Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the current housing market with decreasing house prices, you recently bought a house. Now you are looking for a fire insurance contract. The

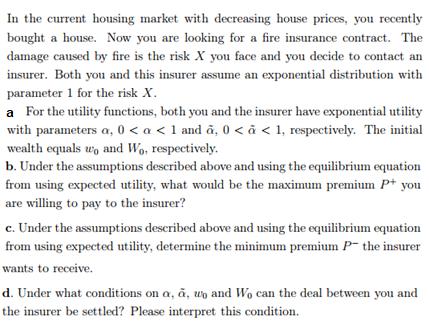

In the current housing market with decreasing house prices, you recently bought a house. Now you are looking for a fire insurance contract. The damage caused by fire is the risk X you face and you decide to contact an insurer. Both you and this insurer assume an exponential distribution with parameter 1 for the risk X. a For the utility functions, both you and the insurer have exponential utility with parameters a, 0 < a < 1 and , 0 < < 1, respectively. The initial wealth equals w, and Wo, respectively. b. Under the assumptions described above and using the equilibrium equation from using expected utility, what would be the maximum premium P+ you are willing to pay to the insurer? c. Under the assumptions described above and using the equilibrium equation from using expected utility, determine the minimum premium P- the insurer wants to receive. d. Under what conditions on a, , up and Wo can the deal between you and the insurer be settled? Please interpret this condition.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a For the utility functions both you and the insurer have exponential utility wit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started