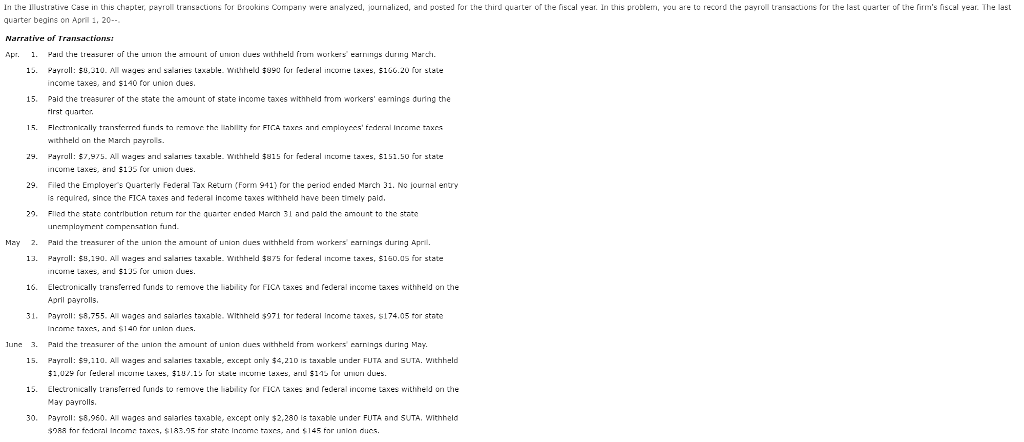

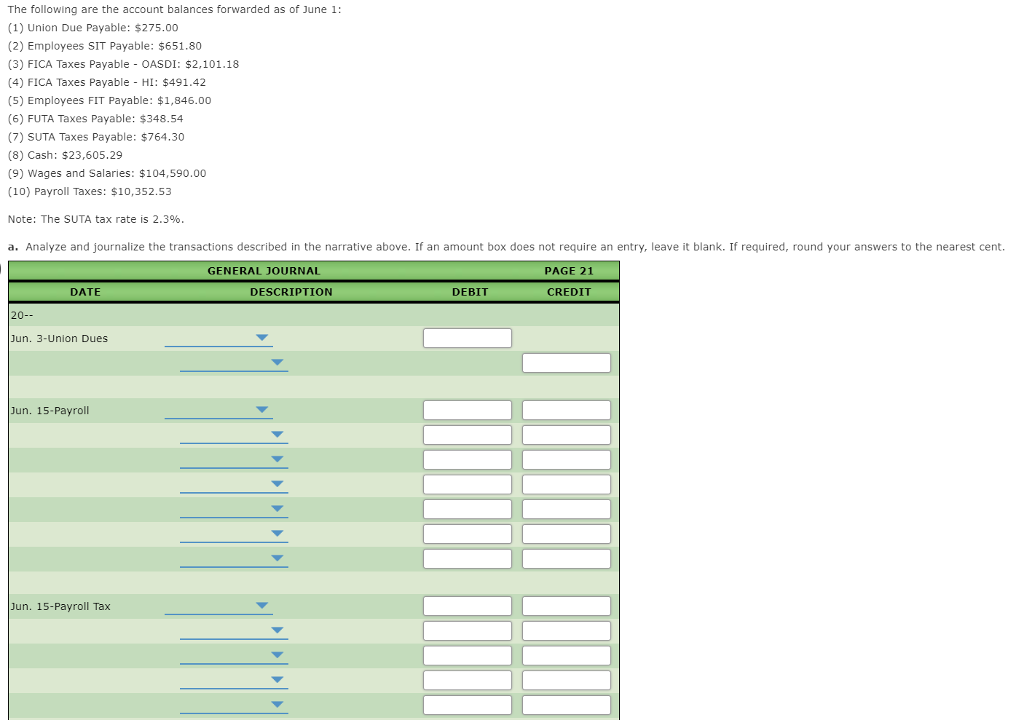

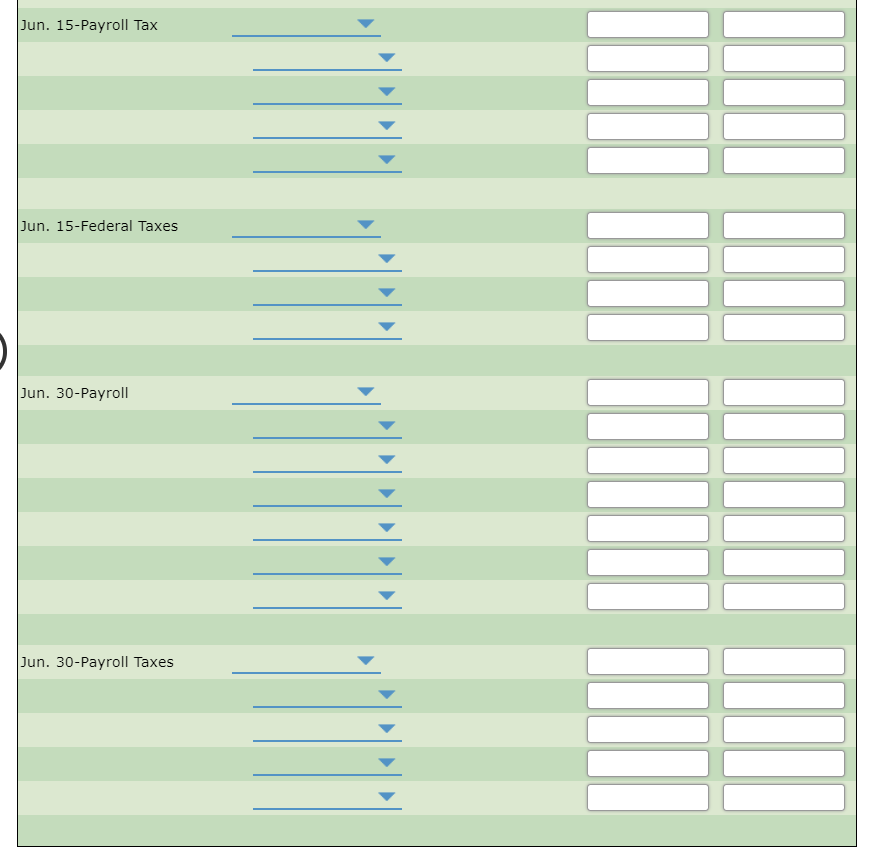

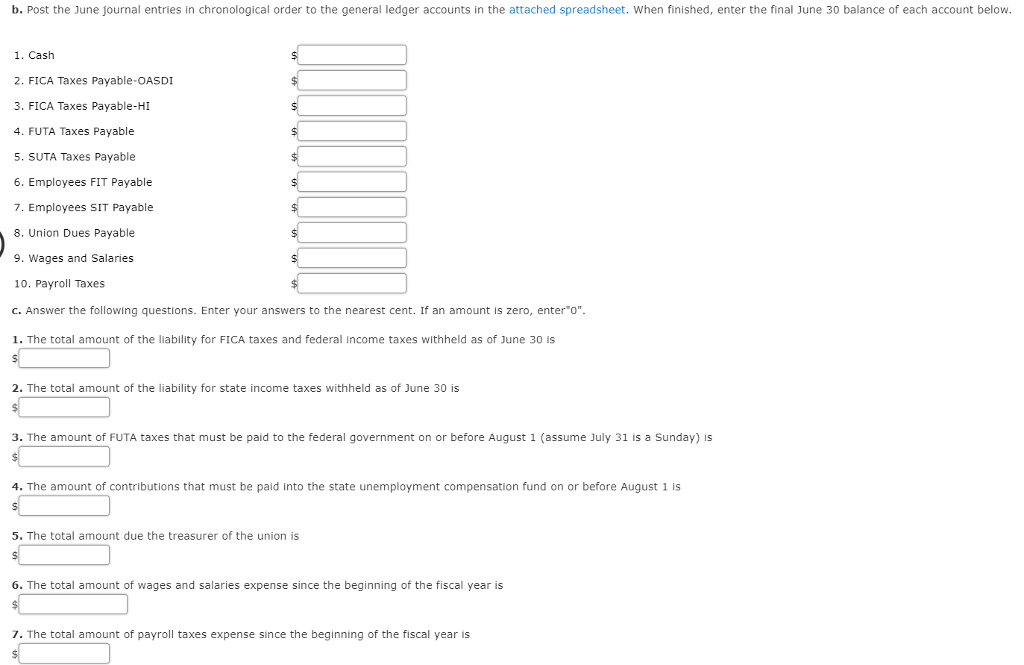

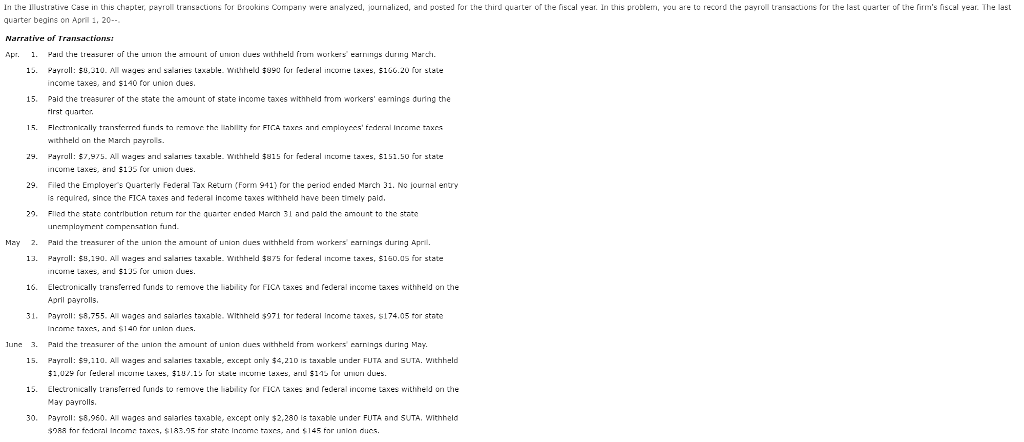

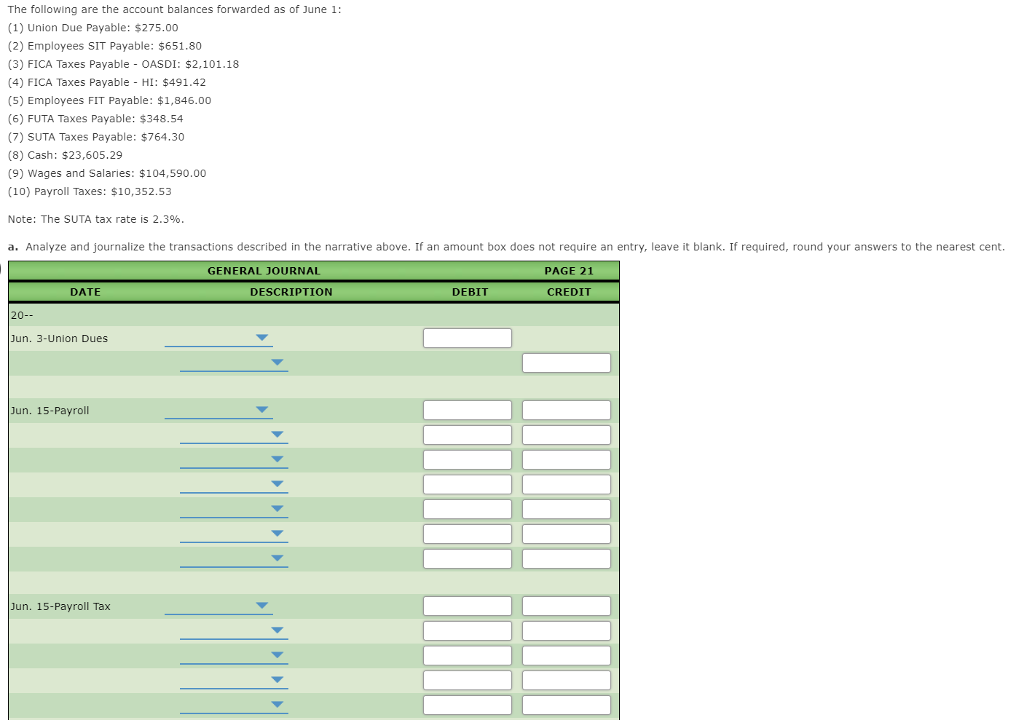

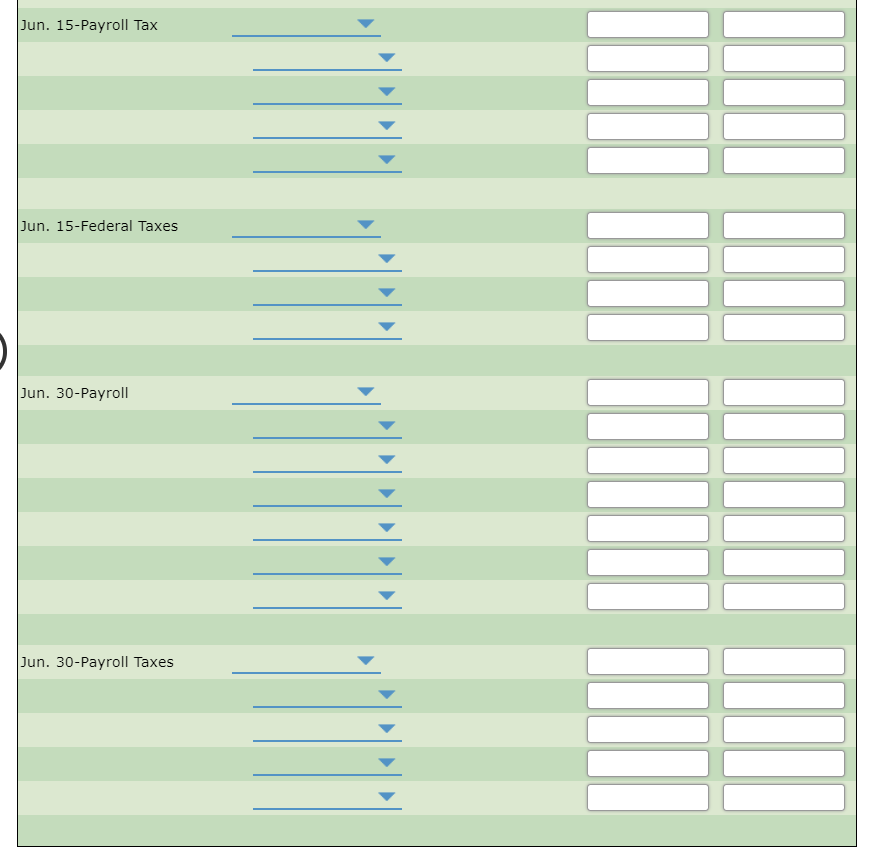

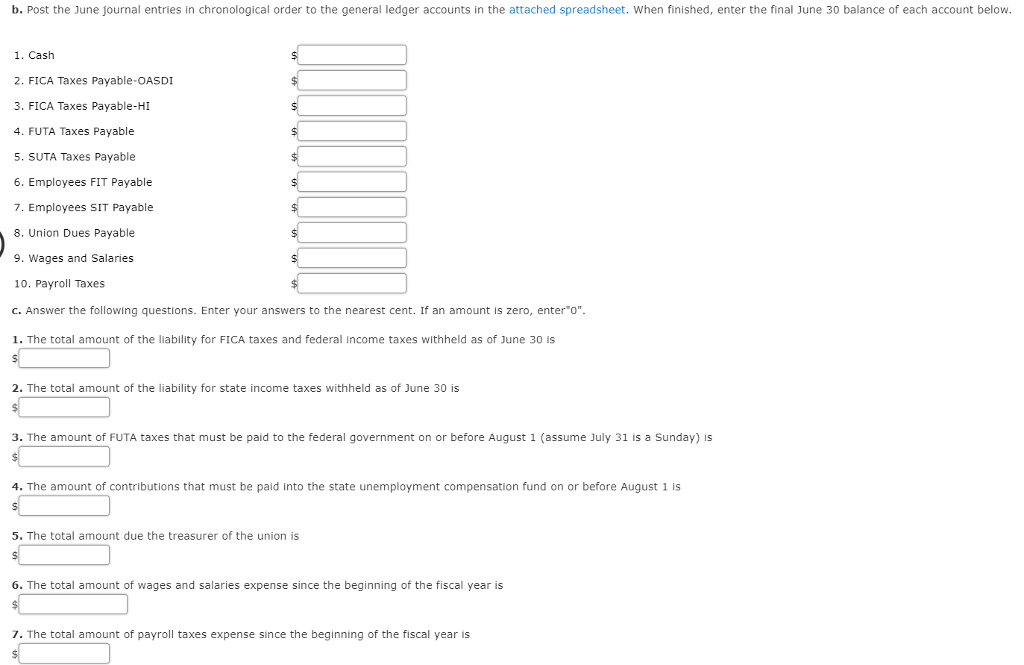

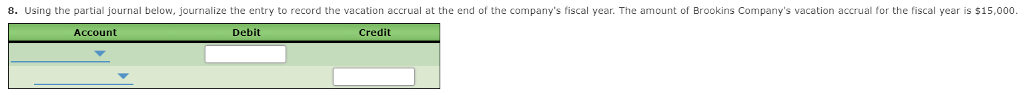

In the lustrative Case in this chapter, payroll trensactions for Brookins Compay were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problei, you are to record the payro transactions for the last quarter of the fir's fiscel year. The last quarter begins on April 1. 20- Narrative of T Apr. 1 Hard the L1 easurer of the union Lhe amount of union dues withheld fturn workers earnings during March. income taxes, and $140 for union dues. 15 Paid the treasurer of the state the amount ot state income taxes withheld trom workers' eamings during the withheld on the March ayrols. Payroll: S7,975. All weges znd sasnes taxable. Withheld $815 for federal income taxes, $151.50 for state iricome taxes, ard $135 for utson dues Filed the Employer's Quarterly Federal Tax Return (Form 941) ror the period ended March 31, Nolournal entry s required, since the FICA taxes and tederal income taxes withheld have been timely paid 29 29. 29. Fllad the state contribution renum tor the quarter anded Mach 31 and pald the amount to the atore Pald the treasurer of the union the amount af union dues withheld fram workers earnings during April. Payroll: S8.190-All weges znd salaries taxable. Withheld $875 for federal income taxes, $150.us for state May 2. 13 16. Electronically trensferred funds to remove the liability for FICA taxes and federal inceme taxes withhe on the April payrolls, 31 Payrall: $8,755. Al wages and salarles taxabla. Witnheld $971 tor tederal Income taxes, $174.05 tor state Income taxea, and s140 or unin dues. lun. 3. Pald te treasurer of th union the amount of union dues withheld frnm workers earnings during May. 15. Payrall: 9.11O. All wages and salaries taxable, except orly $4,210is taxable under FUTA and SUTA. Withheld 15. Eletron cally liarise" ed runds to femove the lidbility for fla, taxes May payrolls. rederel income Laxes withheld url tie 30. Payrall: s8,960. A wages and salaries taxable, except ony $2,280 is taxable under FUTA and SUTA, Withhald In the lustrative Case in this chapter, payroll trensactions for Brookins Compay were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problei, you are to record the payro transactions for the last quarter of the fir's fiscel year. The last quarter begins on April 1. 20- Narrative of T Apr. 1 Hard the L1 easurer of the union Lhe amount of union dues withheld fturn workers earnings during March. income taxes, and $140 for union dues. 15 Paid the treasurer of the state the amount ot state income taxes withheld trom workers' eamings during the withheld on the March ayrols. Payroll: S7,975. All weges znd sasnes taxable. Withheld $815 for federal income taxes, $151.50 for state iricome taxes, ard $135 for utson dues Filed the Employer's Quarterly Federal Tax Return (Form 941) ror the period ended March 31, Nolournal entry s required, since the FICA taxes and tederal income taxes withheld have been timely paid 29 29. 29. Fllad the state contribution renum tor the quarter anded Mach 31 and pald the amount to the atore Pald the treasurer of the union the amount af union dues withheld fram workers earnings during April. Payroll: S8.190-All weges znd salaries taxable. Withheld $875 for federal income taxes, $150.us for state May 2. 13 16. Electronically trensferred funds to remove the liability for FICA taxes and federal inceme taxes withhe on the April payrolls, 31 Payrall: $8,755. Al wages and salarles taxabla. Witnheld $971 tor tederal Income taxes, $174.05 tor state Income taxea, and s140 or unin dues. lun. 3. Pald te treasurer of th union the amount of union dues withheld frnm workers earnings during May. 15. Payrall: 9.11O. All wages and salaries taxable, except orly $4,210is taxable under FUTA and SUTA. Withheld 15. Eletron cally liarise" ed runds to femove the lidbility for fla, taxes May payrolls. rederel income Laxes withheld url tie 30. Payrall: s8,960. A wages and salaries taxable, except ony $2,280 is taxable under FUTA and SUTA, Withhald