Question

In the last few years, colleges and universities have signed exclusivity agreements with a variety of private companies. These exclusivity agreements obligate educational institutions to

In the last few years, colleges and universities have signed exclusivity agreements with a variety of private companies. These exclusivity agreements obligate educational institutions to sell only company's products on campus; no competition. Many of the agreements involve food and beverage firms.

RRC has a total annual enrollment of about 32,000 students. RRC has proposed to Pepsi-Cola and exclusive agreement that would give Pepsi exclusive rights to sell its products at all RRC facilities and campuses for the next year and, an option for future years. In return RRC would receive 40% of the on-campus revenue and an addition lump sum of $125,000 per year. Pepsi has been given one week to respond to the proposal. Your team represents the management at Pepsi.

Here is what the management at Pepsi knows:

The market for soft drinks is measured in terms of the equivalent of 591ml bottles.

Pepsi currently sells an average of 14,00 bottles ( or their equivalents ) per week

RRC primarily operates over 40 weeks of the year

Bottles sell for an average price of $2.50 each

The costs of goof sold amount to $0.75 per bottle

Pepsi is unsure of its market share but suspects it is considerably less than 50%. Pepsi's current annual profit from RRC business is 40 weeks x 14,00 bottles x $1.75 per bottle = $980,000. A quick analysis reveals that if this level of market share hypothetically represented 25% market share, then with an exclusive agreement Pepsi would sell 56,000 per week or 100% of the market:

Annual sales would be $2,240,000 bottles per year ( calculated as 56,000 bottles per week x 40 weeks )

Annual gross revenue would be $2,240 bottles x $2.50 revenue/bottle = $5,600,000

This figure is multiplied by 60% because RRC would be paid 40% of the gross revenue thus 60% x $5,600,000 = $3,360,000

The total cost of 75 cents per bottle ( or $1,680,000 ) and the annual payment to RRC of $125,000 is subtracted to obtain the net profit or $ 3,360,000 - $1,680,000 - $125,000 = $1,555,500

To complicate matters, Pepsi does not know how many soft drinks are sold weekly at RRC thus Pepsi does not in fact know its market share. Coca-Cola is not likely to supply Pepsi with information about its sales which together with Pepsi's line of products constitutes virtually the entire market.

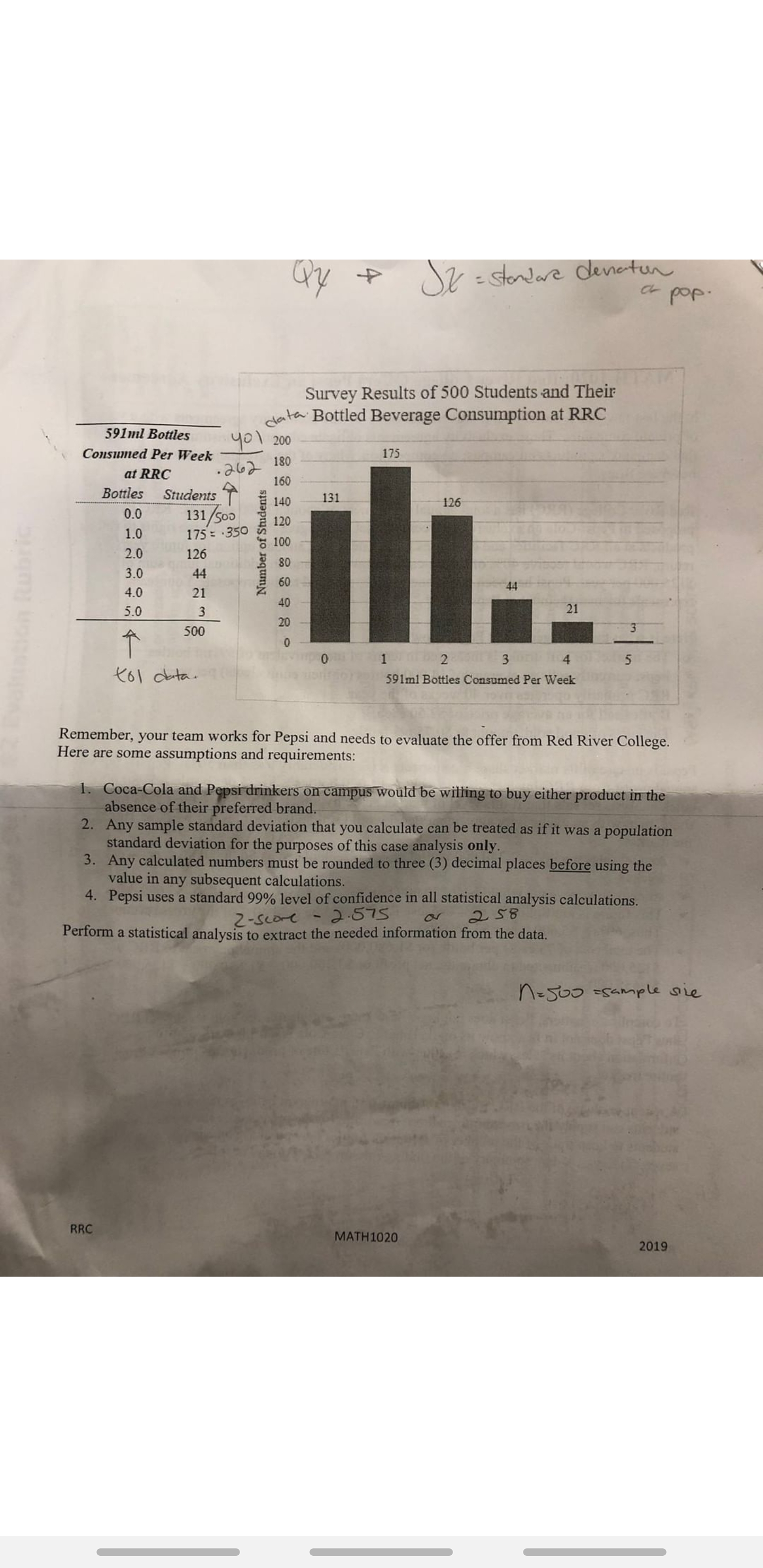

A recent graduate of RRC Business Admin program believes that a survey of the students can supply the needed information. Accordingly, She organized a survey that asks 500 students to keep track of the number of soft drink bottles they purchase on campus over the next seven (7) days. A data summary of the findings are presented on the next page.

591ml Bottles Consumed per week at RRC

Bottles Students

0.0131

1.0175

2.0126

3.044

4.021

5.03

500 total

Remember, your team works for Pepsi and needs to evaluate the offer from RRC. Here are some assumptions and requirements:

1.Coca-Cola and Pepsi drinkers on campus would be willing to buy either product in the absence of their preferred brand

2.Any sample standard deviation that you calculate can be treated as if it was a population standard deviation for the purposes of this case analysis only.

3.Any calculated numbers must be rounded to three (3 ) before using the value in any subsequent calculations.

4.Pepsi uses a standard deviation of 99% level of confidence in all statistical analysis calculations.

************Perform a statistical analysis to extract the needed information from the data.

************ Graph attached. please look at the attachment

The analysis should include the following issues:

1.Show all the work and support all the calculations. Use the Data summary to aid with the calculations.

Since profitability is requested, the assignment needs to show the calculations on how the ream determined profitability for the exclusivity contract.

2.Use the calculations from part (a)above to write a simple paragraph to let the company executives know how the team has interpreted the results and what the recommendation from the team is based on maximizing profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started