Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q.2 During the review of accounting records and financial statements of Jelly Traders (JT) for the year ended 30 June 2023, the following errors

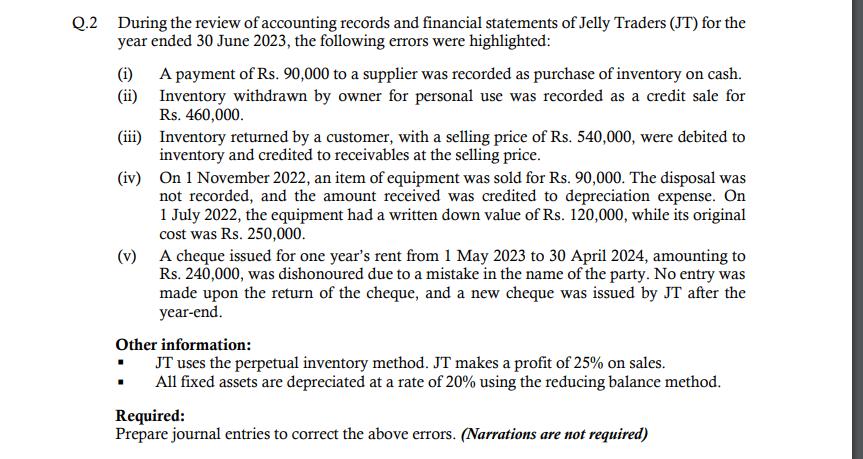

Q.2 During the review of accounting records and financial statements of Jelly Traders (JT) for the year ended 30 June 2023, the following errors were highlighted: (i) A payment of Rs. 90,000 to a supplier was recorded as purchase of inventory on cash. Inventory withdrawn by owner for personal use was recorded as a credit sale for Rs. 460,000. (ii) (iii) Inventory returned by a customer, with a selling price of Rs. 540,000, were debited to inventory and credited to receivables at the selling price. (iv) On 1 November 2022, an item of equipment was sold for Rs. 90,000. The disposal was not recorded, and the amount received was credited to depreciation expense. On 1 July 2022, the equipment had a written down value of Rs. 120,000, while its original cost was Rs. 250,000. (v) A cheque issued for one year's rent from 1 May 2023 to 30 April 2024, amounting to Rs. 240,000, was dishonoured due to a mistake in the name of the party. No entry was made upon the return of the cheque, and a new cheque was issued by JT after the year-end. Other information: JT uses the perpetual inventory method. JT makes a profit of 25% on sales. All fixed assets are depreciated at a rate of 20% using the reducing balance method. Required: Prepare journal entries to correct the above errors. (Narrations are not required)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a As an individual proprietor Wilsons casualty loss deduction is sub...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started