Question

In the condensed financial statements part of this assignment, you will use the companys Securities and Exchange Commission (SEC) 2022 10-K filing to build a

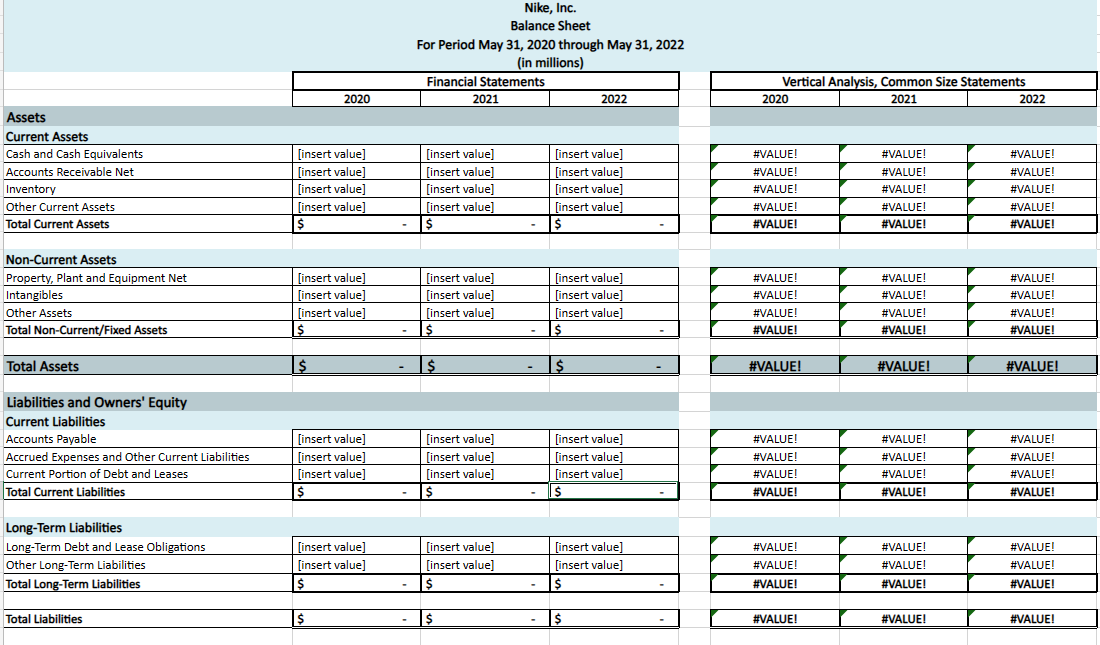

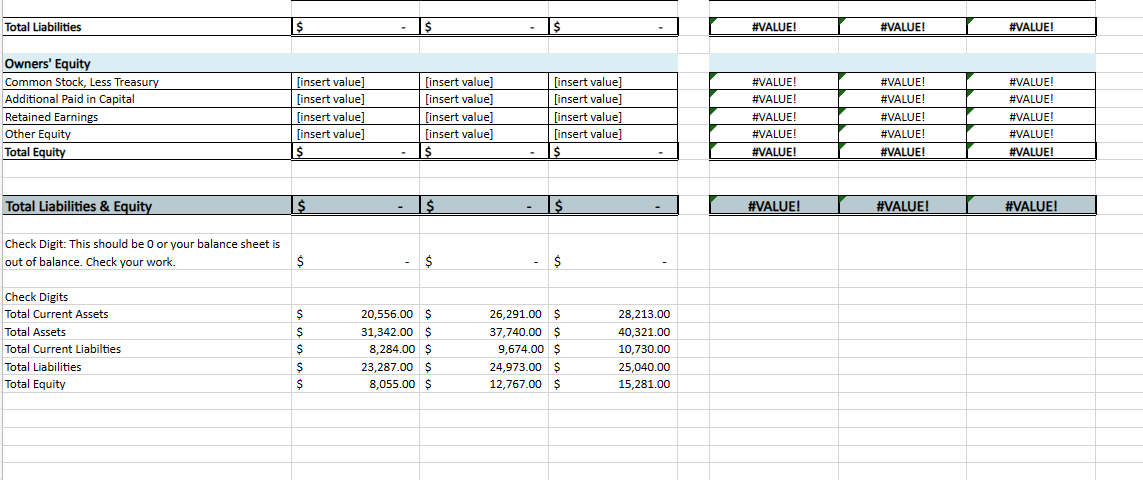

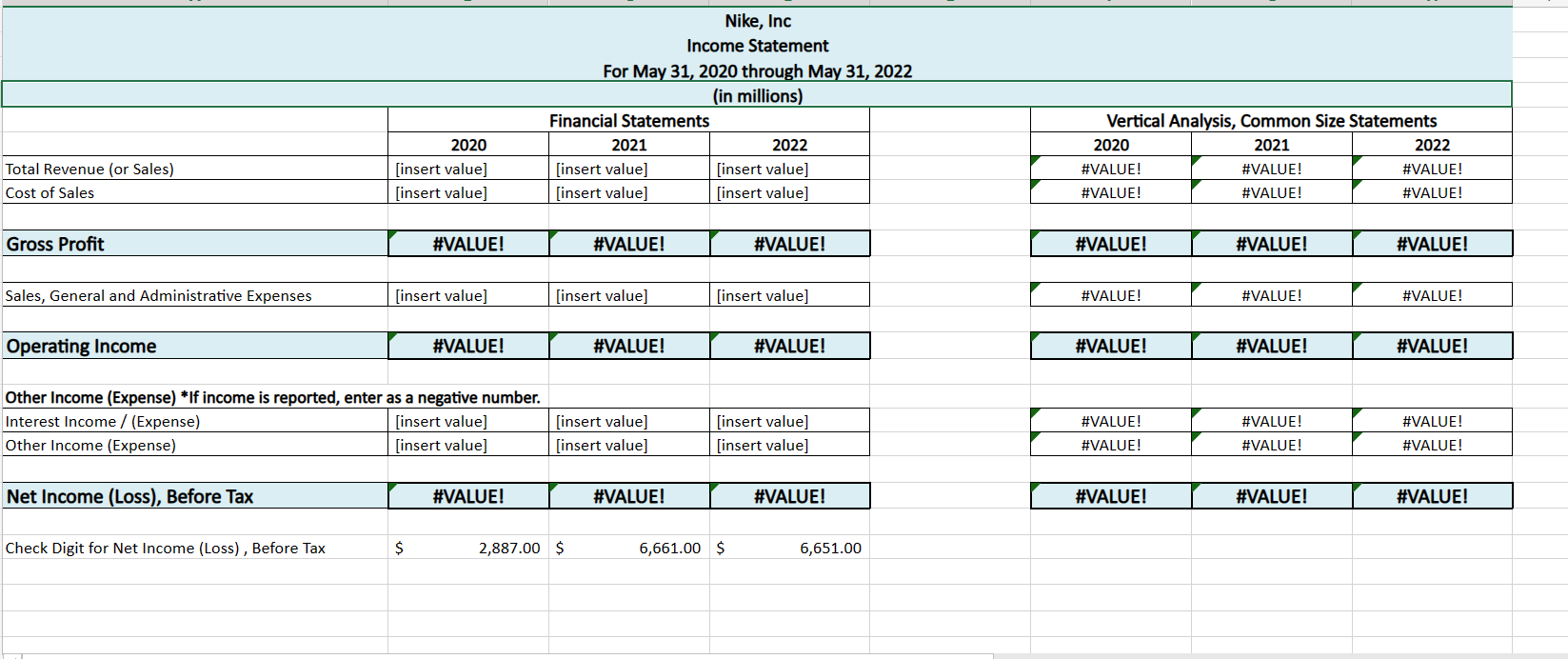

In the condensed financial statements part of this assignment, you will use the companys Securities and Exchange Commission (SEC) 2022 10-K filing to build a condensed version of the balance sheet and income statement in the Module Two Workbook Template linked in the What to Submit section. The SEC 2022 10-K filing will provide three years of income statements and only two years of balance sheets. You will need to find Nikes 2020 Form 10-K filing on the SEC website to pull the 2020 balance sheet to complete the template.

Categories will be different than what you find in the annual report. Use your best judgement when classifying them. If you need to lump certain costs together, then do so. Make certain you keep accounts in the correct category (i.e., current assets, non-current assets, current liabilities, long term liabilities, and owners equity). Each of these sections has an other category you can use. It is important to use the correct categories to have ratios calculate correctly. For example, the company shows cost of sales of $100K, general and administrative (G&A) expenses of $50K, and marketing expense of $10K. Combine the G&A and marketing expenses in the single line on the income statement called Sales, General, and Administrative Expenses in the amount of $60K.

The template will provide a check digit for the Balance Sheet and Income Statement tabs. It will help with ensuring the Balance Sheet tab is balanced and the Income Statement tab net income is correct before tax.

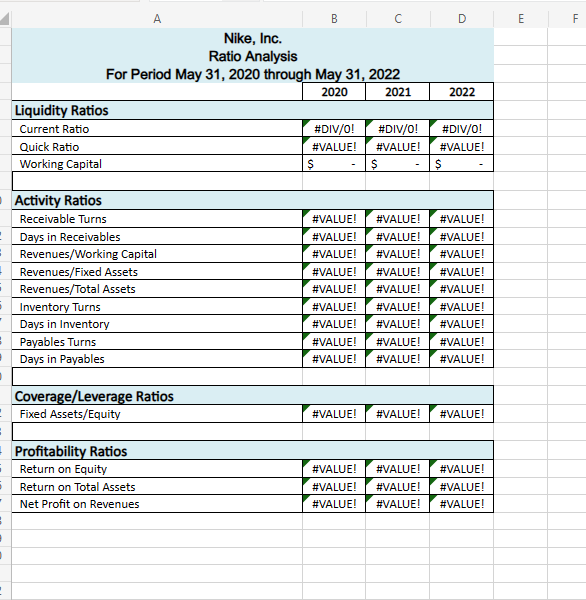

In the template, the ratios auto-calculate. You will not need to analyze the Ratio tab for historical data. You will only use the Ratio tab for explanatory purposes to complete the Module Two Summary Template.

Note: You may choose to complete an assignment using a desktop program instead of SNHU's virtual desktop (VDI); however, technical support will not be provided by SNHU if you select this option

Prepare the companys balance sheet accurately and completely on the Balance Sheet tab in the workbook. Include the following detail in your response: Provide all data available from May 31, 2020, to May 31, 2022. Prepare the company's income statement accurately and completely on the Income Statement tab in the workbook. Include the following details in your response: Provide all data available from May 31, 2020, to May 31, 2022.

ACC 345 Module Two Workbook Template.xlsx (live.com)

Inline XBRL Viewer (sec.gov)

nke-20210531 (sec.gov)

1. Define the measurement of each type of ratio and the accounts included in the calculation. Refer to the Ratios tab. [Insert text.] 2. Explain the significance of each ratio to the company. [Insert text.] 3. Identify an asset or liability being measured at fair value. Provide the specific disclosure note(s). Include the citation(s). [Insert text.] 4. Provide the classification for the GAAP rule that allows the fair value measurement. [Insert text.] Nike, Inc. Balance Sheet For Period May 31, 2020 through May 31, 2022 (in millions) \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Financial Statements } \\ \hline 2020 & 2021 & 2022 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ Vertical Analysis, Common Size Statements } \\ \hline 2020 & 2021 & 2022 \\ \hline \end{tabular} Assets Current Assets Non-Current Assets \begin{tabular}{|l|l|l|} \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline & & \\ \hline & & \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline & & \\ & & \\ \hline & & \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \end{tabular} Long-Term Liabilities Total Liabilities \begin{tabular}{|l|l|l|} \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline & & \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \hline \end{tabular} 1. Define the measurement of each type of ratio and the accounts included in the calculation. Refer to the Ratios tab. [Insert text.] 2. Explain the significance of each ratio to the company. [Insert text.] 3. Identify an asset or liability being measured at fair value. Provide the specific disclosure note(s). Include the citation(s). [Insert text.] 4. Provide the classification for the GAAP rule that allows the fair value measurement. [Insert text.] Nike, Inc. Balance Sheet For Period May 31, 2020 through May 31, 2022 (in millions) \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Financial Statements } \\ \hline 2020 & 2021 & 2022 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ Vertical Analysis, Common Size Statements } \\ \hline 2020 & 2021 & 2022 \\ \hline \end{tabular} Assets Current Assets Non-Current Assets \begin{tabular}{|l|l|l|} \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline & & \\ \hline & & \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline & & \\ & & \\ \hline & & \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \end{tabular} Long-Term Liabilities Total Liabilities \begin{tabular}{|l|l|l|} \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline & & \\ \hline \#VALUE! & \#VALUE! & \#VALUE! \\ \hline \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started