Question

In the current year, Maccabee had an unrealized gain on an available-for-sale debt security, a gain from sale of equipment, and a loss on a

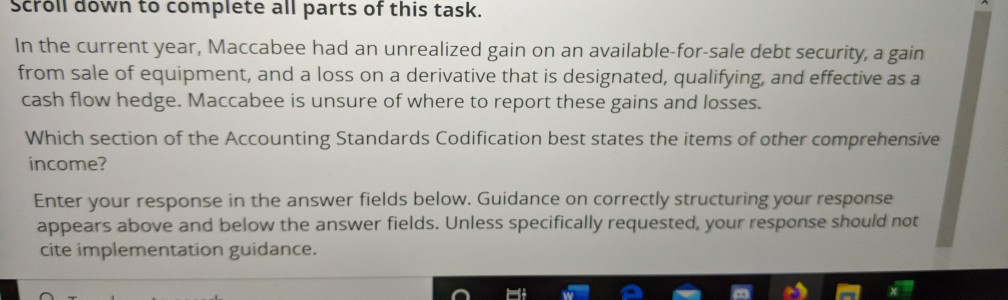

In the current year, Maccabee had an unrealized gain on an available-for-sale debt security, a gain from sale of equipment, and a loss on a derivative that is designated, qualifying, and effective as a cash flow hedge. Maccabee is unsure of where to report these gains and losses.

Which section of the Accounting Standards Codification best states the items of other comprehensive income?

Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Unless specifically requested, your response should not cite implementation guidance.

that's all there is

scroll down to complete all parts of this task. In the current year, Maccabee had an unrealized gain on an available-for-sale debt security, a gain from sale of equipment, and a loss on a derivative that is designated, qualifying, and effective as a cash flow hedge. Maccabee is unsure of where to report these gains and losses. Which section of the Accounting Standards Codification best states the items of other comprehensive income? Enter your response in the answer fields below. Guidance on correctly structuring your response appears above and below the answer fields. Unless specifically requested, your response should not cite implementation guidanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started