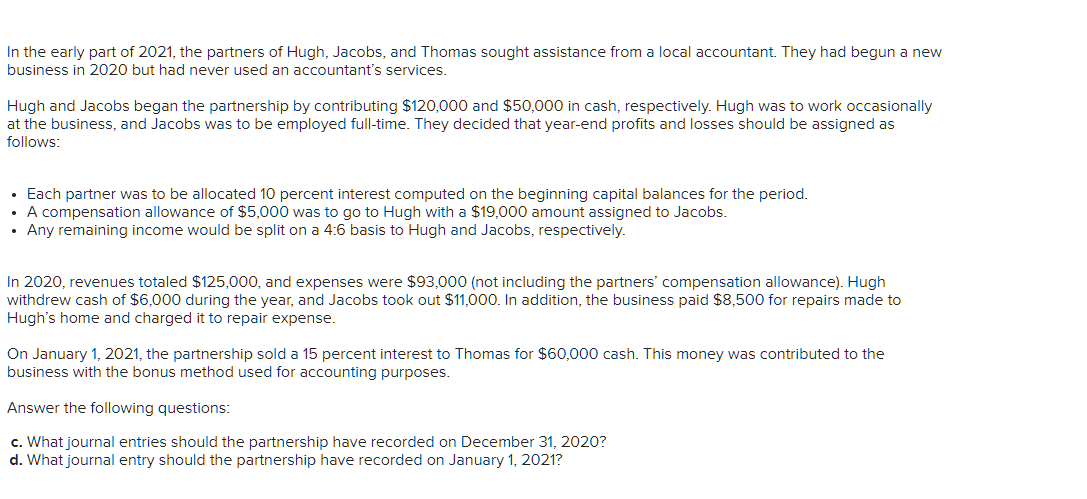

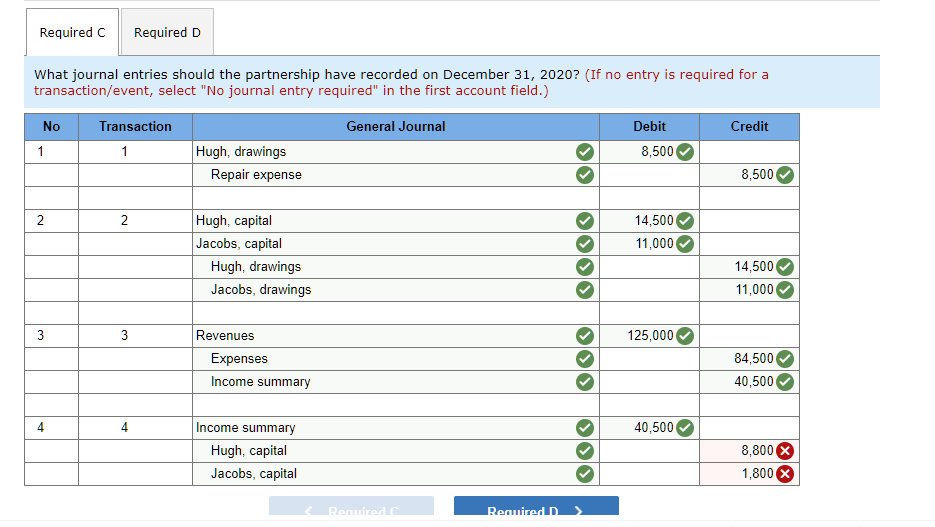

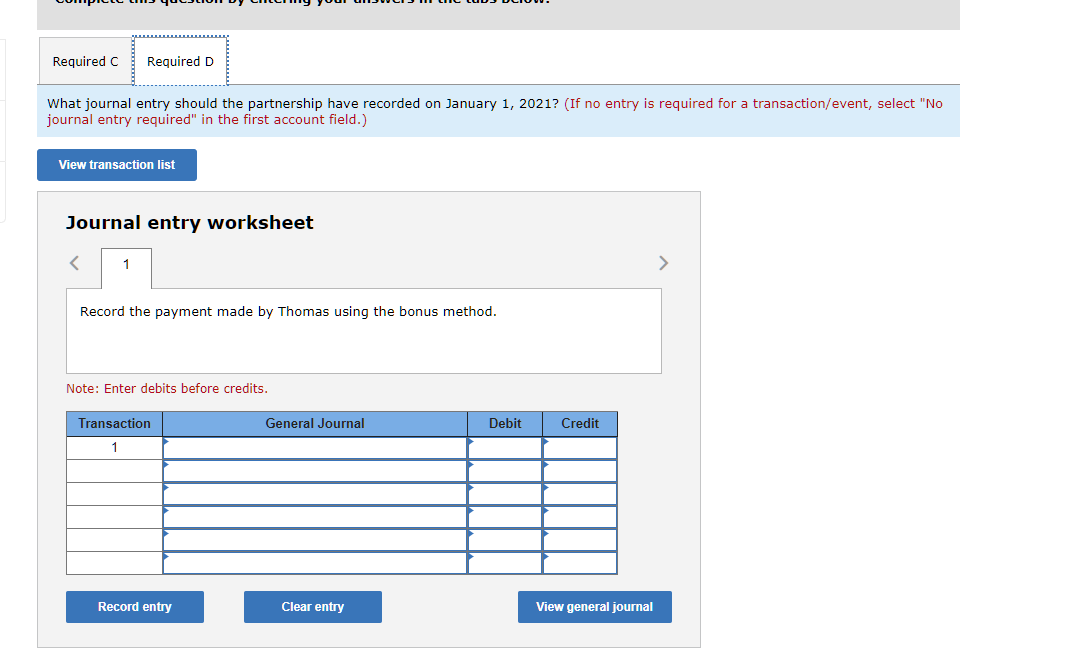

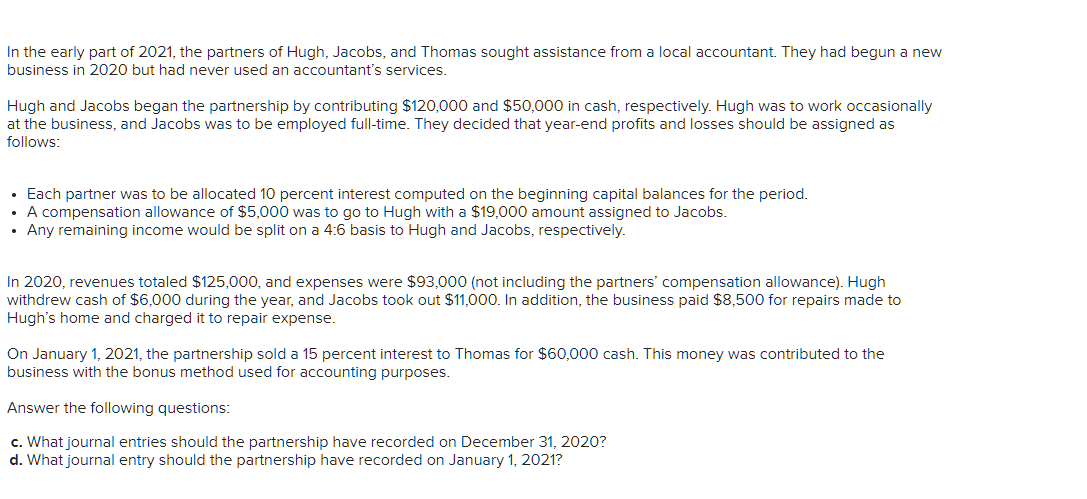

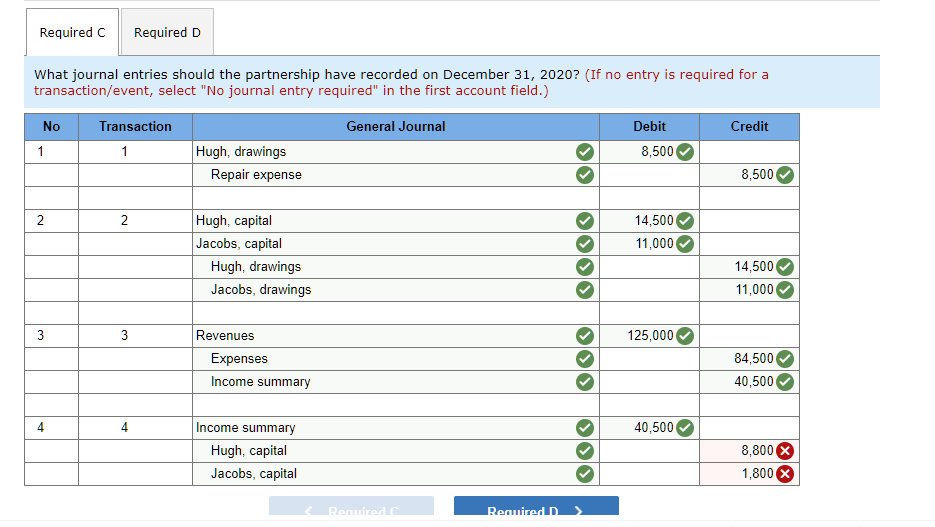

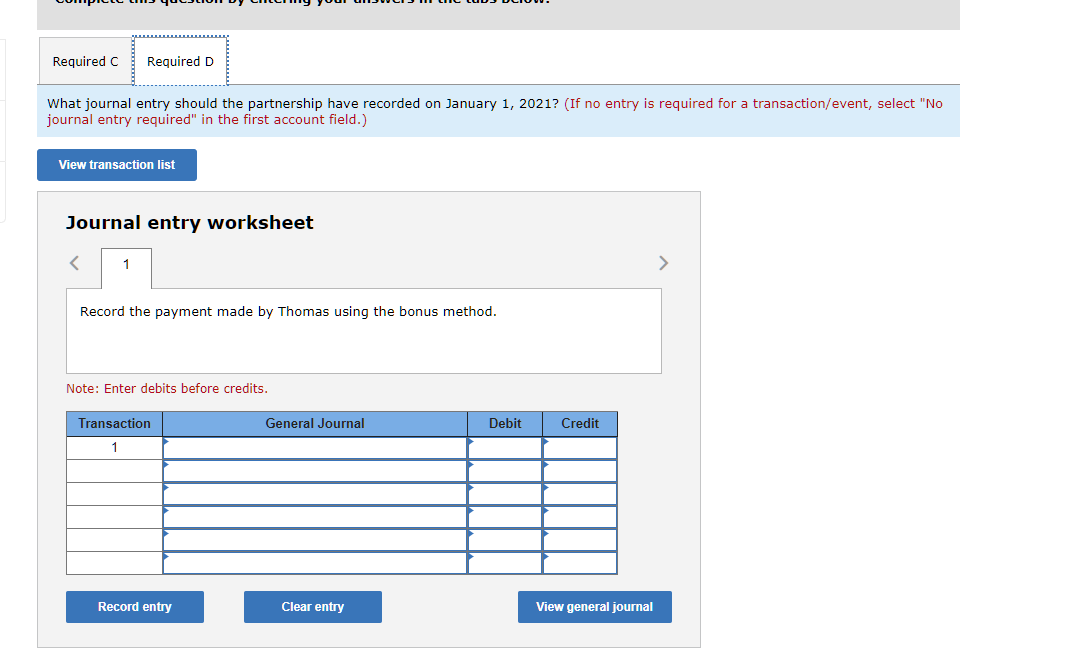

In the early part of 2021, the partners of Hugh, Jacobs, and Thomas sought assistance from a local accountant. They had begun a new business in 2020 but had never used an accountant's services. Hugh and Jacobs began the partnership by contributing $120,000 and $50,000 in cash, respectively. Hugh was to work occasionally at the business, and Jacobs was to be employed full-time. They decided that year-end profits and losses should be assigned as follows: Each partner was to be allocated 10 percent interest computed on the beginning capital balances for the period. A compensation allowance of $5,000 was to go to Hugh with a $19,000 amount assigned to Jacobs. Any remaining income would be split on a 4:6 basis to Hugh and Jacobs, respectively. In 2020, revenues totaled $125,000, and expenses were $93,000 (not including the partners' compensation allowance). Hugh withdrew cash of $6,000 during the year, and Jacobs took out $11,000. In addition, the business paid $8,500 for repairs made to Hugh's home and charged it to repair expense. On January 1, 2021, the partnership sold a 15 percent interest to Thomas for $60,000 cash. This money was contributed to the business with the bonus method used for accounting purposes. Answer the following questions: c. What journal entries should the partnership have recorded on December 31, 2020? d. What journal entry should the partnership have recorded on January 1, 2021? Required Required D What journal entries should the partnership have recorded on December 31, 2020? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No General Journal Credit Transaction 1 Debit 8,500 1 Hugh, drawings Repair expense 8,500 2 N 14,500 11,000 Hugh, capital Jacobs, capital Hugh, drawings Jacobs, drawings 14,500 11,000 3 3 3 125,000 Revenues Expenses Income summary 84,500 40,500 4 4 40,500 Income summary Hugh, capital Jacobs, capital 8,800 X 1,800 X Required Required Required C Required D What journal entry should the partnership have recorded on January 1, 2021? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the payment made by Thomas using the bonus method. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal