Answered step by step

Verified Expert Solution

Question

1 Approved Answer

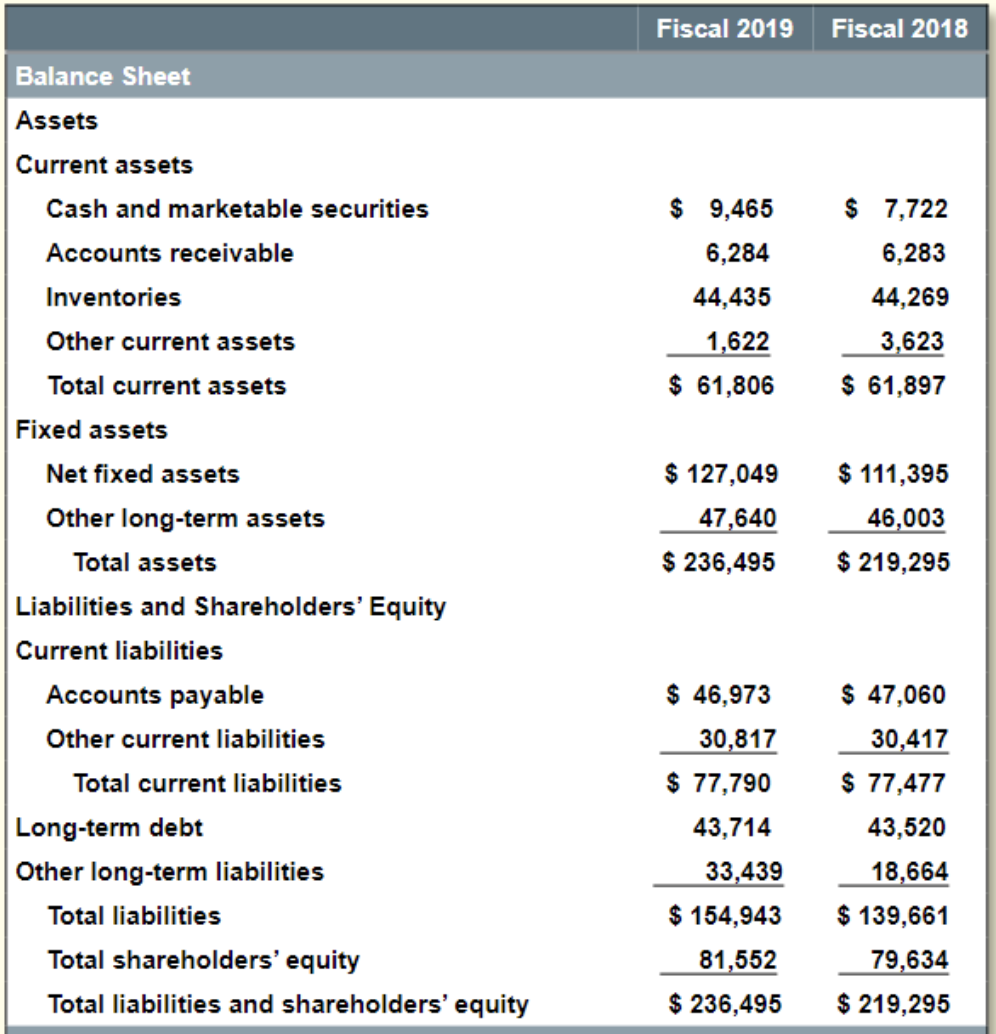

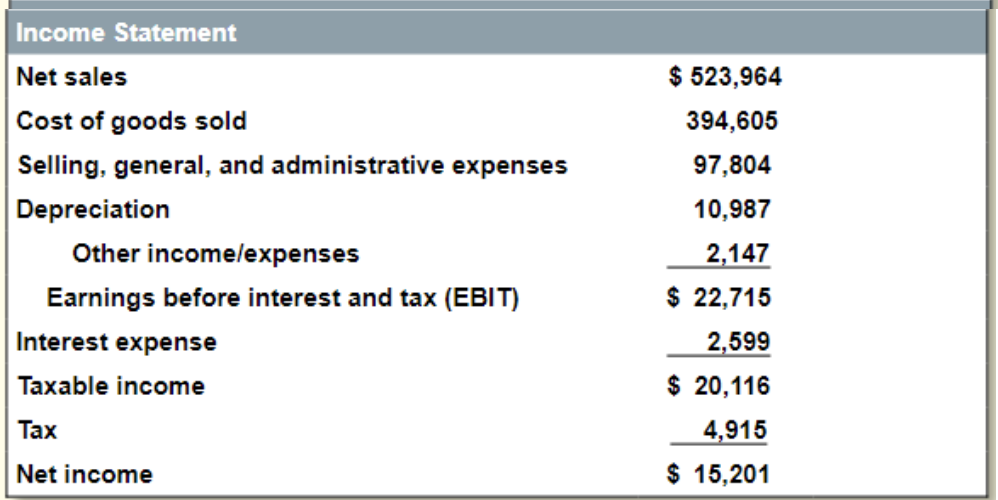

In the following questions, use the balance sheet and the income statements of Walmart shown below. At the end of 2019, Walmart had 2,832 million

In the following questions, use the balance sheet and the income statements of Walmart shown below.

At the end of 2019, Walmart had 2,832 million shares outstanding with a share price of $94. The company's weighted-average cost of capital was about 5%. Assume the corporate tax rate was 21%.

Liquidity Measures:

What was Walmart's quick ratio in 2019? (enter a percentage value with two decimal places)

Liabilities and Shareholders' Equity Current liabilities Accounts payable Other current liabilities Total current liabilities Long-term debt Other long-term liabilities Total liabilities Total shareholders' equity Total liabilities and shareholders' equity \begin{tabular}{rrr} $46,973 & & $47,060 \\ 30,817 & 30,417 \\ \hline$77,790 & & $77,477 \\ 43,714 & & 43,520 \\ 33,439 & & 18,664 \\ \hline$154,943 & $139,661 \\ 81,552 & & 79,634 \\ \hline$236,495 & & $219,295 \end{tabular} Income Statement Net sales Cost of goods sold Selling, general, and administrative expenses Depreciation $523,964394,60597,80410,9872,147$22,7152,599$20,1164,915$15,201Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started