Answered step by step

Verified Expert Solution

Question

1 Approved Answer

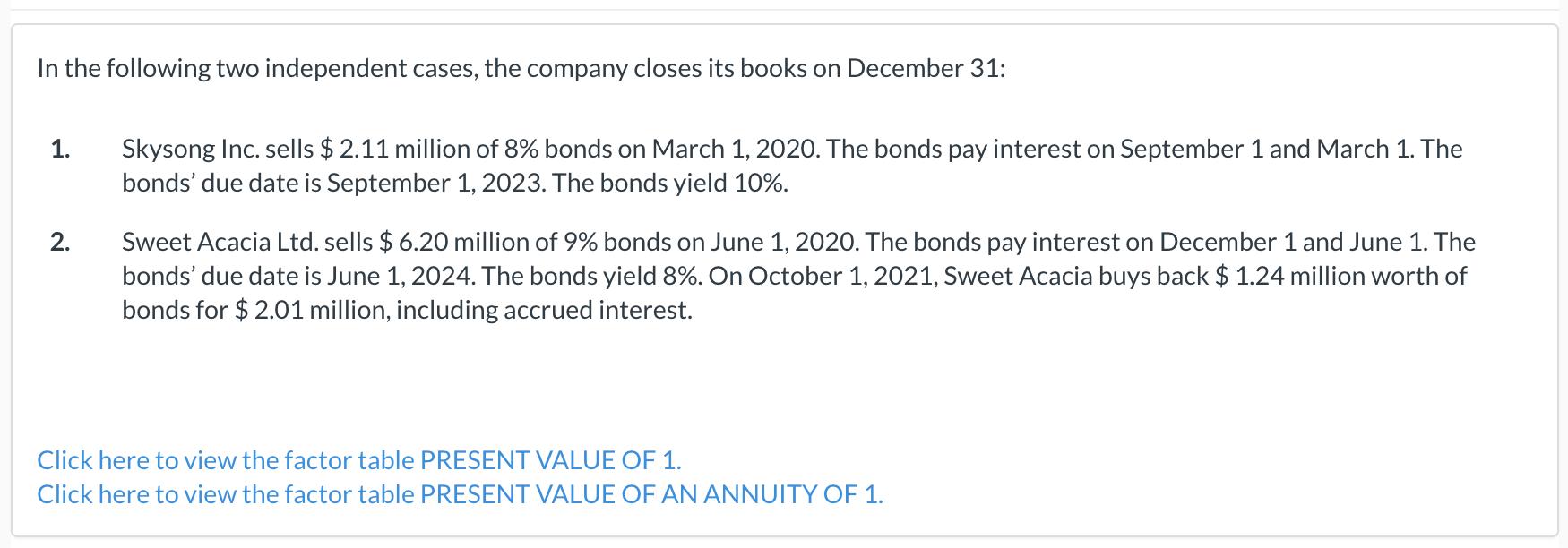

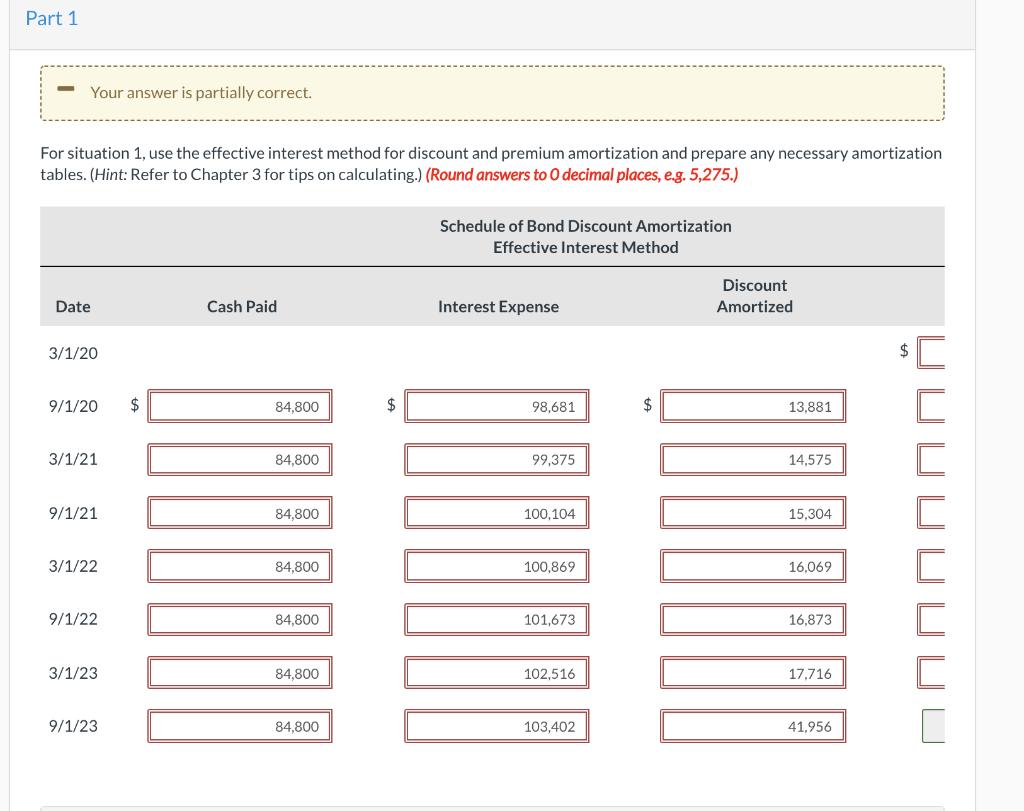

In the following two independent cases, the company closes its books on December 31: 1. 2. Skysong Inc. sells $2.11 million of 8% bonds

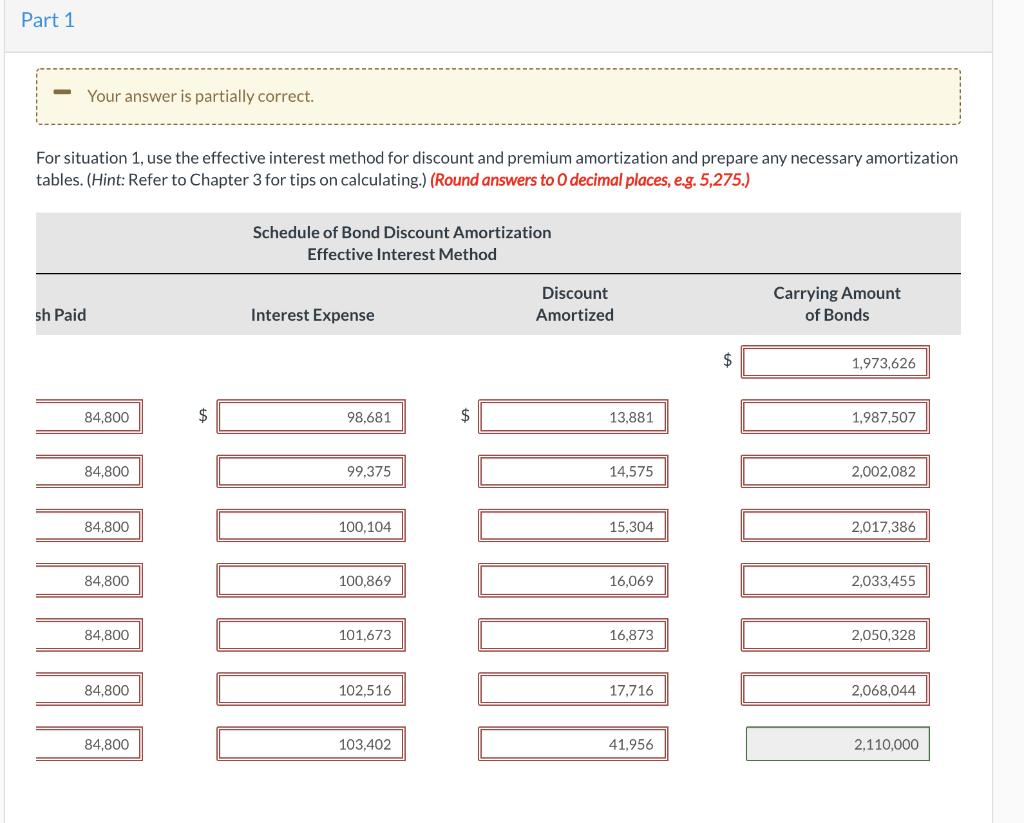

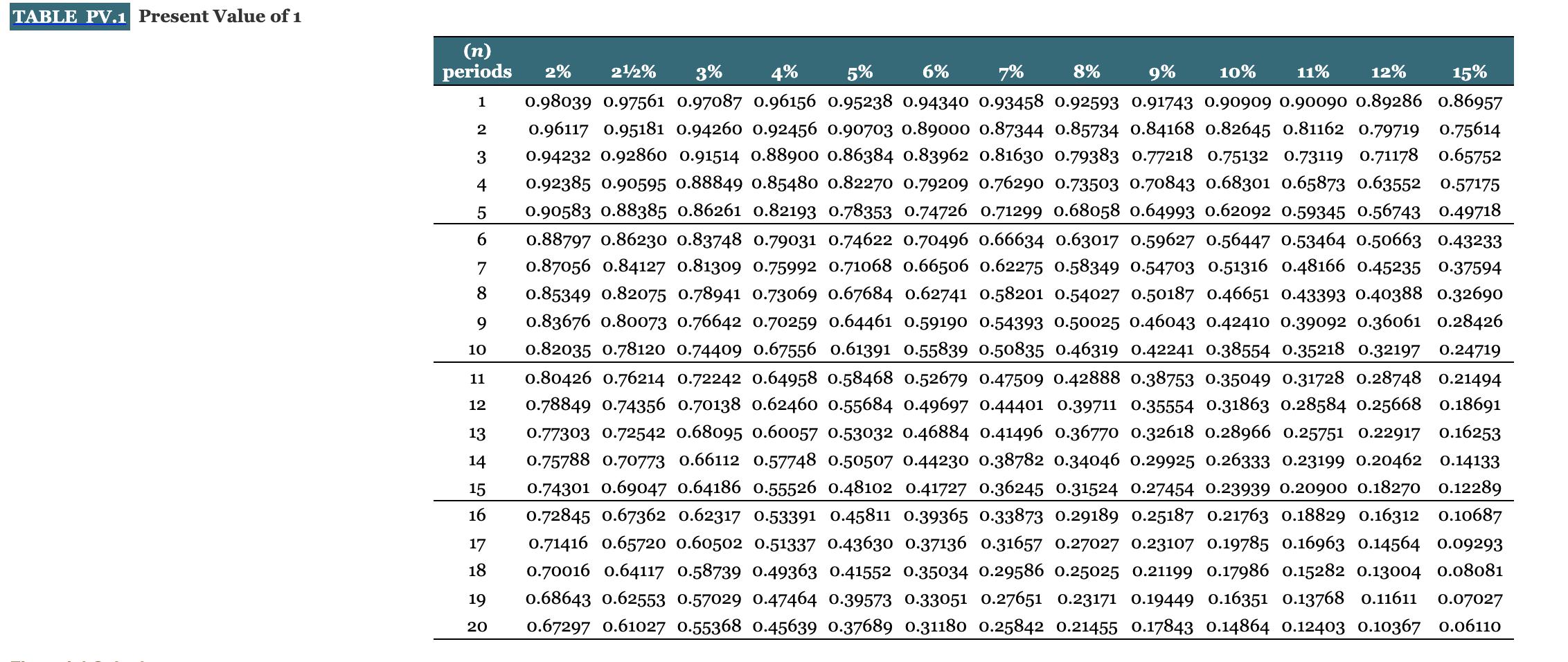

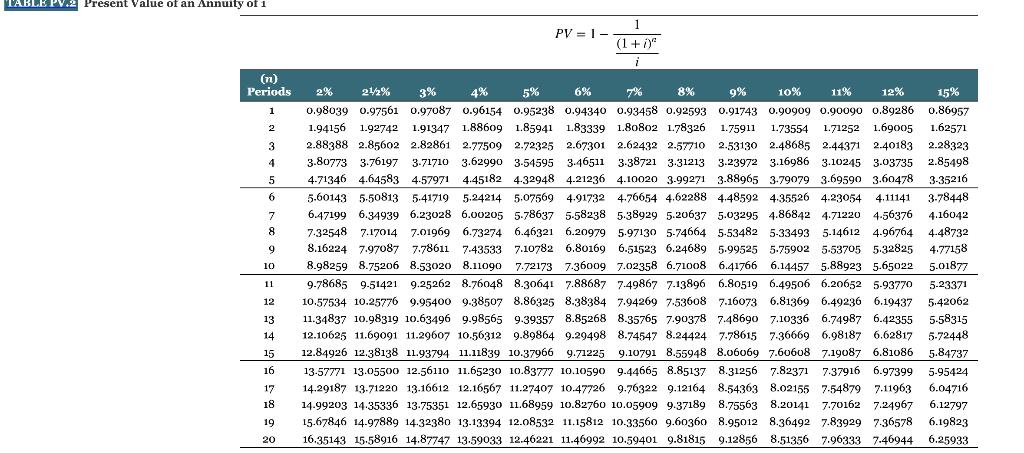

In the following two independent cases, the company closes its books on December 31: 1. 2. Skysong Inc. sells $2.11 million of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The bonds' due date is September 1, 2023. The bonds yield 10%. Sweet Acacia Ltd. sells $ 6.20 million of 9% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The bonds' due date is June 1, 2024. The bonds yield 8%. On October 1, 2021, Sweet Acacia buys back $ 1.24 million worth of bonds for $2.01 million, including accrued interest. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Part 1 Your answer is partially correct. For situation 1, use the effective interest method for discount and premium amortization and prepare any necessary amortization tables. (Hint: Refer to Chapter 3 for tips on calculating.) (Round answers to O decimal places, e.g. 5,275.) Date 3/1/20 9/1/20 3/1/21 9/1/21 3/1/22 9/1/22 3/1/23 9/1/23 $ Cash Paid 84,800 84,800 84,800 84,800 84,800 84,800 84,800 $ Schedule of Bond Discount Amortization Effective Interest Method Interest Expense 98,681 99,375 100,104 100,869 101,673 102,516 103,402 $ Discount Amortized 13,881 14,575 15,304 16,069 16,873 17,716 41,956 C Part 1 - Your answer is partially correct. For situation 1, use the effective interest method for discount and premium amortization and prepare any necessary amortization tables. (Hint: Refer to Chapter 3 for tips on calculating.) (Round answers to O decimal places, e.g. 5,275.) sh Paid 84,800 84,800 84,800 84,800 84,800 84,800 84,800 $ Schedule of Bond Discount Amortization Effective Interest Method Interest Expense 98,681 99,375 100,104 100,869 101,673 102,516 103,402 $ Discount Amortized 13,881 14,575 15.304 16,069 16,873 17,716 41,956 $ Carrying Amount of Bonds 1,973,626 1,987,507 2,002,082 2,017,386 2,033,455 2,050,328 2,068,044 2,110,000 TABLE PV.1 Present Value of 1 (n) periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 3% 4% 5% 6% 7% 8% 9% 10% 11% 2% 212% 12% 15% 0.98039 0.97561 0.97087 0.96156 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.86957 0.96117 0.95181 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.75614 0.94232 0.92860 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75132 0.73119 0.71178 0.65752 0.92385 0.90595 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.57175 0.90583 0.88385 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 0.49718 0.88797 0.86230 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 0.43233 0.87056 0.84127 0.81309 0.75992 0.71068 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.37594 0.85349 0.82075 0.78941 0.73069 0.67684 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 0.32690 0.83676 0.80073 0.76642 0.70259 0.64461 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 0.28426 0.82035 0.78120 0.74409 0.67556 0.61391 0.55839 0.50835 0.46319 0.42241 0.38554 0.35218 0.32197 0.24719 0.80426 0.76214 0.72242 0.64958 0.58468 0.52679 0.47509 0.42888 0.38753 0.35049 0.31728 0.28748 0.21494 0.78849 0.74356 0.70138 0.62460 0.55684 0.49697 0.44401 0.39711 0.35554 0.31863 0.28584 0.25668 0.18691 0.77303 0.72542 0.68095 0.60057 0.53032 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 0.16253 0.75788 0.70773 0.66112 0.57748 0.50507 0.44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 0.14133 0.74301 0.69047 0.64186 0.55526 0.48102 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.12289 0.72845 0.67362 0.62317 0.53391 0.45811 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 0.10687 0.71416 0.65720 0.60502 0.51337 0.43630 0.37136 0.31657 0.27027 0.23107 0.19785 0.16963 0.14564 0.09293 0.70016 0.64117 0.58739 0.49363 0.41552 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.08081 0.68643 0.62553 0.57029 0.47464 0.39573 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 0.07027 0.67297 0.61027 0.55368 0.45639 0.37689 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 0.06110 TABLE PV.2 Present Value of an Annuity of 1 (n) Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 PV = 1 - 1 (1 + i) i 4% 5% 6% 7% 8% 9% 10% 1.62571 2.28323 4.77158 2% 22% 3% 11% 12% 15% 0.98039 0.97561 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.86957 1.94156 1.92742 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 2.88388 2.85602 2.82861 2.77509 2.72325 2.67301 2.62432 2-57710 2.53130 2.48685 2.44371 2-40183 3.80773 3.76197 3.71710 3.62990 3-54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4-71346 4.64583 4-57971 4.45182 4.32948 4.21236 4.10020 3-99271 3.88965 3-79079 3.69590 3.60478 3-35216 5.60143 5.50813 5.41719 5.41719 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.47199 6.34939 6.23028 6.00205 5.78637 5-58238 5.38929 5.20637 5.03295 4.86842 4.71220 4-56376 4.16042 7.32548 7.17014 7.01969 6.73274 6.46321 6.20979 5.97130 5-74664 5-53482 5-33493 5-14612 4.96764 4-48732 8.16224 7.97087 7.78611 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5-53705 5.32825 8.98259 8.75206 8.53020 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 9-78685 9-51421 9.25262 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5-93770 10.57534 10.25776 9.95400 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 11.34837 10.98319 10.63496 9.98565 9-39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5-58315 12.10625 11.69091 11.29607 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5-72448 12.84926 12.38138 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 13-57771 13.05500 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.82371 7.37916 6.97399 5-95424 14.29187 13.71220 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7-54879 7.11963 6.04716 14.99203 14.35336 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 15.67846 14.97889 14.32380 13-13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 16.35143 15.58916 14.87747 13.59033 12.46221 11.46992 10.59401 9.81815 9.12856 8.51356 7.96333 7.46944 6.25933 5.01877 5-23371 5.42062 In the following two independent cases, the company closes its books on December 31: 1. 2. Skysong Inc. sells $2.11 million of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The bonds' due date is September 1, 2023. The bonds yield 10%. Sweet Acacia Ltd. sells $ 6.20 million of 9% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The bonds' due date is June 1, 2024. The bonds yield 8%. On October 1, 2021, Sweet Acacia buys back $ 1.24 million worth of bonds for $2.01 million, including accrued interest. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Part 1 Your answer is partially correct. For situation 1, use the effective interest method for discount and premium amortization and prepare any necessary amortization tables. (Hint: Refer to Chapter 3 for tips on calculating.) (Round answers to O decimal places, e.g. 5,275.) Date 3/1/20 9/1/20 3/1/21 9/1/21 3/1/22 9/1/22 3/1/23 9/1/23 $ Cash Paid 84,800 84,800 84,800 84,800 84,800 84,800 84,800 $ Schedule of Bond Discount Amortization Effective Interest Method Interest Expense 98,681 99,375 100,104 100,869 101,673 102,516 103,402 $ Discount Amortized 13,881 14,575 15,304 16,069 16,873 17,716 41,956 C Part 1 - Your answer is partially correct. For situation 1, use the effective interest method for discount and premium amortization and prepare any necessary amortization tables. (Hint: Refer to Chapter 3 for tips on calculating.) (Round answers to O decimal places, e.g. 5,275.) sh Paid 84,800 84,800 84,800 84,800 84,800 84,800 84,800 $ Schedule of Bond Discount Amortization Effective Interest Method Interest Expense 98,681 99,375 100,104 100,869 101,673 102,516 103,402 $ Discount Amortized 13,881 14,575 15.304 16,069 16,873 17,716 41,956 $ Carrying Amount of Bonds 1,973,626 1,987,507 2,002,082 2,017,386 2,033,455 2,050,328 2,068,044 2,110,000 TABLE PV.1 Present Value of 1 (n) periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 3% 4% 5% 6% 7% 8% 9% 10% 11% 2% 212% 12% 15% 0.98039 0.97561 0.97087 0.96156 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.86957 0.96117 0.95181 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.75614 0.94232 0.92860 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75132 0.73119 0.71178 0.65752 0.92385 0.90595 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.57175 0.90583 0.88385 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 0.49718 0.88797 0.86230 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 0.43233 0.87056 0.84127 0.81309 0.75992 0.71068 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.37594 0.85349 0.82075 0.78941 0.73069 0.67684 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 0.32690 0.83676 0.80073 0.76642 0.70259 0.64461 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 0.28426 0.82035 0.78120 0.74409 0.67556 0.61391 0.55839 0.50835 0.46319 0.42241 0.38554 0.35218 0.32197 0.24719 0.80426 0.76214 0.72242 0.64958 0.58468 0.52679 0.47509 0.42888 0.38753 0.35049 0.31728 0.28748 0.21494 0.78849 0.74356 0.70138 0.62460 0.55684 0.49697 0.44401 0.39711 0.35554 0.31863 0.28584 0.25668 0.18691 0.77303 0.72542 0.68095 0.60057 0.53032 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 0.16253 0.75788 0.70773 0.66112 0.57748 0.50507 0.44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 0.14133 0.74301 0.69047 0.64186 0.55526 0.48102 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.12289 0.72845 0.67362 0.62317 0.53391 0.45811 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 0.10687 0.71416 0.65720 0.60502 0.51337 0.43630 0.37136 0.31657 0.27027 0.23107 0.19785 0.16963 0.14564 0.09293 0.70016 0.64117 0.58739 0.49363 0.41552 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.08081 0.68643 0.62553 0.57029 0.47464 0.39573 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 0.07027 0.67297 0.61027 0.55368 0.45639 0.37689 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 0.06110 TABLE PV.2 Present Value of an Annuity of 1 (n) Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 PV = 1 - 1 (1 + i) i 4% 5% 6% 7% 8% 9% 10% 1.62571 2.28323 4.77158 2% 22% 3% 11% 12% 15% 0.98039 0.97561 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.86957 1.94156 1.92742 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 2.88388 2.85602 2.82861 2.77509 2.72325 2.67301 2.62432 2-57710 2.53130 2.48685 2.44371 2-40183 3.80773 3.76197 3.71710 3.62990 3-54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4-71346 4.64583 4-57971 4.45182 4.32948 4.21236 4.10020 3-99271 3.88965 3-79079 3.69590 3.60478 3-35216 5.60143 5.50813 5.41719 5.41719 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.47199 6.34939 6.23028 6.00205 5.78637 5-58238 5.38929 5.20637 5.03295 4.86842 4.71220 4-56376 4.16042 7.32548 7.17014 7.01969 6.73274 6.46321 6.20979 5.97130 5-74664 5-53482 5-33493 5-14612 4.96764 4-48732 8.16224 7.97087 7.78611 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5-53705 5.32825 8.98259 8.75206 8.53020 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 9-78685 9-51421 9.25262 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5-93770 10.57534 10.25776 9.95400 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 11.34837 10.98319 10.63496 9.98565 9-39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5-58315 12.10625 11.69091 11.29607 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5-72448 12.84926 12.38138 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 13-57771 13.05500 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.82371 7.37916 6.97399 5-95424 14.29187 13.71220 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7-54879 7.11963 6.04716 14.99203 14.35336 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 15.67846 14.97889 14.32380 13-13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 16.35143 15.58916 14.87747 13.59033 12.46221 11.46992 10.59401 9.81815 9.12856 8.51356 7.96333 7.46944 6.25933 5.01877 5-23371 5.42062 In the following two independent cases, the company closes its books on December 31: 1. 2. Skysong Inc. sells $2.11 million of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The bonds' due date is September 1, 2023. The bonds yield 10%. Sweet Acacia Ltd. sells $ 6.20 million of 9% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The bonds' due date is June 1, 2024. The bonds yield 8%. On October 1, 2021, Sweet Acacia buys back $ 1.24 million worth of bonds for $2.01 million, including accrued interest. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Part 1 Your answer is partially correct. For situation 1, use the effective interest method for discount and premium amortization and prepare any necessary amortization tables. (Hint: Refer to Chapter 3 for tips on calculating.) (Round answers to O decimal places, e.g. 5,275.) Date 3/1/20 9/1/20 3/1/21 9/1/21 3/1/22 9/1/22 3/1/23 9/1/23 $ Cash Paid 84,800 84,800 84,800 84,800 84,800 84,800 84,800 $ Schedule of Bond Discount Amortization Effective Interest Method Interest Expense 98,681 99,375 100,104 100,869 101,673 102,516 103,402 $ Discount Amortized 13,881 14,575 15,304 16,069 16,873 17,716 41,956 C Part 1 - Your answer is partially correct. For situation 1, use the effective interest method for discount and premium amortization and prepare any necessary amortization tables. (Hint: Refer to Chapter 3 for tips on calculating.) (Round answers to O decimal places, e.g. 5,275.) sh Paid 84,800 84,800 84,800 84,800 84,800 84,800 84,800 $ Schedule of Bond Discount Amortization Effective Interest Method Interest Expense 98,681 99,375 100,104 100,869 101,673 102,516 103,402 $ Discount Amortized 13,881 14,575 15.304 16,069 16,873 17,716 41,956 $ Carrying Amount of Bonds 1,973,626 1,987,507 2,002,082 2,017,386 2,033,455 2,050,328 2,068,044 2,110,000 TABLE PV.1 Present Value of 1 (n) periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 3% 4% 5% 6% 7% 8% 9% 10% 11% 2% 212% 12% 15% 0.98039 0.97561 0.97087 0.96156 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.86957 0.96117 0.95181 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.75614 0.94232 0.92860 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75132 0.73119 0.71178 0.65752 0.92385 0.90595 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.57175 0.90583 0.88385 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 0.49718 0.88797 0.86230 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 0.43233 0.87056 0.84127 0.81309 0.75992 0.71068 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.37594 0.85349 0.82075 0.78941 0.73069 0.67684 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 0.32690 0.83676 0.80073 0.76642 0.70259 0.64461 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 0.28426 0.82035 0.78120 0.74409 0.67556 0.61391 0.55839 0.50835 0.46319 0.42241 0.38554 0.35218 0.32197 0.24719 0.80426 0.76214 0.72242 0.64958 0.58468 0.52679 0.47509 0.42888 0.38753 0.35049 0.31728 0.28748 0.21494 0.78849 0.74356 0.70138 0.62460 0.55684 0.49697 0.44401 0.39711 0.35554 0.31863 0.28584 0.25668 0.18691 0.77303 0.72542 0.68095 0.60057 0.53032 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 0.16253 0.75788 0.70773 0.66112 0.57748 0.50507 0.44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 0.14133 0.74301 0.69047 0.64186 0.55526 0.48102 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.12289 0.72845 0.67362 0.62317 0.53391 0.45811 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 0.10687 0.71416 0.65720 0.60502 0.51337 0.43630 0.37136 0.31657 0.27027 0.23107 0.19785 0.16963 0.14564 0.09293 0.70016 0.64117 0.58739 0.49363 0.41552 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.08081 0.68643 0.62553 0.57029 0.47464 0.39573 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 0.07027 0.67297 0.61027 0.55368 0.45639 0.37689 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 0.06110 TABLE PV.2 Present Value of an Annuity of 1 (n) Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 PV = 1 - 1 (1 + i) i 4% 5% 6% 7% 8% 9% 10% 1.62571 2.28323 4.77158 2% 22% 3% 11% 12% 15% 0.98039 0.97561 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.86957 1.94156 1.92742 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 2.88388 2.85602 2.82861 2.77509 2.72325 2.67301 2.62432 2-57710 2.53130 2.48685 2.44371 2-40183 3.80773 3.76197 3.71710 3.62990 3-54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4-71346 4.64583 4-57971 4.45182 4.32948 4.21236 4.10020 3-99271 3.88965 3-79079 3.69590 3.60478 3-35216 5.60143 5.50813 5.41719 5.41719 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.47199 6.34939 6.23028 6.00205 5.78637 5-58238 5.38929 5.20637 5.03295 4.86842 4.71220 4-56376 4.16042 7.32548 7.17014 7.01969 6.73274 6.46321 6.20979 5.97130 5-74664 5-53482 5-33493 5-14612 4.96764 4-48732 8.16224 7.97087 7.78611 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5-53705 5.32825 8.98259 8.75206 8.53020 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 9-78685 9-51421 9.25262 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5-93770 10.57534 10.25776 9.95400 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 11.34837 10.98319 10.63496 9.98565 9-39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5-58315 12.10625 11.69091 11.29607 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5-72448 12.84926 12.38138 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 13-57771 13.05500 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.82371 7.37916 6.97399 5-95424 14.29187 13.71220 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7-54879 7.11963 6.04716 14.99203 14.35336 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 15.67846 14.97889 14.32380 13-13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 16.35143 15.58916 14.87747 13.59033 12.46221 11.46992 10.59401 9.81815 9.12856 8.51356 7.96333 7.46944 6.25933 5.01877 5-23371 5.42062 In the following two independent cases, the company closes its books on December 31: 1. 2. Skysong Inc. sells $2.11 million of 8% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The bonds' due date is September 1, 2023. The bonds yield 10%. Sweet Acacia Ltd. sells $ 6.20 million of 9% bonds on June 1, 2020. The bonds pay interest on December 1 and June 1. The bonds' due date is June 1, 2024. The bonds yield 8%. On October 1, 2021, Sweet Acacia buys back $ 1.24 million worth of bonds for $2.01 million, including accrued interest. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Part 1 Your answer is partially correct. For situation 1, use the effective interest method for discount and premium amortization and prepare any necessary amortization tables. (Hint: Refer to Chapter 3 for tips on calculating.) (Round answers to O decimal places, e.g. 5,275.) Date 3/1/20 9/1/20 3/1/21 9/1/21 3/1/22 9/1/22 3/1/23 9/1/23 $ Cash Paid 84,800 84,800 84,800 84,800 84,800 84,800 84,800 $ Schedule of Bond Discount Amortization Effective Interest Method Interest Expense 98,681 99,375 100,104 100,869 101,673 102,516 103,402 $ Discount Amortized 13,881 14,575 15,304 16,069 16,873 17,716 41,956 C Part 1 - Your answer is partially correct. For situation 1, use the effective interest method for discount and premium amortization and prepare any necessary amortization tables. (Hint: Refer to Chapter 3 for tips on calculating.) (Round answers to O decimal places, e.g. 5,275.) sh Paid 84,800 84,800 84,800 84,800 84,800 84,800 84,800 $ Schedule of Bond Discount Amortization Effective Interest Method Interest Expense 98,681 99,375 100,104 100,869 101,673 102,516 103,402 $ Discount Amortized 13,881 14,575 15.304 16,069 16,873 17,716 41,956 $ Carrying Amount of Bonds 1,973,626 1,987,507 2,002,082 2,017,386 2,033,455 2,050,328 2,068,044 2,110,000 TABLE PV.1 Present Value of 1 (n) periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 3% 4% 5% 6% 7% 8% 9% 10% 11% 2% 212% 12% 15% 0.98039 0.97561 0.97087 0.96156 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.86957 0.96117 0.95181 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.75614 0.94232 0.92860 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75132 0.73119 0.71178 0.65752 0.92385 0.90595 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.57175 0.90583 0.88385 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 0.49718 0.88797 0.86230 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 0.43233 0.87056 0.84127 0.81309 0.75992 0.71068 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.37594 0.85349 0.82075 0.78941 0.73069 0.67684 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 0.32690 0.83676 0.80073 0.76642 0.70259 0.64461 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 0.28426 0.82035 0.78120 0.74409 0.67556 0.61391 0.55839 0.50835 0.46319 0.42241 0.38554 0.35218 0.32197 0.24719 0.80426 0.76214 0.72242 0.64958 0.58468 0.52679 0.47509 0.42888 0.38753 0.35049 0.31728 0.28748 0.21494 0.78849 0.74356 0.70138 0.62460 0.55684 0.49697 0.44401 0.39711 0.35554 0.31863 0.28584 0.25668 0.18691 0.77303 0.72542 0.68095 0.60057 0.53032 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 0.16253 0.75788 0.70773 0.66112 0.57748 0.50507 0.44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 0.14133 0.74301 0.69047 0.64186 0.55526 0.48102 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.12289 0.72845 0.67362 0.62317 0.53391 0.45811 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 0.10687 0.71416 0.65720 0.60502 0.51337 0.43630 0.37136 0.31657 0.27027 0.23107 0.19785 0.16963 0.14564 0.09293 0.70016 0.64117 0.58739 0.49363 0.41552 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.08081 0.68643 0.62553 0.57029 0.47464 0.39573 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 0.07027 0.67297 0.61027 0.55368 0.45639 0.37689 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 0.06110 TABLE PV.2 Present Value of an Annuity of 1 (n) Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 PV = 1 - 1 (1 + i) i 4% 5% 6% 7% 8% 9% 10% 1.62571 2.28323 4.77158 2% 22% 3% 11% 12% 15% 0.98039 0.97561 0.97087 0.96154 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.86957 1.94156 1.92742 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 2.88388 2.85602 2.82861 2.77509 2.72325 2.67301 2.62432 2-57710 2.53130 2.48685 2.44371 2-40183 3.80773 3.76197 3.71710 3.62990 3-54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4-71346 4.64583 4-57971 4.45182 4.32948 4.21236 4.10020 3-99271 3.88965 3-79079 3.69590 3.60478 3-35216 5.60143 5.50813 5.41719 5.41719 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.47199 6.34939 6.23028 6.00205 5.78637 5-58238 5.38929 5.20637 5.03295 4.86842 4.71220 4-56376 4.16042 7.32548 7.17014 7.01969 6.73274 6.46321 6.20979 5.97130 5-74664 5-53482 5-33493 5-14612 4.96764 4-48732 8.16224 7.97087 7.78611 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5-53705 5.32825 8.98259 8.75206 8.53020 8.11090 7.72173 7.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 9-78685 9-51421 9.25262 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5-93770 10.57534 10.25776 9.95400 9.38507 8.86325 8.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 11.34837 10.98319 10.63496 9.98565 9-39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5-58315 12.10625 11.69091 11.29607 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5-72448 12.84926 12.38138 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 13-57771 13.05500 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.82371 7.37916 6.97399 5-95424 14.29187 13.71220 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7-54879 7.11963 6.04716 14.99203 14.35336 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 15.67846 14.97889 14.32380 13-13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 16.35143 15.58916 14.87747 13.59033 12.46221 11.46992 10.59401 9.81815 9.12856 8.51356 7.96333 7.46944 6.25933 5.01877 5-23371 5.42062

Step by Step Solution

★★★★★

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

1 Date 3120 9120 3121 9121 3122 9122 3123 9123 Schedule of Bond Discount Amortization E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started