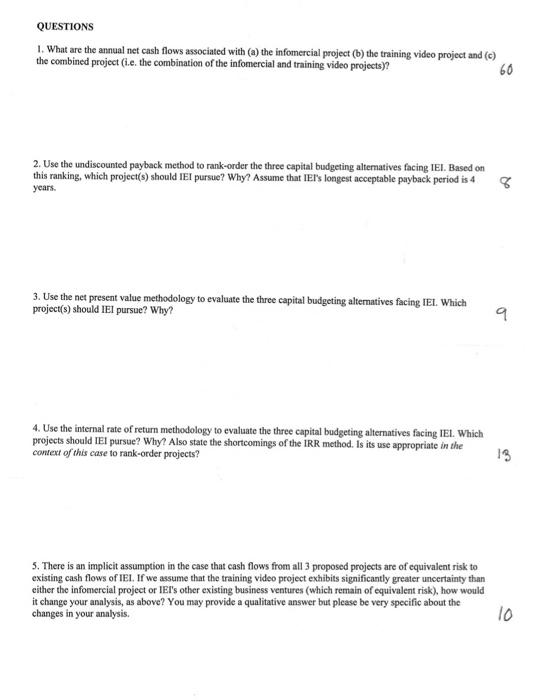

In the good ol' days-before cable TV, fax machines, and multimedia personal computers-the phrase, "... and now a word from our sponsor ..." usually meant just that. Television commercials were confined to thirty- and sixty-second messages, grouped together to occupy only two or three minutes of viewing time. Oceasionally, if you stayed up late enough sitting in front of the tube, you'd see thirty-minute segments on riveting topics like "How to Turn $10 Into $10 Million by Investing in Real Estate That Nobody Wants." Since few people-except for a fow former savings and loan executives-managed to stay awake through these half-hour programs, the shows attracted little interest. The era of the infomercial, those thirty-minute paid video advertisements devoted to selling a particular idea or product, didn't really begin until after the 1992 presidential campaign. Following Ross Perot's unsuccessful bid for public office, however, things started looking up for this new marketing venue. If Perot could use the half-hour segments on latenight TV to capture 19 percent of the popular vote, surely other advertisers could use the infomercial as a way to communicate their message to a sleepy, yet receptive, audience. Indeed, in the wake of the election, many Fortune-500 corporations selling consumer products were enger to take the plunge and go head-to-head with Letterman on late-night TV. Unfortunately, obtaining exelusive airtime and marketing rights in multiple television markets on the same night was a distribution nightmare. Traditional advertising agencies that purchased large blocks of television time bought it during prime viewing hours. In contrast, late-night time was sold by individual stations to local advertisers on a spot basis. Consequently, nationwide distribution of corporate infomereials could be almost impossible. Fortunately, the free enterprise system specializes in impossible situations. In late 1992, sensing a new business opportunity, Infomercial Entertninment, Inc. (IEI) was chartered to corral local late-night television time, and serve as a contract distribution agent for corporate clients seeking to air thirty-minute infomercials throughout the United States. While IEI originally set out to be a distribution agent for late-night TV time, the firm soon realized that many medium-sized corporate advertisers lacked the production and duplication equipment necessary to produce multiple copies of their infomercial messages. Sensing a new opportunity to expand their business, IEI's management team sought to provide video production and duplication services for their customers. Through the careful purchase of used video equipment from a bankrupt motion picture studio in 1993 , IEI could acquire the necessary electronics and video hardware for $200,000, plus a $25,000 charge for installation and delivery of the equipment. This equipment would be depreciated according to the MACRS schedule for five-year property shown in Table 1. IEI's managers believed they could mnss-produce infomercial videos and offer them to corporate clients for $10 each. In 1993 the firm forecast total volume of 5,000 infomercial videos, and estimated the materials cost of production at 50 percent of the net sales price. Labor and overhead expenses would amount to an additional 12 percent of the unit selling price. The firm expected sales to grow at a constant 5 percent anmually over the next ten years, at which time the newly acquired video equipment would be worn-out. Finally, IEI would require an additional investment in working capital totaling $10,000 to support the initial sales incrense promised by the Infomercial project. While IEI was interested in expanding its production operations, the firm also realized that acquisition of the video equipment would give it the added opportunity and capacity to produce corporate training videos for commercial clients. IEI's managers believed they could produce 875 different training films in 1993 , and that clients would order, on average, five copies of each film. The firm believed that demand for its training videos would grow at 7 percent annually over the next 10 years. Each training video would carry a net price of $8 per copy, production and materials costs would total 43 percent of this selling price, and overheed expenses would average 10 percent of the unit selling price. IEI would require an additional $5,000 investment in working capital to support the Training Video projeot. After a ten-year service life, IEI could sell its video equipment for a nominal $20,000. The firm's after-tax weighted average cost of capital is 10 percent, and the video production projects-including both infomercials and training films-are considered to be only slightty more risky than the firm's current business ventures. IEI's marginal tax rate is 35 percent, and the finm's financial statement forecast shows that production costs and overhead expenses will maintain a constant relationship with sales over the next 10 years. 1. What are the annual net cash flows associated with (a) the infomercial project (b) the training video project and (c) the combined project (i.e. the combination of the infomercial and training video projects)? 60 2. Use the undiscounted payback method to rank-order the three capital budgeting alternatives facing IEI. Based on this ranking, which project(s) should IEI pursue? Why? Assume that IEIs longest aeceptable payback period is 4 years. 3. Use the net present value methodology to evaluate the three capital budgeting alternatives facing IEI. Which project(s) should IEI pursue? Why? 4. Use the internal rate of retum methodology to evaluate the three capital budgeting alternatives facing IEL. Which projects should IEI pursue? Why? Also state the shortcomings of the IRR method. Is its use appropriate in the contert of this case to rank-order projects? 13 5. There is an implicit assumption in the case that cash flows from all 3 proposed projects are of equivalent risk to existing cash flows of IEI. If we assume that the training video project exhibits significantly greater uncertainty than either the infomercial project or IEI's other existing business ventures (which remain of equivalent risk), how would it change your analysis, as above? You may provide a qualitative answer but please be very specific about the changes in your analysis