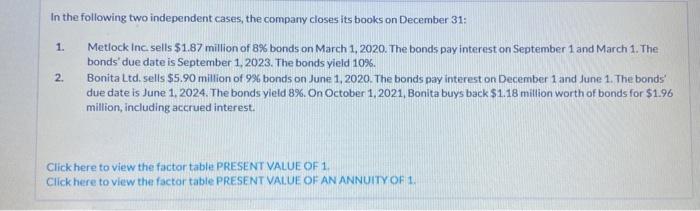

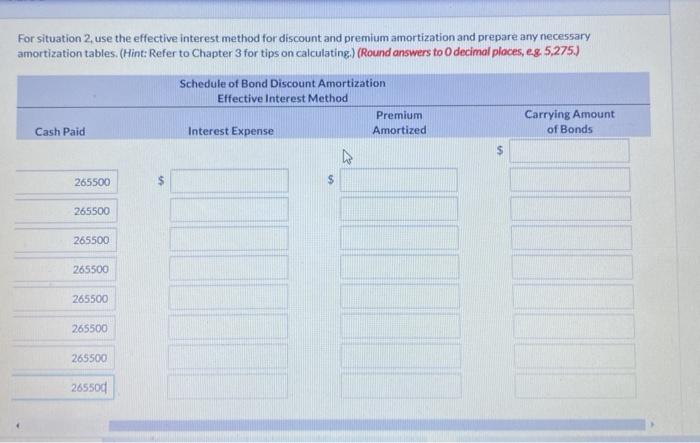

In the following two independent cases, the company closes its books on December 31: 1. Metlock Inc sells $1.87 million of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The bonds'due date is September 1, 2023. The bonds yield 10%. 2. Bonita Ltd. sells $5.90 million of 9% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The bonds due date is June 1, 2024. The bonds yield 8%. On October 1, 2021, Bonita buys back $1.18 million worth of bonds for $1.96 million, including accrued interest. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. For situation 2 use the effective interest method for discount and premium amortization and prepare any necessary amortization tables. (Hint: Refer to Chapter 3 for tips on calculating.) (Round answers to decimal places, eg 5,275.) Schedule of Bond Discount Amortization Effective Interest Method Premium Interest Expense Amortized Carrying Amount of Bonds Cash Paid 265500 $ 265500 265500 265500 265500 265500 265500 265500 In the following two independent cases, the company closes its books on December 31: 1. Metlock Inc sells $1.87 million of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The bonds'due date is September 1, 2023. The bonds yield 10%. 2. Bonita Ltd. sells $5.90 million of 9% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The bonds due date is June 1, 2024. The bonds yield 8%. On October 1, 2021, Bonita buys back $1.18 million worth of bonds for $1.96 million, including accrued interest. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. For situation 2 use the effective interest method for discount and premium amortization and prepare any necessary amortization tables. (Hint: Refer to Chapter 3 for tips on calculating.) (Round answers to decimal places, eg 5,275.) Schedule of Bond Discount Amortization Effective Interest Method Premium Interest Expense Amortized Carrying Amount of Bonds Cash Paid 265500 $ 265500 265500 265500 265500 265500 265500 265500