Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the current year, Peeta Company reported book income of $140,000. Included in that calculation was $50,000 for entertainment expenses and $40,000 for federal

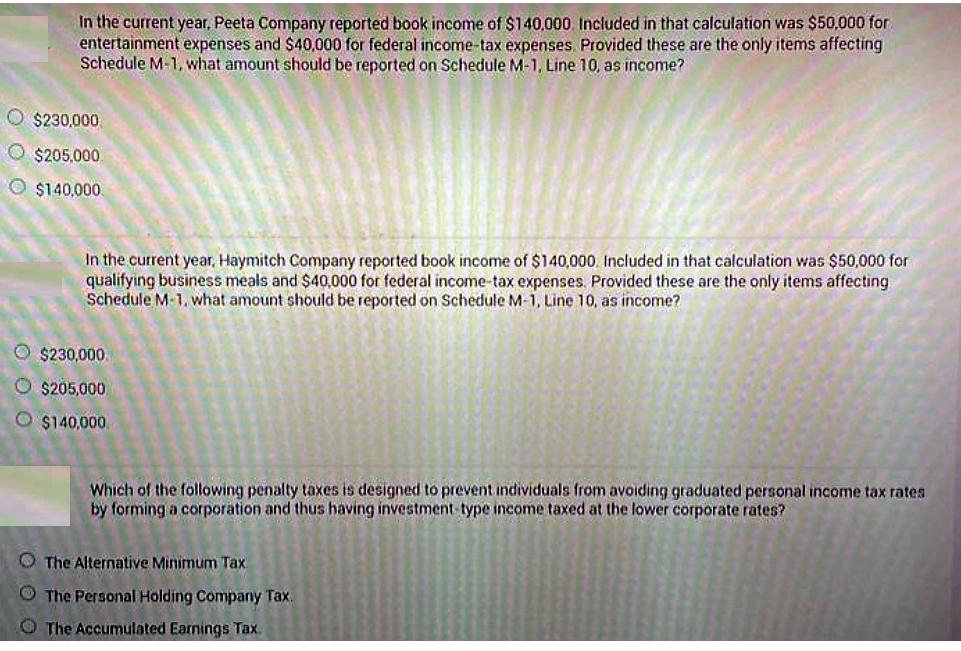

In the current year, Peeta Company reported book income of $140,000. Included in that calculation was $50,000 for entertainment expenses and $40,000 for federal income-tax expenses. Provided these are the only items affecting Schedule M-1, what amount should be reported on Schedule M-1, Line 10, as income? O $230,000 $205,000 O $140,000 In the current year, Haymitch Company reported book income of $140,000. Included in that calculation was $50,000 for qualifying business meals and $40,000 for federal income tax expenses. Provided these are the only items affecting Schedule M-1, what amount should be reported on Schedule M-1, Line 10, as income? $230,000. $205,000 $140,000. Which of the following penalty taxes is designed to prevent individuals from avoiding graduated personal income tax rates by forming a corporation and thus having investment-type income taxed at the lower corporate rates? The Alternative Minimum Tax The Personal Holding Company Tax. The Accumulated Earnings Tax.

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started