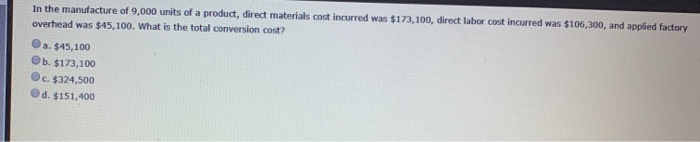

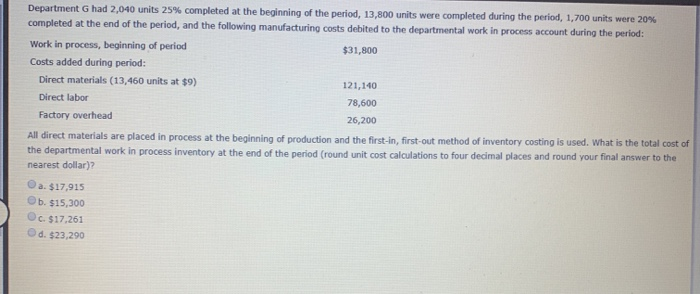

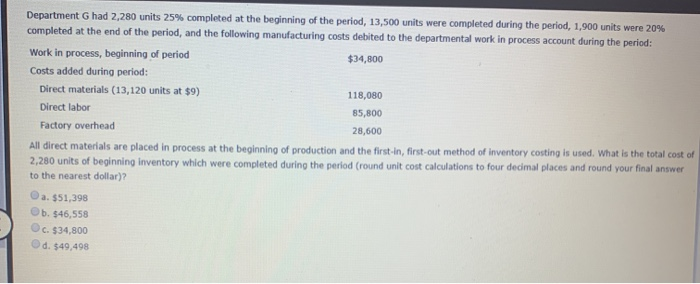

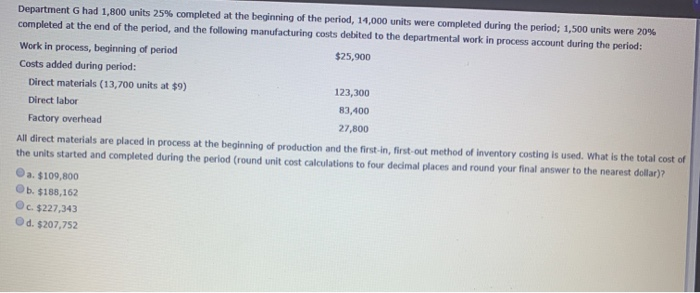

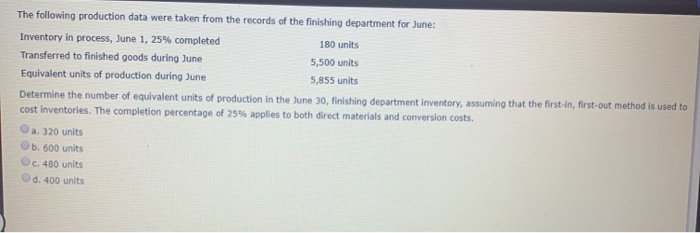

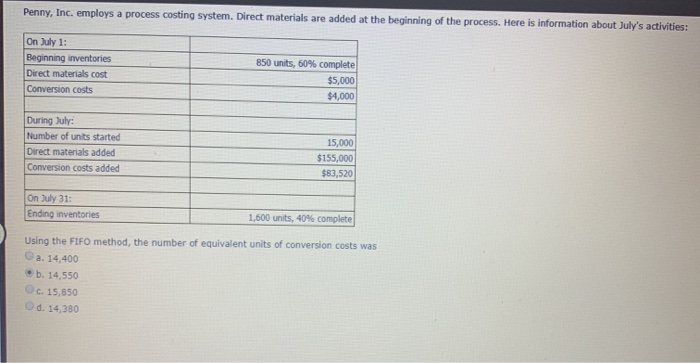

In the manufacture of 9,000 units of a product, direct materials cost incurred was $173, 100, direct labor cost incurred was $106,300, and applied factory overhead was $45,100. What is the total conversion cost? a. $45,100 b. $173,100 c. $324,500 d. $151,400 Department G had 2,040 units 25% completed at the beginning of the period, 13,800 units were completed during the period, 1,700 units were 20% completed at the end of the period, and the following manufacturing costs debited to the departmental work in process account during the period: Work in process, beginning of period $31,800 Costs added during period: Direct materials (13,460 units at $9) 121,140 Direct labor 78,600 Factory overhead 26,200 All direct materials are placed in process at the beginning of production and the first-in, first-out method of inventory costing is used. What is the total cost of the departmental work in process inventory at the end of the period (round unit cost calculations to four decimal places and round your final answer to the nearest dollar)? a. $17,915 b. $15,300 Oc. $17,261 d. $23,290 Department G had 2,280 units 25% completed at the beginning of the period, 13,500 units were completed during the period, 1,900 units were 20% completed at the end of the period, and the following manufacturing costs debited to the departmental work in process account during the period: Work in process, beginning of period $34,800 Costs added during period: Direct materials (13,120 units at $9) 118,080 Direct labor 85,800 Factory overhead 28,600 All direct materials are placed in process at the beginning of production and the first in, first-out method of inventory costing is used. What is the total cost of 2,280 units of beginning inventory which were completed during the period (round unit cost calculations to four decimal places and round your final answer to the nearest dollar)? Oa. $51,398 b. $46,558 c. $34,800 d. $49,498 Department Ghad 1,800 units 25% completed at the beginning of the period, 14,000 units were completed during the period; 1,500 units were 20% completed at the end of the period, and the following manufacturing costs debited to the departmental work in process account during the period: $25,900 Work in process, beginning of period Costs added during period: Direct materials (13,700 units at $9) Direct labor Factory overhead 123,300 83,400 27,800 All direct materials are placed in process at the beginning of production and the first in, first-out method of inventory costing is used. What is the total cost of the units started and completed during the period (round unit cost calculations to four decimal places and round your final answer to the nearest dollar)? a. $109,800 b. $188,162 c. $227,343 d. $207,752 The following production data were taken from the records of the finishing department for June: Inventory in process, June 1, 25% completed Transferred to finished goods during June Equivalent units of production during June 180 units 5,500 units 5,855 units Determine the number of equivalent units of production in the June 30, finishing department inventory, assuming that the first-In, first-out method is used to cost inventories. The completion percentage of 25% applies to both direct materials and conversion costs. a. 320 units b. 600 units c. 480 units d. 400 units Penny, Inc. employs a process costing system. Direct materials are added at the beginning of the process. Here is information about July's activities: On July 1: Beginning inventories Direct materials cost Conversion costs 850 units, 50% complete $5,000 $4,000 15.000 During July: Number of units started Direct materials added Conversion costs added $155.000 $83,520 Ending inventories 1,600 units, 40% complete Using the FIFO method, the number of equivalent units of conversion costs was a. 14,400 b. 14,550 c. 15,850 d. 14.380