Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the bustling city of Metropolis, there stood a renowned multinational corporation named TechSolutions Inc. It was a behemoth in the technology industry, offering cutting-edge

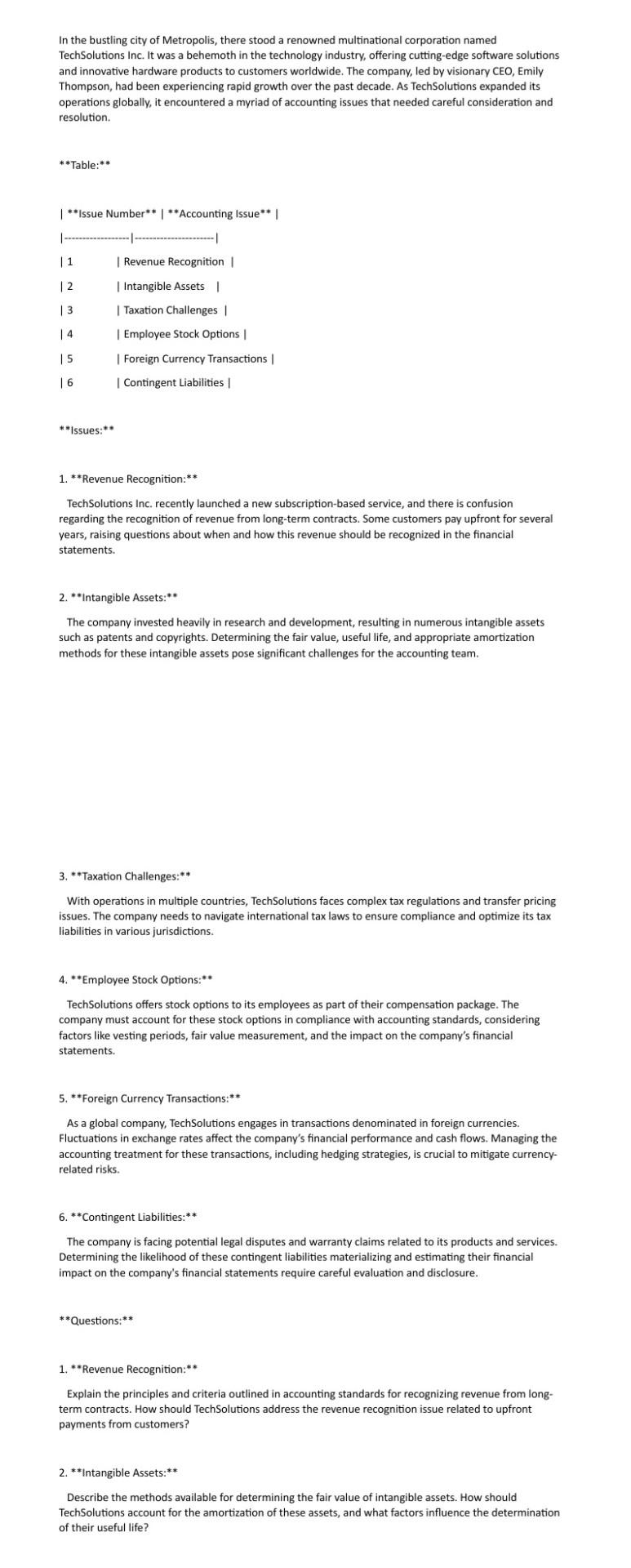

In the bustling city of Metropolis, there stood a renowned multinational corporation named TechSolutions Inc. It was a behemoth in the technology industry, offering cutting-edge software solutions and innovative hardware products to customers worldwide. The company, led by visionary CEO, Emily Thompson, had been experiencing rapid growth over the past decade. As TechSolutions expanded its operations globally, it encountered a myriad of accounting issues that needed careful consideration and resolution. **Table:** **Issue Number** Accounting Issue 1 - |1 | Revenue Recognition | 12 | Intangible Assets | 13 | Taxation Challenges | | 4 | Employee Stock Options | | 5 | Foreign Currency Transactions | | 6 | Contingent Liabilities | **Issues:** 1. **Revenue Recognition:** TechSolutions Inc. recently launched a new subscription-based service, and there is confusion regarding the recognition of revenue from long-term contracts. Some customers pay upfont for several years, raising questions about when and how this revenue should be recognized in the financial statements. 2. **Intangible Assets:* The company invested heavily in research and development, resulting in numerous intangible assets such as patents and copyrights. Determining the fair value, useful life, and appropriate amortization methods for these intangible assets pose significant challenges for the accounting team. 3. **Taxation Challenges:** With operations in multiple countries, TechSolutions faces complex tax regulations and transfer pricing issues. The company needs to navigate international tax laws to ensure compliance and optimize its tax liabilities in various jurisdictions. 4. "*Employee Stock Options: * TechSolutions offers stock options to its employees as part of their compensation package. The company must account for these stock options in compliance with accounting standards, considering factors like vesting periods, fair value measurement, and the impact on the company's financial statements. 5. ** Foreign Currency Transactions:** As a global company, TechSolutions engages in transactions denominated in foreign currencies. Fluctuations in exchange rates affect the company's financial performance and cash flows. Managing the accounting treatment for these transactions, including hedging strategies, is crucial to mitigate currencyrelated risks. 6. **Contingent Liabilities:** The company is facing potential legal disputes and warranty claims related to its products and services. Determining the likelihood of these contingent liabilities materializing and estimating their financial impact on the company's financial statements require careful evaluation and disclosure. **Questions:** 1. **Revenue Recognition:** Explain the principles and criteria outlined in accounting standards for recognizing revenue from longterm contracts. How should TechSolutions address the revenue recognition issue related to upfront payments from customers? 2. **Intangible Assets:** Describe the methods available for determining the fair value of intangible assets. How should Techsolutions account for the amortization of these assets, and what factors influence the determination of their useful life

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started