Answered step by step

Verified Expert Solution

Question

1 Approved Answer

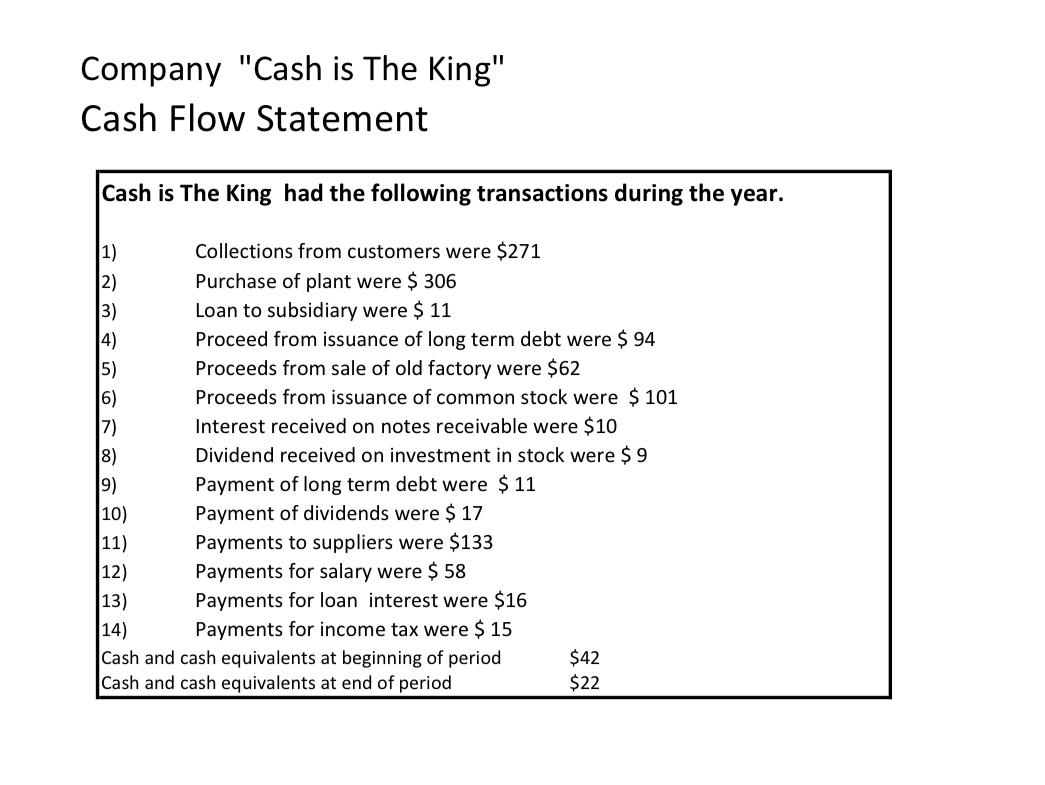

In the question you have to prepare a Cash Flow Statement. Thanks! that's URGENT URGEEEENNTTT Company Cash is The King Cash Flow Statement Cash is

In the question you have to prepare a Cash Flow Statement. Thanks!

that's URGENT

URGEEEENNTTT

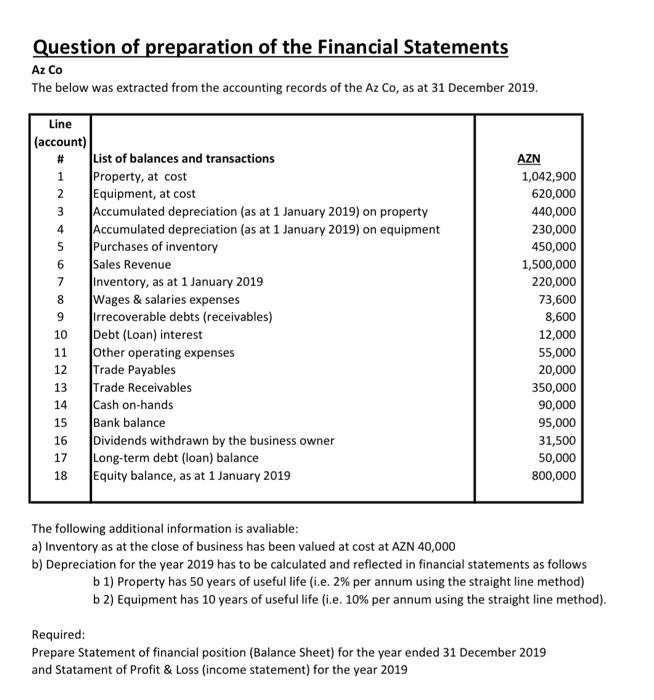

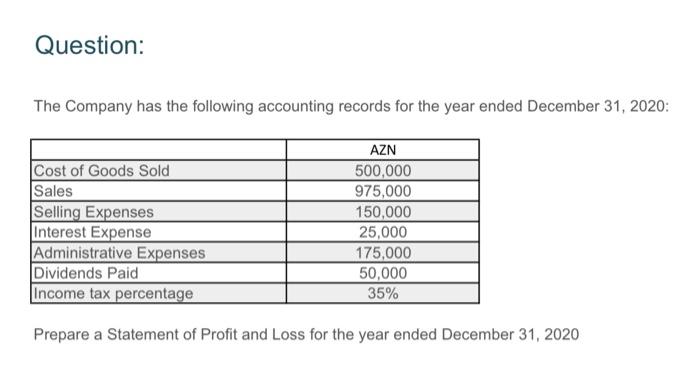

Company "Cash is The King" Cash Flow Statement Cash is The King had the following transactions during the year. 1) Collections from customers were $271 2) Purchase of plant were $ 306 3) Loan to subsidiary were $ 11 4) Proceed from issuance of long term debt were $ 94 5) Proceeds from sale of old factory were $62 6) Proceeds from issuance of common stock were $ 101 7) Interest received on notes receivable were $10 8) Dividend received on investment in stock were $ 9 9) Payment of long term debt were $ 11 10) Payment of dividends were $ 17 11) Payments to suppliers were $133 12) Payments for salary were $ 58 13) Payments for loan interest were $16 14) Payments for income tax were $ 15 Cash and cash equivalents at beginning of period $42 Cash and cash equivalents at end of period $22 Question of preparation of the Financial Statements Az Co The below was extracted from the accounting records of the Az Co, as at 31 December 2019. Line (account) # List of balances and transactions 1 Property, at cost 2 Equipment, at cost 3 Accumulated depreciation (as at 1 January 2019) on property 4 Accumulated depreciation (as at 1 January 2019) on equipment 5 Purchases of inventory 6 Sales Revenue 7 Inventory, as at 1 January 2019 8 Wages & salaries expenses 9 irrecoverable debts (receivables) 10 Debt (Loan) interest 11 Other operating expenses 12 Trade Payables 13 Trade Receivables 14 Cash on-hands 15 Bank balance 16 Dividends withdrawn by the business owner 17 Long-term debt (loan) balance 18 Equity balance, as at 1 January 2019 AZN 1,042,900 620,000 440,000 230,000 450,000 1,500,000 220,000 73,600 8,600 12,000 55,000 20,000 350,000 90,000 95,000 31,500 50,000 800,000 The following additional information is avaliable: a) Inventory as at the close of business has been valued at cost at AZN 40,000 b) Depreciation for the year 2019 has to be calculated and reflected in financial statements as follows b 1) Property has 50 years of useful life (i.e. 2% per annum using the straight line method) b 2) Equipment has 10 years of useful life (i.e. 10% per annum using the straight line method). Required: Prepare Statement of financial position (Balance Sheet) for the year ended 31 December 2019 and Statament of Profit & Loss (income statement) for the year 2019 Question: The Company has the following accounting records for the year ended December 31, 2020: Cost of Goods Sold Sales Selling Expenses Interest Expense Administrative Expenses Dividends Paid Income tax percentage AZN 500,000 975,000 150,000 25,000 175,000 50,000 35% Prepare a statement of Profit and Loss for the year ended December 31, 2020 Company "Cash is The King" Cash Flow Statement Cash is The King had the following transactions during the year. 1) Collections from customers were $271 2) Purchase of plant were $ 306 3) Loan to subsidiary were $ 11 4) Proceed from issuance of long term debt were $ 94 5) Proceeds from sale of old factory were $62 6) Proceeds from issuance of common stock were $ 101 7) Interest received on notes receivable were $10 8) Dividend received on investment in stock were $ 9 9) Payment of long term debt were $ 11 10) Payment of dividends were $ 17 11) Payments to suppliers were $133 12) Payments for salary were $ 58 13) Payments for loan interest were $16 14) Payments for income tax were $ 15 Cash and cash equivalents at beginning of period $42 Cash and cash equivalents at end of period $22 Question of preparation of the Financial Statements Az Co The below was extracted from the accounting records of the Az Co, as at 31 December 2019. Line (account) # List of balances and transactions 1 Property, at cost 2 Equipment, at cost 3 Accumulated depreciation (as at 1 January 2019) on property 4 Accumulated depreciation (as at 1 January 2019) on equipment 5 Purchases of inventory 6 Sales Revenue 7 Inventory, as at 1 January 2019 8 Wages & salaries expenses 9 irrecoverable debts (receivables) 10 Debt (Loan) interest 11 Other operating expenses 12 Trade Payables 13 Trade Receivables 14 Cash on-hands 15 Bank balance 16 Dividends withdrawn by the business owner 17 Long-term debt (loan) balance 18 Equity balance, as at 1 January 2019 AZN 1,042,900 620,000 440,000 230,000 450,000 1,500,000 220,000 73,600 8,600 12,000 55,000 20,000 350,000 90,000 95,000 31,500 50,000 800,000 The following additional information is avaliable: a) Inventory as at the close of business has been valued at cost at AZN 40,000 b) Depreciation for the year 2019 has to be calculated and reflected in financial statements as follows b 1) Property has 50 years of useful life (i.e. 2% per annum using the straight line method) b 2) Equipment has 10 years of useful life (i.e. 10% per annum using the straight line method). Required: Prepare Statement of financial position (Balance Sheet) for the year ended 31 December 2019 and Statament of Profit & Loss (income statement) for the year 2019 Question: The Company has the following accounting records for the year ended December 31, 2020: Cost of Goods Sold Sales Selling Expenses Interest Expense Administrative Expenses Dividends Paid Income tax percentage AZN 500,000 975,000 150,000 25,000 175,000 50,000 35% Prepare a statement of Profit and Loss for the year ended December 31, 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started