In the case: Dell's Working Capital

How could it achieve a growth rate greater than the sustainable growth in 1996, in case it was lesser than the actual 52%?

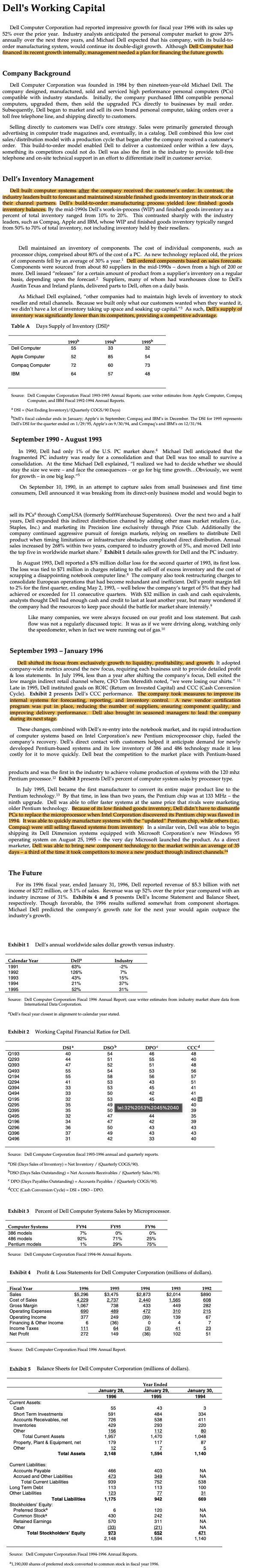

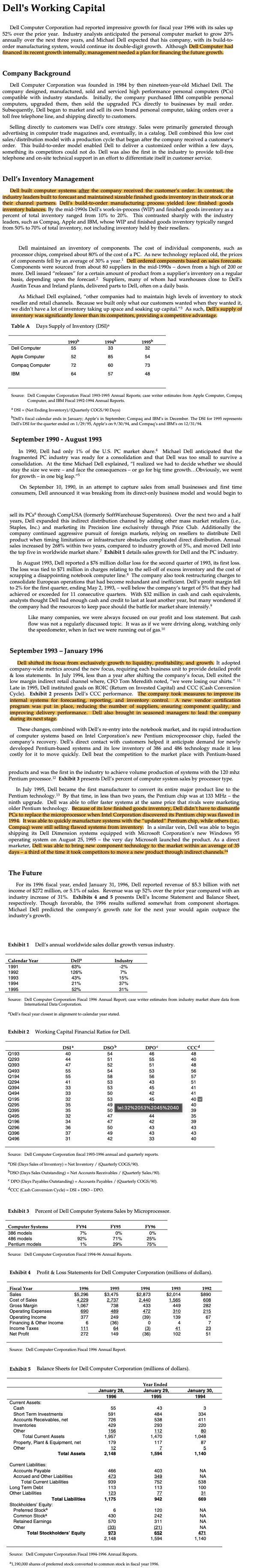

Dell's Working Capital Dell Computer Corporation had reported impressive growth for fiscal year 1996 with its sales up 52% over the prior year. Industry analysts anticipated the personal computer market to grow 20% annually over the next three years, and Michael Dell expected that his company, with its build-to- order manufacturing system, would continue its double-digit growth. Although Dell Computer had financed its recent growth internally, management needed a plan for financing the future growth. Company Background Dell Computer Corporation was founded in 1984 by then nineteen-year-old Michael Dell. The company designed, manufactured, sold and serviced high performance personal computers (PCs) compatible with industry standards. Initially, the company purchased IBM compatible personal computers, upgraded them, then sold the upgraded PCs directly to businesses by mail order. Subsequently, Dell began to market and sell its own brand personal computer, taking orders over a toll free telephone line, and shipping directly to customers. Selling directly to customers was Dell's core strategy. Sales were primarily generated through advertising in computer trade magazines and eventually, in a catalog. Dell combined this low cost sales/ distribution model with a production cycle that began after the company received a customer's order. This build-to-order model enabled Dell to deliver a customized order within a few days, something its competitors could not do. Dell was also the first in the industry to provide toll-free telephone and on-site technical support in an effort to differentiate itself in customer service. Dell's Inventory Management Dell built computer systems after the company received the customer's order. In contrast, the industry leaders built to forecast and maintained sizeable finished goods inventory in their stock or at their channel partners. Dell's build-to-order manufacturing process yielded low finished goods inventory balances. By the mid-1990s Dell's work-in-process (WIP) and finished goods inventory as a percent of total inventory ranged from 10% to 20%. This contrasted sharply with the industry leaders, such as Compaq, Apple and IBM, whose WIP and finished goods inventory typically ranged from 50% to 70% of total inventory, not including inventory held by their resellers. Dell maintained an inventory of components. The cost of individual components, such as processor chips, comprised about 80% of the cost of a PC. As new technology replaced old, the prices of components fell by an average of 30% a year. Dell ordered components based on sales forecasts. Components were sourced from about 80 suppliers in the mid-1990s - down from a high of 200 or more. Dell issued "releases" for a certain amount of product from a supplier's inventory on a regular basis, depending upon the forecast.? Suppliers, many of whom had warehouses close to Dell's Austin Texas and Ireland plants, delivered parts to Dell, often on a daily basis. As Michael Dell explained, "other companies had to maintain high levels of inventory to stock reseller and retail channels. Because we built only what our customers wanted when they wanted it, we didn't have a lot of inventory taking up space and soaking up capital." As such, Dell's supply of inventory was significantly lower than its competitors, providing a competitive advantage. Table A Days Supply of Inventory (DST) 19936 1994 33 1995b 32 Dell Computer 55 Apple Computer 52 85 54 Compaq Computer 72 60 73 IBM 64 57 48 Source: Dell Computer Corporation Fiscal 1993-1995 Annual Reports; case writer estimates from Apple Computer, Compaq Computer, and IBM Fiscal 1992-1994 Annual Reports. a DSI = (Net Ending Inventory)/(Quarterly COGS/90 Days) Dell's fiscal calendar ends in January; Apple's in September, Compaq and IBM's in December. The DSI for 1995 represents Dell's DSI for the quarter ended on 1/29/95, Apple's on 9/30/94, and Compaq's and IBM's on 12/31/94. September 1990 - August 1993 In 1990, Dell had only 1% of the U.S. PC market share. Michael Dell anticipated that the fragmented PC industry was ready for a consolidation and that Dell was too small to survive a consolidation. At the time Michael Dell explained, "I realized we had to decide whether we should stay the size we were - and face the consequences - or go for big time growth... Obviously, we went for growth - in one big leap." On September 10, 1990, in an attempt to capture sales from small businesses and first time consumers, Dell announced it was breaking from its direct-only business model and would begin to sell its PCs through CompUSA (formerly SoftWarehouse Superstores). Over the next two and a half years, Dell expanded this indirect distribution channel by adding other mass market retailers (i.e., Staples, Inc.) and marketing its Precision line exclusively through Price Club. Additionally the company continued aggressive pursuit of foreign markets, relying on resellers to distribute Dell product when timing limitations or infrastructure obstacles complicated direct distribution. Annual sales increased by 268% within two years, compared to industry growth of 5%, and moved Dell into the top five in worldwide market share. Exhibit 1 details sales growth for and the PC industry. In August 1993, Dell reported a $76 million dollar loss for the second quarter of 1993, its first loss. The loss was tied to $71 million in charges relating to the sell-off of excess inventory and the cost of scrapping a disappointing notebook computer line. The company also took restructuring charges to consolidate European operations that had become redundant and inefficient. Dell's profit margin fell to 2% for the first quarter, ending May 2, 1993, - well below the company's target of 5% that they had achieved or exceeded for 11 consecutive quarters. With $32 million in cash and cash equivalents, analysts thought Dell had enough cash and credit to last at least another year, but many wondered if the company had the resources to keep pace should the battle for market share intensify Like many companies, we were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.10 shirts." 11 September 1993 - January 1996 Dell shifted its focus from exclusively growth to liquidity, profitability, and growth. It adopted company-wide metrics around the new focus, requiring each business unit to provide detailed profit &loss statements. In July 1994, less than a year after shifting the company's focus, Dell exited the low margin indirect retail channel where, CFO Tom Meredith noted, "we were losing Late in 1995, Dell instituted goals on ROIC (Return on Invested Capital) and CCC (Cash Conversion Cycle). Exhibit 2 presents Dell's CCC performance. The company took measures to improve its internal systems for forecasting, reporting, and inventory control. A new vendor certification program was put in place, reducing the number of suppliers, ensuring component quality, and improving delivery performance. Dell also brought in seasoned managers to lead the company during its next stage These changes, combined with Dell's re-entry into the notebook market, and its rapid introduction of computer systems based on Intel Corporation's new Pentium microprocessor chip, fueled the company's recovery. Dell's direct contact with customers helped it anticipate demand for newly developed Pentium-based systems and its low inventory of 386 and 486 technology made it less costly for it to move quickly. Dell beat the competition to the market place with Pentium-based products and was the first in the industry to achieve volume production of systems with the 120 mhz Pentium processor.12 Exhibit 3 presents Dell's percent of computer system sales by processor type. In July 1995, Dell became the first manufacturer to convert its entire major product line to the Pentium technology. 13 By that time, in less than two years, the Pentium chip was at 133 MHz - the ninth upgrade. Dell was able to offer faster systems at the same price that rivals were marketing older Pentium technology. Because of its low finished goods inventory, Dell didn't have to dismantle PCs to replace the microprocessor when Intel Corporation discovered its Pentium chip was flawed in 1994. It was able to quickly manufacture systems with the "updated" Pentium chip, while others (i.e., Compaq) were still selling flawed systems from inventory. In a similar vein, Dell was able to begin shipping its Dell Dimension systems equipped with Microsoft Corporation's new Windows 95 operating system on August 25, 1995 - the very day Microsoft launched the product. As a direct marketer, Dell was able to bring new component technology to the market within an average of 35 days - a third of the time it took competitors to move a new product through indirect channels. The Future For its 1996 fiscal year, ended January 31, 1996, Dell reported revenue of $5.3 billion with net income of $272 million, or 5.1% of sales. Revenue was up 52% over the prior year compared with an industry increase of 31%. Exhibits 4 and 5 presents Dell's Income Statement and Balance Sheet, respectively. Though favorable, the 1996 results suffered somewhat from component shortages. Michael Dell predicted the company's growth rate for the next year would again outpace the industry's growth. Exhibit 1 Dell's annual worldwide sales dollar growth versus industry. Della Calendar Year 1991 1992 1993 1994 1995 63% 126% 43% 21% Industry -2% 7% 15% 37% 52% 31% Source: Dell Computer Corporation Fiscal 1996 Annual Report; case writer estimates from industry market share data from International Data Corporation. Dell's fiscal year closest in alignment to calendar year stated. Exhibit 2 Working Capital Financial Ratios for Dell. DSI DSob DPOC Q193 0293 Q393 40 44 47 54 51 52 54 58 46 55 51 cccd 48 40 48 0493 Q194 55 55 53 56 56 57 Q394 0494 33 33 53 50 45 42 45 Q195 Q295 Q395 2495 Q196 tel:32%2053%2045%2040 32 35 35 32 34 41 41 40 V 40 39 35 39 53 49 50 47 47 44 42 Q296 Q396 Q496 36 37 31 50 49 42 43 43 33 43 43 40 Source: Dell Computer Corporation fiscal 1993-1996 annual and quarterly reports. DSI (Days Sales of Inventory) = Net Inventory / (Quarterly COGS/90). DSO (Days Sales Outstanding) = Net Accounts Receivables / (Quarterly Sales/90). DPO (Days Payables Outstanding) = Accounts Payables / (Quarterly COGS/90). dccc (Cash Conversion Cycle) = DSI + DSO-DPO. Exhibit 3 Percent of Dell Computer Systems Sales by Microprocessor. FY94 FY95 FY96 Computer Systems 386 models 486 models Pentium models 7% 92% 1% 0% 71% 29% 0% 25% 75% Source: Dell Computer Corporation Fiscal 1994-96 Annual Reports. Exhibit 4 Profit & Loss Statements for Dell Computer Corporation (millions of dollars). 1996 1994 1993 1992 Fiscal Year Sales Cost of Sales Gross Margin Operating Expenses Operating Income Financing & Other Income Income Taxes Net Profit 1995 $3,475 2.737 738 489 249 (36) 64 149 $5,296 4,229 1,067 690 377 6 111 272 $890 608 282 215 $2,873 2.440 433 472 (39) 0 (3) (36) $2,014 1,565 449 310 139 4 41 102 67 7 23 51 Source: Dell Computer Corporation Fiscal 1996 Annual Report. Exhibit 5 Balance Sheets for Dell Computer Corporation (millions of dollars). January 28, 1996 Year Ended January 29, 1995 January 30, 1994 Current Assets: Cash 55 43 3 Short Term Investments Accounts Receivables, net Inventories Other Total Current Assets Property, Plant & Equipment, net Other Total Assets 591 726 429 156 1,957 179 12 2,148 484 538 293 112 1.470 117 Z 1,594 334 411 220 80 1,048 87 5 1,140 466 473 939 113 123 Current Liabilities: Accounts Payable Accrued and Other Liabilities Total Current Liabilities Long Term Debt Other Liabilities Total Liabilities Stockholders' Equity: Preferred Stock Common Stock Retained Earnings Other Total Stockholders' Equity 403 349 752 113 77 942 NA NA 538 100 31 669 1,175 6 430 570 120 242 311 NA NA NA (33) 973 2,148 (21) 652 1,594 NA 471 1,140 Source: Dell Computer Corporation Fiscal 1994-1996 Annual Reports. -1,190,000 shares of preferred stock converted to common stock in fiscal year 1996. Dell's Working Capital Dell Computer Corporation had reported impressive growth for fiscal year 1996 with its sales up 52% over the prior year. Industry analysts anticipated the personal computer market to grow 20% annually over the next three years, and Michael Dell expected that his company, with its build-to- order manufacturing system, would continue its double-digit growth. Although Dell Computer had financed its recent growth internally, management needed a plan for financing the future growth. Company Background Dell Computer Corporation was founded in 1984 by then nineteen-year-old Michael Dell. The company designed, manufactured, sold and serviced high performance personal computers (PCs) compatible with industry standards. Initially, the company purchased IBM compatible personal computers, upgraded them, then sold the upgraded PCs directly to businesses by mail order. Subsequently, Dell began to market and sell its own brand personal computer, taking orders over a toll free telephone line, and shipping directly to customers. Selling directly to customers was Dell's core strategy. Sales were primarily generated through advertising in computer trade magazines and eventually, in a catalog. Dell combined this low cost sales/ distribution model with a production cycle that began after the company received a customer's order. This build-to-order model enabled Dell to deliver a customized order within a few days, something its competitors could not do. Dell was also the first in the industry to provide toll-free telephone and on-site technical support in an effort to differentiate itself in customer service. Dell's Inventory Management Dell built computer systems after the company received the customer's order. In contrast, the industry leaders built to forecast and maintained sizeable finished goods inventory in their stock or at their channel partners. Dell's build-to-order manufacturing process yielded low finished goods inventory balances. By the mid-1990s Dell's work-in-process (WIP) and finished goods inventory as a percent of total inventory ranged from 10% to 20%. This contrasted sharply with the industry leaders, such as Compaq, Apple and IBM, whose WIP and finished goods inventory typically ranged from 50% to 70% of total inventory, not including inventory held by their resellers. Dell maintained an inventory of components. The cost of individual components, such as processor chips, comprised about 80% of the cost of a PC. As new technology replaced old, the prices of components fell by an average of 30% a year. Dell ordered components based on sales forecasts. Components were sourced from about 80 suppliers in the mid-1990s - down from a high of 200 or more. Dell issued "releases" for a certain amount of product from a supplier's inventory on a regular basis, depending upon the forecast.? Suppliers, many of whom had warehouses close to Dell's Austin Texas and Ireland plants, delivered parts to Dell, often on a daily basis. As Michael Dell explained, "other companies had to maintain high levels of inventory to stock reseller and retail channels. Because we built only what our customers wanted when they wanted it, we didn't have a lot of inventory taking up space and soaking up capital." As such, Dell's supply of inventory was significantly lower than its competitors, providing a competitive advantage. Table A Days Supply of Inventory (DST) 19936 1994 33 1995b 32 Dell Computer 55 Apple Computer 52 85 54 Compaq Computer 72 60 73 IBM 64 57 48 Source: Dell Computer Corporation Fiscal 1993-1995 Annual Reports; case writer estimates from Apple Computer, Compaq Computer, and IBM Fiscal 1992-1994 Annual Reports. a DSI = (Net Ending Inventory)/(Quarterly COGS/90 Days) Dell's fiscal calendar ends in January; Apple's in September, Compaq and IBM's in December. The DSI for 1995 represents Dell's DSI for the quarter ended on 1/29/95, Apple's on 9/30/94, and Compaq's and IBM's on 12/31/94. September 1990 - August 1993 In 1990, Dell had only 1% of the U.S. PC market share. Michael Dell anticipated that the fragmented PC industry was ready for a consolidation and that Dell was too small to survive a consolidation. At the time Michael Dell explained, "I realized we had to decide whether we should stay the size we were - and face the consequences - or go for big time growth... Obviously, we went for growth - in one big leap." On September 10, 1990, in an attempt to capture sales from small businesses and first time consumers, Dell announced it was breaking from its direct-only business model and would begin to sell its PCs through CompUSA (formerly SoftWarehouse Superstores). Over the next two and a half years, Dell expanded this indirect distribution channel by adding other mass market retailers (i.e., Staples, Inc.) and marketing its Precision line exclusively through Price Club. Additionally the company continued aggressive pursuit of foreign markets, relying on resellers to distribute Dell product when timing limitations or infrastructure obstacles complicated direct distribution. Annual sales increased by 268% within two years, compared to industry growth of 5%, and moved Dell into the top five in worldwide market share. Exhibit 1 details sales growth for and the PC industry. In August 1993, Dell reported a $76 million dollar loss for the second quarter of 1993, its first loss. The loss was tied to $71 million in charges relating to the sell-off of excess inventory and the cost of scrapping a disappointing notebook computer line. The company also took restructuring charges to consolidate European operations that had become redundant and inefficient. Dell's profit margin fell to 2% for the first quarter, ending May 2, 1993, - well below the company's target of 5% that they had achieved or exceeded for 11 consecutive quarters. With $32 million in cash and cash equivalents, analysts thought Dell had enough cash and credit to last at least another year, but many wondered if the company had the resources to keep pace should the battle for market share intensify Like many companies, we were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.10 shirts." 11 September 1993 - January 1996 Dell shifted its focus from exclusively growth to liquidity, profitability, and growth. It adopted company-wide metrics around the new focus, requiring each business unit to provide detailed profit &loss statements. In July 1994, less than a year after shifting the company's focus, Dell exited the low margin indirect retail channel where, CFO Tom Meredith noted, "we were losing Late in 1995, Dell instituted goals on ROIC (Return on Invested Capital) and CCC (Cash Conversion Cycle). Exhibit 2 presents Dell's CCC performance. The company took measures to improve its internal systems for forecasting, reporting, and inventory control. A new vendor certification program was put in place, reducing the number of suppliers, ensuring component quality, and improving delivery performance. Dell also brought in seasoned managers to lead the company during its next stage These changes, combined with Dell's re-entry into the notebook market, and its rapid introduction of computer systems based on Intel Corporation's new Pentium microprocessor chip, fueled the company's recovery. Dell's direct contact with customers helped it anticipate demand for newly developed Pentium-based systems and its low inventory of 386 and 486 technology made it less costly for it to move quickly. Dell beat the competition to the market place with Pentium-based products and was the first in the industry to achieve volume production of systems with the 120 mhz Pentium processor.12 Exhibit 3 presents Dell's percent of computer system sales by processor type. In July 1995, Dell became the first manufacturer to convert its entire major product line to the Pentium technology. 13 By that time, in less than two years, the Pentium chip was at 133 MHz - the ninth upgrade. Dell was able to offer faster systems at the same price that rivals were marketing older Pentium technology. Because of its low finished goods inventory, Dell didn't have to dismantle PCs to replace the microprocessor when Intel Corporation discovered its Pentium chip was flawed in 1994. It was able to quickly manufacture systems with the "updated" Pentium chip, while others (i.e., Compaq) were still selling flawed systems from inventory. In a similar vein, Dell was able to begin shipping its Dell Dimension systems equipped with Microsoft Corporation's new Windows 95 operating system on August 25, 1995 - the very day Microsoft launched the product. As a direct marketer, Dell was able to bring new component technology to the market within an average of 35 days - a third of the time it took competitors to move a new product through indirect channels. The Future For its 1996 fiscal year, ended January 31, 1996, Dell reported revenue of $5.3 billion with net income of $272 million, or 5.1% of sales. Revenue was up 52% over the prior year compared with an industry increase of 31%. Exhibits 4 and 5 presents Dell's Income Statement and Balance Sheet, respectively. Though favorable, the 1996 results suffered somewhat from component shortages. Michael Dell predicted the company's growth rate for the next year would again outpace the industry's growth. Exhibit 1 Dell's annual worldwide sales dollar growth versus industry. Della Calendar Year 1991 1992 1993 1994 1995 63% 126% 43% 21% Industry -2% 7% 15% 37% 52% 31% Source: Dell Computer Corporation Fiscal 1996 Annual Report; case writer estimates from industry market share data from International Data Corporation. Dell's fiscal year closest in alignment to calendar year stated. Exhibit 2 Working Capital Financial Ratios for Dell. DSI DSob DPOC Q193 0293 Q393 40 44 47 54 51 52 54 58 46 55 51 cccd 48 40 48 0493 Q194 55 55 53 56 56 57 Q394 0494 33 33 53 50 45 42 45 Q195 Q295 Q395 2495 Q196 tel:32%2053%2045%2040 32 35 35 32 34 41 41 40 V 40 39 35 39 53 49 50 47 47 44 42 Q296 Q396 Q496 36 37 31 50 49 42 43 43 33 43 43 40 Source: Dell Computer Corporation fiscal 1993-1996 annual and quarterly reports. DSI (Days Sales of Inventory) = Net Inventory / (Quarterly COGS/90). DSO (Days Sales Outstanding) = Net Accounts Receivables / (Quarterly Sales/90). DPO (Days Payables Outstanding) = Accounts Payables / (Quarterly COGS/90). dccc (Cash Conversion Cycle) = DSI + DSO-DPO. Exhibit 3 Percent of Dell Computer Systems Sales by Microprocessor. FY94 FY95 FY96 Computer Systems 386 models 486 models Pentium models 7% 92% 1% 0% 71% 29% 0% 25% 75% Source: Dell Computer Corporation Fiscal 1994-96 Annual Reports. Exhibit 4 Profit & Loss Statements for Dell Computer Corporation (millions of dollars). 1996 1994 1993 1992 Fiscal Year Sales Cost of Sales Gross Margin Operating Expenses Operating Income Financing & Other Income Income Taxes Net Profit 1995 $3,475 2.737 738 489 249 (36) 64 149 $5,296 4,229 1,067 690 377 6 111 272 $890 608 282 215 $2,873 2.440 433 472 (39) 0 (3) (36) $2,014 1,565 449 310 139 4 41 102 67 7 23 51 Source: Dell Computer Corporation Fiscal 1996 Annual Report. Exhibit 5 Balance Sheets for Dell Computer Corporation (millions of dollars). January 28, 1996 Year Ended January 29, 1995 January 30, 1994 Current Assets: Cash 55 43 3 Short Term Investments Accounts Receivables, net Inventories Other Total Current Assets Property, Plant & Equipment, net Other Total Assets 591 726 429 156 1,957 179 12 2,148 484 538 293 112 1.470 117 Z 1,594 334 411 220 80 1,048 87 5 1,140 466 473 939 113 123 Current Liabilities: Accounts Payable Accrued and Other Liabilities Total Current Liabilities Long Term Debt Other Liabilities Total Liabilities Stockholders' Equity: Preferred Stock Common Stock Retained Earnings Other Total Stockholders' Equity 403 349 752 113 77 942 NA NA 538 100 31 669 1,175 6 430 570 120 242 311 NA NA NA (33) 973 2,148 (21) 652 1,594 NA 471 1,140 Source: Dell Computer Corporation Fiscal 1994-1996 Annual Reports. -1,190,000 shares of preferred stock converted to common stock in fiscal year 1996