Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the course of your review of the accounts, you discover the following adjustments: 1. Depreciation for the year was P50,000. 75% is chargeable

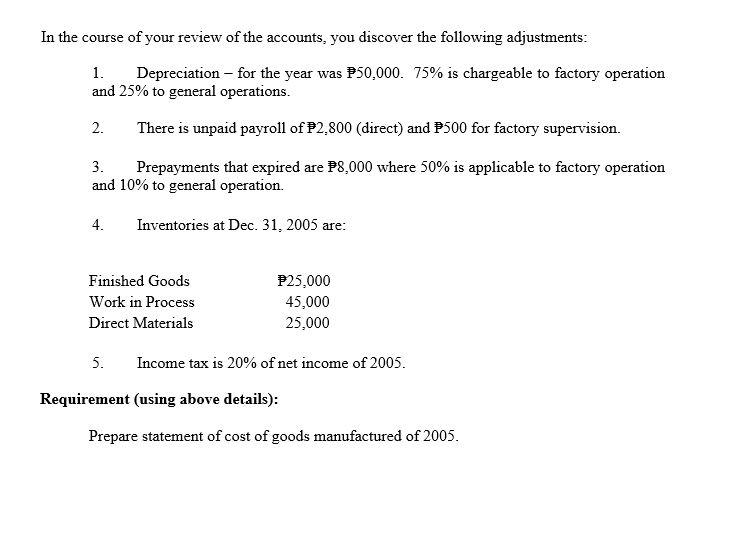

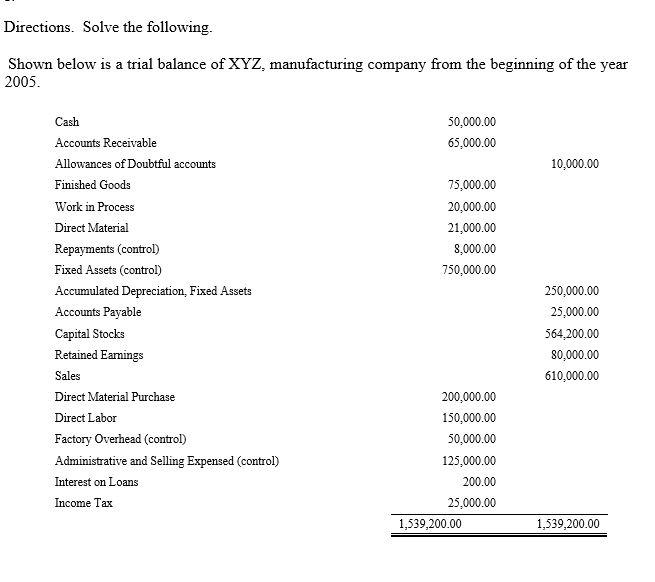

In the course of your review of the accounts, you discover the following adjustments: 1. Depreciation for the year was P50,000. 75% is chargeable to factory operation and 25% to general operations. There is unpaid payroll of P2,800 (direct) and P500 for factory supervision. 2. 3. Prepayments that expired are P8,000 where 50% is applicable to factory operation and 10% to general operation. 4. Inventories at Dec. 31, 2005 are: Finished Goods Work in Process Direct Materials P25,000 45,000 25,000 5. Income tax is 20% of net income of 2005. Requirement (using above details): Prepare statement of cost of goods manufactured of 2005. Directions. Solve the following. Shown below is a trial balance of XYZ, manufacturing company from the beginning of the year 2005. Cash Accounts Receivable Allowances of Doubtful accounts Finished Goods Work in Process Direct Material Repayments (control) Fixed Assets (control) Accumulated Depreciation, Fixed Assets Accounts Payable Capital Stocks Retained Earnings Sales Direct Material Purchase Direct Labor Factory Overhead (control) Administrative and Selling Expensed (control) Interest on Loans Income Tax 50,000.00 65,000.00 75,000.00 20,000.00 21,000.00 8,000.00 750,000.00 200,000.00 150,000.00 50,000.00 125,000.00 200.00 25,000.00 1,539,200.00 10,000.00 250,000.00 25,000.00 564,200.00 80,000.00 610,000.00 1,539,200.00

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Cost of Goods Manufactured The Calculation of cost of goods manufactured by taken the conside...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started