Question

In the funds internal rating system, the interest coverage is defined as EBITDA divided by interest expense. The leverage is defined as long-term debt divided

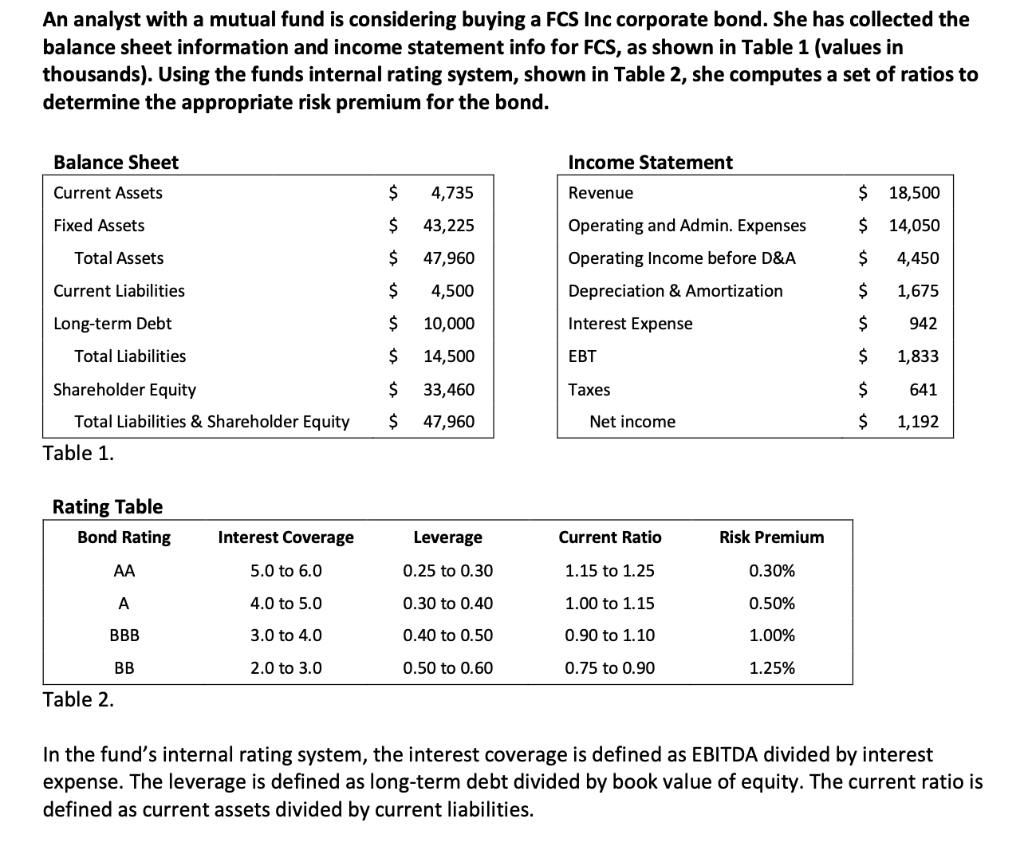

In the funds internal rating system, the interest coverage is defined as EBITDA divided by interest expense. The leverage is defined as long-term debt divided by book value of equity. The current ratio is defined as current assets divided by current liabilities.

a) Compute the ratios to determine the appropriate bond rating for the FCS Inc bond.

The market debt ratio (MDR) is defined as the book value of total debt divided by the sum of the book value of total debt and the market value of equity. Assume that 1/3 of the current liabilities on FCS Incs balance sheet are short-term debt. Currently, FCS Incs MDR is 0.40. The beta of the companys stock is 1.20. The bond is currently trading at a risk premium of 55 basis points

b) Assuming a risk-free rate of 3.0%, a market risk premium of 6.0%, and a tax rate of 25%, find the weighted average cost of capital.

c) FCS Inc has reached the stable growth stage. Its capital expenditures are 1.12x depreciation, and the change in net working capital is zero. Find the implied growth rate for the free cash flow to the firm (FCFF).

An analyst with a mutual fund is considering buying a FCS Inc corporate bond. She has collected the balance sheet information and income statement info for FCS, as shown in Table 1 (values in thousands). Using the funds internal rating system, shown in Table 2, she computes a set of ratios to determine the appropriate risk premium for the bond. Table 1. Iapie . In the fund's internal rating system, the interest coverage is defined as EBITDA divided by interest expense. The leverage is defined as long-term debt divided by book value of equity. The current ratio is defined as current assets divided by current liabilitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started