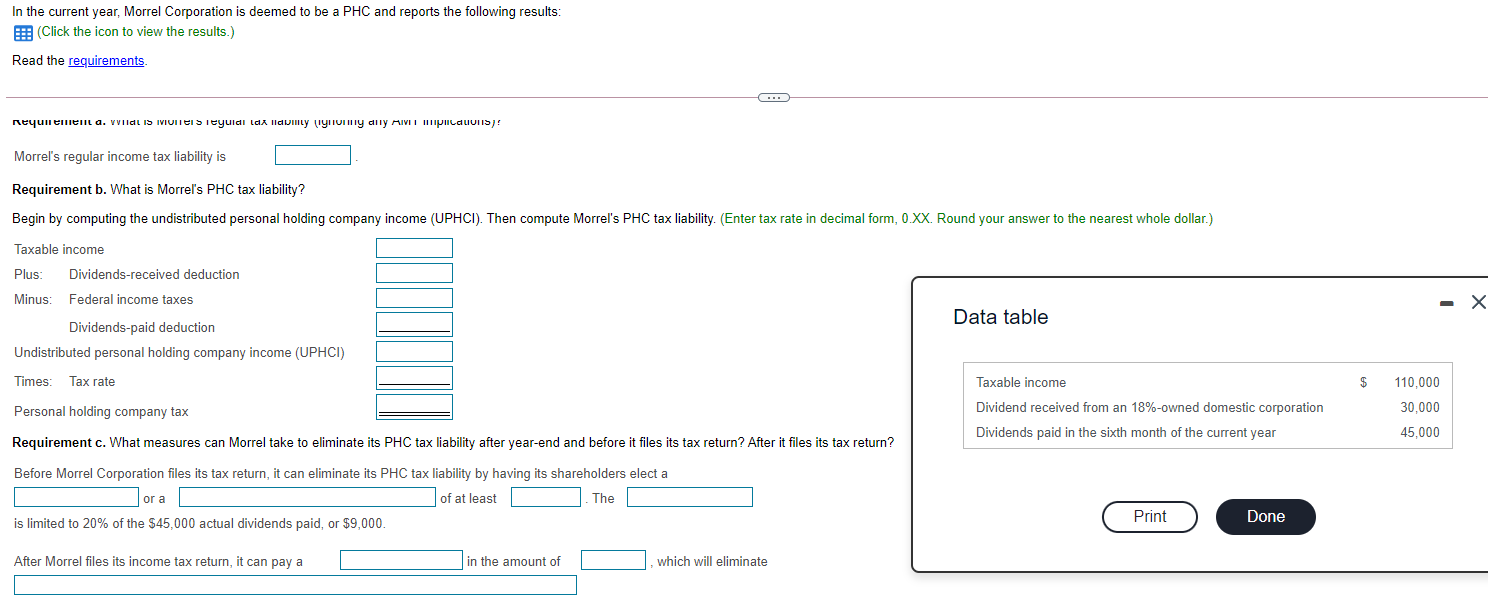

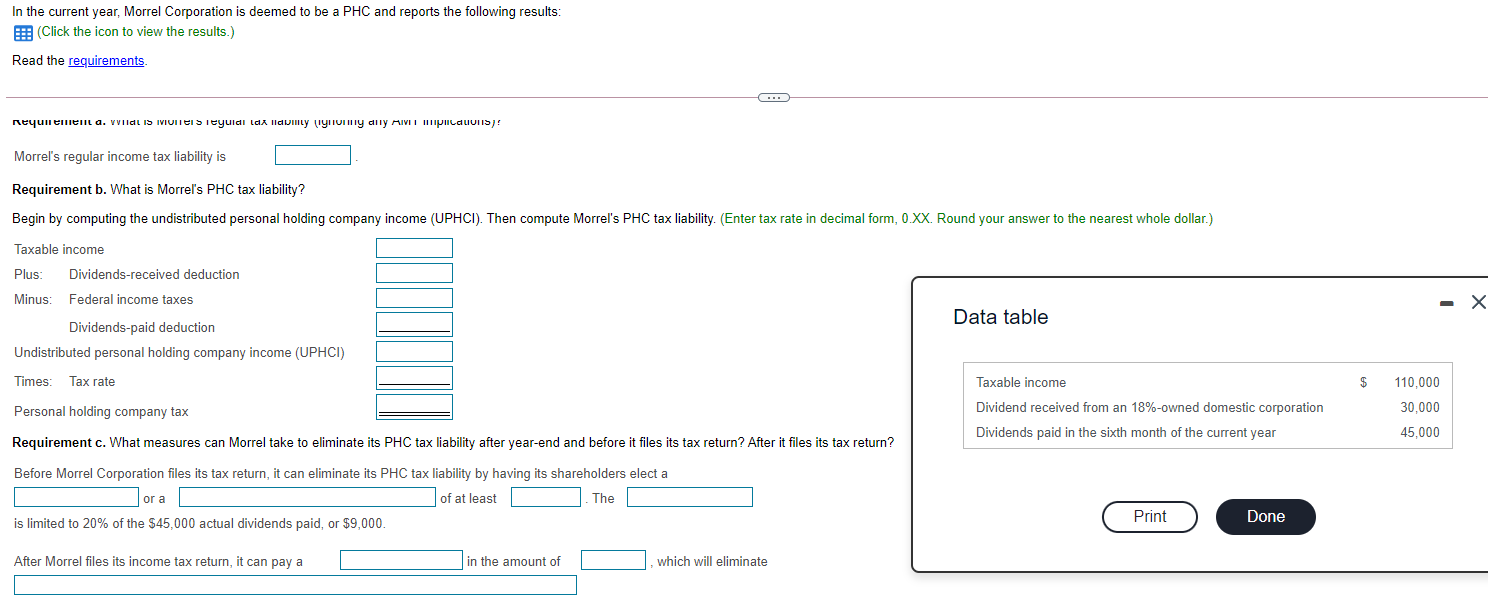

In the current year, Morrel Corporation is deemed to be a PHC and reports the following results: (Click the icon to view the results.) Read the requirements ... Requirement a. VIIALIS VIVITEIS Teyulai tax liauty (LY TO Y any AIVI MILLIULIS)! Morrel's regular income tax liability is Requirement b. What is Morrel's PHC tax liability? Begin by computing the undistributed personal holding company income (UPHCI). Then compute Morrel's PHC tax liability. (Enter tax rate in decimal form, 0.XX. Round your answer to the nearest whole dollar.) Taxable income Plus: Dividends-received deduction Minus Federal income taxes Data table Dividends-paid deduction Undistributed personal holding company income (UPHCI) Times Tax rate $ 110.000 Personal holding company tax Taxable income Dividend received from an 18%-owned domestic corporation Dividends paid in the sixth month of the current year 30,000 45,000 Requirement c. What measures can Morrel take to eliminate its PHC tax liability after year-end and before it files its tax return? After it files its tax return? Before Morrel Corporation files its tax return, it can eliminate its PHC tax liability by having its shareholders elect a or a of at least The is limited to 20% of the $45,000 actual dividends paid, or $9,000 Print Done After Morrel files its income tax return, it can pay a in the amount of which will eliminate In the current year, Morrel Corporation is deemed to be a PHC and reports the following results: (Click the icon to view the results.) Read the requirements ... Requirement a. VIIALIS VIVITEIS Teyulai tax liauty (LY TO Y any AIVI MILLIULIS)! Morrel's regular income tax liability is Requirement b. What is Morrel's PHC tax liability? Begin by computing the undistributed personal holding company income (UPHCI). Then compute Morrel's PHC tax liability. (Enter tax rate in decimal form, 0.XX. Round your answer to the nearest whole dollar.) Taxable income Plus: Dividends-received deduction Minus Federal income taxes Data table Dividends-paid deduction Undistributed personal holding company income (UPHCI) Times Tax rate $ 110.000 Personal holding company tax Taxable income Dividend received from an 18%-owned domestic corporation Dividends paid in the sixth month of the current year 30,000 45,000 Requirement c. What measures can Morrel take to eliminate its PHC tax liability after year-end and before it files its tax return? After it files its tax return? Before Morrel Corporation files its tax return, it can eliminate its PHC tax liability by having its shareholders elect a or a of at least The is limited to 20% of the $45,000 actual dividends paid, or $9,000 Print Done After Morrel files its income tax return, it can pay a in the amount of which will eliminate