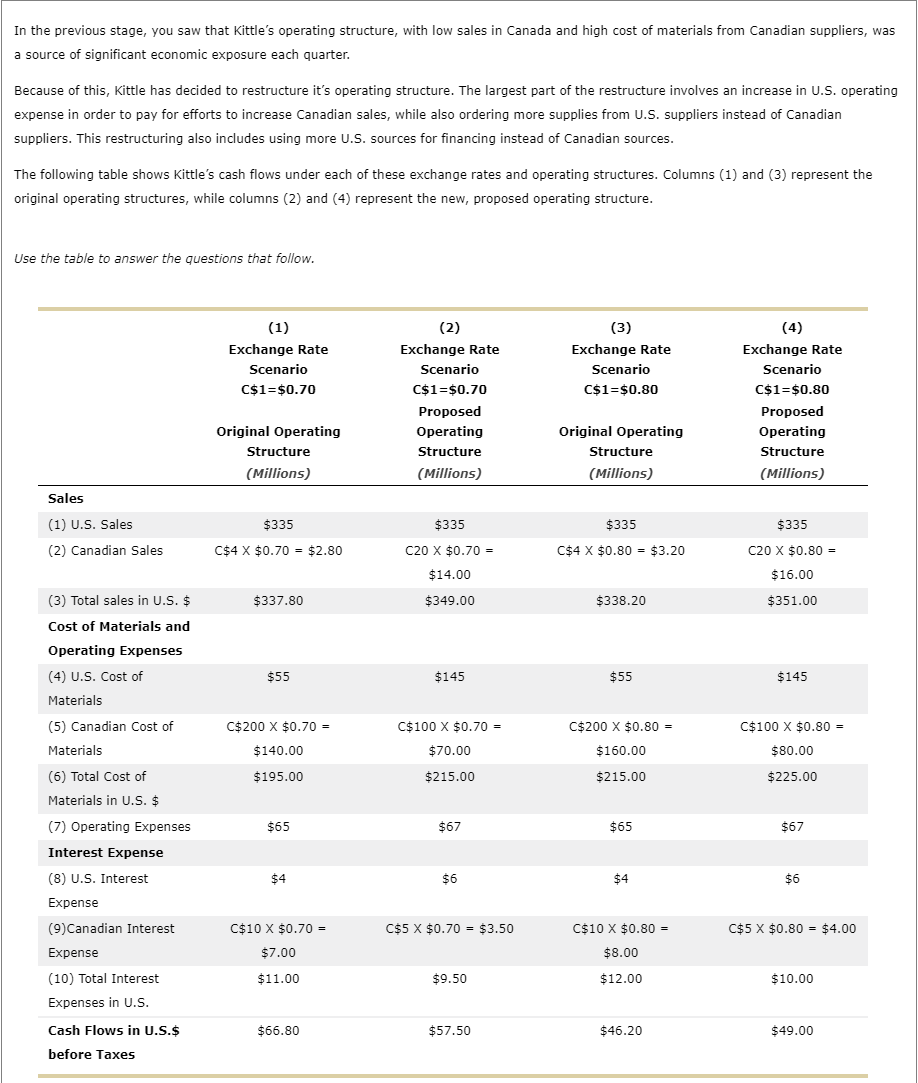

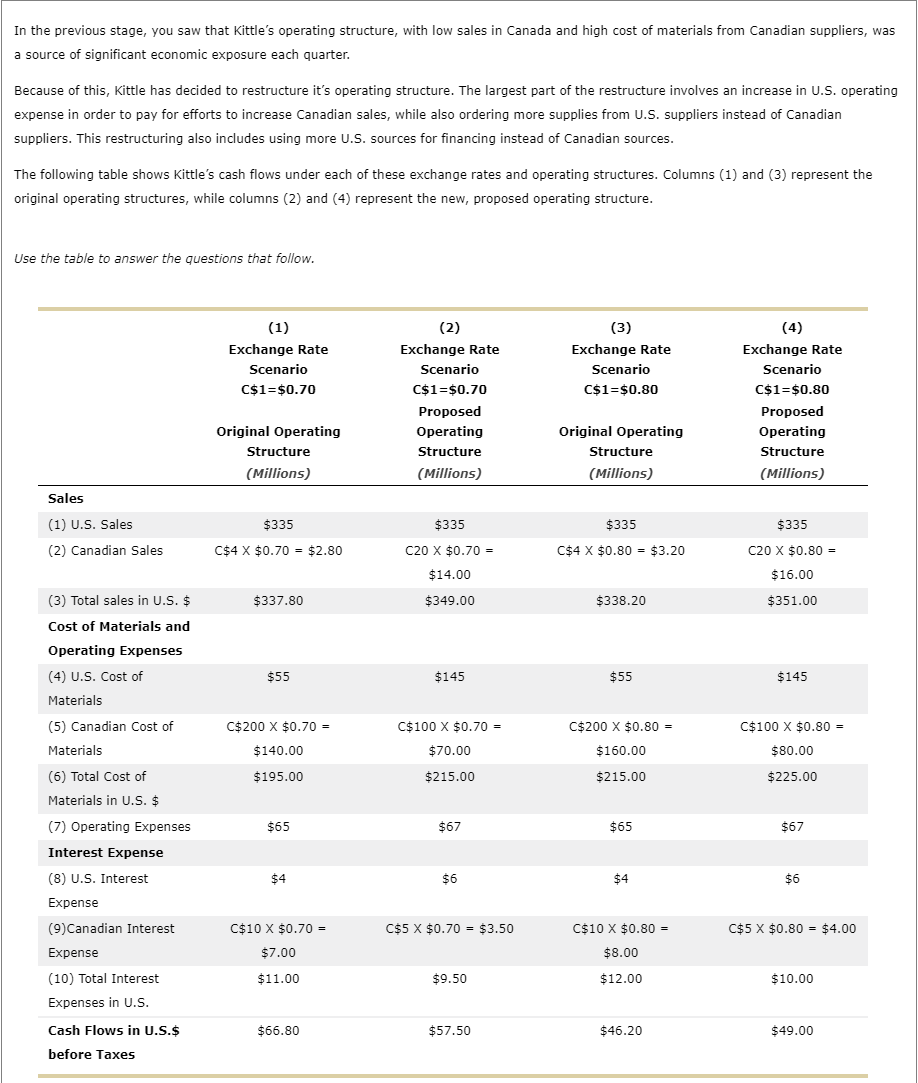

In the previous stage, you saw that Kittle's operating structure, with low sales in Canada and high cost of materials from Canadian suppliers, was a source of significant economic exposure each quarter. Because of this, Kittle has decided to restructure it's operating structure. The largest part of the restructure involves an increase in U.S. operating expense in order to pay for efforts to increase Canadian sales, while also ordering more supplies from U.S. suppliers instead of Canadian suppliers. This restructuring also includes using more U.S. sources for financing instead of Canadian sources. The following table shows Kittle's cash flows under each of these exchange rates and operating structures. Columns (1) and (3) represent the original operating structures, while columns (2) and (4) represent the new, proposed operating structure. Use the table to answer the questions that follow. On the following graph, use the blue points (circle symbols) to plot the U.S. dollar cash flows from the original operating structure under both exchange rate scenarios $0.70 and $0.80. Then use the orange points (square symbols) to plot the U.S. dollar cash flows from the proposed operating structure under both exchange rate scenarios $0.70 and $0.80. Plot the points from left to right in the order you want them to appear. Line segments will connect automatically. Because the line for the proposed operating structure is , the U.S. dollar cash flows in the proposed operating structure are sensitive to changes in the exchange rate of the Canadian dollar when compared with the U.S. dollar cash flows of the original operating structure. uppose that Kittle Co, a U.S.-based MNC that both purchases supplies from Canada and sells exports in Canada, is seeking to measure the economic zposure of its cash flows. Kittle wishes to analyze how its cash flows might change under different exchange rates for the Canadian dollar (the only reign currency in which it deals). In the previous stage, you saw that Kittle's operating structure, with low sales in Canada and high cost of materials from Canadian suppliers, was a source of significant economic exposure each quarter. Because of this, Kittle has decided to restructure it's operating structure. The largest part of the restructure involves an increase in U.S. operating expense in order to pay for efforts to increase Canadian sales, while also ordering more supplies from U.S. suppliers instead of Canadian suppliers. This restructuring also includes using more U.S. sources for financing instead of Canadian sources. The following table shows Kittle's cash flows under each of these exchange rates and operating structures. Columns (1) and (3) represent the original operating structures, while columns (2) and (4) represent the new, proposed operating structure. Use the table to answer the questions that follow. On the following graph, use the blue points (circle symbols) to plot the U.S. dollar cash flows from the original operating structure under both exchange rate scenarios $0.70 and $0.80. Then use the orange points (square symbols) to plot the U.S. dollar cash flows from the proposed operating structure under both exchange rate scenarios $0.70 and $0.80. Plot the points from left to right in the order you want them to appear. Line segments will connect automatically. Because the line for the proposed operating structure is , the U.S. dollar cash flows in the proposed operating structure are sensitive to changes in the exchange rate of the Canadian dollar when compared with the U.S. dollar cash flows of the original operating structure. uppose that Kittle Co, a U.S.-based MNC that both purchases supplies from Canada and sells exports in Canada, is seeking to measure the economic zposure of its cash flows. Kittle wishes to analyze how its cash flows might change under different exchange rates for the Canadian dollar (the only reign currency in which it deals)