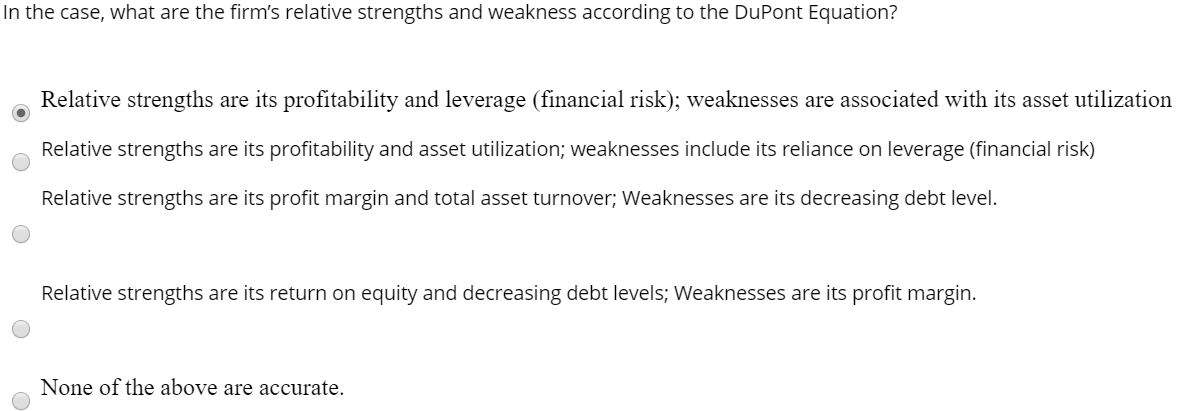

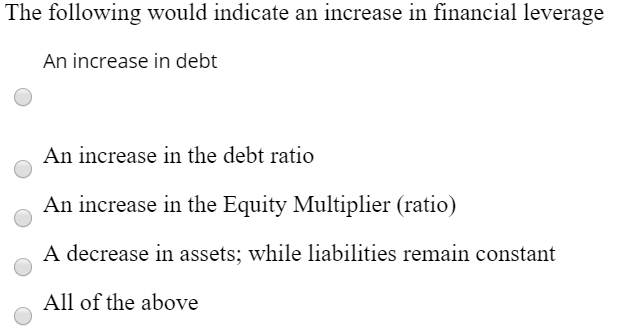

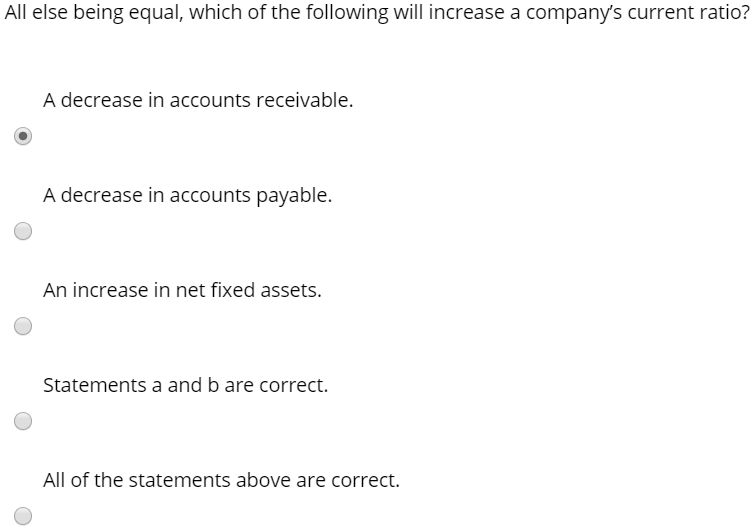

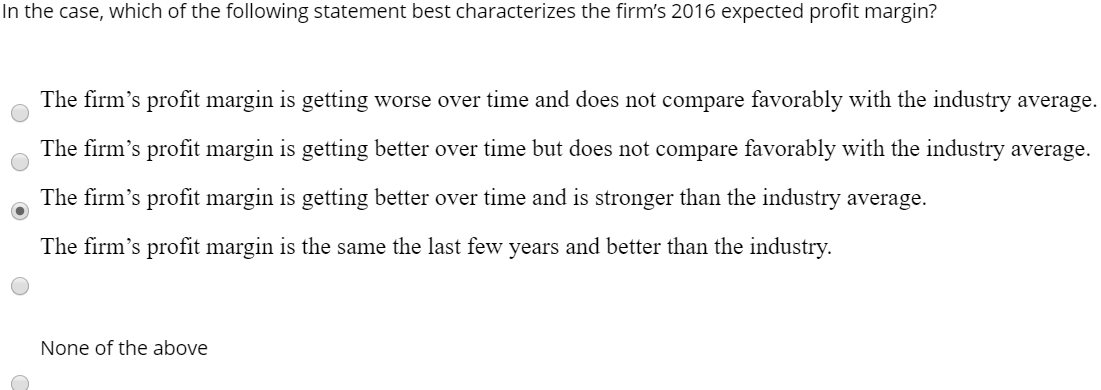

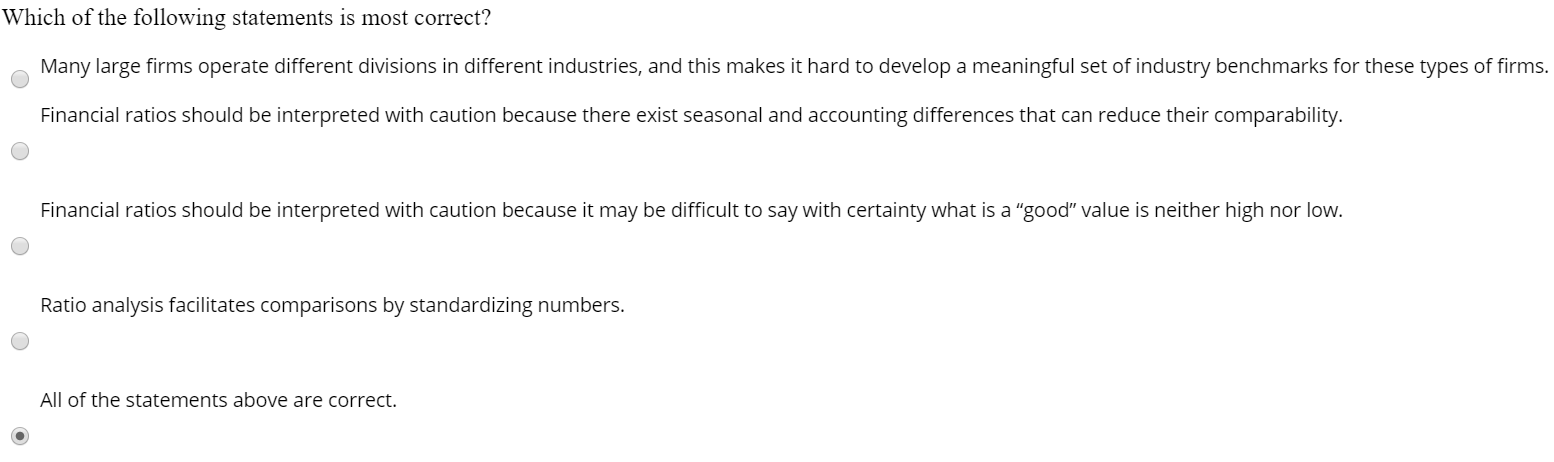

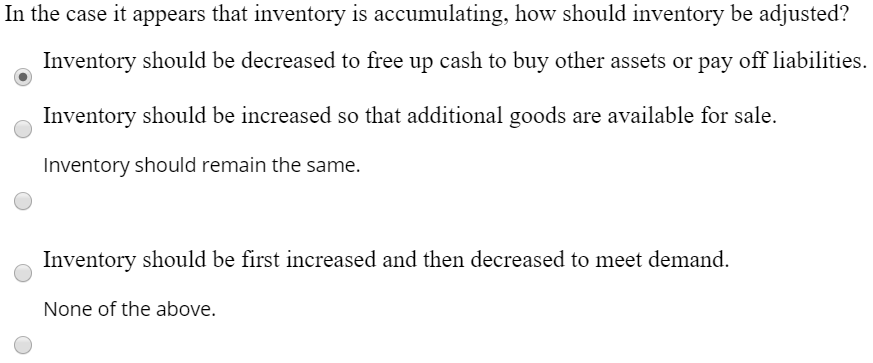

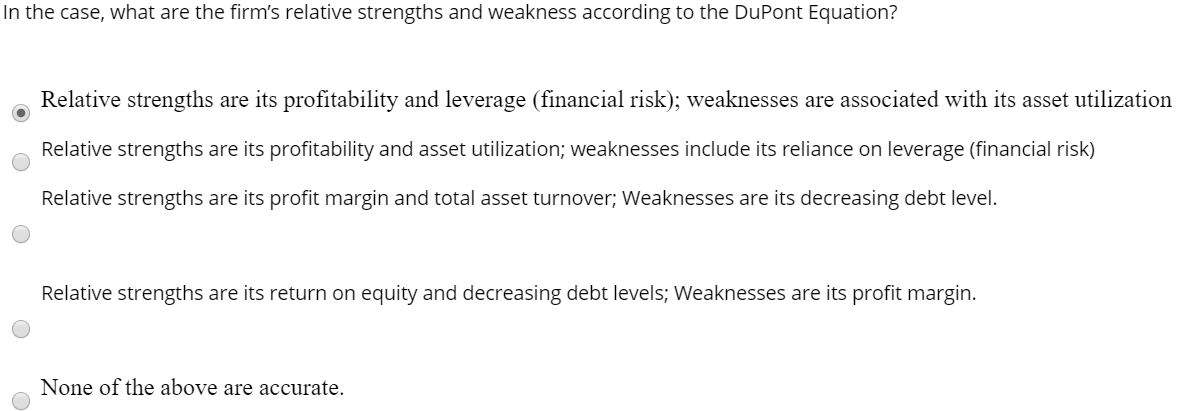

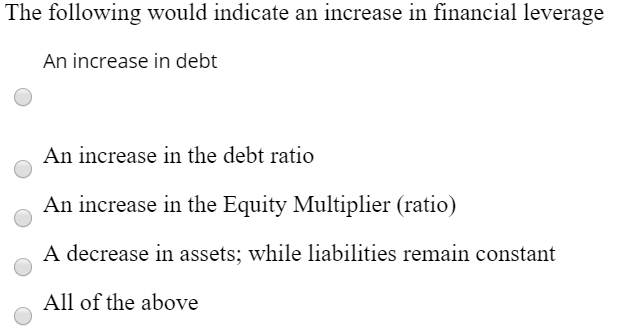

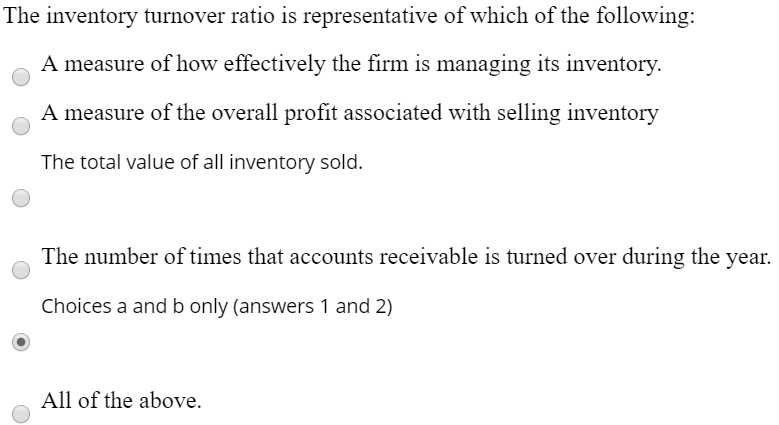

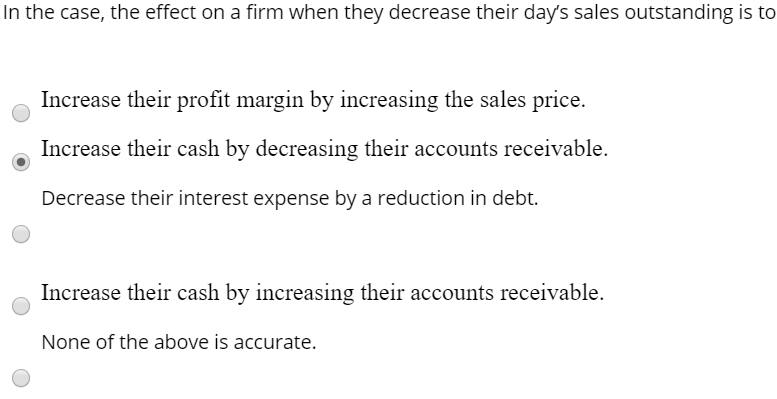

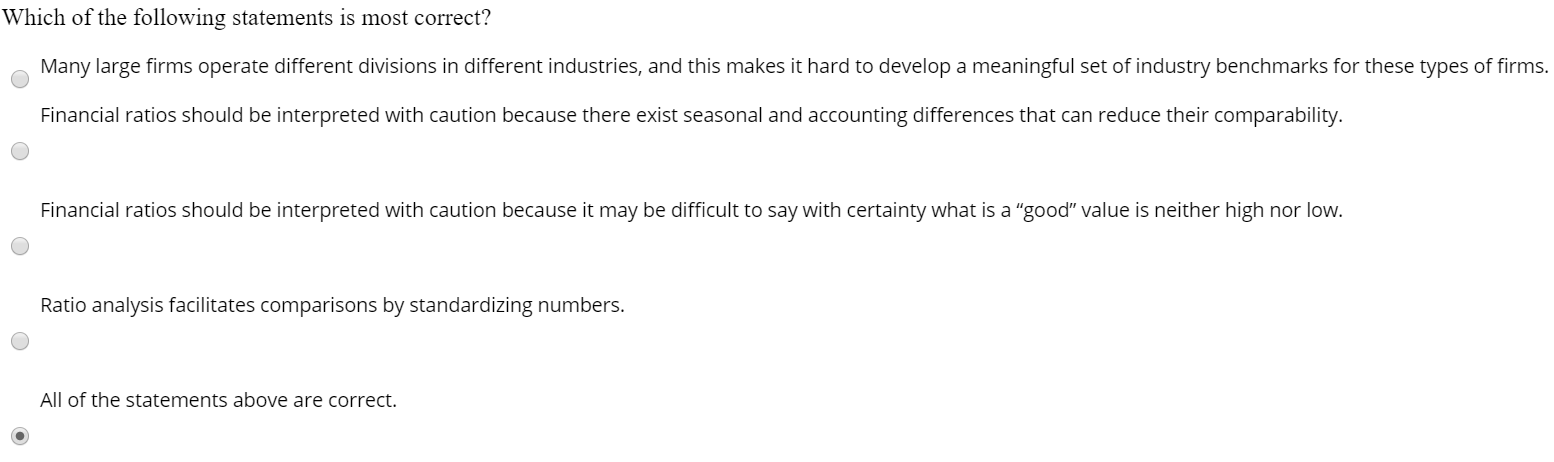

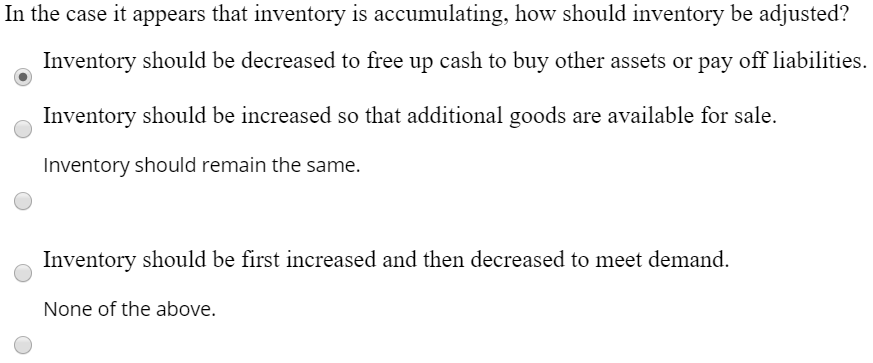

In the case, what are the firm's relative strengths and weakness according to the DuPont Equation? Relative strengths are its profitability and leverage (financial risk); weaknesses are associated with its asset utilization Relative strengths are its profitability and asset utilization; weaknesses include its reliance on leverage (financial risk) Relative strengths are its profit margin and total asset turnover; Weaknesses are its decreasing debt level. Relative strengths are its return on equity and decreasing debt levels; Weaknesses are its profit margin. None of the above are accurate. The following would indicate an increase in financial leverage An increase in debt An increase in the debt ratio An increase in the Equity Multiplier (ratio) A decrease in assets; while liabilities remain constant All of the above All else being equal, which of the following will increase a company's current ratio? A decrease in accounts receivable. A decrease in accounts payable. An increase in net fixed assets. Statements a and b are correct. All of the statements above are correct. In the case, which of the following statement best characterizes the firm's 2016 expected profit margin? The firm's profit margin is getting worse over time and does not compare favorably with the industry average. The firm's profit margin is getting better over time but does not compare favorably with the industry average. The firm's profit margin is getting better over time and is stronger than the industry average. The firm's profit margin is the same the last few years and better than the industry. None of the above What is the operating margin in 2016 equal to in the case? -2.17% 7% 3.6% 7.3% 5.55% Which of the following is not a true statement about effective ratio analysis? Ratios should NOT be used to compare across time or across firms. Ratios should be analyzed in isolation. Ratios are used by Managers to help evaluate the future as well as an attempt to gauge how to correct current deficiencies. Ratios are used by Bankers to evaluate the ability of the firm to maintain certain levels of debt and interest. Ratios are used by the owners to develop incentive programs that encourage management to impact specific ratios. All of the answers provided are accurate reasons to compute a ratio The inventory turnover ratio is representative of which of the following: A measure of how effectively the firm is managing its inventory. A measure of the overall profit associated with selling inventory The total value of all inventory sold. The number of times that accounts receivable is turned over during the year. Choices a and b only (answers 1 and 2) All of the above. In the case, the effect on a firm when they decrease their day's sales outstanding is to Increase their profit margin by increasing the sales price. Increase their cash by decreasing their accounts receivable. Decrease their interest expense by a reduction in debt. Increase their cash by increasing their accounts receivable. None of the above is accurate. Which of the following statements is most correct? Many large firms operate different divisions in different industries, and this makes it hard to develop a meaningful set of industry benchmarks for these types of firms. Financial ratios should be interpreted with caution because there exist seasonal and accounting differences that can reduce their comparability. Financial ratios should be interpreted with caution because it may be difficult to say with certainty what is a "good" value is neither high nor low. Ratio analysis facilitates comparisons by standardizing numbers. All of the statements above are correct. In the case it appears that inventory is accumulating, how should inventory be adjusted? Inventory should be decreased to free up cash to buy other assets or pay off liabilities. Inventory should be increased so that additional goods are available for sale. Inventory should remain the same. Inventory should be first increased and then decreased to meet demand. None of the above. In the case, what are the firm's relative strengths and weakness according to the DuPont Equation? Relative strengths are its profitability and leverage (financial risk); weaknesses are associated with its asset utilization Relative strengths are its profitability and asset utilization; weaknesses include its reliance on leverage (financial risk) Relative strengths are its profit margin and total asset turnover; Weaknesses are its decreasing debt level. Relative strengths are its return on equity and decreasing debt levels; Weaknesses are its profit margin. None of the above are accurate. The following would indicate an increase in financial leverage An increase in debt An increase in the debt ratio An increase in the Equity Multiplier (ratio) A decrease in assets; while liabilities remain constant All of the above All else being equal, which of the following will increase a company's current ratio? A decrease in accounts receivable. A decrease in accounts payable. An increase in net fixed assets. Statements a and b are correct. All of the statements above are correct. In the case, which of the following statement best characterizes the firm's 2016 expected profit margin? The firm's profit margin is getting worse over time and does not compare favorably with the industry average. The firm's profit margin is getting better over time but does not compare favorably with the industry average. The firm's profit margin is getting better over time and is stronger than the industry average. The firm's profit margin is the same the last few years and better than the industry. None of the above What is the operating margin in 2016 equal to in the case? -2.17% 7% 3.6% 7.3% 5.55% Which of the following is not a true statement about effective ratio analysis? Ratios should NOT be used to compare across time or across firms. Ratios should be analyzed in isolation. Ratios are used by Managers to help evaluate the future as well as an attempt to gauge how to correct current deficiencies. Ratios are used by Bankers to evaluate the ability of the firm to maintain certain levels of debt and interest. Ratios are used by the owners to develop incentive programs that encourage management to impact specific ratios. All of the answers provided are accurate reasons to compute a ratio The inventory turnover ratio is representative of which of the following: A measure of how effectively the firm is managing its inventory. A measure of the overall profit associated with selling inventory The total value of all inventory sold. The number of times that accounts receivable is turned over during the year. Choices a and b only (answers 1 and 2) All of the above. In the case, the effect on a firm when they decrease their day's sales outstanding is to Increase their profit margin by increasing the sales price. Increase their cash by decreasing their accounts receivable. Decrease their interest expense by a reduction in debt. Increase their cash by increasing their accounts receivable. None of the above is accurate. Which of the following statements is most correct? Many large firms operate different divisions in different industries, and this makes it hard to develop a meaningful set of industry benchmarks for these types of firms. Financial ratios should be interpreted with caution because there exist seasonal and accounting differences that can reduce their comparability. Financial ratios should be interpreted with caution because it may be difficult to say with certainty what is a "good" value is neither high nor low. Ratio analysis facilitates comparisons by standardizing numbers. All of the statements above are correct. In the case it appears that inventory is accumulating, how should inventory be adjusted? Inventory should be decreased to free up cash to buy other assets or pay off liabilities. Inventory should be increased so that additional goods are available for sale. Inventory should remain the same. Inventory should be first increased and then decreased to meet demand. None of the above