Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the late 90s it was observed that the relative price of equipment (capital) has declined at an average annual rate of more than

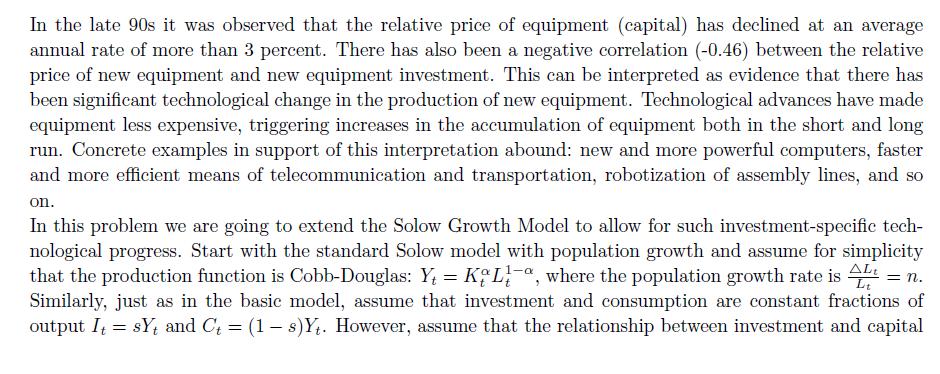

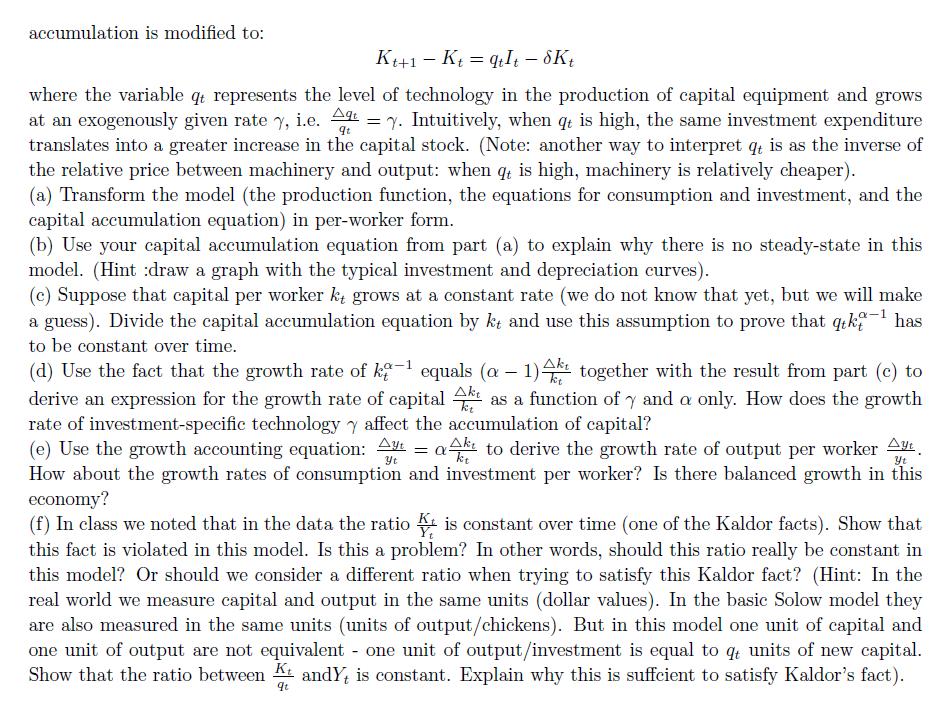

In the late 90s it was observed that the relative price of equipment (capital) has declined at an average annual rate of more than 3 percent. There has also been a negative correlation (-0.46) between the relative price of new equipment and new equipment investment. This can be interpreted as evidence that there has been significant technological change in the production of new equipment. Technological advances have made equipment less expensive, triggering increases in the accumulation of equipment both in the short and long run. Concrete examples in support of this interpretation abound: new and more powerful computers, faster and more efficient means of telecommunication and transportation, robotization of assembly lines, and so on. In this problem we are going to extend the Solow Growth Model to allow for such investment-specific tech- nological progress. Start with the standard Solow model with population growth and assume for simplicity that the production function is Cobb-Douglas: Y = KL-a, where the population growth rate is t = n. Similarly, just as in the basic model, assume that investment and consumption are constant fractions of output ItsY and C = (1 s)Yt. However, assume that the relationship between investment and capital = accumulation is modified to: Kt+1- Kt = qtIt - 8Kt qt where the variable qt represents the level of technology in the production of capital equipment and grows at an exogenously given rate y, i.e. At = y. Intuitively, when qt is high, the same investment expenditure translates into a greater increase in the capital stock. (Note: another way to interpret qt is as the inverse of the relative price between machinery and output: when qt is high, machinery is relatively cheaper). (a) Transform the model (the production function, the equations for consumption and investment, and the capital accumulation equation) in per-worker form. (b) Use your capital accumulation equation from part (a) to explain why there is no steady-state in this model. (Hint :draw a graph with the typical investment and depreciation curves). (c) Suppose that capital per worker kt grows at a constant rate (we do not know that yet, but we will make a guess). Divide the capital accumulation equation by kt and use this assumption to prove that qikt- has to be constant over time. Akt (d) Use the fact that the growth rate of k- equals (a - 1)4k together with the result from part (c) to derive an expression for the growth rate of capital as a function of y and a only. How does the growth rate of investment-specific technology y affect the accumulation of capital? (e) Use the growth accounting equation: Ayt tak to derive the growth rate of output per worker Ay = Yt Yt How about the growth rates of consumption and investment per worker? Is there balanced growth in this economy? (f) In class we noted that in the data the ratio is constant over time (one of the Kaldor facts). Show that this fact is violated in this model. Is this a problem? In other words, should this ratio really be constant in this model? Or should we consider a different ratio when trying to satisfy this Kaldor fact? (Hint: In the real world we measure capital and output in the same units (dollar values). In the basic Solow model they are also measured in the same units (units of output/chickens). But in this model one unit of capital and one unit of output are not equivalent - one unit of output/investment is equal to q units of new capital. Show that the ratio between Kandy, is constant. Explain why this is suffcient to satisfy Kaldor's fact). qt

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps shown in more detail a Transform model in perworker terms Production fun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started