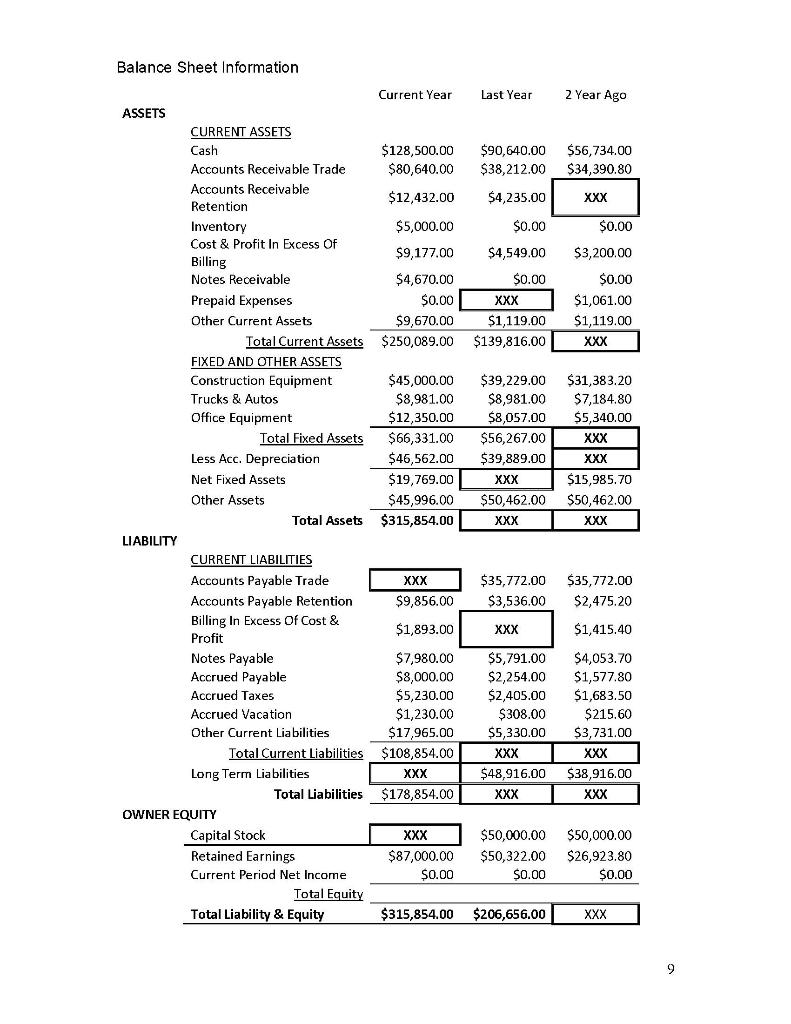

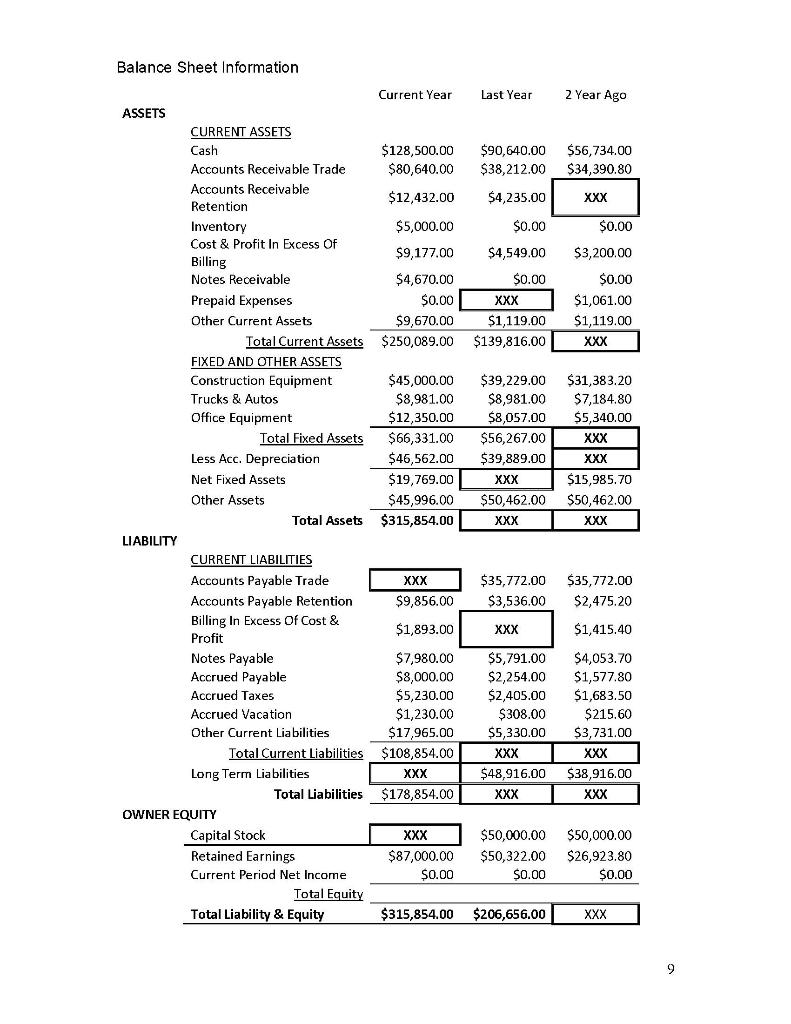

In the following Balance Sheet, there are multiple numbers that are missing. These numbers are identified by "XXX". You are asked to identify some of these numbers in the following set of questions.

- What is the $ value that should replace the "XXX" reflecting the Total Equity in the Last Year column?

- What is the $ value that should replace the "XXX" reflecting the Total Current Liabilities in the Last Year column?

- What is the $ value that should replace the "XXX" reflecting the Total Current Liabilities in the 2 Years Ago column?

- What is the $ value that should replace the "XXX" reflecting the Capital Stocks in the Current Year column?

- What is the $ value that should replace the "XXX" reflecting the Accounts Payable Trade in the Current Year column?

Balance Sheet Information Current Year Last Year 2 Year Ago $128,500.00 $80,640.00 $90,640.00 $38,212.00 $56,734.00 $34,390.80 $12,432.00 $4,235.00 XXX $0.00 $0.00 $5,000.00 $9,177.00 $4,670.00 $0.00 $9,670.00 $250,089.00 $4,549.00 $0.00 XXX $1,119.00 $139,816.00 $3,200.00 $0.00 $1,061.00 $1,119.00 XXX ASSETS CURRENT ASSETS Cash Accounts Receivable Trade Accounts Receivable Retention Inventory Cost & Profit In Excess of Billing Notes Receivable Prepaid Expenses Other Current Assets Total Current Assets FIXED AND OTHER ASSETS Construction Equipment Trucks & Autos Office Equipment Total Fixed Assets Less Acc. Depreciation Net Fixed Assets Other Assets Total Assets LIABILITY CURRENT LIABILITIES Accounts Payable Trade Accounts Payable Retention Billing In Excess of Cost & Profit Notes Payable Accrued Payable Accrued Taxes Accrued Vacation Other Current Liabilities Total Current Liabilities Long Term Liabilities Total Liabilities OWNER EQUITY Capital Stock Retained Earnings Current Net Income Total Equity Total Liability & Equity $45,000.00 $8,981.00 $12,350.00 $66,331.00 $46,562.00 $19,769.00 $45,996.00 $315,854.00 $39,229.00 $8,981.00 $8,057.00 $56,267.00 $39,889.00 XXX $50,462.00 XXX $31,383.20 $7,184.80 $5,340.00 XXX XXX $15,985.70 $50,462.00 XXX XXX $9,856.00 $35,772.00 $3,536.00 $35,772.00 $2,475.20 $1,893.00 XXX $1,415.40 $7,980.00 $8,000.00 $5,230.00 $1,230.00 $17,965.00 $108,854.00 XXX $5,791.00 $2,254.00 $2,405.00 $308.00 $5,330.00 XXX $48,916.00 XXX $4,053.70 $1,577.80 $1,683.50 $215.60 $3,731.00 XXX $38,916.00 XXX $178,854.00 XXX $87,000.00 $0.00 $50,000.00 $50,322.00 SO.O $50,000.00 $26,923.80 $0.00 $315,854.00 $206,656.00 XXX 9 Balance Sheet Information Current Year Last Year 2 Year Ago $128,500.00 $80,640.00 $90,640.00 $38,212.00 $56,734.00 $34,390.80 $12,432.00 $4,235.00 XXX $0.00 $0.00 $5,000.00 $9,177.00 $4,670.00 $0.00 $9,670.00 $250,089.00 $4,549.00 $0.00 XXX $1,119.00 $139,816.00 $3,200.00 $0.00 $1,061.00 $1,119.00 XXX ASSETS CURRENT ASSETS Cash Accounts Receivable Trade Accounts Receivable Retention Inventory Cost & Profit In Excess of Billing Notes Receivable Prepaid Expenses Other Current Assets Total Current Assets FIXED AND OTHER ASSETS Construction Equipment Trucks & Autos Office Equipment Total Fixed Assets Less Acc. Depreciation Net Fixed Assets Other Assets Total Assets LIABILITY CURRENT LIABILITIES Accounts Payable Trade Accounts Payable Retention Billing In Excess of Cost & Profit Notes Payable Accrued Payable Accrued Taxes Accrued Vacation Other Current Liabilities Total Current Liabilities Long Term Liabilities Total Liabilities OWNER EQUITY Capital Stock Retained Earnings Current Net Income Total Equity Total Liability & Equity $45,000.00 $8,981.00 $12,350.00 $66,331.00 $46,562.00 $19,769.00 $45,996.00 $315,854.00 $39,229.00 $8,981.00 $8,057.00 $56,267.00 $39,889.00 XXX $50,462.00 XXX $31,383.20 $7,184.80 $5,340.00 XXX XXX $15,985.70 $50,462.00 XXX XXX $9,856.00 $35,772.00 $3,536.00 $35,772.00 $2,475.20 $1,893.00 XXX $1,415.40 $7,980.00 $8,000.00 $5,230.00 $1,230.00 $17,965.00 $108,854.00 XXX $5,791.00 $2,254.00 $2,405.00 $308.00 $5,330.00 XXX $48,916.00 XXX $4,053.70 $1,577.80 $1,683.50 $215.60 $3,731.00 XXX $38,916.00 XXX $178,854.00 XXX $87,000.00 $0.00 $50,000.00 $50,322.00 SO.O $50,000.00 $26,923.80 $0.00 $315,854.00 $206,656.00 XXX 9