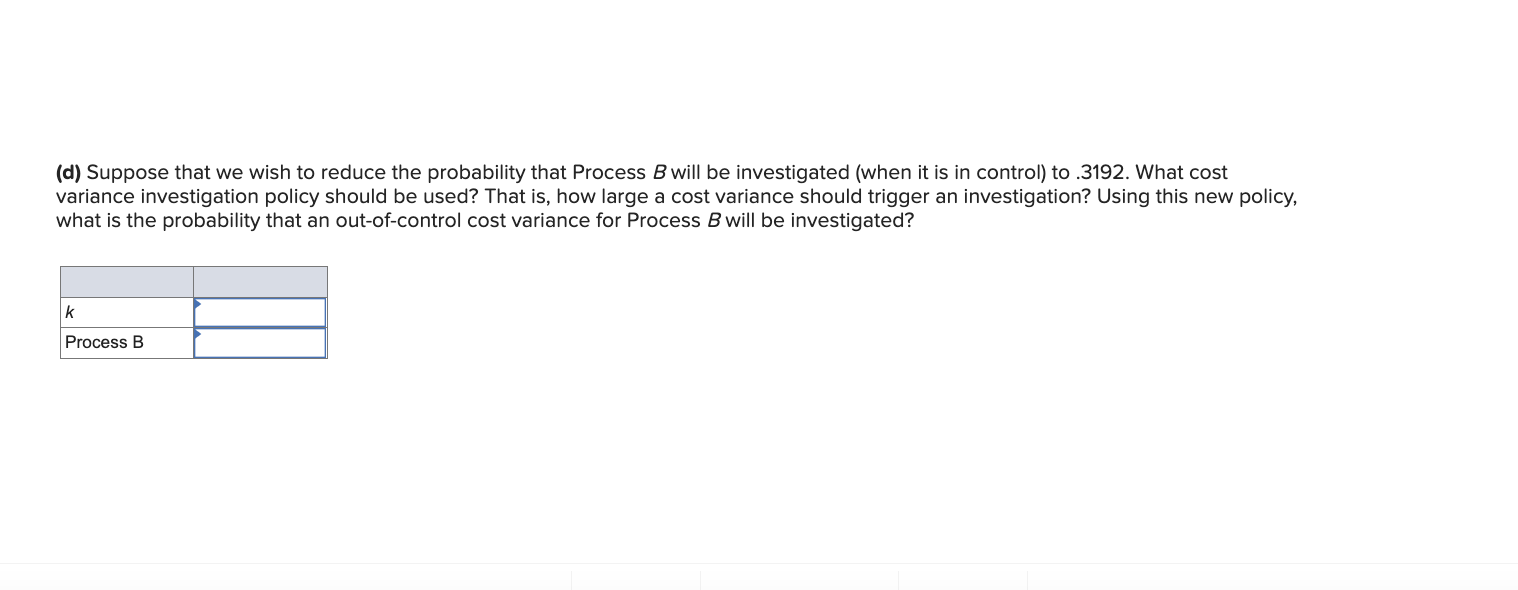

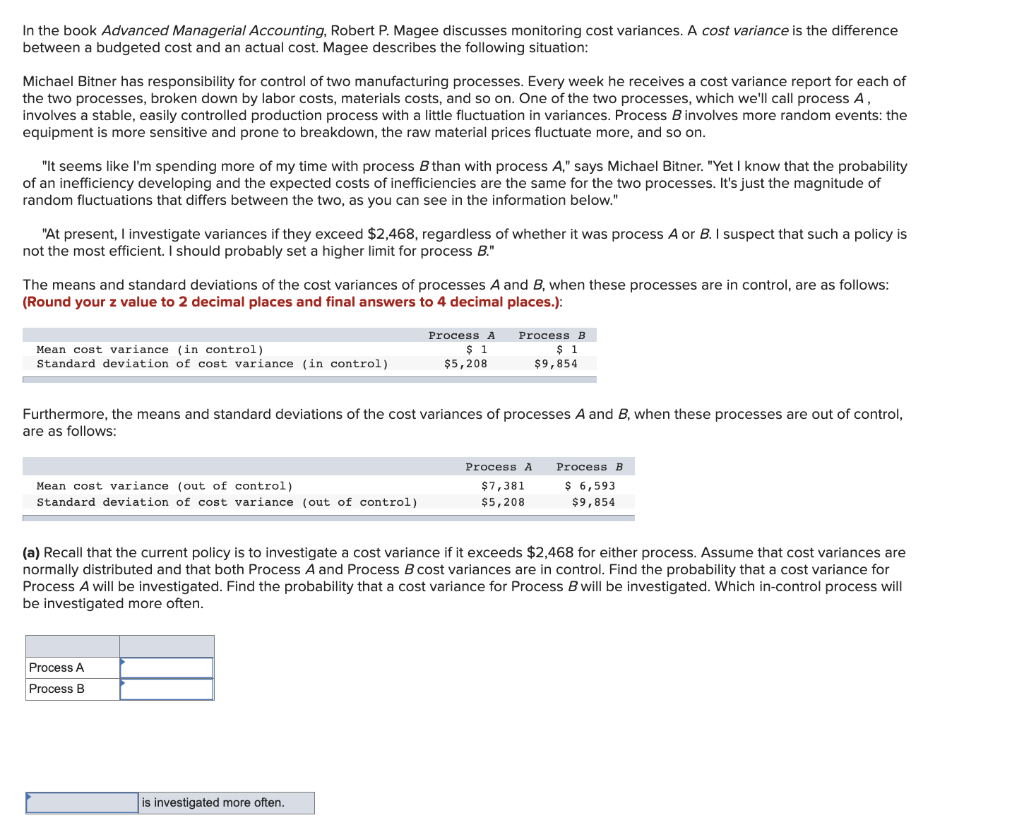

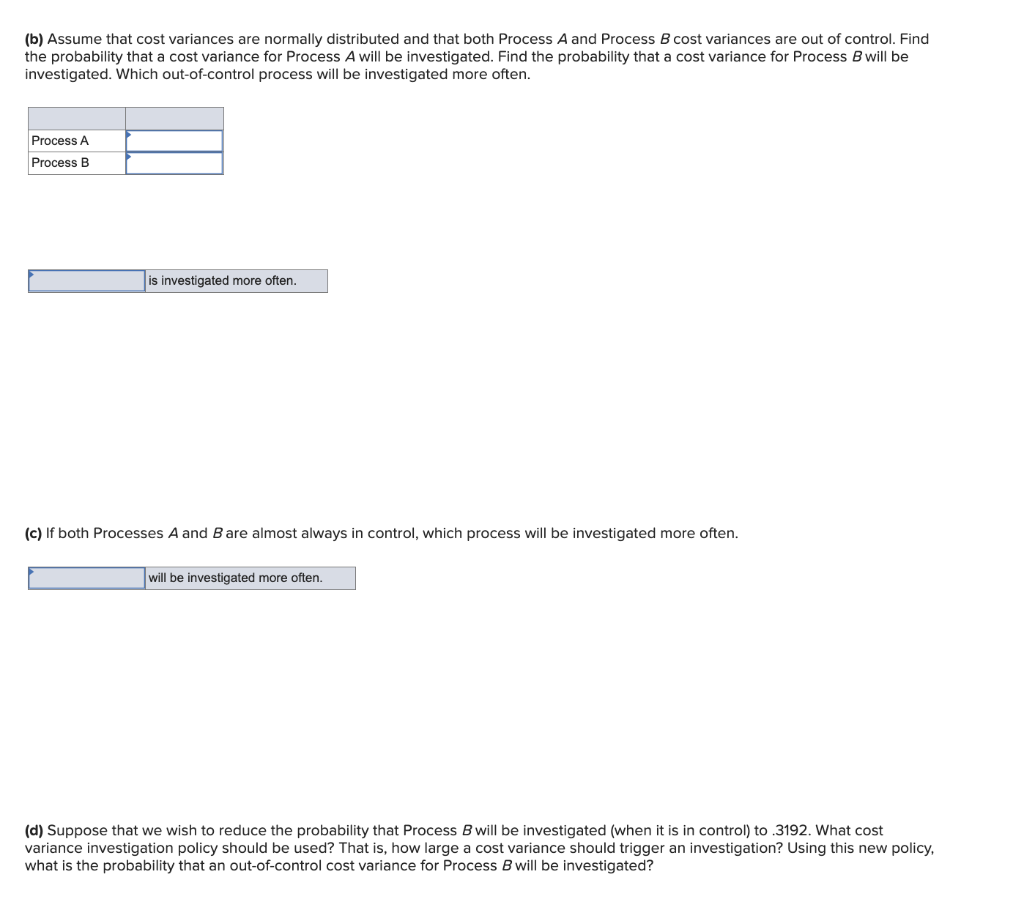

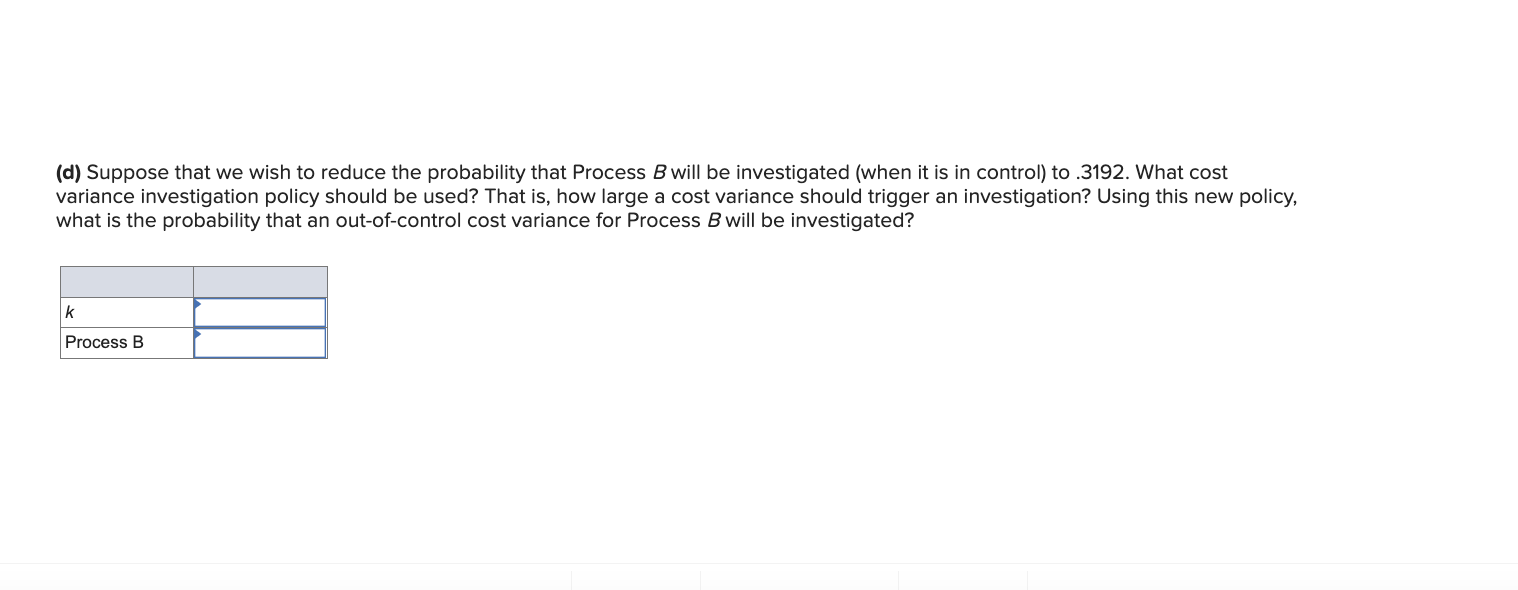

In the book Advanced Managerial Accounting, Robert P. Magee discusses monitoring cost variances. A cost variance is the difference between a budgeted cost and an actual cost. Magee describes the following situation: Michael Bitner has responsibility for control of two manufacturing processes. Every week he receives a cost variance report for each of the two processes, broken down by labor costs, materials costs, and so on. One of the two processes, which we'll call process A, involves a stable, easily controlled production process with a little fluctuation in variances. Process B involves more random events: the equipment is more sensitive and prone to breakdown, the raw material prices fluctuate more, and so on. "It seems like I'm spending more of my time with process B than with process A," says Michael Bitner. "Yet I know that the probability of an inefficiency developing and the expected costs of inefficiencies are the same for the two processes. It's just the magnitude of random fluctuations that differs between the two, as you can see in the information below." "At present, I investigate variances if they exceed $2,468, regardless of whether it was process A or B. I suspect that such a policy is not the most efficient. I should probably set a higher limit for process B." The means and standard deviations of the cost variances of processes A and B, when these processes are in control, are as follows: (Round your z value to 2 decimal places and final answers to 4 decimal places.): Furthermore, the means and standard deviations of the cost variances of processes A and B, when these processes are out of control, are as follows: (a) Recall that the current policy is to investigate a cost variance if it exceeds $2,468 for either process. Assume that cost variances are normally distributed and that both Process A and Process B cost variances are in control. Find the probability that a cost variance for Process A will be investigated. Find the probability that a cost variance for Process B will be investigated. Which in-control process will be investigated more often. (b) Assume that cost variances are normally distributed and that both Process A and Process B cost variances are out of control. Find the probability that a cost variance for Process A will be investigated. Find the probability that a cost variance for Process B will be investigated. Which out-of-control process will be investigated more often. (c) If both Processes A and B are almost always in control, which process will be investigated more often. (d) Suppose that we wish to reduce the probability that Process B will be investigated (when it is in control) to 3192 . What cost variance investigation policy should be used? That is, how large a cost variance should trigger an investigation? Using this new policy, what is the probability that an out-of-control cost variance for Process B will be investigated? (d) Suppose that we wish to reduce the probability that Process B will be investigated (when it is in control) to .3192. What cost variance investigation policy should be used? That is, how large a cost variance should trigger an investigation? Using this new policy, what is the probability that an out-of-control cost variance for Process B will be investigated? In the book Advanced Managerial Accounting, Robert P. Magee discusses monitoring cost variances. A cost variance is the difference between a budgeted cost and an actual cost. Magee describes the following situation: Michael Bitner has responsibility for control of two manufacturing processes. Every week he receives a cost variance report for each of the two processes, broken down by labor costs, materials costs, and so on. One of the two processes, which we'll call process A, involves a stable, easily controlled production process with a little fluctuation in variances. Process B involves more random events: the equipment is more sensitive and prone to breakdown, the raw material prices fluctuate more, and so on. "It seems like I'm spending more of my time with process B than with process A," says Michael Bitner. "Yet I know that the probability of an inefficiency developing and the expected costs of inefficiencies are the same for the two processes. It's just the magnitude of random fluctuations that differs between the two, as you can see in the information below." "At present, I investigate variances if they exceed $2,468, regardless of whether it was process A or B. I suspect that such a policy is not the most efficient. I should probably set a higher limit for process B." The means and standard deviations of the cost variances of processes A and B, when these processes are in control, are as follows: (Round your z value to 2 decimal places and final answers to 4 decimal places.): Furthermore, the means and standard deviations of the cost variances of processes A and B, when these processes are out of control, are as follows: (a) Recall that the current policy is to investigate a cost variance if it exceeds $2,468 for either process. Assume that cost variances are normally distributed and that both Process A and Process B cost variances are in control. Find the probability that a cost variance for Process A will be investigated. Find the probability that a cost variance for Process B will be investigated. Which in-control process will be investigated more often. (b) Assume that cost variances are normally distributed and that both Process A and Process B cost variances are out of control. Find the probability that a cost variance for Process A will be investigated. Find the probability that a cost variance for Process B will be investigated. Which out-of-control process will be investigated more often. (c) If both Processes A and B are almost always in control, which process will be investigated more often. (d) Suppose that we wish to reduce the probability that Process B will be investigated (when it is in control) to 3192 . What cost variance investigation policy should be used? That is, how large a cost variance should trigger an investigation? Using this new policy, what is the probability that an out-of-control cost variance for Process B will be investigated? (d) Suppose that we wish to reduce the probability that Process B will be investigated (when it is in control) to .3192. What cost variance investigation policy should be used? That is, how large a cost variance should trigger an investigation? Using this new policy, what is the probability that an out-of-control cost variance for Process B will be investigated