Question

In the following 4 questions, you will determine the following for The Home Depot - Free Cash Flow Value of firm today, using the

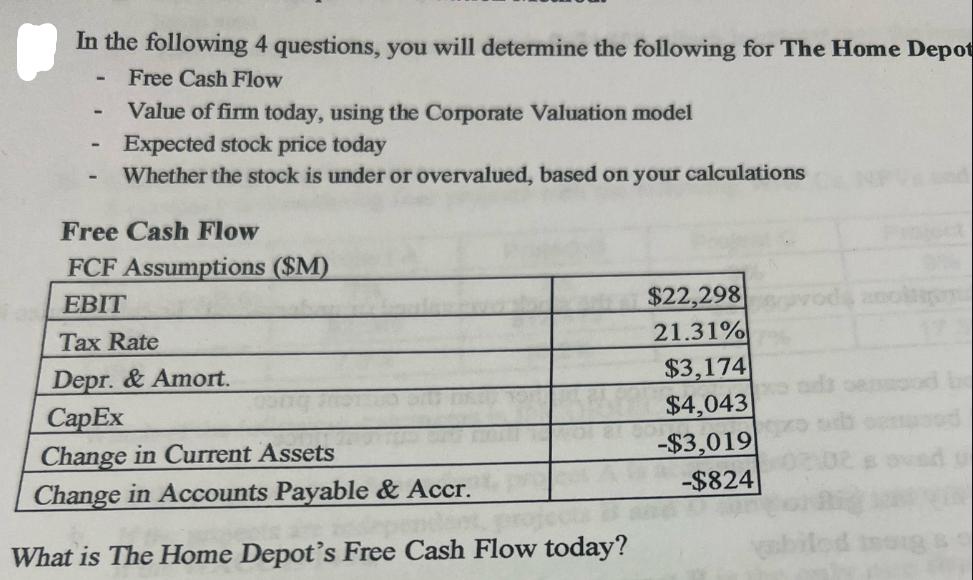

In the following 4 questions, you will determine the following for The Home Depot - Free Cash Flow Value of firm today, using the Corporate Valuation model - Expected stock price today - Whether the stock is under or overvalued, based on your calculations Free Cash Flow FCF Assumptions ($M) EBIT Tax Rate Depr. & Amort. CapEx Change in Current Assets Change in Accounts Payable & Accr. What is The Home Depot's Free Cash Flow today? $22,298 21.31% $3,174 $4,043 -$3,019 -$824

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate The Home Depots Free Cash Flow FCF today we can use the formula FC...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial statements

Authors: Stephen Barrad

5th Edition

978-007802531, 9780324186383, 032418638X

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App